by Calculated Risk on 1/04/2008 02:21:00 PM

Friday, January 04, 2008

Glassman: "Real estate excesses will vanish by spring 2008"

A few days ago, the WSJ asked: Will Home Prices Hit Bottom by June?. The WSJ's Greg Ip provided a link to a research report by James Glassman, economist at J.P. Morgan Chase. (no relation to James K. Glassman, co-author of “Dow 36,000″)

"The correction of housing prices is well under way. Given the present trends in income and house prices, real estate excesses of the past five years will have vanished by spring 2008.And Glassman references this figure:

Click on graph for larger image.

Click on graph for larger image.This graph is incorrect. The author is comparing gross income per household vs. the S&P / Case-Shiller house price index.

The repeat sales index determines the average change in a house price. The gross income could be distorted by a few individuals with extraordinary income gains.

The average change in a house price could be distorted too, if the most expensive homes appreciated at a much faster rate than other homes. But this doesn't appear to be an issue.

Instead of using the gross income per household, the author should use the median household income gain for homeowners (probably the top 2/3 of households).

This is a simple error, but it leads to a very wrong conclusion. The real estate excesses will not vanish by spring 2008.

Besides the graph is very funny - the housing bubble of the late '80s is graphed as the normal price range. And the subsequent housing bust is graphed as housing being undervalued. That was a very painful bust for many builders and homeowners, and that bubble / bust was small compared to the current bubble.

S&P may cut $6.42 Billion in CDOs

by Calculated Risk on 1/04/2008 12:24:00 PM

From Reuters: S&P may cut $6.42 bln CDOs affecting 149 tranches

Standard & Poor's may cut the rating on $6.42 billion of collateralized debt obligations (CDOs) following downgrades to billions of dollars worth of second-lien residential mortgage-backed securities last month.

S&P said the action affects 149 tranches from 43 U.S. cash flow and hybrid CDOs of asset-backed securities.

December Employment Report

by Calculated Risk on 1/04/2008 08:31:00 AM

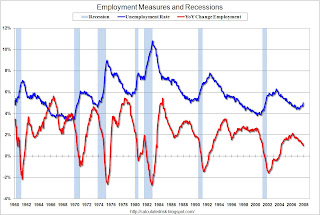

Update: This graph shows the unemployment rate and the year-over-year change in employment vs. recessions. Click on graph for larger image.

Click on graph for larger image.

The rise in unemployment, from a cycle low of 4.4% to 5.0% will set off alarm bells.

Also concerning is the YoY change in employment is less than 1%, also suggesting a recession.

Employment numbers can be heavily revised, but this report will definitely get attention.

Original Post: From the BLS: Employment Situation Summary

The unemployment rate rose to 5.0 percent in December, while nonfarm payroll employment was essentially unchanged (+18,000), the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Job growth in several service-providing industries, including professional and technical services, health care, and food services, was largely offset by job losses in construction and manufacturing. Average hourly earnings rose by 7 cents, or 0.4 percent.

Click on graph for larger image.

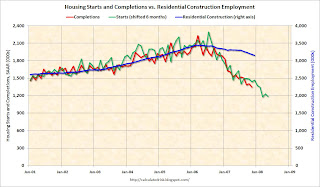

Click on graph for larger image.Residential construction employment declined 28,500 in December, and including downward revisions to previous months, is down 293.1 thousand, or about 8.5%, from the peak in March 2006. (compared to housing starts off almost 50%).

Note the scale doesn't start from zero: this is to better show the change in employment.

This second graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions typically lag Starts by about 6 months.

This second graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions typically lag Starts by about 6 months.This suggests residential construction employment could fall significantly from current levels.

Overall this is a very weak report, and the unemployment rate rising to 5% will set off recession arguments.

Thursday, January 03, 2008

Analysts: Corporate Defaults to Rise "Drastically"

by Calculated Risk on 1/03/2008 05:51:00 PM

From the WSJ Deal Journal: Citi and J.P. Morgan Predict a Buffet of Defaults (hat tip James)

With credit flowing to practically any company in need of cash in recent years, the rate of defaults for U.S. high-yield companies fell to just 0.34% in December, according to a J.P. Morgan Chase analysis. The J.P. Morgan analyst, Peter Acciavatti, predicts that is about to rise drastically, to 4% by the end of 2009 ... Citigroup expects the default rate to surge to 5.5% ...And from Bloomberg: Buffets Misses Coupon Payment; Bonds Fall to New Low

Buffets Inc., the largest operator of buffet-style restaurants in the U.S., failed to make a coupon payment on $293 million of debt, sending the bond prices plunging to a record low.

...

The missed payment sparked concerns that corporate defaults are starting to escalate as the worst home sales market since 1981 slows the economy. Tousa Inc., the Florida homebuilder that lost 99 percent of its market value in the past year, also missed interest obligations on $485 million in debt, the company said in a regulatory filing yesterday.

Consumer Delinquency Rate Highest Since Last Recession

by Calculated Risk on 1/03/2008 01:48:00 PM

From Reuters: Consumers late payers on most loans since recession (hat tip Mike_in_Fl)

Americans are falling further behind on consumer loans, with late payments rising to the highest level since the nation's last recession in 2001, data released Thursday show.A nice follow up to my earlier post on auto sales.

In its quarterly study of consumer borrowing, the American Bankers Association said the percentage of loans at least 30 days past due rose to 2.44 percent in the July-to-September period from 2.27 percent in the previous quarter.

The delinquency rate, which covers eight loan categories, was the highest since a 2.51 percent rate in the second quarter of 2001. Late payments on some types of loans rose to levels not seen since the 1990s.

...

Meanwhile, late payments on "indirect" auto loans, which are made through dealerships, totaled 2.86 percent in the third quarter, a 16-year high.

Credit-card delinquencies fell to 4.18 percent from 4.39 percent in the second quarter.