by Calculated Risk on 1/17/2007 01:12:00 PM

Wednesday, January 17, 2007

Fed's Mishkin on Monetary Policy and House Prices

From Fed Governor Frederic Mishkin: The Role of House Prices in Formulating Monetary Policy

Once again the Fed is arguing against taking action when a possible bubble is forming. This is the same argument Greenspan made during the stock market bubble, but this time the issue is housing. However, the Fed stands ready to take action if the bursting of the bubble impacts the general economy.

Mishkin's conclusion:

Large run-ups in prices of assets such as houses present serious challenges to central bankers. I have argued that central banks should not give a special role to house prices in the conduct of monetary policy but should respond to them only to the extent that they have foreseeable effects on inflation and employment. Nevertheless, central banks can take measures to prepare for possible sharp reversals in the prices of homes or other assets to ensure that they will not do serious harm to the economy.

NAHB: Builder Confidence Improves in January

by Calculated Risk on 1/17/2007 12:59:00 PM

From NAHB: Builder Confidence Improves in January

Click on graph for larger image.

Click on graph for larger image.

Excerpts:

The HMI increased from an upwardly revised 33 in December to 35 in January, its highest level since July of 2006.

...

Two out of three component indexes registered improvement in January. The index gauging current single-family home sales and the index gauging traffic of prospective buyers each gained three points, to 36 and 26 respectively, while the index gauging sales expectations for the next six months remained unchanged at 49.

Meanwhile, three out of four regions surveyed in the HMI posted gains in January. Two-point gains were registered in the Northeast, Midwest and South, to 39, 24 and 41, respectively. The HMI for the West remained unchanged from the previous month at 32.

MBA: Purchase Applications Decrease

by Calculated Risk on 1/17/2007 10:39:00 AM

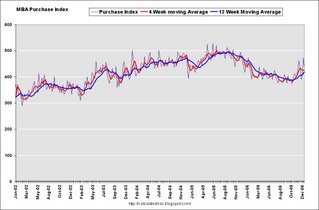

The Mortgage Bankers Association (MBA) reports: Refinance Applications Increase and Purchase Applications Decrease Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 667.2, a decrease of 0.6 percent on a seasonally adjusted basis from 671.1 one week earlier. On an unadjusted basis, the Index increased 28.9 percent compared with the previous week and was up 9.8 percent compared with the same week one year earlier.Mortgage rates increased:

The Refinance Index increased by 6.3 percent to 2045.8 from 1923.8 the previous week and the seasonally adjusted Purchase Index decreased by 7 percent to 439.7 from 472.8 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.19 from 6.13 percent ...

The average contract interest rate for one-year ARMs increased to 5.85 percent from 5.79 ...

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 0.2 percent to 427.4 from 426.6 for the Purchase Index.

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 0.2 percent to 427.4 from 426.6 for the Purchase Index.The refinance share of mortgage activity increased to 49.9 percent of total applications from 48.4 percent the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 21.2 from 20.1 percent of total applications from the previous week.

Tuesday, January 16, 2007

Leamer: Is a Recession Ahead?

by Calculated Risk on 1/16/2007 02:59:00 PM

Dr. Edward Leamer, Director UCLA Anderson Forecast, writes in The Economists' Voice: Is a Recession Ahead? The Models Say Yes, but the Mind Says No

My view, announced in December 2005, is that this time will be different. This time the problems in housing will stay in housing. So far, I am feeling very smug. But this keeps me up at night. In this column, first the models, and then the mind. The models say that a recession is coming soon. The mind says otherwise.I'll have more later, but here is Dr. Leamer's conclusion:

The mind: why i think the models are wrong

The models that rely on history suggest that the extreme problems in housing currently being corrected will almost surely infect the rest of the economy, but that history does not take into account two important facts:

• Manufacturing is not poised to contribute much to job loss.

• Real interest rates are very low and there is no evident credit crunch, now or on the horizon.

These facts make the problem in housing less severe than it would be otherwise, and help to confine the pathology to the directly affected real estate sectors: builders, real estate brokers and real estate bankers.

...

The models say “recession;” the mind says “no way.” I’m going with the mind. This time the problems in housing will stay in housing. If you are a builder or a broker, it will feel like a deep depression. The rest of us will hardly notice.

DataQuick: SoCal New price peak, slowest December in ten years

by Calculated Risk on 1/16/2007 02:06:00 PM

DataQuick reports: New price peak, slowest December in ten years

Southern California's housing market ... prices reached a new peak while sales volume remained at a ten-year low ...

The median price paid for a home in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties was $495,000 last month, a new record. That was up 1.6 percent from $487,000 for the month before, and up 3.3 percent from $479,000 for December a year ago, according to DataQuick Information Systems.

The previous peak was $493,000 last June. Year-over-year price increases have been in the single digits for nine months. Last month's record median was in large part due to strong sales of new homes, which is normal for December.

"The market is still readjusting after the frenzy in 2004 and 2005. Market indicators tend to point in different directions during a turn. We are watching the San Diego market carefully, sales and price trends there have tended to lead the region," said Marshall Prentice, DataQuick president.

A total of 22,485 new and resale homes were sold regionwide last month. That was up 10.3 percent from 20,388 in November, and down 22.3 percent from 28,952 in December a year ago. Last month was the slowest December since 1995 when 19,202 homes were sold. DataQuick's statistics go back to 1988, the December average is 23,699 sales.

...

While year-over-year sales in the region have declined for the last 13 months, San Diego County's sales started to decline 30 months ago. San Diego County's median peaked in November 2005 at $518,000 and was $483,000 last month, a 6.8 percent decline.