by Calculated Risk on 2/17/2010 09:41:00 PM

Wednesday, February 17, 2010

Report: Treasury Secretary to Chair Systemic Risk Council

From Sewell Chan at the NY Times: Agreement Near on New Overseer of Banking Risks

The Senate and the Obama administration are nearing agreement on forming a council of regulators, led by the Treasury secretary, to identify systemic risk to the nation’s financial system, officials said Wednesday.I can just imagine a council in 2004 and 2005 led by ex-Treasury Secretary John Snow with Alan Greenspan as Vice Chair. Yeah, that would have worked well ...

...

The effect would be to diminish the authority of the Federal Reserve ... Ben S. Bernanke, is willing to go along with a Treasury-led council.

James Bullard, president of the St. Louis Fed, thinks this will fail:

“If [Bernanke]’s giving up, it’s because he’s somehow making some calculations about what the realities are,” Mr. Bullard said.

“But I’m telling you, this business of how we’re going to give this to a committee and we’re going to have an effective response to the next crisis. That is a joke.”

Q4: Quarterly Housing Starts and New Home Sales

by Calculated Risk on 2/17/2010 06:45:00 PM

This morning the Census Bureau has released the "Quarterly Starts and Completions by Purpose and Design" report for Q4 2009.

Monthly housing starts (even single family starts) cannot be compared directly to new home sales, because the monthly housing starts report from the Census Bureau includes apartments, owner built units and condos that are not included in the new home sales report.

However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The quarterly report shows that there were 71,000 single family starts, built for sale, in Q4 2009, and that is less than the 82,000 new homes sold for the same period. This data is Not Seasonally Adjusted (NSA).

This is the 9th consecutive quarter with homebuilders selling more homes than they start.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because homebuilders do build spec homes and many builders were stuck with some “unintentional spec homes” because of cancellations during the bust. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts (blue) were higher than sales (red), and inventories of new homes increased. For the last 9 quarters, starts have been below sales – and new home inventories have been falling. The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Condo starts in Q4 were at an all time record low of 3,000 condos built for sale. This breaks the record set in Q1, Q2 and Q3 of 2009 of 5,000 condos per quarter. The previous record was 8,000 set in Q1 1991 (data started in 1975). Only 18,000 condos were started in 2009, far below the previous low of 41,000 in 1991.

Units built for rent set an all time record low in Q4 (19,000 units in Q4 2009 compared to the previous record low of 21,000 units in Q1 1993). With the vacancy rate at a record high, the demand for new rental units will stay low for some time.

Owner built units are above the record low set in Q1 2009 (31,000 units compared to 24,000 units in Q1 2009), however the pickup in owner built starts was probably mostly seasonal (this is NSA data).

And the largest category - starts of single family units, built for sale - was very low at 71,000 units in Q4.

With starts so low in every category, the number of units added to the housing stock in 2010 will be at a record low - and that will help reduce the significant excess inventory of housing units.

HAMP: 116,000 Permanent Mods, Over 1,000 Permanent Mods Cancelled

by Calculated Risk on 2/17/2010 04:11:00 PM

From Treasury: Administration Releases January Loan Modification Report

Click on graph for larger image  in new window.

in new window.

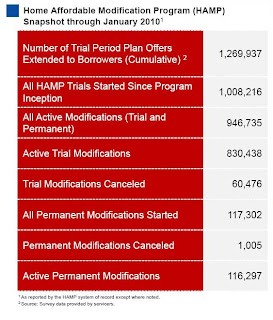

Just over 116,000 modifications are now permanent.

Here is the link at Treasury. See here for a list of reports.

If there were 416,471 cumulative HAMP trial modifications in August - how come there were only 116,297 permanent mods and 60,476 disqualified modifications by the end of January? The numbers don't add up.

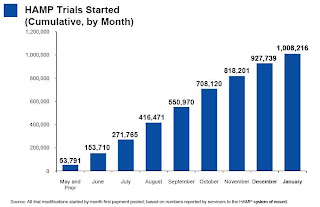

What happened to the other 240,000 modifications? I guess they we will find out in the February report when the servicers start removing delinquent borrowers from the trial modification program. The second graph shows the cumulative HAMP trial programs started.

The second graph shows the cumulative HAMP trial programs started.

Notice that the pace of new trial modifications has slowed sharply from over 150,000 in Septmenber to just over 80,000 in January 2010. This is slowest pace since May 2009 and is probably because of two factors: 1) servicers are now pre-qualifying borrowers, and 2) servicers are running out of eligible borrowers.

Edit: Also - 1,005 permanent modifications have already failed. At first that seemed high considering those borrowers made all the trial modification payments ... but I suppose that is about the expected re-default rate.

FOMC Minutes: Expect "slow improvement in the labor market"

by Calculated Risk on 2/17/2010 02:00:00 PM

In the most recent FOMC statement, the Fed removed all references to residential housing. This was in recognition that the housing sector is not as strong as it appeared in November or December. This makes the FOMC Minutes a little more interesting this month ... first, as a review, here are the housing comments from the last three FOMC statements:

Nov, 2009: "Activity in the housing sector has increased over recent months"

Dec, 2009: "The housing sector has shown some signs of improvement over recent months."

Jan, 2010: No comment.

And here are the January FOMC minutes on residential real estate:

The recovery in the housing market slowed in the second half of 2009, even though a number of factors supported housing demand. Interest rates for conforming 30-year fixed-rate mortgages remained historically low. ... Sales of new homes also turned down in November and December, retracing part of their recovery earlier in the year. Similarly, starts of single-family homes retreated a little from June to December after advancing briskly last spring. ...And the economic outlook:

By and large, participants judged that residential investment had stabilized but did not expect housing construction to make a sizable contribution to economic growth during the next year or two.

In their discussion of the economic situation and outlook, participants agreed that the incoming data and information received from business contacts, though mixed, indicated that economic growth had strengthened in the fourth quarter, that firms were reducing payrolls at a less rapid pace, and that downside risks to the outlook for economic growth had diminished a bit further. Participants saw the economic news as broadly in line with the expectations for moderate growth and subdued inflation in 2010 that they held when the Committee met in mid-December; moreover, financial conditions were much the same, on balance, as when the FOMC last met. Accordingly, participants' views about the economic outlook had not changed appreciably. Many noted the evidence that the pace of inventory decumulation slowed quite substantially in the fourth quarter of 2009 as firms increased output to bring production into closer alignment with sales. Participants saw the slower pace of inventory reductions as a welcome indication that, in general, firms no longer had large inventory overhangs. But they observed that business contacts continued to report great reluctance to build inventories, increase payrolls, and expand capacity. Participants expected the economic recovery to continue, but most anticipated that the pickup in output and employment growth would be rather slow relative to past recoveries from deep recessions. A moderate pace of expansion would imply slow improvement in the labor market this year, with unemployment declining only gradually. Most participants again projected that the economy would grow somewhat more rapidly in 2011 and 2012, generating a more pronounced decline in the unemployment rate, as financial conditions and the availability of credit continue to improve. In general, participants saw the upside and downside risks to the outlook for economic growth as roughly balanced. Participants agreed that underlying inflation currently was subdued and was likely to remain so for some time. Some noted the risk that, with output well below potential over the next couple of years, inflation could edge further below the rates they judged most consistent with the Federal Reserve's dual mandate for maximum employment and price stability; others, focusing on risks to inflation expectations and the challenge of removing monetary accommodation in a timely manner, saw inflation risks as tilted toward the upside, especially in the medium term.

The weakness in labor markets continued to be an important concern for the FOMC; moreover, the prospects for job growth remained an important source of uncertainty in the economic outlook, particularly in the outlook for consumer spending. While the average pace of layoffs diminished substantially in recent months, few firms were hiring. The unusually large fraction of individuals who were working part time for economic reasons, as well as the uncommonly low level of the average workweek, pointed to a gradual increase in payrolls for some time even if hours worked were to increase substantially as the economic recovery proceeded. Indeed, many business contacts again reported that they would be cautious in hiring, saying they expected to meet any near-term increase in demand by raising existing employees' hours and boosting productivity, thus delaying the need to add employees.

emphasis added

Housing Starts, Vacant Units and the Unemployment Rate

by Calculated Risk on 2/17/2010 12:29:00 PM

The following two graphs are updates from previous posts with the housing start data released this morning.

The following graph shows total housing starts and the percent vacant housing units (owner and rental) in the U.S. Note: this is a combined vacancy rate based on the Census Bureau vacancy rates for owner occupied and rental housing through Q4 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Notice that total starts are not rebounding quickly as a number of analysts expected. Instead starts have moved sideways for the last eight months.

It is very unlikely that there will be a strong rebound in housing starts with a near record number of vacant housing units.

The vacancy rate has continued to climb even after housing starts fell off a cliff. Initially this was because of a significant number of completions. Also some hidden inventory (like some 2nd homes) have become available for sale or for rent, and lately some households have probably doubled up because of tough economic times. The second graph shows single family housing starts and unemployment (inverted). (The first graph shows total housing starts)

The second graph shows single family housing starts and unemployment (inverted). (The first graph shows total housing starts)

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

This suggests unemployment might peak in Summer 2010 since housing starts bottomed in April 2009. However, since I expect the housing recovery to be sluggish, I also expect unemployment to remain high throughout 2010.