by Calculated Risk on 9/20/2007 12:47:00 AM

Thursday, September 20, 2007

Sallie Mae Deal in Jeopardy

From the NY Times: Deal to Buy Sallie Mae in Jeopardy

The consortium that had agreed to buy Sallie Mae for $25 billion plans to return to the negotiating table and seek a lower price ...The $900 million breakup fee is a little higher than the reported percentage writedowns at Lehman and Morgan Stanley. If unsuccessful, this would be the largest deal to fall apart so far in this cycle.

The buyers — the private equity firms J. C. Flowers & Company and Friedman Fleischer & Lowe, as well as two banks, JPMorgan Chase and Bank of America — met Tuesday to discuss the best way to pressure Sallie Mae into accepting a lower price, these people said.

While the group is hoping to renegotiate the price of Sallie Mae, these people said, it may also be willing to walk away and pay the $900 million breakup fee.

Wednesday, September 19, 2007

Saudi Arabia Refuses to Cut Rates

by Calculated Risk on 9/19/2007 06:19:00 PM

From The Telegraph: Fears of dollar collapse as Saudis take fright

Saudi Arabia has refused to cut interest rates in lockstep with the US Federal Reserve for the first time, signalling that the oil-rich Gulf kingdom is preparing to break the dollar currency peg in a move that risks setting off a stampede out of the dollar across the Middle East.This ties back to my post yesterday on a possible vicious cycle. To attract sufficient foreign capital flows to cover the U.S. current account deficit, interest rates in the U.S. may need to rise significantly.

"This is a very dangerous situation for the dollar," said Hans Redeker, currency chief at BNP Paribas.

Saudi Arabia has $800bn (£400bn) in their future generation fund, and the entire region has $3,500bn under management. They face an inflationary threat and do not want to import an interest rate policy set for the recessionary conditions in the United States," he said.

The Saudi central bank said today that it would take "appropriate measures" to halt huge capital inflows into the country, but analysts say this policy is unsustainable and will inevitably lead to the collapse of the dollar peg.

The Greenspan conundrum was that long rates didn't rise at the Fed Funds rate was increased. Bernanke's conundrum may be that long rates don't fall (or maybe even increase) as he lowers the Fed Funds rate!

Moody's Forecasts House Prices to Fall 7.7% Nationwide

by Calculated Risk on 9/19/2007 04:38:00 PM

From CNN Money: Double-digit home price drops coming

According to an analysis conducted by Moody's Economy.com, declines will exceed 10 percent in 86 of the 379 largest housing markets. And 290 of the cities will experience price drops of 1 percent or more.See story for Moody's price forecast for top 100 cities.

The survey attempted to identify the high and low points of housing prices in each of the markets, some of which started declining from their peak in the third quarter of 2005. All are median prices for single-family houses.

Nationally, Moody's is projecting an average price decline of 7.7 percent. That's a jump from the 6.6 percent total price drop that the company was forecasting in June and more than twice that of last October's forecast of a 3.6 percent price decrease.

Here are the top ten by forecasted price declines:

| Rank | Area | State | Peak | Bottom | Peak to bottom home price decline |

| 1 | Stockton | CA | 06Q1 | 08Q4 | -25.0 |

| 2 | Palm Bay-Melbourne-Titusville | FL | 06Q1 | 08Q4 | -24.9 |

| 3 | Sarasota-Bradenton-Venice | FL | 06Q1 | 08Q3 | -24.8 |

| 4 | Reno-Sparks | NV | 06Q1 | 09Q1 | -22.4 |

| 5 | Modesto | CA | 06Q2 | 08Q3 | -22.3 |

| 6 | Detroit-Livonia-Dearborn | MI | 05Q3 | 09Q1 | -21.3 |

| 7 | Fresno | CA | 06Q2 | 09Q1 | -20.0 |

| 8 | Oxnard-Thousand Oaks-Ventura | CA | 06Q2 | 08Q3 | -19.2 |

| 9 | Sacramento--Arden-Arcade--Roseville | CA | 06Q1 | 08Q4 | -19.1 |

| 10 | Las Vegas-Paradise | NV | 06Q2 | 08Q4 | -18.7 |

Look at the price bottoms; Moody's is mostly forecasting the price bottoms to happen in late 2008. That would make this one of the shortest duration housing busts with similar price declines in history. Historically declines of this magnitude have taken 5 to 7 years because house prices are sticky.

My guess is prices will decline further than Moody's is expecting, and the duration of the bust will be longer.

Banks Balk, PHH Deal in Jeopardy

by Calculated Risk on 9/19/2007 02:16:00 PM

From Bloomberg: PHH Sale to GE, Blackstone May Collapse as Banks Balk

PHH Corp., the New Jersey-based mortgage lender that agreed to be bought by General Electric Co. and Blackstone Group LP, said the $1.8 billion sale may unravel as lenders back away from some leveraged buyouts.Other deals in trouble include Genesco and Reddy Ice.. The banks are balking as they report write downs from the LBO loans - and try to avoid more pier loans on their balance sheets. See the WSJ: Fuzzy LBO Math

JPMorgan Chase & Co. and Lehman Brothers Holdings Inc. told Blackstone they may fall $750 million short in funding its part of the deal ...

``There will be some deals that won't get done, but it won't be the big names,'' billionaire financier Wilbur Ross, whose New York-based WL Ross & Co. invests in distressed companies, said today in an interview. ``Some of the smaller deals have better escape hatches.''

The [Morgan Stanley]’s finance chief, David Sidwell, told Bloomberg in an interview that net of fees, Morgan Stanley had $726 million of markdowns on $31 billion of leveraged-loan commitments.

Lehman Brothers Holdings said Tuesday on a conference call that it had “more than” $1 billion of paper losses on $27 billion of such commitments.

Fed: Household Debt Service and Financial Obligations Ratios

by Calculated Risk on 9/19/2007 01:07:00 PM

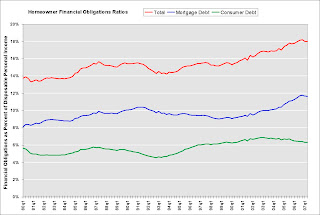

The Federal Reserve released the Q2 Household Debt Service and Financial Obligations Ratios today.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. This data has limited value in terms of absolute numbers, but might be useful in looking at trends. Here is the discussion from the Fed:

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only a rough approximation of the current debt service ratio faced by households. Nonetheless, this rough approximation may be useful if, by using the same method and data series over time, it generates a time series that captures the important changes in household debt service payments.

Click on graph for larger image.

Click on graph for larger image.After several years of the homeowners financial obligations ratio (FOR) increasing rapidly - due almost entirely to increases in mortgage obligations - it appears the FOR might have peaked at the end of 2006.

The recent rapid increase in the FOR was especially stunning considering interest rates were falling (if the debt to income ratio had stayed stable, the FOR would have declined along with rates).

Even with the small declines over the first half of 2007, the homeowner FOR (and mortgage FOR) are still near record levels. For the FOR to decline to more normal levels requires some mix of an increase in disposable personal income, a decrease in debt, or a decrease in interest rates. This correction process will probably take several years, as U.S. households work to reduce their financial obligations as a percent of DPI.