by Calculated Risk on 5/01/2009 08:13:00 PM

Friday, May 01, 2009

Bank Failure 32: America West Bank, Layton, Utah

Whom do they remind you of?

Moe, Curly, Larry.

by Soylent Green is People

From the FDIC: Cache Valley Bank, Logan, Utah, Assumes All of the Deposits of America West Bank, Layton, Utah

America West Bank, Layton, Utah, was closed today by the Utah Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Cache Valley Bank, Logan, Utah, to assume all of the deposits of America West.

...

As of December 31, 2008, America West Bank had total assets of approximately $299.4 million and total deposits of $284.1 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $119.4 million. Cache Valley Bank's acquisition of all of the deposits of America West Bank was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives.

America West Bank is the 32nd bank to fail in the nation this year and the second in Utah. The last FDIC-insured institution to fail in the state was MagnetBank, Salt Lake City, on January 30, 2009.

WSJ: Citi Needs "Up to $10 Billion" in Capital

by Calculated Risk on 5/01/2009 07:54:00 PM

From the WSJ: Citi Said to Need Up to $10 Billion

Citigroup Inc. may need to raise as much as $10 billion in new capital, according to people familiar with the matter ...If Citi isn't required to raise capital, I doubt there will be much confidence in the stress test results. I was expecting a much higher number than $10 billion.

The bank ... is negotiating with the Federal Reserve and may need less if regulators accept the bank's arguments about its financial health ... In a best-case scenario, Citigroup could wind up having a roughly $500 million cushion above what the government is requiring.

Also, from the NY Times: Citigroup to Sell Japanese Units for $5.56 Billion

Citigroup said Friday that it would sell its Japanese brokerage and investment banking units for $5.56 billion, securing much-needed capital before results due this coming week from a U.S. government “stress test” of its financial health.

...

Citigroup said it would realize a loss of $200 million on the transaction, which would generate $2.5 billion in tangible common equity, a measure of financial health.

Bank Failure 31: Citizens Community Bank, Ridgewood, New Jersey

by Calculated Risk on 5/01/2009 05:05:00 PM

Mixing money aroma...

Two Jersey banks merge.

by Soylent Green is People

From the FDIC: North Jersey Community Bank, Englewood Cliffs, New Jersey, Assumes All of the Deposits of Citizens Community Bank, Ridgewood, New Jersey

Citizens Community Bank, Ridgewood, New Jersey, was closed today by the New Jersey Department of Banking and Insurance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with North Jersey Community Bank, Englewood Cliffs, New Jersey, to assume all of the deposits of Citizens Community Bank.

...

As of December 31, 2008, Citizens Community Bank had total assets of approximately $45.1 million and total deposits of $43.7 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $18.1 million. North Jersey Community Bank's acquisition of the deposits of Citizens Community Bank was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives.

Citizens Community Bank is the 31st bank to fail in the nation this year and the first in New Jersey. The last FDIC-insured institution to fail in the state was Dollar Savings Bank, Newark, on February 14, 2004.

Bank Failure 30: Silverton Bank, National Association, Atlanta, Georgia

by Calculated Risk on 5/01/2009 04:14:00 PM

Silverton Bank, crash and burn.

May might be hectic

by Soylent Green is People

From the FDIC: FDIC Creates Bridge Bank to Take Over Operations of Silverton Bank, National Association, Atlanta, Georgia

The Federal Deposit Insurance Corporation (FDIC) created a bridge bank to take over the operations of Silverton Bank, National Association, Atlanta, Georgia, after the bank was closed today by the Office of the Comptroller of the Currency (OCC). ...

Silverton Bank did not take deposits directly from the general public nor did it make loans to consumers. It was a commercial bank that provided correspondent banking services to its client banks.

Silverton Bank had approximately 1,400 client banks in 44 states, and operated six regional offices. It provided a variety of services for its clients, including credit card operations, clearing accounts, investments, consulting, purchasing loans, and selling loan participations. Since the FDIC created a new bank to take over the operations of Silverton Bank, there is not expected to be any meaningful impact on the bank's clients.

...

At the time of its closing, Silverton Bank had approximately $4.1 billion in assets and $3.3 billion in deposits, all of which are expected to be within the FDIC's insurance limits.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $1.3 billion. Silverton Bank is the 30th bank to fail in the nation this year and the sixth in Georgia. The last FDIC-insured institution to fail in the state was American Southern Bank, Kennesaw, on April 24

Auto Sales: Very weak in April

by Calculated Risk on 5/01/2009 03:24:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

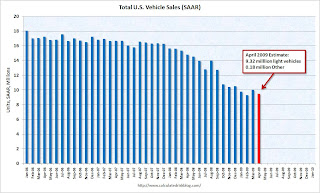

This graph shows the historical vehicle sales from the BEA (blue) and an estimate for April (light vehicle sales of 9.32 million SAAR from AutoData Corp).

Note: this graph includes a small number of heavy vehicle sales to compare to the BEA.

On a seasonally adjusted basis, total sales were still above the February level, but not much.

A few quotes:

"Industrywide, April felt more like a dust bowl than a spring garden for new car sales."

Jim O'Donnell, president of BMW in North America, May 1, 2009.

"It's kind of like the anchor bouncing a long on the bottom of the lake. It has found bottom and it's tripping along a little bit. I think we have found the bottom in aggregate."

Mark LeNeve, GM vice president for sales and marketing, sales conference call, May 1, 2009.

"The industry appears to have stabilized, as it's been fairly level for the past four months. We know where the bottom is, and as the economy struggles to recover, vehicle sales should follow."

Chrysler President Jim Press, May 1, 2009.