by Calculated Risk on 11/11/2005 04:36:00 PM

Friday, November 11, 2005

Housing: Foreclosures and Unemployment

First comes rising housing inventories, then slowing activity and less mortgage extraction, followed by a drop in retail sales, rising foreclosures, falling house prices and less housing related employment. At least that is the general sequence I expect.

In Massachusetts, inventories to sales is already over 8 months, prices have started to fall and foreclosures are rising: A rise in foreclosures

Don't look now, but that whistling sound you're hearing is the air leaking out of the housing bubble.And from Australia, a country that has already seen falling housing prices: Unemployment rate rises further

...

More disturbing yet is a sharp rise in foreclosures. Over the first nine months of this year, foreclosures in Massachusetts are up 33 percent over the same period in 2004.

"We are seeing a big increase, we've seen a steady increase, and there's going to be more going forward," Jeremy Shapiro, president and co-founder of Framingham-based ForeclosuresMass.com said.

Behind the figures lie several factors. Zero-interest mortgages allowed buyers to borrow more than they could afford. Interest rates are going up, pushing up payments for those holding adjustable-rate mortgages. Families mortgaged to the hilt can't handle it when one earner loses a job or some unexpected expense comes up.

Job-shedding in Australia has extended into a second month.Most of the United States is in the 'rising inventories' phase, but these stories depict the probable future for much of the US.

A plunge in full-time job numbers has more than offset a solid rise in part-time positions.

Official figures show full-time places slumped in October by 60,800 - the worst outcome since the 1991 recession.

The number of people looking for work has declined, and that has kept a lid on the rise in the jobless rate.

It now stands at 5.2 per cent.

FRBSF Economic Letter: Spendthrift Nation

by Calculated Risk on 11/11/2005 01:08:00 PM

Senior economist Kevin J. Lansing of the San Francisco Federal Reserve Bank writes: Spendthrift Nation

In September 2005, the personal saving rate out of disposable income was negative for the fourth consecutive month. A negative saving rate means that U.S. consumers are spending more than 100% of their monthly after-tax income. The recent data are part of a trend of declining personal saving rates observed for two decades. During the 1980s, the personal saving rate averaged 9.0%. During the 1990s, the personal saving rate averaged 5.2%. Since 2000, the personal saving rate has averaged only 1.9%.Dr. Lansing presents a model of wealth effects on savings and compares the model to actual data:

This Economic Letter discusses some of the factors that appear to be driving the secular decline in the personal saving rate. These factors include rapid increases in stock market and residential property wealth, which households apparently view as a substitute for the quaint practice of putting aside money each month from their paychecks. Rapidly rising stock and house prices, fueled by an accommodative environment of low interest rates and a proliferation of "exotic" mortgage products (loans with little or no down payment, minimal documentation of income, and payments for interest-only or less) have sustained a boom in household spending and provided collateral for record-setting levels of household debt relative to income.

Going forward, the possibility of cooling asset markets and rising borrowing costs may cause the personal saving rate to revert to levels which are more in line with historical averages. While such a development would act as near-term drag on household spending and GDP growth, an increase in domestic saving would help correct the large imbalance that now exists in the U.S. current account (the combined balances of the international trade account, net foreign income, and unilateral transfers).

Figure 4 plots the U.S. personal saving rate together with the fitted saving rate from the model. The simple behavioral model can account for 89% of the variance in the U.S. personal saving rate from 1960:Q1 to 2005:Q1. A slightly improved fit can be obtained by adding a time trend to the regression equation. A time trend is a proxy for ongoing credit industry innovations (growth of subprime lending, home equity loans, exotic mortgages, etc.) which have expanded consumer access to borrowed money and reduced the need for precautionary saving.Hat tip to Joshua for sending me the article!

Figure 4 suggests that the decades-long decline in the U.S. personal saving rate is largely a behavioral response to long-lived bull markets in stocks and housing together with falling nominal interest rates over the same period. Since 2000, the rate of residential property appreciation has been more than double the growth rate of personal disposable income. In many areas of the country, the ratio of house prices to rents (a valuation measure analogous to the price-earnings ratio for stocks) is at an all-time high, raising concerns about a housing bubble. Reminiscent of the widespread margin purchases by unsophisticated investors during the stock market mania of the late-1990s, today's housing market is characterized by an influx of new buyers, record transaction volume, and a growing number of property acquisitions financed almost entirely with borrowed money.

According to the model, the personal saving rate would be expected to halt its decline and start moving up if stock or housing markets sagged, or if long-term interest rates jumped, say, due to inflation fears. An increase in the personal saving rate would slow the growth of household spending which, in turn, would have negative implications for the derived demands of business investment, inventory accumulation, and business hiring. But, on a positive note, a pickup in saving activity in the household sector would help offset the ongoing deficit spending in the government sector. A rise in net domestic saving would reduce the U.S. economy's reliance on foreign capital inflows as a source of saving. At present, the U.S. current account deficit stands at more than 6% of GDP, implying that the U.S. economy must draw in around $3 billion per day from foreign investors to finance domestic spending.

Housing Affordability and More

by Calculated Risk on 11/11/2005 11:50:00 AM

First, two articles on DC and Phoenix:

Housing Market Cooling, Data Say

In Washington, Sales Are Down, Inventory Is Up

The trend is most striking in Northern Virginia, where most of the region's growth has occurred, but it is evident almost everywhere. Statistics on home sales released by Metropolitan Regional Information Systems Inc., the regional multiple-listing service, show that:Phoenix: Housing market cools ... along with weather

In the two counties and three cities that make up the Northern Virginia market, more than twice as many homes were available for sale in October as in the same month one year ago -- 7,122 homes, compared with 3,254 -- and sales are off 28 percent.

In the District, listings are up 62 percent and sales are down 28 percent.

In Montgomery County, listings are up 49 percent and sales are down 8 percent.

In Prince George's County, the listings are up 45 percent. But home sales have remained fairly stable, dropping only 2.6 percent.

The last time the region had this many houses for sale was the late 1990s, the MRIS figures show.

Phoenix real estate executive Rich Rector has been seeing something unusual lately as he makes his rounds: "Open House" signs.And on affordability: C.A.R. reports California's Housing Affordability Index fell four points to 15 percent in September

...

Whatever the reasons, there are signs the frenzy is coming to an end. There are now 17,000 residential properties listed for sale, up from just 5,000 a few months ago, and would-be buyers have regained some of their bargaining power.

The percentage of households in California able to afford a median-priced home stood at 15 percent in September, a 4 percentage-point decrease compared with the same period a year ago when the Index was at 19 percent, according to a report released today by the California Association of REALTORS® (C.A.R.). The September Housing Affordability Index (HAI) increased 1 percentage point compared with August, when it stood at 14 percent.

Thursday, November 10, 2005

Housing Inventory: DC and Tucson

by Calculated Risk on 11/10/2005 01:28:00 PM

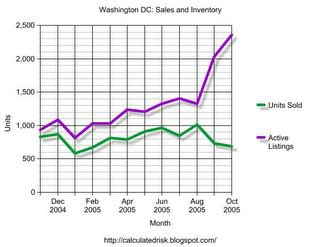

Inventories continue to rise. The following graph (thanks to DC Broker DC1000) shows sales and active listing over the last year:

Click on graph for larger image.

Although inventories have surged since August, the ratio of inventory to sales is only 3.44 - still low by historical standards.

Also, prices have been mostly flat over the last 7 or 8 months. And days on market hasn't risen substantially yet.

In Tucson, The Daily Star reports: Tucson-area home-price rise resumes. The lead is the small increase in area prices, but inventories reached a ten year high:

Tucson-area home values broke out of a four-month malaise in October, with the median sale price increasing by $5,000 to $224,000.Tucson's inventory to sales ratio is now 3.9 months.

But the number of homes available for sale in the metropolitan area has reached a 10-year-high, suggesting that Tucson's housing market is becoming more favorable to buyers.

...

Although active listings climbed to 5,330, the market appears healthy, said Judy Lowe, president of the Tucson Association of Realtors Multiple Listing Service. With more homes for sale, Vest said, the market pendulum is swinging back toward buyers, but it "still has a long way to go."

...

The number of houses sold was down 2.6 percent, from 1,404 in September to 1,368 in October. October's sales were still up by 5.6 percent compared with the 1,295 homes sold in October 2004.

September Record Trade Deficit: $66.1 Billion

by Calculated Risk on 11/10/2005 08:30:00 AM

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis released the monthly trade balance report today for September:

"... total September exports of $105.2 billion and imports of $171.3 billion resulted in a goods and services deficit of $66.1 billion, $6.8 billion more than the $59.3 billion in August, revised.Note: all numbers are seasonally adjusted.

September exports were $2.8 billion less than August exports of $108.0 billion. September imports were $4.0 billion more than August imports of $167.3 billion."

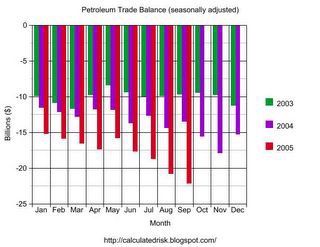

Click on graph for larger image.

The September record was the result of both a sharp drop in exports and a significant increase in imports.

Imports from China set another record of $23.307 Billion, while exports to China were off from August ($3.2 Billion vs. $3.9 Billion). Imports from Japan were off slightly to $10.9 Billion.

The average contract price for oil set a new record of $57.32 per barrel breaking the old record of $52.65 in July. Crude oil imports dropped significantly, but the quantity of refined products increased. On a NSA basis, the value for September imports was the same as August petroleum imports.

The SA petroleum trade deficit set another record of $22.2 Billion.

This was a difficult month to forecast due to the hurricanes.