by Calculated Risk on 2/24/2010 05:03:00 PM

Wednesday, February 24, 2010

97,000 Homeowners in "Loan Mod Limbo"

Paul Kiel at ProPublica reports: Chase and Other Servicers Leave Many in Loan Mod Limbo; Treasury Threatens Penalties

About 97,000 homeowners in the government’s mortgage modification program have been stuck in a trial period for over six months. Most of them, about 60,000, have their mortgages with a single mortgage servicer, JPMorgan Chase.Paul Kiel has much more.

Trial periods are designed to last only three months, after which mortgage servicers are supposed to either give homeowners a permanent modification or drop them from the program. According to a ProPublica analysis, about 475,000 homeowners have been in a trial modification for longer than three months.

A couple of key points on HAMP I've mentioned before:

The January guidance from Treasury addressed both of the above points.

Effective for all trial period plans with effective dates on or after June 1, 2010, a servicer may evaluate a borrower for HAMP only after the servicer receives the following documents, subsequently referred to as the “Initial Package”. The Initial Package includes:The trial period will start after the initial documents are received, a trial plan is sent to the borrower, and the borrower makes the initial payment.Request for Modification and Affidavit (RMA) Form, IRS Form 4506-T or 4506T-EZ, and Evidence of Income

The second key component of the directive is how to handle all the current trial modifications. For the borrowers who have not made all of their payments, the directive requires the HAMP trial program to be canceled. For borrowers who have made payments, but are missing documentation, Treasury provides some additional guidelines.

This suggests that there will be fewer trial modifications per month in the future (this is already happening, see graph below) and a surge of trial cancellations in February.

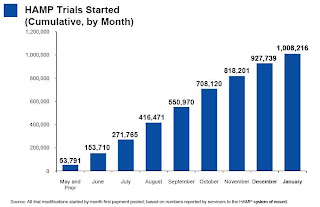

This is graph is from the January Treasury report. This shows the cumulative HAMP trial programs started.

This is graph is from the January Treasury report. This shows the cumulative HAMP trial programs started.Notice that the pace of new trial modifications has slowed sharply from over 150,000 in September to just over 80,000 in January 2010. This is slowest pace since May 2009 and is probably because of two factors: 1) servicers are now pre-qualifying borrowers, and 2) servicers are running out of eligible borrowers.

Housing: The Best Leading Indicator for the Economy

by Calculated Risk on 2/24/2010 02:24:00 PM

Historically the best leading indicator for the economy (and employment) has been housing. I've been writing about this for years. For a great summary paper, see Professor Leamer's presentation from the 2007 Jackson Hole Symposium: Housing and the Business Cycle

For housing as a leading indicator, I use Residential Investment (quarterly from the BEA's GDP report), and monthly data on Housing Starts and New Home sales from the Census Bureau, and builder confidence from the NAHB.

Two key points:

So here is a review of the three monthly leading indicators:

Housing Starts

Click on graph for larger image in new window.

Click on graph for larger image in new window.Total housing starts were at 591 thousand (SAAR) in January, up 2.8% from the revised December rate, and up 24% from the all time record low in April 2009 of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Total starts had rebounded to 590 thousand in June, and have moved mostly sideways for eight months.

Single-family starts were at 484 thousand (SAAR) in January, up 1.5% from the revised December rate, and 36% above the record low in January and February 2009 (357 thousand). Just like for total starts, single-family starts have been at about this level for eight months.

Housing starts are moving sideways ...

Builder Confidence

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).The housing market index (HMI) was at 17 in February. This is an increase from 15 in January.

The record low was 8 set in January 2009. This is still very low - and this is what I've expected - a long period of builder depression. The HMI has been in the 15 to 19 range since May 2009.

More moving sideways ...

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

New Home Sales

The Census Bureau reports This graph shows New Home Sales vs. recessions for the last 45 years.

The Census Bureau reports This graph shows New Home Sales vs. recessions for the last 45 years.New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 309 thousand. This is a record low and a sharp decrease from the 348 thousand rate in December.

And it would be generous to even call this "moving sideways".

So these leading indicators suggest any growth will be sluggish and choppy.

Now some people might argue that housing starts and new home sales are about to increase sharply. Based on what? That seems unlikely with the large number of excess housing units (new and existing homes and rental units). See: Housing Stock and Flow

As I noted above, it might be different this time with exports and technology leading the way, but I'll stick with housing as a business cycle indicator.

Freddie Mac: "Potential Large Wave of Foreclosures"

by Calculated Risk on 2/24/2010 11:55:00 AM

"We start 2010 with some early signs of stabilization in the housing market, with house prices and home sales likely nearing the bottom sometime in 2010. We expect that low mortgage rates, relatively high affordability and the homebuyer tax credit will help continue to fuel the recovery. Still, the housing recovery remains fragile, with significant downside risk posed by high unemployment and a potential large wave of foreclosures."The quote is from the Freddie Mac Q4 earnings release:

Freddie Mac Chief Executive Officer Charles E. Haldeman, Jr.

Freddie Mac Releases Fourth Quarter and Full-Year 2009 Financial Results Fourth quarter 2009 net loss was $6.5 billion. After the dividend payment of $1.3 billion to the U.S. Department of the Treasury (Treasury) on the senior preferred stock, net loss attributable to common stockholders was $7.8 billion ... for the fourth quarter of 2009.Another $7.8 billion in losses ...

...

Full-year 2009 net loss was $21.6 billion. After dividend payments of $4.1 billion during the year to Treasury on the senior preferred stock, net loss attributable to common stockholders was $25.7 billion ... for the full-year 2009.

New Home Sales fall to Record Low in January

by Calculated Risk on 2/24/2010 10:15:00 AM

Note: See previous post for video and discussion of Bernanke's testimony.

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 309 thousand. This is a record low and a sharp decrease from the revised rate of 348 thousand in December. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red column for 2010. In January 2010, 21 thousand new homes were sold (NSA).

This is below the previous record low of 24 thousand in January 2009. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now 6% below the previous record low in January 2009.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now 6% below the previous record low in January 2009.

Sales of new single-family houses in January 2010 were at a seasonally adjusted annual rate of 309,000 ... This is 11.2 percent (±14.0%)* below the revised December rate of 348,000 and is 6.1 percent (±15.1%)* below the January 2009 estimate of 329,000.And another long term graph - this one for New Home Months of Supply.

There were 9.1 months of supply in January. Rising, but still significantly below the all time record of 12.4 months of supply set in January 2009.

There were 9.1 months of supply in January. Rising, but still significantly below the all time record of 12.4 months of supply set in January 2009.The seasonally adjusted estimate of new houses for sale at the end of January was 234,000. This represents a supply of 9.1 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Months-of-supply and inventory have both peaked for this cycle, but sales have set a new record low. New home sales are far more important for the economy than existing home sales, and new home sales will remain under pressure until the overhang of excess housing inventory declines much further.

Obviously this is another extremely weak report.

Bernanke Humphrey-Hawkins Testimony at 10 AM ET

by Calculated Risk on 2/24/2010 09:50:00 AM

Federal Reserve Chairman Ben Bernanke is scheduled to provide the Semiannual Monetary Policy Report to the Congress before the House Committee on Financial Services at 10 AM ET.

I'll add a link to the prepared testimony, and I'll be posting the New Home sales numbers shortly after 10 AM. Commenters: Hopefully we can discuss Bernanke's testimony (especially the Q&A) on this thread, and New Home sales on the following thread).

Here is the CNBC feed.

Here is the C-Span Link

Prepared Testimony: Semiannual Monetary Policy Report to the Congress