by Calculated Risk on 8/12/2005 10:24:00 PM

Friday, August 12, 2005

NYTimes: Assess Your Area's Real Estate Bubble

The NYTimes suggests waiting for the experts to declare the bubble over in your area might be too late. Do Try This at Home: Assess Your Area's Real Estate Bubble

... the main driver of today's market is consumer psychology. Home prices go up as long as people expect them to go up.The article gives some examples of slowing markets:

When they stop believing, prices fall - and no economist in Washington can get wind of that faster than someone chatting over knockwurst at a neighborhood block party. "Economists looking at the macrodata will be the last to know," said Richard A. Brown, chief economist at the Federal Deposit Insurance Corporation.

"It's taking a lot longer to sell a home," says Karl A. Martone, a Re/Max Properties agent in Providence, where homes now sit on the market an average of 65 days, up from 14 days a year ago. The region has almost six months of inventory, which is up 35 percent from a year ago.And an example of prices disconnected from fundamentals:

Vicki Doran, a real estate agent with Coldwell Banker in Providence, says: "It's switching to a buyer's market. Last year buyers had to snap things up. Now they can shop around."

Take a look at the hot San Diego condo market. In Park Place, one of the many sleek towers of condominiums recently slung up around Petco Park, a one-bedroom condo is offered for $719,000. Someone buying it would expect to make mortgage payments of about $3,775 a month, plus monthly maintenance fees.The article goes on to give several indicators of when a market has topped. Rising inventories is at the top of my list right now. And on loan quality:

But someone really wanting to live in the high-rise, with hardwood floors, granite countertops and city views for a lot less, could rent a nearly identical unit in the same building for $2,400 a month. That is clear evidence prices have to move down.

The popularity of interest-only mortgages could become one of the best indicators of a fragile market, several economists say. Mr. Thornberg of UCLA Anderson says it's a sign that lenders are scraping the bottom of the barrel. "We are close to running out of shills," he says.But in the end it all comes down to sentiment. The entire article is worth reading.

Dr. Leamer: Housing a "fragile and dangerous situation"

by Calculated Risk on 8/12/2005 08:03:00 PM

AP reporter Michael Liedtke writes on housing: Real estate strong despite higher interest. Of course I'm drawn to this quote from Dr. Leamer, UCLA Anderson Forecast Director:

"It's very hard to understand the psychology of any market," said UCLA economics professor Edward Leamer. "But it's fundamentally clear that the housing market is in a fragile and dangerous situation."The article is balanced and touches on the San Diego and Boston housing markets. It concludes:

It's difficult to predict how high mortgage rates will have to rise before home prices are hurt, but industry observers like Karevoll believe the tipping point is somewhere between 7 and 8 percent.How it gets better is prices more aligned with incomes. Also, based on New Home Sales, I believe the "tipping point" is far lower than 7 or 8%.

Meanwhile, current mortgage rates remain enticing, especially to buyers who remember when rates were still above 10 percent in the 1990s, said Denver-area real estate agent Bill Kosena.

"Interest rates are extremely low," he said. "I don't know how it gets any better than it is."

WSJ: Rise in Supply Suggests Housing Market Cooling

by Calculated Risk on 8/12/2005 02:32:00 PM

The WSJ reports:

Rise in Supply of Homes for SaleExcerpt:

Suggests Market Could Be Cooling

By JAMES R. HAGERTY and KEMBA DUNHAM

Staff Reporters of THE WALL STREET JOURNAL

August 12, 2005; Page A1

"The number of homes available for sale has increased sharply in some of the nation's hottest real-estate markets -- one of several recent signs suggesting that air may be seeping out of the frenzied U.S. housing market.

Home prices have surged an average of about 50% in the U.S. in the last five years, largely thanks to the lowest mortgage interest rates in more than four decades and what has been a shortage of available homes in many markets. But some economists and housing-industry analysts believe supply is catching up with demand -- a trend that could cause home-price appreciation to slow down in the months ahead.

In San Diego County, for instance, where the median home price has more than doubled in the last five years, the number of homes listed for sale totaled 12,149 on July 8, more than twice the 5,995 available a year earlier, according to the San Diego Association of Realtors.

In northern Virginia, an area dominated by the fast-growing suburbs of Washington, inventories are up 26% from a year earlier. "Sales have slowed down for sure," says Tip Powers, president of Realty Direct Inc., Sterling, Va. He says home prices have flattened out and speculators are starting to shy away from the market because they no longer can count on quickly unloading properties at a profit.

A similar rise is being seen in Massachusetts, where home inventories are up 31%, according to officials of real-estate organizations there. Real-estate brokers say inventories also are up in such markets as Chicago, Las Vegas and Orlando."

.

.

.

Several factors point to a possible cooling of the market. Mortgage interest rates have been edging higher in recent weeks, raising the cost of purchasing a new home and knocking some potential buyers out of the market. The average rate for a 30-year fixed mortgage is 5.89%, said Freddie Mac, a mortgage-finance company, this week. That's up from 5.53% in late June.

In some markets, such as California and Florida, prices have surged past the ability of many people to afford a home. Additionally, banking regulators have begun to raise questions about whether mortgage lenders are being prudent enough -- which eventually could prompt some lenders to tighten credit standards.

Virginia Housing: "It’s Changing"

by Calculated Risk on 8/12/2005 11:39:00 AM

UPDATE: More inventory data - GREATER NORTHERN VIRGINIA AREA

| Active Listings | 2005 | 2004 | Pct.Chg |

| Single Family Homes | 8,800 | 6,588 | 33.6% |

| Condos & Coops | 1,544 | 1,010 | 52.9% |

| TOTAL | 10,344 | 7,598 | 36.1% |

Leesburg Today reports the Virginia housing market is "changing". The story has many positive comments, but:

... there are definite signs of a slowdown and that the market is undergoing a correction ... reported an across-the-board slowing, a build up of inventories and a shift in power from the seller-dominated market of the past few years back to the buyer.The housing market is still strong, but the story is rising inventories:

Fischer noted that inventories have quadrupled in the resale market over the past two-and-a-half months. Although that trend has not extended yet to new home sales, Fischer predicted "it’s reasonable to expect that as those inventories build, that will have an impact on the new home frenzy."

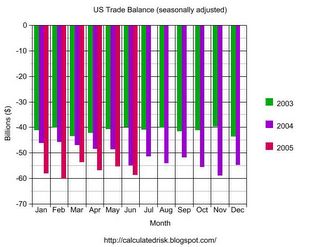

U.S. Trade Deficit: $58.8 Billion for June

by Calculated Risk on 8/12/2005 08:47:00 AM

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis released the monthly trade balance report today for June:

"... total June exports of $106.8 billion and imports of $165.6 billion resulted in a goods and services deficit of $58.8 billion, $3.4 billionNote: all numbers are seasonally adjusted.

more than the $55.4 billion in May, revised.

June exports were virtually unchanged from May, and June imports were $3.4 billion more than May imports of $162.2 billion."

Click on graph for larger image.

June 2005 was only 7% worse than June 2004. For the first six months of 2005, the trade deficits is up 18% over the same period in 2004.

Imports from China were a record $20.988 Billion. And Imports from Japan rebounded to $11.989 Billion.

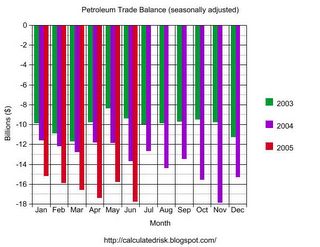

The average contract price for oil of $44.40 was just below the record of $44.76 in April.

Based on initial data, the trade deficit for July will be close to the seasonally adjusted record of $60.1 Billion set in February.