by Calculated Risk on 8/08/2005 06:53:00 PM

Monday, August 08, 2005

Housing: Q2 Prices Strong

From a story on CBS MarketWatch by Rex Nutting (always informative): U.S. house prices soar 16.5% in Q2

U.S. housing prices reaccelerated in the second quarter, mortgage giant Fannie Mae said Monday.This is really no surprise; housing was clearly very strong in Q2. If there is a slowdown it has started in the last month with rising inventories. Apparently Fannie Mae chief economist David Berson believes housing is still strong:

Recent data on home sales, mortgage applications and homebuilder attitudes "show no slowdown in the housing market," said Fannie Mae chief economist David Berson.Berson is a straight shooter, and he is certainly correct on existing and new home sales and homebuilder attitudes. I think there has been some weakness in mortgage applications. But all of this data (except mortgage applications) is backwards looking.

I'm looking forward to the Q2 data from OFHEO:

OFHEO will release its comprehensive housing price index for the second quarter on Sept. 1, including data from both Fannie and Freddie Mac. The data are based on comparing purchase prices for the same home over time.Hat tip to Fred C. Dobbs in the comments!

Housing: The August Story?

by Calculated Risk on 8/08/2005 01:12:00 PM

My guess is this will be the theme for the month of August: Housing inventory spikes in 'burbs.

Inventory of single-family houses is piling up in Greater Boston in a sure sign the residential real estate market is slowing.First, there is a seasonal component to inventories - they usually rise in August. So its important to do a YoY comparison.

Buyers are taking advantage of the increased inventory, waiting longer before they make their offers and hitting more open houses. Sellers, meanwhile, many of whom are trying to cash out near the height of the market, are growing increasingly frustrated as their houses sit on the market for weeks and months.

The number of listings of single-family houses in 17 towns in Greater Boston was up 25 percent or more last week compared with one year ago. And those houses are taking longer to sell. In four towns, listings increased 50 percent or more.Second, some see this simply as a return to normal market conditions:

The slowdown is not a bubble bursting, and in many cases is merely a return to more traditional market conditions, after months of record-breaking sales volume and prices.Others are less sanguine:

The "huge amount of inventory" is bringing prices down in Milton and Quincy, said Betsy Trethewey of Re/Max Landmark in Milton. Sellers are not acknowledging the changing dynamic, though, she said.Or maybe the housing story will be the spreading of the bubble. There are bubble concerns in Fort Collins, Colorado housing and Sioux Fall, South Dakota farm land.

Price reductions from $20,000 to $60,000 are not unusual, she said. Sellers are frustrated, and some are angry, she said. "They've been very spoiled for the past few years. They're not accepting the truth of what is actually happening," Trethewey said.

Sellers traditionally are slower to realize when the market is changing, usually because their information is more dated than buyers'.

Fort Collins might have a housing market not only as overheated as Denver but also nearly as overpriced as San Francisco, Atlanta and San Diego.Or maybe the story will be rising foreclosures:

A shift in the types of mortgages being used in Fort Collins may indicate the city is facing a steep housing market with buyers struggling to find a way to afford homes, according to recent statistics.

Of Fort Collins' April purchase loans, 42 percent were interest-only mortgages, in addition to 33 percent of refinances, according to LoanPerformance, a San Francisco real estate information service.

"Foreclosure inventory is up nearly 10 percent compared to July 2004 -- an uncharacteristic upward trend throughout the summer months," said Brad Geisen, president and CEO, Foreclosure.com. "More significantly, we are seeing an increase in foreclosures in a majority of states. These blanket increases may indicate that factors such as weakening sustainable home ownership and the volatility of the housing market are beginning to add to the geographic economic factors that contribute to foreclosures."I think the August story will be rising inventories, followed later by fewer transaction. The foreclosure story is probably for next year.

Sunday, August 07, 2005

Krugman on Housing Bust: Not a pop, but with a Hiss.

by Calculated Risk on 8/07/2005 10:15:00 PM

Dr. Paul Krugman writes in Monday's NY Times:

This is the way the bubble ends: not with a pop, but with a hiss.Over on Angry Bear I added a chart showing the slow, steady price declines associated with previous housing busts. Krugman also addresses bubble "denial" in his commentary. Krugman writes:

Of course, some people still deny that there's a housing bubble. Let me explain how we know that they're wrong.His commentary is short, and for those looking for proof of a bubble, Krugman doesn't come close. But as I wrote in the comments to the previous post:

One piece of evidence is the sense of frenzy about real estate, which irresistibly brings to mind the stock frenzy of 1999. Even some of the players are the same. The authors of the 1999 best seller "Dow 36,000" are now among the most vocal proponents of the view that there is no housing bubble.

I now understand there is no way to convince everyone there is a bubble. I suppose that is a third "bubble" characteristic:Krugman thinks the bubble may have already started deflating. If inventories rise as much as I expect, I will agree.

1) Fundamentals out of line.

2) Excessive Speculation.

and 3) Denial!

San Diego Housing Market Update

by Calculated Risk on 8/07/2005 02:54:00 AM

As a follow up to the LA Times article that discussed the slowing San Diego housing market: I spoke with one of the top RE agents in San Diego yesterday and she told me the market has taken a "nosedive". (Her words referring to time on market, not prices). She told me specifically about two of her listings that have been on the market for 45 days that would have sold in a week or two earlier this year.

Also the LA Times article included this comment on the previous bust (1991-1997):

San Diego home prices were virtually flat for six years."Virtually flat" is being generous.

Click on graph for larger image.

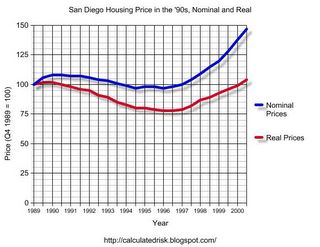

Click on graph for larger image.According to the OFHEO house price index, housing in San Diego experienced a steady decline for six years following the peak in 1991. In nominal terms, house prices dropped 10% in San Diego and didn't achieve their previous highs until Q4 1999 - eight years after the previous peak.

In real terms (adjusted for CPI less shelter), house prices declined 24%, also over a six year period and didn't recovery their value until Q2 2001 - eleven years after the peak.

Finally, this housing bubble appears far worse than the '91 bubble. Earlier I posted a Price-Rent ratio for the US on Angry Bear:"Housing: Speculation and the Price-Rent Ratio". And the same calculation for San Diego.

UPDATE: See link for San Diego Price to Rent ratio.

Based on the price-rent ratio and many other measures, the current housing bubble dwarfs the '91 housing bubble. Therefore it might be reasonable to expect that the bust will also be worse and last longer.

LA Times: Looking for Signs of Home Bubble

by Calculated Risk on 8/07/2005 02:39:00 AM

The Sunday LA Times features a story on the slowing San Diego housing market.

John Karevoll, chief analyst at DataQuick Information Services in La Jolla, which tracks home prices, called San Diego "our statistical canary in the mine shaft."Of course San Diego could suffer more than other areas:

"It is further along in the current cycle, and what happens there could predict what will happen elsewhere," he said.

Now, several factors could cause a more pronounced slowdown here, analysts say.And some important comments on jobs:

One is the region's far-below-average level of affordability. By one measure, only 9% of households can afford the area's $493,000 median home price — the level at which half of all homes sold for more, half for less. By contrast, affordability statewide is 16%; nationwide, it is 50%.

Another worry is the region's high level of risky loans. San Diego has been a standout in the use of unconventional lending. The region ranks No. 1 in the use of so-called piggyback loans, which let borrowers with low down payments finance a home purchase without paying for mortgage insurance. And the majority of buyers in San Diego still use loans with an "interest only" option, a type of adjustable rate mortgage in which borrowers need only pay interest in the first few years but could see the monthly payment mushroom in later years.

...

"Those of us with long enough memories know that real estate is cyclical," said Mark Milner, PMI's senior vice president and chief risk officer. "But we've never seen a cycle with so many of these kinds of loans, so nobody knows how the market will react if there's an economic shock."

... a shock could come from a wave of job losses. Although San Diego added 20,000 jobs between June 2004 and this June, the biggest gains were in real-estate-related jobs such as construction, according to Hanley Wood Market Intelligence, a research firm.Virtually flat is being generous (see next post).

Analysts say a deflating housing market could reverse that job trend, much as a contraction in the aerospace industry touched off a Southern California housing market downturn in the early 1990s. San Diego home prices were virtually flat for six years.