by Calculated Risk on 8/07/2005 02:39:00 AM

Sunday, August 07, 2005

LA Times: Looking for Signs of Home Bubble

The Sunday LA Times features a story on the slowing San Diego housing market.

John Karevoll, chief analyst at DataQuick Information Services in La Jolla, which tracks home prices, called San Diego "our statistical canary in the mine shaft."Of course San Diego could suffer more than other areas:

"It is further along in the current cycle, and what happens there could predict what will happen elsewhere," he said.

Now, several factors could cause a more pronounced slowdown here, analysts say.And some important comments on jobs:

One is the region's far-below-average level of affordability. By one measure, only 9% of households can afford the area's $493,000 median home price — the level at which half of all homes sold for more, half for less. By contrast, affordability statewide is 16%; nationwide, it is 50%.

Another worry is the region's high level of risky loans. San Diego has been a standout in the use of unconventional lending. The region ranks No. 1 in the use of so-called piggyback loans, which let borrowers with low down payments finance a home purchase without paying for mortgage insurance. And the majority of buyers in San Diego still use loans with an "interest only" option, a type of adjustable rate mortgage in which borrowers need only pay interest in the first few years but could see the monthly payment mushroom in later years.

...

"Those of us with long enough memories know that real estate is cyclical," said Mark Milner, PMI's senior vice president and chief risk officer. "But we've never seen a cycle with so many of these kinds of loans, so nobody knows how the market will react if there's an economic shock."

... a shock could come from a wave of job losses. Although San Diego added 20,000 jobs between June 2004 and this June, the biggest gains were in real-estate-related jobs such as construction, according to Hanley Wood Market Intelligence, a research firm.Virtually flat is being generous (see next post).

Analysts say a deflating housing market could reverse that job trend, much as a contraction in the aerospace industry touched off a Southern California housing market downturn in the early 1990s. San Diego home prices were virtually flat for six years.

Saturday, August 06, 2005

Gasoline Demand Strong, Inventories Drop

by Calculated Risk on 8/06/2005 12:01:00 AM

Oil prices (WTI Sept Delivery) closed over $62 per barrel today. And gasoline is averaging $2.29 per gallon. Gasoline prices are expected to set a new nominal record next week. Despite this relatively high price, demand for gasoline has remained robust.

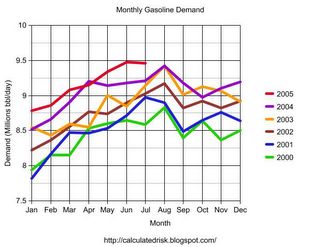

Click on graph for larger image.

This graph (data from DOE) shows the average US daily demand for gasoline by month for the last 6 years. Although there is some randomness, demand has clearly been increasing every year and demand growth remains robust in 2005.

Most of the increase in gasoline prices has come from increases in the price of crude oil. Both pgl and Kash have pointed this out on Angry Bear. But now, due to some refinery problems, gasoline stocks have been dropping. The AP noted:

At least seven refineries have reported problems of one kind or another, ranging from fires at Chevron Corp.'s El Segundo, Calif., and BP PLC's Texas City refineries to the complete shutdown of Exxon Mobil's plant in Joliet, Ill.Although gasoline stocks have dropped, they are still in the normal range and refinery problems have not impacted gasoline prices yet.

The DOE comments:

Recent refinery problems point to the potential for higher prices as the next few weeks unfold, but absent any additional major petroleum infrastructure problems, a repeat of the August 2003 price spike is very unlikely.Since gasoline stocks are low and demand growth robust any disruption (a hurricane in the GOM or a refinery fire) could lead to significantly higher gasoline prices.

Meanwhile, stocks of crude oil remain above normal. The primary reason for the high price of crude, according to the DOE, is the limited excess world production capacity, not lack of current supply. Dr. Hamilton offers some other possible reasons and discusses peak oil issues with geography professor Dr. Robert Kaufmann at the WSJ Online.

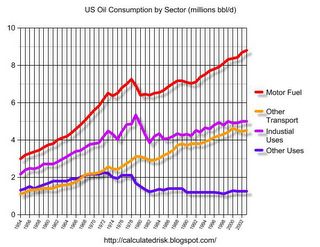

The final graph shows oil consumption by sector. You can see why it is important to follow gasoline demand.

The industrial sector has never returned to the 1979 consumption levels (due to a combination of efficiencies and substitutes) and "other uses" has also declined significantly, primarily because electricity generation has moved away from oil. This leaves motor fuel and "other transportation" as the major growth sectors for oil consumption.

This suggests that any reduction in oil consumption will have to come mainly from transportation. To reduce oil consumption for transportation, people will have to drive less, buy more efficient vehicles, or substitutes, suitable for transportation, will have to be found.

So far, even at these higher prices, we haven't seen any evidence of reduced consumption for transportation.

Friday, August 05, 2005

UK: Personal insolvencies hit record high

by Calculated Risk on 8/05/2005 09:56:00 PM

The Guardian reports:

The number of personal insolvencies in England and Wales has risen to its highest level in 45 years, official figures showed today.I wonder if this is related to the housing slowdown? The article provides these statistics:

In the April to June period, the number of personal insolvencies rose to 15,394, the highest since comparable records began in 1960, the Department of Trade and Industry said.John Butler of HSBC cautions about a change in the bankruptcy laws, but notes Scotland didn't change their rules and is seeing a similar trend. Butler added:

That was up 36.8% compared to a year ago and 11.7% on the quarter. The insolvencies were made up of 11,195 bankruptcies - also the highest on record - and 4,199 individual voluntary arrangements.

...

The main British banks have all reported a rise in bad loans as more people have fallen into arrears with their loan and credit card payments. Barclays today said provisions for bad loans and other credit provisions rose 20% to £706m in the first quarter, although Barclays said the rise at its Barclaycard credit card unit was partly due to an increase in lending.

"The worrying element is that at a time of high employment and low interest rates insolvencies have been rising," Mr Butler said.I found these comments interesting:

"The recent overall signs that the labour market has started to soften means that there is a growing risk that individual insolvencies will climb markedly further over the coming months," said Howard Archer of the consultancy Global Insight.Usually rate cuts are intended to encourage more borrowing. It sounds like Archer is arguing this cut was intended to provide "relief" to overextended borrowers. Wouldn't that require more stringent lending guidelines in conjunction with the rate cut?

"While Thursday's cut in interest rates will provide some very modest relief to debtors, there is the danger that it could encourage people to borrow more," Mr Archer said. "This is something the Bank of England will need to keep a close eye on."

Harney: "Wall Street Puts Breaks on Option ARMs"

by Calculated Risk on 8/05/2005 12:15:00 PM

Kenneth R. Harney writes that Wall Street has put the brakes on Option ARMs. He believes that an Aug 1st S&P negative report downgrade on option ARMs, combined with a new rgulatory guidance in the Fall will be "sayonara" for Option ARMs.

On Aug. 1, Standard & Poor's blew the whistle on option ARMs. After an intensive study of recent mortgage-backed bonds, it concluded that lenders are allowing credit standards to slip too far. And too many of the borrowers using option ARMs are paying the minimum amounts per month, thereby accumulating potentially toxic levels of debt — especially in markets where home values are likely to soften.Judging by the negligible impact of the previous "guidance", the S&P report

“We wanted to jump in before this got any worse,'' said Standard & Poor's mortgage bond director Michael Stack. By “any worse,'' he meant that if credit standards continued to decline, there would be a rising probability of defaults on option ARMs — something unacceptable to bond investors.

A second development potentially affecting option ARMs is under way at the federal financial regulatory agencies. A task force headed by Deputy Comptroller of the Currency Barbara Grunkemeyer is preparing new underwriting and credit risk guidelines on option ARMs, interest-only mortgages and reduced-documentation loans offered by the nation's lenders. In an interview, Grunkemeyer said the new guidelines could be out “by early fall,'' but there is no specific target date.

She said that financial regulators have “noticed that these products have taken off in the past six months.'' The goal of the guidelines will not be to eliminate any particular loan type, she emphasized, but “to make sure banks are offering (interest-only and option ARMs) in a safe and sound manner and doing so in a way that allows consumers to understand the risks.''

Hat tip to Ben Jones - a all housing, all the time, site. I'm primarily following housing since I think it is the key to the overall economy going forward. Housing has been the driver for jobs, credit growth, the declining savings rate, and probably even a major contributor to the trade deficit. I believe the end of the housing boom will lead to slower growth and will have major implications for the World economy.

Thursday, August 04, 2005

California Realtors: Income Gap Increases

by Calculated Risk on 8/04/2005 09:00:00 PM

The California Association of Realtors (C.A.R.) released survey results this week showing: "California Households Fall $70,480 Short in Income Needed to Purchase Home; Income Gap in San Francisco Bay Area at $102,230"

California households, with a median household income of $53,840, are $70,480 short of the $124,320 qualifying income needed to purchase a median-priced home at $530,430 in California, according to the California Association of REALTORS(R) (C.A.R.) Homebuyer Income Gap Index(TM) (HIGI) report for the second quarter of 2005, released today.

Click on graph for larger image.

Click on graph for larger image.The Homebuyer Income Gap Index(TM) for California increased 28.3 percent during the second quarter of 2005 compared to the second quarter of 2004, when the gap stood at $54,920, the median household income was $52,630, and qualifying income needed to purchase a median-priced home at $461,280 was $107,550.Although I think there are some inherent problems comparing medium income to medium house prices, the year over year comparison seems appropriate.