by Calculated Risk on 9/07/2007 11:23:00 AM

Friday, September 07, 2007

Indymac Writes to Shareholders

Press Release: Indymac Provides Update on Current Performance

Dear shareholders and other Indymac stakeholders:

...the mortgage and housing markets are very difficult, and the private secondary markets have significantly worsened. The illiquidity in the secondary markets, and consequent significant and abrupt spread widening for all mortgage products except those saleable to the GSEs, have negatively impacted the profitability of our mortgage production division. ... we have largely converted our mortgage production to a GSE-eligible model ...

... Given the current operating environment and our anticipated earnings performance, I believe it is prudent to assess our current common stock dividend payout, and I plan to recommend to the Board of Directors that we reduce our quarterly dividend payout to $0.25 per share for the time being. ... I also believe that we will be able to sustain this level of dividend payout through the current down cycle for the mortgage and housing markets, which is presently forecasted to worsen before it gets better.

... the secondary mortgage markets have changed dramatically, and in response we have transformed our mortgage production from largely an Alt-A platform at the beginning of the quarter to roughly 90 percent GSE-eligible production currently. ... We expect that our production volumes will be down substantially, by roughly one-half in the fourth quarter, although we are experiencing some pricing power on new loans such that our margins are improving. With production volumes coming down, we need to again take steps to right-size our organization and have announced internally our intentions to do so, starting with a voluntary severance program, which will be followed by additional involuntary layoffs. Combined, we see a reduction of roughly 10 percent of our workforce, or approximately 1,000 employees, over the next several months.

emphasis added

August Employment Report

by Calculated Risk on 9/07/2007 09:03:00 AM

From WSJ: Payrolls Fall for First Time Since 2003, Likely Pressuring Fed to Cut Rates

U.S. employment fell for the first time in four years last month on steep drops in construction and manufacturing payrolls, suggesting that the housing recession is starting to grip the broader economy.Here is the BLS report. Note that the unemployment rate was unchanged, even though the household survey showed a decline in employment of 316,000 in August. The reason is the household survey showed the labor force fell by 340,000, keeping the unemployment rate the same.

...

Nonfarm payrolls fell 4,000 in August, the first decline since August 2003, the Labor Department said Friday.

Previous reports were revised sharply lower. July job growth was revised down to 68,000 from 92,000. June gains were revised to 69,000 from 126,000. The 44,000 monthly average job gain for the past three months is down sharply from the 147,000 average between January and May.

The unemployment rate, however, was unchanged last month at 4.6%.

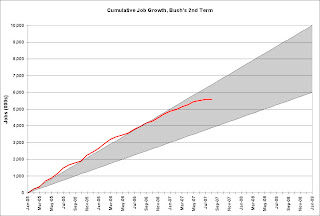

Click on graph for larger image.

Click on graph for larger image.Here is the cumulative nonfarm job growth for Bush's 2nd term. The gray area represents the expected job growth (from 6 million to 10 million jobs over the four year term). Job growth has been solid for the last 2 1/2 years and is near the top of the expected range.

Residential construction employment declined 23,000 in August, and including downward revisions to previous months, is down 167.6 thousand, or about 4.9%, from the peak in March 2006. (compare to housing starts off 30%).

Note the scale doesn't start from zero: this is to better show the change in employment.

Poor People Are Sharks

by Anonymous on 9/07/2007 08:23:00 AM

This, by Michael Lewis of Bloomberg, is hysterical. Hat tips for the dozens of you who sent me the link.

There's a reason the rich aren't getting richer as fast as they should: they keep getting tangled up with the poor. It's unrealistic to say that Wall Street should cut itself off entirely from poor -- or, if you will, ``mainstream'' -- culture. As I say, I'll still do business with the masses. But I'll only engage in their finances if they can clump themselves together into a semblance of a rich person. I'll still accept pension fund money, for example. (Nothing under $50 million, please.) And I'm willing to finance the purchase of entire companies staffed basically with poor people. I did deals with Milken, before they broke him. I own some Blackstone. (Hang tough, Steve!)Do I need to dredge up the old posts from the days (a mere few months ago) when "Subprime Is About Helping The Poor" was baloney du jour? Or do you all still remember that as vividly as I do?

But never again will I go one-on-one again with poor people. They're sharks.

How Many Mortgages Are Brokered?

by Anonymous on 9/07/2007 07:18:00 AM

I thought I knew the answer to that question, roughly, but twice in the last two days I've seen a number thrown around that surprised me. This morning it was The Morning Call, "Survey: 33 percent of home loans didn't close last month," the first paragraph of which sayeth:

A third of home loans originated by mortgage brokers failed to close in August as investors shied away from riskier borrowers, a new survey says.Oh. So it's not 33% of home loans, it's 33% of brokered home loans. And how many is that?

Mortgage brokers account for about one-third of total mortgage originations, and have originated a larger share of loans to riskier borrowers, so the percentage of failed loans in the entire market may be smaller.Oh. A third of a third failed to close. Or, roughly, 11% of "home loans." Which makes a less impressive headline, for sure.

But what's with that one-third of mortgages being brokered? I seem to recall that back in the glory days, when brokers wanted to take more credit for their part in the "economic miracle," the number was a bit higher. So I just started surfing.

McClatchy, July 5 2007:

Mortgage brokers, who originate up to two-thirds of home loans, have exploited their lack of federal regulation to loosen lending standards in ways that sparked today's high mortgage-default rates among borrowers with weak credit.

Baltimore Sun, August 30 2007:

Some states are looking to require that mortgage brokers act in the best interests of consumers. Roughly two-thirds of mortgages are originated through brokers, and consumer advocates say some steered borrowers to high-cost loans or deliberately excluded real estate taxes and insurance escrow to make mortgage payments look more affordable.

National Association of Mortgage Brokers, May 31 2007:

The National Association of Mortgage Brokers is the voice of the mortgage broker industry with more than 25,000 members in all 50 states and the District of Columbia. NAMB provides education, certification and government affairs representation for the mortgage broker industry, which originates over 50% of all residential loans in the United States.

National Mortgage News, undated:

In 2006 loan brokers using table-funding (the wholesale channel) accounted for 26% of the $3.267 trillion in residential loans originated in the U.S., or $849.4 billion. Brokers and correspondents (correspondents are depositories or mortgage bankers using warehouse lines) together accounted for 62% of all loans produced, or $2.02 trillion. In 2005 retail accounted for 43%, wholesale 27%, and correspondent 30%. These exclusive survey figures are courtesy of the The Mortgage Industry Directory and The Quarterly Data Report.

Mortgage Bankers Association, September 2006:

for the market as a whole in 2004 and 2005, 49-50 percent of loan originations were through a broker channel, 42-45 percent through retail originations, and the remainder through direct marketing channels.

A problem here seems to be difficulty in distinguishing between a "broker" (who has no money, basically) and a "correspondent" (who has enough money to close the loan and disburse funds). The problem is overlap: Correspondents originate brokered loans and then sell them to "wholesale lenders," who also themselves originate brokered loans. It's a big and complex food chain and double-counting as well as non-counting are chronic problems.

Why should we care? Well, besides wanting some reality check on that eye-popping statistic that started all this rumination, I'd like to know if broker market share is truly shrinking in the backlash. I'll keep you posted if I find, um, consistent information.

Paulson: Economy will "Pay Penalty" for Turmoil

by Calculated Risk on 9/07/2007 12:07:00 AM

From MarketWatch: Turmoil could take months to resolve, Paulson says

"There have been real strains in the capital markets and across some of the credit markets," Paulson told the Nightly Business Report on PBS. "And I think this will take a while to play out, and almost certainly over time this will have an impact on our economy."

"It's certainly going to be into the weeks, maybe a number of months," he said. .... Paulson said the economy would pay a "penalty," but insisted that the U.S. and global economies were "very strong."

Paulson said estimates of 2 million foreclosures are exaggerated.