by Calculated Risk on 2/10/2006 10:34:00 AM

Friday, February 10, 2006

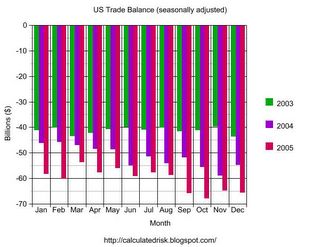

December U.S Trade Deficit: $65.7 Billion

Please see Dr. Setser's comments: Big, and getting bigger.

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis reports that the U.S. trade deficit for December was $65.7 Billion.

Click on graph for larger image.

And on an annual basis, the AP reports: U.S. Trade Deficit Hits All-Time High

The U.S. trade deficit soared to an all-time high of $725.8 billion in 2005, pushed upward by record imports of oil, food, cars and other consumer goods. The deficit with China hit an all-time high as did America's deficits with Japan, Europe, OPEC, Canada, Mexico and South and Central America.

The Commerce Department reported Friday that the gap between what America sells abroad and what it imports rose to $725.8 billion last year, up by 17.5 percent from the previous record of $617.6 billion set in 2004.

It marked the fourth consecutive year that America's trade deficit has set a record as American consumers continued their seemingly insatiable demand for all things foreign from new cars to televisions and electronic goods.

...

The U.S. trade deficit with China rose to a record $201.6 billion last year, the highest deficit ever recorded with any country and 24.5 percent above the previous record of $161.9 billion set in 2004. Part of that increase reflected a 42.6 percent increase in imports of Chinese clothing and textiles, which soared at the beginning of the year after the removal of global quotas.

...

The United States also recorded record deficits with Japan at $82.7 billion. Until it was surpassed by China in 2000, Japan was the country that had the largest trade gap each year with the United States.

America's trade deficit set records with much of the rest of the world as well. Among those records was a $122.4 billion gap with the 25-nation European Union, a $92.7 billion deficit with the nations that belong to the Organization of Petroleum Exporting Countries, a $76.5 billion deficit with Canada and a $50.1 billion deficit with Mexico. Canada and Mexico are America's partners in the North American Free Trade Agreement. The deficit with the countries of South and Central America rose to a record $50.7 billion last year.

A huge 39.4 percent jump in petroleum imports, which rose to $251.6 billion, was a major factor contributing to last year's deficit increase. The price of those imports rose to an all-time high, reflecting tight global supplies. The United States was forced to import more oil in the fall after Hurricane Katrina caused widespread shutdowns of Gulf Coast production.

Thursday, February 09, 2006

The 30 Year Bond and the Flat Yield Curve

by Calculated Risk on 2/09/2006 03:24:00 PM

The Treasury Department today issued 30-year bonds for the first time since 2001. From the AP: 30-Year Bond Sold for 1st Time in 5 Years

The Treasury Department sold $14 billion of the bonds with a yield of 4.53 percent.Here are some recent quotes:

FED Funds Rate: 4.5%

Five Year Note: 4.54%

Ten Year Note: 4.54%

30 Year Bond: 4.53%

I don't think we need a graph to visualize a flat line!

Wednesday, February 08, 2006

Bush Budget: Confusing Reporting

by Calculated Risk on 2/08/2006 07:57:00 PM

Yesterday, the Wisconsin State Journal presented this graphic on their front page (pdf).

Click on graphic for larger image.

The first mistake is to include off-budget items (mostly SSI) in the Bush budget. Obviously the Journal is just following the confusing Bush budget document, but this distorts the proposed percentages for revenues and expenditures.

Look at interest payments. The graphic indicates interest payments will be 9% of the budget. This is completely bogus as interest payments are accelerating rapidly.

The International Herald Tribune quotes our friend Dr. Brad Setser: Effect of rising debt soon to be felt in U.S.

"Up until now, rising debt has been offset by a falling interest rate," said Brad Setser, an economist at Roubini Global Economics in New York. "Now, debt is still rising and the interest rate is no longer falling. The consequence of rising debt will no longer be masked."In fact, the budget estimates interest payments will be $441 Billion in ficsal 2007. So if we take the Bush budget estimate (including SSI), then $441 Billion divided by $2.77 Trillion is 16% of the budget.

So how did the Journal get 9%? Easy. They include SSI in the budget expenditures and exclude interest payments from the General Fund to SSI Trust Fund. So they use $247 billion in interest payment on debt held by the public and a budget of $2.77 Trillion = 9%. Two compounding errors.

Here is the real percentage: The Bush on-budget expenditures are $2.1 Trillion. Interest payments are $441 Billion. So interest payments are 21% of on-budget expenditures (see Table 1.4 pdf)

Mortgage Application Volume Declines, Rates Rise

by Calculated Risk on 2/08/2006 09:50:00 AM

The Mortgage Bankers Association (MBA) reports that mortgage applications declined for the week ending Feb 3rd.

Click on graph for larger image.

The Market Composite Index — a measure of mortgage loan application volume was 619.3 – a decrease of 1.2 percent on a seasonally adjusted basis from 626.8 one week earlier. On an unadjusted basis, the Index increased 2.2 percent compared with the previous week but was down 16.4 percent compared with the same week one year earlier.

The seasonally-adjusted Purchase Index decreased by 2.4 percent to 425.1 from 435.7 the previous week whereas the Refinance Index increased by 0.2 percent to 1751.0 from 1747.2 one week earlier.

Rates on mortgages increased: The average contract interest rate for 30-year fixed-rate mortgages increased to 6.25 percent from 6.20 percent one week earlier ...

The average contract interest rate for one-year ARMs was steady at 5.48 percent ...

Activity is still high, but falling again as mortgage rates are once again rising.

Tuesday, February 07, 2006

WSJ Econoblog: Stitching a New Safety Net

by Calculated Risk on 2/07/2006 07:46:00 PM

Economics Professors Andrew Samwick and Mark Thoma discuss retirement and health insurance in today's WSJ econoblog: Stitching a New Safety Net.

Dr. Polley's take on the debate:

I really enjoyed reading this Econoblog, and I'll tell you why. Mark Thoma and Andrew Samwick do an outstanding job of showing the Wall Street Journal readers how economists can have a debate on a controversial subject like this. The reader can clearly identify the points of agreement and disagreement. Mark nails the question: How much social insurance should be provided by the government and how much should be provided by markets. They both note the market failures in health insurance. Samwick calls attention to the way the tax code distorts the private insurance market. By identifying the questions and highlighting specific economic issues of incentives, efficiency, and equity, they generate a lot of light and surprisingly little heat.I believe the two most pressing financial problems facing America are the structural General Fund deficit and health care. This discussion provides an excellent starting point for any debate on reforming health care.