by Calculated Risk on 9/21/2007 04:25:00 PM

Friday, September 21, 2007

Harman Says Buyout Scuttled

WSJ: Harman Says Buyout Scuttled

Harman International Industries Inc. learned this afternoon that Kohlberg Kravis Roberts & Co. and Goldman Sachs Group's GS Capital Partners VI Fund LP don't intend to complete their $8 billion buyout of Harman.The breakup fee is $225 Million. Perhaps that is why KKR is arguing Harman breached the merger agreement - to avoid, or at least negotiate, the fee.

...

Harman said the private-equity companies informed [Harman] that they believe there was a "material adverse change" in Harman's business and that Harman breached the merger agreement.

Harman disagrees ...

Q2 Mortgage Equity Withdrawal: $140.3 Billion

by Calculated Risk on 9/21/2007 03:41:00 PM

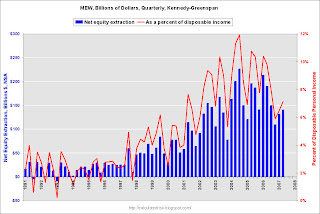

Here are the Kennedy-Greenspan estimates of home equity extraction for Q2 2007, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41. Click on graph for larger image.

Click on graph for larger image.

For Q2 2007, Dr. Kennedy has calculated Net Equity Extraction as $140.3 Billion, or 7.1% of Disposable Personal Income (DPI). Note that equity extraction for Q1 2007 has been revised upwards to $131.3 Billion.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

It is very likely that MEW will collapse in Q3 2007, based on the tighter lending standards and falling home prices, leading, most likely, to less consumer spending.

HSBC to Close U.S. Mortgage Unit

by Calculated Risk on 9/21/2007 12:57:00 PM

From the WSJ: HSBC to Close U.S. Mortgage Unit

HSBC PLC will close its standalone U.S. subprime-mortgage business and take $945 million in related charges ...The beat goes on.

The London banking giant will close Decision One Mortgage, which originates nonprime mortgages through brokers. Instead, the company will focus on loan origination and servicing through its HFC and Beneficial bank branches.

...

Approximately 750 people will lose their jobs ...

Fed's Kohn on Causes of Housing Bubble

by Calculated Risk on 9/21/2007 11:48:00 AM

From Fed Vice Chairman Donald L. Kohn: Success and Failure of Monetary Policy since the 1950s. An excerpt on the causes of the housing bubble:

"... it is far too soon to pass judgment on what went wrong in the U.S. housing market and why. I suspect that, when studies are done with cooler reflection, the causes of the swing in house prices will be seen as less a consequence of monetary policy and more a result of the emotions of excessive optimism followed by fear experienced every so often in the marketplace through the ages. To some extent, too, the amplitude of the housing cycle was heightened by the newness of the subprime market, the fragmentation of regulatory oversight responsibility for that market, and the complexity and opacity of the newer instruments for transforming and distributing risk. Low policy interest rates early in this decade helped feed the initial rise in house prices. However, the worst excesses in the market probably occurred when short-term rates were already well on their way to more normal levels, but longer-term rates were held down by a variety of forces. And similar, sometimes even sharper, trajectories of house prices have been witnessed in some economies in which the central banks said they were paying more attention to asset prices."Many very lengthy papers will be written on the causes of the bubble. Agree or disagree, Kohn touches on a few key points: monetary policy definitely contributed to the initial surge in prices, lax oversight - Kohn says because of "fragmentation of regulatory oversight responsibility" - allowed the bubble to expand, and speculation played a key role. I'll post on what I consider the key causes this weekend.

Report: Harman LBO Deal in Trouble

by Calculated Risk on 9/21/2007 02:19:00 AM

Another private equity LBO is in trouble.

From the WSJ: Harman's Suitors Sour on Buyout

The private-equity buyers of Harman International Industries Inc. are balking at completing the $8 billion purchase of the audio-equipment maker, people familiar with the matter said, as yet another leveraged buyout falls into a hostile tête-à-tête between buyer and seller.Based on previous reports, the average loss on recent LBOs has been about 4% of the

...

Should KKR and Goldman choose to break the deal, they would have to pay a $225 million termination fee, according to corporate filings. That fee is about 2.86% of the deal's value, which is somewhat lower than other transactions of a similar size, according to an analysis by MergerMetrics.com.

As an aside, the Harman business has recently underperformed expectations, probably as a direct result of the housing bust.