by Calculated Risk on 4/27/2009 12:52:00 PM

Monday, April 27, 2009

Q1 2009: Homeownership Rate at 2000 Levels

The homeownership rate is back to the level of Q2 2000. So much for the homeownership gains of the last 8+ years. Gone.

This morning the Census Bureau reported the homeownership and vacancy rates for Q1 2009. Here are a few graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The homeownership rate decreased to 67.3% and is now back to the levels of Q2 2000.

Note: graph starts at 60% to better show the change.

The homeownership rate increased because of demographics and changes in mortgage lending. The increase due to demographics (older population) will probably stick, so I expect the rate to decline to the 66% to 67% range - and not all the way back to 64% to 65%.

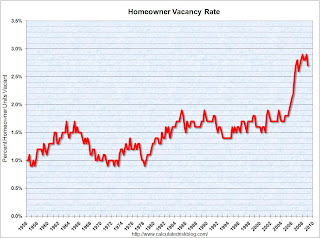

The homeowner vacancy rate was 2.7% in Q1 2009. A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, so perhaps the vacancy rate has stabilized in the 2.7% to 2.9% range.

A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, so perhaps the vacancy rate has stabilized in the 2.7% to 2.9% range.

This leaves the homeowner vacancy rate about 1.0% above normal, and with approximately 75 million homeowner occupied homes; this gives about 750 thousand excess vacant homes.

The rental vacancy rate was steady at 10.1% in Q1 2009.  It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 10.1% to 8%, there would be 2.1% X 40 million units or about 820,000 units absorbed.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 10.1% to 8%, there would be 2.1% X 40 million units or about 820,000 units absorbed.

This would suggest there are about 820 thousand excess rental units in the U.S.

There are also approximately 100 thousand excess new homes above the normal inventory level (for home builders) - plus some uncounted condos.

If we add this up, 820 thousand excess rental units, 750 thousand excess vacant homes, and 100 thousand excess new home inventory, this gives about 1.7 million excess housing units in the U.S. that need to be absorbed over the next few years. (Note: this data is noisy, so it's hard to compare numbers quarter to quarter, but this is probably a reasonable approximation).

These excess units will keep pressure on housing starts and prices for some time.

Another House "Deal of the Week"

by Calculated Risk on 4/27/2009 12:19:00 PM

Zach Fox at the North County Times brings us another house "Deal of the Week": Come to Murrieta, 70 percent off!

Murrieta is in south Riverside County, just north of Temecula. This is part of the notorious Inland Empire.

Here is the price history for the featured 1,442-square-foot home:

July 1997: $60,000

August 2006: $330,545

January 2009: $96,000

Zach writes:

When we started Deal of the Week in February, we focused on outliers that posted huge declines. No more. This isn't an outlier; this is pretty much the neighborhood average. Homes similar to this 1,442-square-foot, single-family house have been selling left and right in the $100,000 to $120,000 range in this area of Murrieta. Dipping into five figures isn't uncommon.I'm always amazed by the peak prices - usually in 2005 and 2006. What is the payment on a $96K home? Probably just over $500 per month PITI with 10% down. (principal, interest, taxes and insurance).

Bank Failure: FDIC Payout Transactions

by Calculated Risk on 4/27/2009 09:28:00 AM

There have been two large payout bank seizures this month (as opposed to finding a buyer). The first was New Frontier Bank in Greeley, Colorado on April 10th, and the second was First Bank of Beverly Hills, California last Friday.

A former regulator told me that payouts are very rare except in rural areas (where there are no buyers). He told me:

These two recent payouts are kinda stunning. I can't stress how hard FDIC works to avoid payouts. They are highly disruptive to customers and quite expensive for the Agency. ... A payout is an operational nightmare for FDIC. ... It's a bigger and messier job than it might appear to anyone who hasn't been through it....that was a pretty story on 60 Minutes a while back, but that wasn't a payout. The pressure is incredible.From the Denver Post: Bank liquidation a blow to Greeley (ht David)

Greeley's largest bank was so larded with troubled assets that, for the first time in three decades, federal officials couldn't find another bank willing to do the liquidation. On April 10, they appointed themselves bank executives to hasten its demise.Pretty amazing story about a bank growing from a trailer in 1998 to $2 billion in assets this year.

"It's a phantom," said Fred Ozyp, the receivership specialist for the Federal Deposit Insurance Corp. heading the liquidation over the next two weeks.

The dream started in a double-wide trailer on Greeley's west side.First Bank of Beverly Hills had total assets of $1.5 billion. Two fairly sizable banks with no buyers.

It was 1998, and Seastrom, a former Eaton bank manager, decided to go into business for himself. He rounded up at least $6 million from investors and hung out the "New Frontier Bank" shingle on a mobile-home awning. The logo featured the company's initials at the center of a galaxy.

His lending universe: the growing housing market and sprawling agriculture industry of Weld County.

GM Restructuring Plan

by Calculated Risk on 4/27/2009 08:54:00 AM

From CNBC: GM Confirms Plans to Cut Jobs, Eliminate Pontiac

General Motors said it would .... eliminate its Pontiac brand ... expects to cut its hourly work force [by 21,000 for the current] level of 61,000 ... It will cut its number of plants to 34 in 2010 from 47 now....Here is the press conference at 9 AM ET:

Sunday, April 26, 2009

GM to Announce New Restructuring Plan at 9 AM ET

by Calculated Risk on 4/26/2009 10:22:00 PM

GM press release: GM President and CEO Fritz Henderson to Update Media on Revised GM Viability Plan

General Motors President and CEO Fritz Henderson will host a press conference on Monday, April 27, to update the media on GM's revised viability plan.Here is a story about the ever changing auto forecasts: G.M.’s Ever-Changing Art of Financial Forecasting

The press conference will run from 9 to 10 a.m. EDT

...

The press conference will also be webcast at http://media.gm.com.

Also a Chrysler story: Chrysler and Union Agree to Deal Before Federal Deadline