by Calculated Risk on 1/18/2007 08:02:00 PM

Thursday, January 18, 2007

Pulte Homes Warns

Pulte Homes warns on Q4 results.

"Pulte Homes continues to navigate through a challenging operating environment, with demand for new homes during the fourth quarter still far below pre-2006 levels."Pulte had already guided earnings expectations lower. Now they are reducing their Q4 earnings estimates again:

Richard J. Dugas, Jr., President and CEO of Pulte Homes, Jan 18, 2007

The Company expects fourth quarter results to be in the range of a loss of $.05 to earnings of $.05 per diluted share from continuing operations. Pulte Homes had previously issued earnings guidance in the range of $.30 to $.70 per diluted share, guiding to the lower end of the range in its earnings conference call for the third quarter.Orders are getting worse:

The Company closed 12,566 homes during the fourth quarter of 2006, a decline of 20% from the fourth quarter of 2005. Net new orders for the quarter were 6,446 homes, a 34% decrease from last year's fourth quarter. For the full year 2006, home closings were 41,487, down 9% compared with 2005. Net new orders for the full year 2006 decreased 29% from the prior year to 33,925 homes.But the cancellation rate improved slightly:

"... [Pulte] experienced a stabilization to a slight improvement in our fourth quarter cancellation rate compared with the third quarter, as this metric showed progressive improvement throughout the period."Of course if orders fall to zero, the cancellation rate will decline to zero too. So this metric needs to be kept in context.

Impairments are much worse than expected:

On a preliminary basis, Pulte Homes anticipates that these impairments and land-related charges will be in the range of $330 million to $350 million for the fourth quarter, or $.83 to $.88 per diluted share. The Company previously issued guidance of $150 million for impairments and land-related charges.Perhaps the only good news is Pulte is reducing their production:

"[Pulte] continue[s] to reduce the number of homes we are starting, as evidenced by our meaningful reduction in speculative units under construction during the quarter."

DataQuick: 2006 California Sales Lowest Since 1996

by Calculated Risk on 1/18/2007 02:39:00 PM

DataQuick reports: California December Home Sales

Last month's sales made for the slowest December since 1996 when 33,591 homes were sold.Note that 1996 was the last year of the early '90s housing bust in California.

Click on graph for larger image.

Click on graph for larger image.A total of 41,100 new and resale houses and condos were sold statewide last month. That's up 4.8 percent from 39,200 for November and down 22.2 percent from a 52,800 for December 2005.Although some areas in California are already seeing YoY nominal price declines - like San Mateo, Sonoma, San Diego and Ventura - the median YoY price in California increased slightly.

Last month's sales made for the slowest December since 1996 when 33,591 homes were sold.

The median price paid for a home last month was $474,000. That was up 1.1 percent from November's $469,000, and up 3.5 percent from $458,000 for December a year ago.

Housing: Starts and Completions

by Calculated Risk on 1/18/2007 11:06:00 AM

The Census Bureau reports on housing Permits, Starts and Completions. Seasonally adjusted permits rose slightly:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,596,000. This is 5.5 percent above the revised November rate of 1,513,000, but is 24.3 percent below the December 2005 estimate of 2,107,000.Starts were up for the second straight month:

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 1,642,000. This is 4.5 percent above the revised November estimate of 1,572,000, but is 18.0 percent below the December 2005 rate of 2,002,000.And Completions were flat, at just below the recent record levels:

Privately-owned housing completions in December were at a seasonally adjusted annual rate of 1,900,000. This is 0.4 percent above the revised November estimate of 1,893,000, but is 2.7 percent below the December 2005 rate of 1,953,000.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Starts vs. Completions.

I'm a little surprised at the slight rebound in starts, especially since completions and inventories are still near record levels. Still Starts have fallen "off a cliff", and completions have just started to fall.

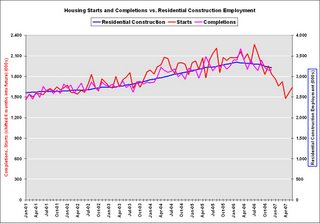

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment are highly correlated, and Completions lag Starts by about 6 months.

Based on historical correlations, it is reasonable to expect Completions and residential construction employment to follow Starts "off the cliff". This would indicate the loss of 400K to 600K residential construction employment jobs by this Summer.

Wednesday, January 17, 2007

Worth a second look ...

by Calculated Risk on 1/17/2007 05:51:00 PM

If you missed Tanta's most recent post, it is definitely worth reading (and rereading): Information is Power, Which is Why You Don’t Get Any.

Make sure you read the comments too.

I just hope she wasn't referring to me when she wrote:

"... next time I'll write something calm and polite and professional and bland and get my case jumped by the readers who are tired of calm and polite and professional and bland because that's all you ever get in the newspaper and we come to blogs for some juice."

DataQuick: Bay Area home prices flat, slow sales

by Calculated Risk on 1/17/2007 05:14:00 PM

From DataQuick: Bay Area home prices flat, slow sales

Bay Area home prices were flat last month while the sales pace was the slowest pace in a decade ...Just six months ago, DataQuick reported "indicators of market distress are still largely absent" and "foreclosure rates are coming up from last year's low point, but are still below normal levels". Now foreclosures are in the "normal range", and from the information I'm receiving, foreclosures will be significantly above normal shortly.

A total of 7,488 new and resale houses and condos sold in the Bay Area last month. That was up 3.9 percent from 7,204 in November, and down 19.9 percent from 9,347 for December last year, according to DataQuick Information Systems.

Sales have declined on a year-over-year basis the last 21 months. Last month's sales count was the lowest for any December since 1996 when 7,180 homes were sold. The average for all Decembers since 1988 is 8,339.

...

The median price paid for a Bay Area home was $612,000 in December. That was down 0.6 percent from $616,000 in November and up 0.5 percent from $609,000 for December a year ago. The median peaked last June at $644,000.

...

Indicators of market distress are still in the normal range. Financing with adjustable-rate mortgages is flat. Foreclosure activity is rising but is still in the normal range. Down payment sizes are stable. Flipping rates and non-owner occupied buying activity are down, DataQuick reported.