by Calculated Risk on 8/20/2005 10:53:00 PM

Saturday, August 20, 2005

Housing Bagholders: "Wall St. Waits to See What Will Be Repaid"

The Los Angeles Times reports: Wall St. Waits to See What Will Be Repaid

The financial services industry has made it possible for millions of Americans to stop thinking, "I can't afford that."Food for thought (or concern). If investors pull back, yields will rise and a housing decline will be a self-fulfilling prophecy. But where will those investors move their money? Ten year treasuries yielding 4.2%?

Now, Wall Street is beginning to wonder how many people really couldn't afford what they bought in recent years on incredibly cheap credit.

One-percent mortgage loans, zero-percent car loans, home-equity loans for more than what your property is worth — all of this has been the cushy financial reality for U.S. consumers in this decade. No house, car or vacation has been out of reach, thanks to a network of eager lenders and the global army of investors who've supplied them with capital at rock-bottom rates.

In the midst of any wild party, however, some people do things they later come to regret. And while talk of a housing bubble has been incessant over the last year, only now are the money handlers on Wall Street beginning to worry about payback — that is, how much of the credit extended in this borrowing extravaganza won't be paid back.

...

Home mortgage and equity line-of-credit debt has swelled from $4.8 trillion at the end of 2000 to nearly $8 trillion now. And behind every borrower there's a lender.

Which raises the question: How fast will investors in financial company stocks and in mortgage-backed bonds rush to sell, if they begin to sense that a wave of loan defaults is inevitable?

Richard X. Bove, a veteran banking industry analyst at the firm of Punk, Ziegel & Co. in New York, last week sent clients a research report with a chilling title: "This Powder Keg is Going to Blow."

...

The biggest threat of upheaval is in the mortgage-backed securities market itself.

That market, worth nearly $4 trillion, has provided much of the capital for the housing boom. Instead of holding on to the loans they make, many lenders package them and sell them to investors worldwide via mortgage-backed bonds. The bond owners get the loan interest and principal passed through to them.

The genius of the mortgage-backed securities market is how it has been sliced and diced by investment bankers. There's a piece of a mortgage to match every investor's need — long-term and short-term paper, high yield and lower yield, insured and uninsured.

But the increasing complexity of the securities also raises the risk that some investors will feel they can't be sure exactly what they're holding, particularly in the case of bonds backed by the new wave of adjustable-rate mortgage loans. If investors begin to worry that they won't be repaid, their rush for the exits could be thunderous.

"Securitization shifts risks from banks to other investors, but this does not necessarily mean less systemic risk [to the economy and markets] because we don't know how these relatively new market participants will react in a declining market," Joseph Abate, a senior economist at brokerage Lehman Bros., said in a report to clients Friday.

Friday, August 19, 2005

NAR Cautions Buyers on Specialty Loans

by Calculated Risk on 8/19/2005 03:18:00 PM

The National Association or Realtors (NAR) cautioned homebuyers on certain loans today:

Homebuyers may not realize that monthly payments on some types of specialty mortgages can increase by as much as 50 percent or more when the introductory period ends.I suppose late is better than never. Just yesterday I posted excerpts from: Home buyers get comfy with debt. I suspect some of those buyers are going to wish they had been "cautioned".

...

"Consumers are susceptible to loans with monthly payments that can spike dramatically, or that actually increase the amount they owe on their home." NAR President Al Mansell of Salt Lake City.

...

"We’re warning homebuyers to approach these new mortgages carefully," says Mike Calhoun, general counsel for the Center for Responsible Lending. "They should be cautious about accepting a mortgage they can’t afford. These mortgages can be devastating for families who are stretching their budget to buy a home."

"Consumers particularly need to understand the risks inherent in specialty mortgages when financing a home purchase," says David Lereah, NAR’s chief economist.

Housing: "'For Sale' Signs Mushroom"

by Calculated Risk on 8/19/2005 12:32:00 PM

The Sacramento Bee reports: Region's home sales signal softer market.

Jim Eggleston, owner of Sacramento's biggest residential "For Sale" sign installer, predicts this will be his busiest week in 21 years in business. He's had to hire an extra worker and buy a new delivery truck since his crew planted a one-day record of 225 signs on Monday.In my neighborhood, I see the same phenomenon. And the Desert Sun (Palm Springs, CA) reports:

"There are whole lot of houses going up for sale," says Eggleston, who promises next-day installation when a real estate broker orders a new sign. "The number of 'For Sale' signs we're removing keeps going down relative to the number we're putting up."

Price rises come as local sales counts have recently been falling, and the inventory of unsold resale homes is up dramatically from a year ago.Next week nationwide existing home inventories for July will be reported. Should be interesting.

According to DataQuick, the total 1,259 new-construction and resale homes sold in July was down 12.1 percent from a year ago.

And unsold resale inventory is currently at around 3,452 properties, according to Greg Berkemer, executive vice president of the California Desert Association of Realtors. That figure is up 63 percent from a year ago and is more than twice the 1,400 seen in April 2004.

Thursday, August 18, 2005

Oil's Impact on the Economy

by Calculated Risk on 8/18/2005 08:16:00 PM

Several blogs are commenting on oil's potential impact on the economy. First a quote:

"People are able to pull money out of their homes and put it into their gas tanks," said Mark Zandi, chief economist at Economy.com. "So the overall effects on consumer spending have been small."Mortgage extraction to purchase consumables is probably not a viable long term strategy. Dr. Roubini comments:

Until now consumers have reacted to the oil shock as if it was a temporary shock: when a shock to real income is temporary it is optimal to maintain the consumption level and reduce savings in face of reduced real income. But if the shock is persistent or permanent the rational response to the reduced income should a reduction in consumption equivalent to the permanent reduction of income with little effect on savings. U.S. consumers have reacted so far to the oil shock as if it was temporary and they have further reduced their savings rate down to zero; but two years of large and protracted increases in oil prices suggest that part of the shock is permanent. With already stretched and slow-growing incomes, U.S. consumer have dipped into their rising housing wealth and borrowed more and more against it, in part to finance the real income shock from higher oil prices.Professor Hamilton expresses concern that consumer psychology might be changing:

In my opinion, the reason that the oil price increases of the last two years have not caused a recession yet is that they have built up gradually, and resulted not from a drop in supply but instead from strong global demand. Faced with a gradual price increase and rising incomes, most people have been able to adapt to the higher prices and make adjustments in an orderly way that does not cause serious economic dislocations.Barry Ritholtz, who is already predicting a recession in 2006, also comments on consumer psychology:

On the other hand, just within the last couple of weeks, I've been hearing a lot more expressions of anxiety and concern-- the sort of psychological factors that produce abrupt spending changes.

While Oil may be a much smaller percentage of GDP today than it was in the 1970s, the relative financial conditions of indebted consumers may also be that much less able to absorb an extended shock than it was then.And as usual, I provide a few graphs over on Angry Bear. Dr. Roubini concludes:

...

Record high gasoline prices, that fall back a little but stay inflated; Add a housing boom that doesn't crash, but merely fizzles. The ongoing refinacing machine which drove so much consumer spending decellerates rapidly. Add to it a War which the majority of the country now believes turns out to be "Not worth it" and a significant percent (though not quite a majority) beleives we were led into under "false premises." Lastly, the myriad stimulus from the government -- tax cuts, ultra low interest rates, deficit spending, increased money supply, military expenditures -- all begin to fade.

What might all this a recipe for?

Is there a risk of an outright recession? Probably not as consumption is still firm and labor market conditions are modestly improving. But a significant U.S. growth slowdown by year end to a level below the 3.5% U.S. potential growth rate cannot be excluded: growth slumping towards the 2.0-2.5% range by early 2006 cannot be ruled out if oil prices remain at current level. And the expectation that the Fed may ease in face of such economic slowdown may prove incorrect: with a housing bubble and a large current account deficit and a core inflation rate that may be creeping soon above 2% the Fed may not be able to afford to ease if the economy slows down. In 2003 when the concerns were about deflation, the Fed reacted to the pre-Iraqi war oil spike and economic slowdown by reducing the Fed Fund rate to 1%. Today, with inflationary pressures modestly creeping up the Fed would face a much tougher dilemma if the latest oil shock turns to be, as likely, stagflationary.I have a similar view (from my AB post): My view (not Angry Bear) is a combination of a housing slowdown and high energy prices will probably lead to an economic slowdown next year, and possibly a recession.

So, if oil prices remain at the current levels or increase further there is not yet the risk of an outright recession but certainly a high probability of a significant economic slowdown by year end and into 2006.

EDAB/UCLA July Report

by Calculated Risk on 8/18/2005 02:11:00 PM

Economic Development Alliance for Business (EDAB) presents a monthly economic report for the East Bay (Northern California). Christopher Thornberg, Senior Economist for UCLA Anderson Forecast is the author. A few excerpts:

(Hat tip to Brian Smits who sent me this report)

"... unfortunately there is a big problem brewing out there that is unlikely to go away quietly: the massive run-up in real estate prices across the state. Housing prices have continued to grow at a truly spectacular rate across the state and again in the Bay Area. Rampant speculation continues to fuel the fire as investors have seemingly already forgotten the lessons learned so hard in the last major asset bubble that ended not even five years ago. While there are those who try and rationalize the rapid increase in prices, we see no justification for these increases—the fundamentals that drive the price of a housing asset have been pointing to a cool market, not a hot one. Rental growth remains weak, mortgage rates have been rising slowly, and contrary to common belief the pace of home building in the area is completely in line with the growth of the workforce—the so-called housing shortage does not exist. Yes, inventory levels are low but this is due to frantic behavior of buyers."But Thornberg believes the economic problems are a year away:

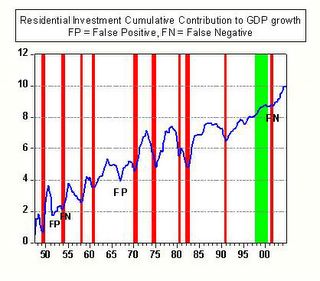

"There are some preliminary data that show what may be the beginning of the cooling of the market. But a major slowdown is at least a year away, if not more. Expect the recovery to continue well into 2006 and job growth in the East Bay to pick up speed during these 12 months. The end of 2006 or early 2007 will be the beginning of trouble, however."Thornberg presents the following graph showing that housing slowdowns have preceded eight of the 10 recessions since WWII.

Click on graph for larger image.

New Home Sales is one of my favorite leading indicators. Here are a couple of posts: New Home Sales as Leading Indicator and Update: New Home Sales as Leading Indicator.

I'm looking for a drop in housing transaction as an indicator of an economic slowdown and possible recession in '06. Thornberg also thinks its too early to predict a recession and compares the late '80s slump (leading to the early '90s recession) to today.

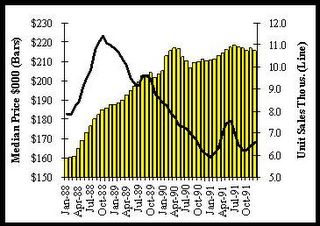

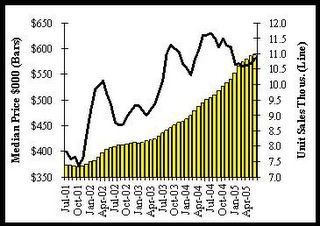

"The ... chart shows unit sales and median prices at the end of the late eighties run-up in prices. Market activity peaked in the end of 1988, and price appreciation began to slow within 6 months, and stopped within 18. So keep an eye on market activity, since this will be the first sign of impending problems. More recently unit sales have begun to fall, and you can see some slowdown in price appreciation. This may not be completely convincing evidence since you can see a similar slowdown in 2002 that quickly reversed itself. Of course this time prices are higher and more out of whack relative to income, and interest rates are rising rather than falling. This makes it considerably more likely to be the beginning of the end."

"... as of now the bubble continues to expand. And while there are certainly signs that we are past the peak in this state, activity remains at a historically high pace. There is almost no chance of a major economic slowdown in the next 12 months for the nation ..."There is much more in the report.