by Calculated Risk on 12/09/2005 07:27:00 PM

Friday, December 09, 2005

Minimum-Payment Loans Get Maximum Crackdown

The WaPo reports: Minimum-Payment Loans Get Maximum Crackdown

Federal financial regulators appear to be on the verge of reining in one of the most popular mortgages in hot housing markets nationwide -- loans that allow 1 percent to 2 percent payment rates leading to "negative amortization."The author is basing this article on John Dugan's remarks last week (Comptroller of the Currency).

UPDATE: I linked to the wrong speech ... here is the correct one:

For excerpts see: Remarks by John C. Dugan, Comptroller of the Currency

And here is the complete text of Dugan's remarks (pdf).

The bottom line for 2006: Look for tougher standards on popular 1 percent and 2 percent minimum-payment plans, and fewer qualified buyers in high-cost markets where wild appreciation has been sustained in part by reality-bending rate-reduction programs

Housing and Jobs

by Calculated Risk on 12/09/2005 03:18:00 PM

The LA Times reports: Mortgage Industry Job Losses May Rise With Interest Rates

As interest rates have risen, refinancings have faded and applications for loans to purchase homes have begun to decline, according to the Mortgage Bankers Assn.And the impact from these job losses could ripple through the economy:

Many borrowers already have taken out equity from their homes through refinancings and second mortgages. If home prices level off, as many predict, these homeowners will have less equity to extract and less incentive to refinance.

Mortgage Bankers Assn. economist Doug Duncan said jobs would be lost as some companies pared their staffs and others were acquired or went out of business. The number of job reductions will depend on how high rates go, he said, with as many as 80,000 positions eliminated should 30-year fixed rates climb to 8.25%, up from 6.32% currently.

In addition to layoffs, experts also expect a shakeout in the ranks of mortgage brokers, the independent loan originators whose numbers have swollen along with the home-lending boom that began in 2001.

These brokers aren't counted in the payroll surveys conducted by the government. John Marcell, president of the California Assn. of Mortgage Brokers, believes that they now total about 25,000 in the state, but predicts that's about to change radically as ill-trained brokers who got into the business during the boom now find it harder to make a living.

"I would say probably half of what's out there today could wash out," Marcell said.

By reducing spending power and demand for office space, the loss of mortgage jobs can cause ripple effects through local economies like Orange County's. Ryan Ratcliff, an economist for the Anderson Forecast at UCLA, said studies of the early 1990s recession showed that regions with large employment in the mortgage industry were hurt disproportionately in economic downturns.When I first started looking at the housing market, I wrote this on Angry Bear: After the Housing Boom: Impact on the Economy. So far employment and mortgage equity withdrawal are still solid, but those are areas to watch closely.

Best of Times II

by Calculated Risk on 12/09/2005 12:37:00 AM

For a related post, see Kash's: The Role of Spending Growth in the Deficit

Many people think of the "Baby Bust" as the period right after the "Baby Boom". The real Baby Bust happened from 1925 to 1939. See this animation:

This has important implications for policy. Those people born between 1925 and 1939 are now 66 to 80 years old - the peak years for receiving retirement benefits.

The Baby Boomers are 40 to 60 - their peak earning years.

So these are the Best of Times for fiscal policy: fewer than the normal percentage of the population are recipients of elderly social programs, and a larger than normal percentage are in their peak earning years.

Social Security should be running a large surplus, and it is!

Medicare should be running a large surplus, but it is only breaking even.

The Federal Government should be running a large surplus, but it is running a large deficit.

From the prespective of demographics, the US Government needs to address the General Fund deficit NOW. America also needs to reform the health care system. These are the two most pressing long term fiscal issues for America.

Thursday, December 08, 2005

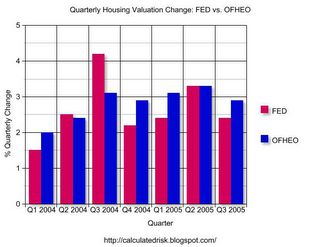

Household Valuation Change: FED vs. OFHEO

by Calculated Risk on 12/08/2005 09:11:00 PM

With the release of the Flow of Funds report today, I decided to compare the FED's estimate of the total value of household real estate with the OFHEO House Price Index (HPI). Of course OFHEO only reports the nominal change in house prices, so the comparison is really between the changes in valuation (either annually or quarterly).

I thought this might be interesting, mostly to see if there is a difference between the two approaches. The FED reports the total valuation of household real estate. This includes any new stock put into place and improvements to existing stock. OFHEO reports the change in the price of existing stock.

To compute the annual change for the FED for existing stock, I started with year N. For year N+1, I subtracted construction estimates from the Census Bureau of new private single family construction and improvements.

Click on graph for larger image.

The first graph shows the annual change from both the FED (subtracting new construction as above) and the OFHEO HPI. Clearly both methods yield similar results and I don't see any systemic bias either way.

The second graph is for the last seven quarters, and shows the quarterly change for both sets of data.

Once again both methods yield similar results with no discernible bias. This gives me a little more confidence in both data sets, unless the FED uses the OFHEO HPI as part of their calculation!

FED: Q3 Mortgage Debt increased at 14% Annual Rate

by Calculated Risk on 12/08/2005 12:16:00 PM

The FED Flow of Funds report was released today. It shows that household mortgage debt increased at a 14% annual rate in Q3, 2005.

On a dollar basis, household mortgage debt increased by an all time record $289.5 Billion in the 3rd quarter. The last 7 quarters (billions increase in household mortgages):

q1 2004: $190.4

q2 2004: $211.1

q3 2004: $277.1

q4 2004: $223.5

q1 2005: $176.5

q2 2005: $263.7

q3 2005: $289.5

The debt story continues.