by Calculated Risk on 2/23/2010 12:57:00 PM

Tuesday, February 23, 2010

Shadow Rental Market Pushing down Rents

Here is an audio interview from Jon Lansner: Scott Monroe of South Coast Apartment Association visits Jon Lansner of the OC Register

"Rents are down and vacancies are up. Demand is off, and we attribute really to to the fact that here has been a pretty significant erosion of jobs in the Orange County markets. And it is having a trickle down effect. In addition to that, our members are saying that they are competing quite a bit with what historically has not been a competitor for us - that's the gray market or the shadow market - which are condominium rentals and single family home rentals and things of that nature. There is just a lot of product on the market."Monroe says they are seeing much more multi-generational housing, and he expects "doubling up" to last for another 12 months or so.

Scott Monroe, Pres. of South Coast Apartment Association

And this brings up a key point - the supply of rental units has been surging:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (Source: Census Bureau).

The total number of rental units (red and blue) bottomed in Q2 2004, and started climbing again. Since Q2 2004, there have been over 4.7 million units added to the rental inventory.

Note: please see caution on using this data - this number might be a little too high, but the concepts are the same even with a lower increase.

This increase in units has more than offset the recent strong migration from ownership to renting, so the rental vacancy rate is now at 10.7% and the apartment vacancy rate is at a record high.

Where did these approximately 4.7 million rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 1.1 million units completed as 'built for rent' since Q2 2004. This means that another 3.6 million or so rental units came mostly from conversions from ownership to rentals.

These could be investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling.

As Scott Monroe noted, this huge surge in rental supply - what he calls the "gray or shadow market" - has pushed down rents, and pushed the rental vacancy rate to record levels. Yes, people are doubling up with friends and family during the recession, and some renters are now buying again, but the main reason for the record vacancy rate is the surge in supply. Eventually many of these "gray market" rentals will be sold as homes again - keeping the existing home supply elevated for years.

FDIC Q4 Banking Profile: 702 Problem Banks

by Calculated Risk on 2/23/2010 10:48:00 AM

The FDIC released the Q4 Quarterly Banking Profile today. The FDIC listed 702 banks with $403 billion in assets as “problem” banks in Q4, up from 552 banks with $346 billion in assets in Q3, and 252 and $159.4 billion in assets in Q4 2008.

Note: Not all problem banks will fail - and not all failures will be from the problem bank list - but this shows the problem is significant and still growing.

The Unofficial Problem Bank List shows 617 problem banks - and will continue to increase as more formal actions (or hints of pending actions) are released. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of FDIC insured "problem" banks since 1990.

The 702 problem banks reported at the end of Q4 is the highest since 1992.

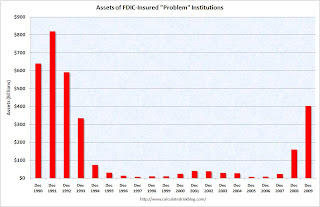

The second graph shows the assets of "problem" banks since 1990. The assets of problem banks are the highest since 1992.

The assets of problem banks are the highest since 1992.

On the Deposit Insurance Fund:

The Deposit Insurance Fund (DIF) decreased by $12.6 billion during the fourth quarter to a negative $20.9 billion (unaudited) primarily because of $17.8 billion in additional provisions for bank failures. ... For the year, the fund balance shrank by $38.1 billion, compared to a $35.1 billion decrease in 2008.

The DIF’s reserve ratio was negative 0.39 percent on December 31, 2009, down from negative 0.16 percent on September 30, 2009, and 0.36 percent a year ago. The December 31, 2009, reserve ratio is the lowest reserve ratio for a combined bank and thrift insurance fund on record.Note: This doesn't mean the FDIC DIF is out of money or bankrupt. The FDIC reserves against future losses, and they don't include the prepay of assessments in the DIF (although they have the cash). The FDIC has plenty of cash right now - although there will probably be hundreds of bank failures over the next couple of years, and the FDIC might have to borrow from the Treasury in the future.

Forty-five insured institutions with combined assets of $65.0 billion failed during the fourth quarter of 2009, at an estimated cost of $10.2 billion. For all of 2009, 140 FDIC-insured institutions with assets of $169.7 billion failed, at an estimated cost of $37.4 billion. This was the largest number of failures since 1990 when 168 institutions with combined assets of $16.9 billion failed (excluding thrifts resolved by the RTC).

Case-Shiller House Prices increase in December

by Calculated Risk on 2/23/2010 09:37:00 AM

Note: as usual, the S&P website crashes when they release the monthly house price data. I'll post some graphs when the data is available.

The WSJ reports:

[The composite 10 and 20] indexes dropped 0.2% from the previous month, although adjusted for seasonal factors, they increased 0.3%.More from Reuters: Home Prices Fall 2.5% as Market Recovery Still Weak (note: Reuters is reporting the NSA data).

...

Month-to-month gainers were led by Los Angeles, which rose 1%. Chicago again fared worst, falling 1.6%.

Report: State Tax Revenues decline in Q4

by Calculated Risk on 2/23/2010 08:10:00 AM

From the Rockefeller Institute: States Reported Fifth Consecutive Drop in Tax Collections in the Fourth Quarter of 2009 (ht Ann)

State tax revenues declined by 4.1 percent nationwide during the final quarter of calendar 2009, the fifth consecutive quarter of reduced collections, according to a report issued today by the Rockefeller Institute of Government.Here is the report: Final Quarter of 2009 Brought Still

The five straight quarters of year-over-year decline in overall tax collections represent a record length of such decreases, the Institute said.

...

“Calendar 2009 will be remembered as bringing historically sharp declines in tax revenue to states,” the report says. “Revenue gains toward the end of calendar 2009 were often driven by legislated tax increases rather than growth in the economy and tax base.”

Despite revenue gains in some states during the fourth quarter, the report concludes, “another negative quarter for the nation as a whole would not be unexpected. The troubling fiscal picture for states remains clearly in place.”

More Declines in State Tax Revenue

Tax revenues are still weak, and most states are still running large deficits. As a recent CNNMoney article notes:

States are looking at a total budget gap of $180 billion for fiscal 2011, which for most of them begins July 1. These cuts could lead to a loss of 900,000 jobs, according to Mark Zandi, chief economist of Moody's Economy.com.This suggests that more state and local government job cuts are coming.

Monday, February 22, 2010

Judge Accepts "Half-baked justice" in BofA-SEC Settlement

by Calculated Risk on 2/22/2010 11:36:00 PM

Louise Story at the NY Times writes: Judge Accepts S.E.C.’s Deal With Bank of America

[A] federal judge wrote on Monday that he had reluctantly approved a $150 million settlement with the Securities and Exchange Commission.And from the Judge:

"In short, the proposed settlement, while considerably improved over the vacuous proposal made last August in connection with the Undisclosed Bonuses case, is far from ideal. Its greatest virtue is that it is premised on a much better developed statement of the underlying facts and inferences drawn therefrom, which, while disputed by the Attorney General in another forum, have been carefully scrutinized by the Court here and found not to be irrational. Its greatest defect it that it advocates very modest punitive, compensatory, and remedial measures that are neither directed at the specific individuals responsible for the nondisclosures nor appear likely to have more than a very modest impact on corporate practices or victim compensation. While better than nothing, this is half-baked justice at best."I always enjoy some judicial snark.

Judge Jed S. Rakoff, Feb 22, 2010