by Calculated Risk on 10/27/2009 03:56:00 PM

Tuesday, October 27, 2009

Update on Housing Tax Credit

Here is more on the housing tax credit debate ...

First, from Reuters: Democrats Agree to Extend Home-Buyer Tax Credit: Dodd

"We're close, we're close but I can't get into any details until it's a done deal," said Republican Senator Johnny Isakson.I've heard reports that the "phase out" proposal is off the table, and the tax credit will run through April (backers of course will then try to extend it again). The latest report is the credit would be expanded with higher income limits, and would include certain move-up buyers (those who have lived in their current home for some number of years - perhaps five or more).

...

Dodd and Isakson want to extend the credit through June of next year and broaden it to anyone buying a primary residence, not just first-time buyers.

The details are changing constantly ...

CRE: Liberty Property Trust Conference Call Comments

by Calculated Risk on 10/27/2009 02:37:00 PM

Here are some comments worth reading for an understanding of the office and industrial CRE space from the Liberty Property Trust conference call. (ht Brian) Note: Liberty Property Trust owns both office and industrial properties.

LRY: During the third quarter we sold $63 million in operating properties at a 9.5% cap rate.That is worth reading twice. Rents fell off a cliff in Q3, and the are projecting a significant decline over the next year. Combine that with double digit cap rates - and that means a serious decline in property values. UPDATE: the decline in rents in Q3 was in the pipeline: "[F]rom our perspective, what this quarter is showing is the effect of leases signed this year finally commencing and you seeing what's happening to the rents. So what you're seeing today is the effect of the decline in the rents over the over the first three quarters of the year."

With respect to dispositions for 2009 through the end of the third quarter, we have sold $145 million in assets. We think the total for the year will be approximately $175 million. We see less activity for us in the sales area in 2010. We anticipate sales activity in 2010 to be in the 75 to $125 million range. The cap rate on these sales will be in the 9 to 11% range.

And the final item to discuss, the most significant, what do we expect for the same-store group of properties which represent over 90% of our revenue? For the first six months of 2009, rents for renewal and replacement leases increased by 2.8%. For the third quarter they decreased by 13.9%. We expect this third quarter experience to repeat itself for the balance of 2009 and for 2010. We are projecting that rents for 2010 will decrease by 10 to 15% on a straightline basis.

emphasis added

LRY: In the second quarter we reported a pickup in [leasing] activity, more prospects and more tenants willing to make decisions, decisions which include taking advantage of real estate markets or advantageous rates. This trend continued in the third quarter where we signed leases for 3.5 million square feet of new, renewal and development pipeline space and 207 transactions. While there are deals in the market, there is clearly a bifurcation among landlords between the haves and the have-notes in terms of capital. Prospects and brokers are more concerned about a landlord's ability to deliver on its promises.And from the Q&A:

Although the troubled tenant phenomenon has significantly abated, leasing space is very much a deal by deal balancing act. The reality of the market is that the downward rental pressure is the norm, and most leases today are being signed at 10 to 15% below expiring rates. Pressure is more acute on new leases than on renewals. Concessions are primarily free rent and lower base rent. And tenant improvements are lower on renewals than replacement leases, but overall credit drives tenant improvement dollars. On the whole, market demand is well below that of a year ago. Most tenants are renewing and are either staying the same size or downsizing of the very few are expanding. In our markets, the average size of a new office and industrial lease is smaller by about 13%. In spite of weaker demand and lower rents, 85% of the renewals, and 90% of new leases contained contractual rent bumps, of 2% to 3% per year.

Analyst: Can you talk about what you might be looking for in terms of acquisitions from either by asset or market or return expectation?In their view, lenders are dealing with condos, hotels and some retail. Those are the most overbuilt areas of commercial real estate.

LRY: We've been following this fairly closely in a variety of ways, and it's pretty clear to us that what's happening to us in the market right now, is that the lending world, the banks, are dealing with an inflow of troubled real estate loans. What they're dealing with most immediately are condo projects, hotel projects, and a smattering of retail. There has been limited amount of office and industrial product that has kind of gotten into the -- all the way into the distress category and where the banks are taking it over. We think, though, that that might happen, that some product might get to that point and get recycled. Candidly I think the same lag effect with distress on these properties. These lenders are only gearing up sort of right now. There was one that somebody we talked to had 10 people in a workout unit and now they're up to 100. So they're kind of getting their arms around it.

Analyst: I just want to hear more on what's driving your viewpoint that industrial will rebound quicker than office.

LRY: The industrial space is going to respond to somewhat better consumer confidence. It's going to respond to increased trade activity. It's going to respond to any degree of stabilization in the housing market generally. So as the economy gets better, it's the easiest thing you can do, and you can do it very quickly, is put material back on racks in the warehouse and build up inventories. It takes employment increases to begin to put new seats -- new bodies in seats in offices. And given that the September job number still was a negative 263,000, that is to say we have yet to see a positive monthly job number, it just feels like that, that hiring aspect is a ways off, and once it starts, and we talked a little bit about this in some prior calls we think there is some amount of shadow space in the market, that is really manifesting itself in, you know, sort of every fifth desk in an office building is empty because of hiring freezes and job cuts over the last year and a half. So even when companies begin to hire we think they're going to first fill that desk before they need new space. And I think -- I think you really see the evidence of that, that is the shadow space, when you look at the average size of an office renewal in the markets we're in, I'm not talking about Liberty's performance, I'm talking about what is happening in the markets, and the average size of leases is down, which I think represents the fact that as leases expire and people come into the market, even to renew or to take a new space or taking less space than they had. Hence, the very significant absorption numbers we've seen in office. I think the way this plays out, materials back on racks in warehouses, I think that is why we're seeing some activity in the flex space. Because again that can be a smaller distribution play in a market. It can also be more of a tech company or a bio-tech kind of company, but that the classic office worker will be the last piece of this puzzle to come back into focus.

Analyst: What sort of job growth assumptions are in your occupancy target for next year. We're still bleeding jobs. If we have zero net jobs in the US next year do you think you hit your occupancy target?

LRY: Let me first talk about the job assumption number and then the question about the occupancy. Our opinion on this is that unfortunately we're going to see pretty timid job numbers. I think it's even conceivable that we have one or two more months of job losses. Our guess earlier this year was that we might hit 8 million jobs lost and we're at 7.3 so far, and jobs might not go positive until the beginning of next year, and I think you're going to see modest job numbers. You know, the kind of numbers that, you know, don't even keep up with population growth. So and as I said, and this is important in our thinking, we do believe that there is some amount of shadow space out there, that will eat up demand even when it begins to happen, so I think there's a quarter or two of lag in the office even when the job numbers get better before you start seeing it turn into positive absorption. So all of that net is we're assuming -- we're not looking for job growth to significantly affect our occupancy next year. We're looking at this plus or minus 1%, as a number that is consistent with where we see the world.

Home-Buyer Tax Credit and Unemployment

by Calculated Risk on 10/27/2009 01:53:00 PM

From the NY Times: The Case for More Stimulus. Excerpt:

... Washington is not providing a coherent plan for effective stimulus. The Senate has been hamstrung for nearly a month over the most basic relief-and-recovery boost: an extension of unemployment benefits. The Obama administration has called for an expensive crowd-pleaser of dubious effectiveness: sending every Social Security recipient an extra $250.It is hard to understand why the next round of stimulus should include any extension of the home-buyer tax credit. It has a minimal impact on unemployment, it is poorly targeted, and as the NY Times notes "It's waste".

...

Other measures being floated are less effective than unemployment benefits and aid to states. Many of the $250 checks to Social Security beneficiaries will not be spent quickly, because many recipients have no pressing need for the extra money. Proposals by some lawmakers to extend and expand the $8,000 tax credit for first-time homebuyers are even less well targeted. Since it was enacted in February, only an estimated 15 percent of buyers who claimed the credit needed the money to make the purchase. It’s not stimulus when you pay people to do something they would have done anyway. It’s waste.

emphasis added

Meanwhile, the AP is reporting of potential "massive" teacher layoffs in Arizona, and Tom Abate at the San Francisco Chronicle reports the underemployment rate in California is 21.9%: Underemployed compound state's jobless troubles:

The state Employment Development Department estimates that this underemployment rate hit 21.9 percent in September.The best help for the housing market is reducing unemployment and thereby encouraging new household formation. New household formation is always low during a recession as people double up or move into their parent's basements. Once these people become confident in their employment prospects, they will be looking to move out of the basement - excluding of course Matthew McConaughey's character in "Failure to Launch".

That figure includes 1.9 million jobless Californians, 1.4 million people who had to work part time, and 865,000 adults loosely described as discouraged.

"Underemployment is at the highest level since we started keeping these records in 1994," said economist Sylvia Allegretto of the Institute for Research on Labor and Employment at UC Berkeley.

Note: Reuters has more on the current status of the tax credit: Where's Home-Buyer Tax Credit Headed in the House, Senate?

Lawmakers in the Senate are debating whether to extend it, or even expand it, and a vote could come as early as Tuesday. The House, which would also need to approve the measure, has yet to act.

House Prices: Stress Test and Price-to-Rent

by Calculated Risk on 10/27/2009 10:35:00 AM

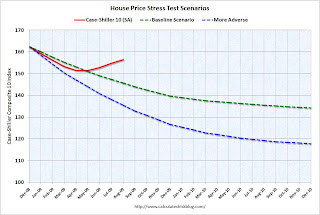

This following graph compares the Case-Shiller Composite 10 SA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts). The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

Case-Shiller Composite 10 Index (SA), August: 156.4

Stress Test Baseline Scenario, August: 145.6

Stress Test More Adverse Scenario, August: 135.5

House prices are 7.4% higher than the baseline scenario, and 15% higher than the more adverse scenario.

There were three key economic stress test parameters: house prices, GDP and unemployment. Both house prices and GDP are performing better than the baseline scenario, and unemployment is performing worse than both stress test scenarios.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through August 2009 using the Case-Shiller Composite Indices (SA): Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph shows the price to rent ratio (January 2000 = 1.0) for the Case-Shiller composite indices. For rents, the national Owners' Equivalent Rent from the BLS is used.

At the peak of the housing bubble it was obvious that prices were out of line with fundamentals. Now most of the adjustment in the price-to-rent ratio is behind us. It appears the ratio is still a little high, and I expect some further decline in prices - especially with rents now falling.

The BLS reported for September:

The increase [in CPI] occurred despite declines in the indexes for rent and owners' equivalent rent, the first decreases in those indexes since 1992.The decrease in OER was at an annual rate of 1.7% and based on media reports, and apartment surveys, it appears rents will continue to decline for some time. This will push up the price-to-rent ratio unless house prices fall.

Note: some would argue the price-to-rent ratio being a little too high is reasonable based on mortgage rates and "affordability".

Case-Shiller Home Price Index Increases in August

by Calculated Risk on 10/27/2009 09:15:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for August this morning.

This monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). This is the Seasonally Adjusted data - some sites report the NSA data.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.5% from the peak, and up about 1.0% in August.

The Composite 20 index is off 31.3% from the peak, and up 1.0% in August. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 10.7% from August 2008.

The Composite 20 is off 11.4% from August 2008.

This is still a very significant YoY decline in prices.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices increased (SA) in 16 of the 20 Case-Shiller cities in August.

Prices increased (SA) in 16 of the 20 Case-Shiller cities in August.

In Las Vegas, house prices have declined 55.6% from the peak. At the other end of the spectrum, prices in Dallas are only off about 4.8% from the peak - and up in 2009. Prices have declined by double digits from the peak in 18 of the 20 Case-Shiller cities.

The debate continues - is the price increase because of the seasonal mix (distressed sales vs. non-distressed sales), the impact of the first-time home buyer frenzy on prices, less supply because of modifications and the general slowdown in the foreclosure process, or have prices actually bottomed? My guess is we will see further house price declines in many areas.

I'll compare house prices to the stress test scenarios soon.