by Calculated Risk on 1/08/2008 07:53:00 PM

Tuesday, January 08, 2008

Falling House Prices: Videos

The first video is from Bakersfield (2 minutes):

Remember the guy who predicted house prices would be up 10% this year? Here he is explaining his view today (1 minute 16 seconds):

Sample Newsletter

by Calculated Risk on 1/08/2008 04:49:00 PM

Here is the January Newsletter (858KB PDF) for everyone as a sample.

Enjoy.

For current subscribers, your 12 month period starts with the February issue (first week in February). If you didn't receive an earlier email - and signed up before last Friday - please send me an email to verify your email address - please specify how you paid (letter or PayPal). I think I have everything sorted out.

If you'd like to subscribe, here is the sign up page ($60 annual fee).

Just to be clear: the blog will stay the same, and much of the newsletter material is from the blog. Best Wishes to All.

AT&T Sees Softness in Consumer Business

by Calculated Risk on 1/08/2008 03:55:00 PM

Click on picture for larger image.

Click on picture for larger image.

Headlines via Brian.

"Hoping we can manage through this downcycle"

'softness' in consumer business.

Not feeling economic effect in corporate sales.

UPDATE: AP story: AT&T CEO Sees Slowdown in Consumer Side

CD Rates and NIMs

by Calculated Risk on 1/08/2008 01:44:00 PM

The WSJ had an interesting article this morning on the margin squeeze at many banks. From the WSJ: Banks' Narrowing Margins

Many banks ... are likely to report narrowing in net interest margins -- a key measure of industry profitability -- already at the lowest level since 1991.Check out the CD rates at CountryWide and IndyMac.

Much of the pinch is being attributed to a scramble for deposits. Even though the Federal Reserve has been cutting interest rates, many banks are still offering attractive rates for deposits. A quarterly survey released last week by Citigroup Inc. found that "the competition to raise new deposits" via certificates of deposit and money-market funds "remains intense."

...

While banks are now collecting less interest on loans because of the Fed's rate reductions, they are still making the same interest payments to depositors.

CountryWide is offering a 6 month CD with an APY of 5.45%.

IndyMac is offering a 3 months CD with an APY of 5.4%.

Click on graph for larger image.

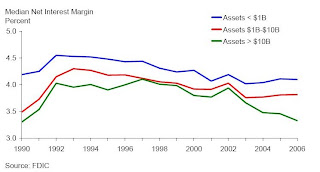

Click on graph for larger image.Here is a graph from the FDIC (through 2006) of Net Interest Margins (NIMs) by bank size. Even though the larger banks have seen more of a NIM squeeze, the smaller banks make more of their income from NIMs.

Another concern is that banks have been growing their asset portfolios to lessen the impact of falling NIMs. From the FDIC last year:

To offset the effects of lower margins, institutions have been growing their asset portfolios. ... Small and mid-size institutions have been increasing their concentrations in riskier assets, such as CRE loans and construction and development (C&D) loans. This suggests that, although small and mid-size institutions have been more successful in limiting the erosion of their nominal NIMs, they have achieved this success in part by assuming higher levels of credit risk.I eagerly await the next Emerging Risks report from the FDIC.

Countrywide Bankruptcy Rumor and Denial

by Calculated Risk on 1/08/2008 01:33:00 PM

From Bloomberg: Countrywide Loses Most Since 1987 on Bankruptcy Bets

Countrywide Financial Corp. dropped the most in two decades on the New York Stock Exchange amid speculation the largest U.S. mortgage lender will file for bankruptcy.From Reuters: Countrywide Financial denies bankruptcy rumors

...

``There's some sort of rumor that they would go under, but it's purely a rumor,'' said Thomas Garcia, head of trading at Thornburg Investment Management, which oversees about $50 billion in Santa Fe, New Mexico.

"There is no substance to the rumor that Countrywide is planning to file for bankruptcy, and we are not aware of any basis for the rumor that any of the major rating agencies are contemplating negative action relative to the company," Countrywide said in a statement.Just another false CFC bankruptcy rumor.