by Calculated Risk on 2/22/2010 08:33:00 AM

Monday, February 22, 2010

Chicago Fed: Economic Activity Increased in January

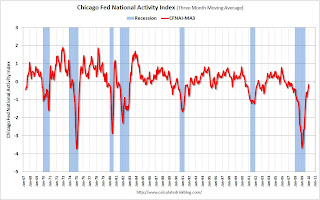

Note: This is a composite index based on a number of economic releases.

From the Chicago Fed: Index shows economic activity increased sharply in January

The Chicago Fed National Activity Index was +0.02 in January, up from –0.58 in December. ...

The index’s three-month moving average, CFNAI-MA3, increased to –0.16 in January from –0.47 in December, reaching its highest level since July 2007. January’s CFNAI-MA3 suggests that, consistent with the early stages of a recovery following a recession, growth in national economic activity is beginning to near its historical trend. With regard to inflation, the amount of economic slack reflected in the CFNAI-MA3 indicates subdued inflationary pressure from economic activity over the coming year.

Production-related indicators made a positive contribution to the index for the seventh consecutive month. As a group, they contributed +0.45 in January, up from +0.14 in December. ...

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

A CFNAI-MA3 value below –0.70 following a period of economic expansion indicates an increasing likelihood that a recession has begun. A CFNAI-MA3 value above –0.70 following a period of economic contraction indicates an increasing likelihood that a recession has ended. A CFNAI-MA3 value above +0.20 following a period of economic contraction indicates a significant likelihood that a recession has ended.Although the CFNAI-MA3 improved in January, the index is still negative. According to Chicago Fed, it is still too early to call the official recession over - although the likelihood that a recession has ended is increasing.

Sunday, February 21, 2010

Sunday Night Futures

by Calculated Risk on 2/21/2010 11:59:00 PM

The U.S. futures are up a little tonight:

Futures from CNBC show the S&P 500 up a couple of points.

Here are the futures from barchart.com

Most of the Asian markets are up tonight, with the Nikkei and Hang Seng up over 2.5%.

From Bloomberg: Asian Stocks, Oil Advance as U.S. Interest Rate Concern Eases

Asian stocks jumped the most since November, oil rose and the yen fell on speculation Federal Reserve Chairman Ben S. Bernanke will signal that U.S. interests rates will be kept near a record low.The article suggests some investors misunderstood the increase in the discount rate. Bernanke testifies on Wednesday (see Weekly Summary and a Look Ahead), and he will definitely say that the Fed will hold rates low for an extended period.

Best to all.

Chief Lending Officer Pleads Guilty to Concealing Material Facts from FDIC

by Calculated Risk on 2/21/2010 08:49:00 PM

The Bank of Clark County was the 2nd bank to fail in 2009. It had assets of $440 million and is estimated to have cost the Deposit Insurance Fund between $120 and $145 million.

From Courtney Sherwood at the Portland Business Journal: Former Bank of Clark County executive pleads guilty to felony charge (ht Jason)

[A] plea agreement filed Friday in U.S. District Court ... outlines former Chief Lending Officer David Kennelly’s guilty plea on a count of “scheme to conceal material facts.”These were appraisals related to C&D (Construction & Development) loans and obviously showed huge losses for the bank. Hiding material information from examiners is pretty stunning ...

...

The bank ordered new appraisals on 23 real estate-backed loans to prepare for [a November 2008 safety and soundness examination by the FDIC and Washington state bank examiners].

Before regulators arrived, Kennelly told a vice president identified as “K.B.” that there were several appraisals that Kennelly “did not want to see the light of day,” ...

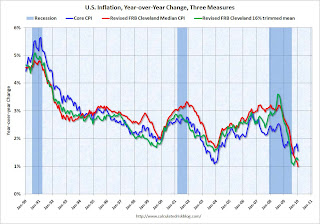

Graph of Core CPI, and Cleveland Fed Measures of Inflation

by Calculated Risk on 2/21/2010 05:00:00 PM

A combination of significant resource slack, and a policy of pushing down rents (an unintended consequence of the first time homebuyer tax credit), pushed core inflation (CPI minus food and energy) negative in January for the first time since 1982. This was no surprise.

Professor Krugman has more and suggests focusing on the Cleveland Fed measures of inflation:

[C]ore CPI has been behaving erratically lately, making me doubt whether it’s still a good guide to underlying inflation (by which I mean the trend in prices that, unlike commodity prices, have a lot of inertia).That inspired me to put all three measures on one graph:

What I find myself looking at these days are the Cleveland Fed “trimmed” inflation measures, which exclude outlying large price movements; the ultimate trim is the median, the rise in the price of the median category. And these indicators tell a story of dramatic disinflation in the face of a weak economy ... We may have to start calling the Fed chairman Bernanke-san, after all.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year change in core CPI, and the two Clevelend Fed measures of inflation (median and trimmed mean). All three measures are moving down.

If we just look at the last three months, Core CPI is essentially unchanged and the Median is only up at about a 0.5% annual rate.

Despite all the talk about the Fed possibly raising the Fed funds rate in the 2nd half of 2010, with high unemployment and low measured inflation, it is very unlikely that the Fed will raise the Fed Funds rate any time soon - probably not until 2011 at the earliest.

Weekly Summary and a Look Ahead

by Calculated Risk on 2/21/2010 12:12:00 PM

Update: The FDIC Quarterly Banking Profile (Q4) will probably be released mid-week (ht Greg)

This will be a busy week for economic data highlighted by several key economic releases for both residential and commercial real estate: Case-Shiller house prices, new home sales, existing home sales, the Moodys' commercial property price index and the CRE related Architecture Billings Index will all be released this week.

On Tuesday, the S&P Case-Shiller House Price Index for December (actually three month average of Oct, Nov, and Dec) and the Q4 National Index will be released. The consensus is for the Composite 20 Index to have declined 3.1% from Dec 2008 - or basically flat from November to December (seasonally adjusted).

On Wednesday, the Census Bureau will report on New Home Sales for January. The consensus is for an increase to about 360 thousand (SAAR), from 342 thousand in December. Also the February AIA Architecture Billings Index will be released, and this will probably show a continued contraction in commercial real estate architectural billings (a leading indicator for non-residential construction). Also on Wednesday, Fed Chairman Ben Bernanke will provide the Semiannual Monetary Policy Report to the House Committee on Financial Services.

On Thursday, the Durable Goods report will be released, and the closely watched weekly report on initial unemployment claims. I also expect the Moodys/REAL Commercial Property Price Index for December will be released.

On Friday, the first revision to the Q4 GDP report will be released (consensus is for unchanged from the initial report of 5.7% GDP growth annualized in Q4), the Chicago Purchasing Managers' Index for February (consensus is for continued expansion, but a decline to 60 from 61.5 last month), and Existing Home Sales for January. Consensus is for a 1% increase in existing home sale to 5.5 million (SAAR) from 5.45 million in December (I'll take the under).

There will be several Fed speeches during the week, and probably more bank failures announced on Friday.

And a summary of last week ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.Total housing starts were at 591 thousand (SAAR) in January, up 2.8% from the revised December rate, and up 24% from the all time record low in April 2009 of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for eight months.

Single-family starts were at 484 thousand (SAAR) in January, up 1.5% from the revised December rate, and 36% above the record low in January and February 2009 (357 thousand). Just like for total starts, single-family starts have been at about this level for eight months.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).Note: any number under 50 indicates that more builders view sales conditions as poor than good.

The housing market index (HMI) was at 17 in February. This is an increase from 15 in January.

The record low was 8 set in January 2009. This is still very low - and this is what I've expected - a long period of builder depression. The HMI has been in the 15 to 19 range since May.

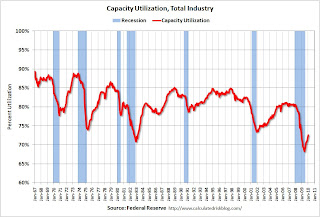

From the Fed: "Industrial production increased 0.9 percent in January following a gain of 0.7 percent in December. ... The capacity utilization rate for total industry rose 0.7 percentage point to 72.6 percent, a rate 8.0 percentage points below its average from 1972 to 2009."

From the Fed: "Industrial production increased 0.9 percent in January following a gain of 0.7 percent in December. ... The capacity utilization rate for total industry rose 0.7 percentage point to 72.6 percent, a rate 8.0 percentage points below its average from 1972 to 2009."This graph shows Capacity Utilization. Capacity utilization at 72.6% is still far below normal - and far below the pre-recession levels of 80.5% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

Also - this is the highest level for industrial production since Dec 2008, but production is still 10.1% below the pre-recession levels at the end of 2007.

This graph shows mortgage delinquencies by "bucket" (time deliquent).

This graph shows mortgage delinquencies by "bucket" (time deliquent).Loans 30 days delinquent declined in Q4, but are still above the levels in 2007 - and at about the level of early 2008 - when prices were falling sharply.

The 60 day bucket also declined in Q4, but it is still above the levels of 2008.

The 90 day and 'in foreclosure' rates are at record levels. Obviously the lenders have been slow to start foreclosure proceedings and to actually foreclose.

This graph shows the national LoanPerformance data since 1976. January 2000 = 100.

This graph shows the national LoanPerformance data since 1976. January 2000 = 100.The national average of home prices declined 1.0 percent in December 2009 compared to November 2009. The index is off 3.7% over the last year, and off 28.2% from the peak.

The index has declined for four consecutive months.

This is the house price indicator used by the Fed.

Best wishes to all.