by Calculated Risk on 4/12/2009 09:36:00 PM

Sunday, April 12, 2009

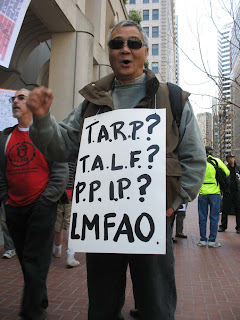

Protest at the San Francisco Fed

A couple of photos from the "A New Way Forward" protest at the San Francisco Fed yesterday. Photo credit: Darin Greyerbiehl, 4/11/2009. More photos here.

|  |

Another House Price Round Trip to the 1990s

by Calculated Risk on 4/12/2009 06:55:00 PM

Zach Fox at the North County Times brings us another house "Deal of the Week": Sans stability in San Marcos

San Marcos is in north county San Diego.

Here is the price history for the featured 3 bedroom, 2 bath, 2 car garage home:

May 1992: $115,500

April 2003: $275,000

April 2006: $440,000

March 2009: $135,000 (REO)

The March 2009 price was a distressed sale, and is half off the 2003 price. Once again, I wonder what buyers (and lenders) were thinking in 2006?

Stalled CRE Projects in D.C.

by Calculated Risk on 4/12/2009 10:19:00 AM

"Everybody is building these big buildings, and they're empty. It is sad. I live in a ghost town."From the WaPo article on the stalled commercial construction projects at the Capitol Riverfront Business Improvement District: At Nationals Park, District of Dreams Hits a Slump (ht mort_fin)

Robert Siegel, an advisory neighborhood commissioner

A few excerpts:

At [Nationals owner Theodore N. Lerner]'s 10-story office building at 20 M St., the lobby doors are sometimes locked much of the afternoon. The only tenant is a bank.Here is a map of the D.C. neighborhood. And a Google map of the area:

A few blocks away, at 2nd and M streets SE, sits a parking lot where developer Chris Smith had planned to build a 10-story office building without a tenant signed in advance. Now he says he needs to have the building about 70 percent leased to even try for financing.

Closer to the Anacostia River, Florida Rock owns land where a cement plant still operates. It hopes to begin construction on office, retail, hotel and residential buildings in the fall of 2010 -- if it can get financing and find a major office tenant.

Nearby, Cleveland-based Forest City stopped construction on a loft building at its project, the Yards, because it couldn't get a loan. It is trying to get financing through a city housing program to restart construction. In the meantime, brown paper and plywood cover the windows.

At developer JPI's apartment project, called Capitol Yards, about half of the nearly 700 apartments are leased. For the past four months, the developer offered two to three months of free rent on the units, which start at roughly $1,600 for a one-bedroom.

View Larger Map

And I had heard that D.C. was immune ...

CRE: Easter Bunny Found in a Field of Steel

by Calculated Risk on 4/12/2009 12:34:00 AM

These photos are of a CRE project in San Diego.

Photo credit: Michael C.

Michael writes:

Who knew that i-beams create a perfect home for cottontails!Now it is one building and a field of steel.

... this was suppose to be 12 buildings and three parking garages.

Michael estimates the delivered steel takes up a football field!

At least the rabbits have found a place to hide.

Saturday, April 11, 2009

Krugman on Economy and Stress Tests

by Calculated Risk on 4/11/2009 10:00:00 PM

Here is an interview with Paul Krugman earlier this week ...

"We have some real real problems. They are not going to go away through self-fulfilling optimism. One of the little things that has been reported is that the IMF now - International Monetary Fund - has upped its estimate of losses on bad loans to $4 trillion. Not so long ago $1 trillion was considered an exorbitant estimate."On delaying the release of the stress test results (actually the original release date was the end of April):

Paul Krugman, April 7, 2009

I think we can say pretty clearly that if the stress tests were saying that every thing was fine, they probably wouldn't be eager to postpone the release of that. This is a problem. One of the versions that we're hearing is that they'll release some generic information, but not information on particular banks. Boy would that be a downer. What everyone is worried about is what we talk about Japan in the '90s - keeping the zombie banks still shambling forward. There is a lot of feeling that American zombie banks now on the march. This news was not good. It made that scenario look a little bit more likely.