by Calculated Risk on 8/04/2005 01:26:00 AM

Thursday, August 04, 2005

Wednesday, August 03, 2005

California Investor: "Your Market was Undervalued"

by Calculated Risk on 8/03/2005 11:34:00 PM

Catherine Wilkinson writes for BKCI 2 in Boise, Idaho: Real Estate Sales Surge

If you build it, they will come. And as fast as homes are being built in the Treasure Valley, the faster out of state investors primarily from California and Nevada are buying them up. I've never seen anything like it in my entire life." said Tony Drost with the National Association of Retail Property Managers. He also adds he's having a hard time keeping up with the demand. "I personally field about 7 phone calls a day."Emphasis by Ms. Wilkinson.

Experts say the market is so hot single family home sales and prices have set record numbers in the first half of 2005.

An average price of a home in Meridian was about $177,000, in just six months that number increased 14%.

But Meridian was not the only city experiencing dramatic changes..

Nampa and Eagle saw their home prices increase by 11%, and in Boise prices jumped a whopping 23%. "It's all numbers you can see the appreciation happening and it actually escalates as more invest and it's just going to continue going up," said Drost.

California investor Bob Koop says it was a deal he couldn't pass up. "It seemed like your market as a whole was undervalued."

But this hot housing market bubble could pop as more rental property become available. Rental prices are going down, something Drost warns his investors about before they buy, "There's 200 single family homes for rent in Meridian. In March when I did my search there was roughly 36 homes which at the time I thought was kind of high and now when I look at 200 I don't even know what to think."

But Koop says Boise's a bargain, and is in fact coming back to buy more, "I'll be up there in two weeks."

I have nothing to add.

Housing: More Inventory

by Calculated Risk on 8/03/2005 12:59:00 PM

Realty Times reports: San Francisco, California Real Estate Cools Slightly:

"Wow. Inventory is rising and sitting!," says Realtor James Kastner. "I saw several properties on broker's tour that have been on the market a few weeks -- even a few price reductions. Inventory tends to surge after a holiday weekend -- and drop before. Remember that we have Labor Day coming."So the increase might just be seasonal. And this from Realtor Jeffrey Tong:

"Prices are still increasing, however there are no longer 20 offers on each house -- more like two. Although I don't believe the amount of buyer interest has waned, it appears many are just pausing to see what happens to the market."Occasionally I like to check in on the Downtown San Diego condo market (see graphic). The trend of increasing inventories appears to be continuing.

Tuesday, August 02, 2005

Zero Savings and Housing

by Calculated Risk on 8/02/2005 07:18:00 PM

General Glut notes today that savers have reached the Rubicon of zero savings. But will they cross it? Dr. Hamilton had a recent discussion on savings and showed that the rate has been declining for 20+ years.

CNN has an article, The zero-savings problem, tying the recent lack of savings to the housing boom:

Even as a government report Tuesday showed the national savings rate at zero -- that's right nada -- the rise in the value of homes has given the average U.S. household a net worth of greater than $400,000, according to a separate report from the Federal Reserve.And that could mean problems ahead:

Household real estate assets have risen by just over two-thirds since 1999, and the run up has enabled consumers to spend more money than they are bringing home in their paychecks. They're viewing their homes almost like ATM machines, using home equity loans and refinancings to pull out cash and support a higher level of spending.

"[Rising home values] are making people feel they don't need to save," said Lakshman Achuthan, managing director of the Economic Cycle Research Institute.

That means they are spending more of their paychecks than they would otherwise. That's good news for the current economy but it could cause trouble longer term, according to some economists.

The low savings rate has kept consumers spending, which in turn has kept the economy growing.

"We've backed ourselves into a very dangerous situation," said Dean Baker, co-director of the Center for Economic and Policy Research. "The economy is dependent on everyone consuming like crazy. If everyone heard my diatribe and said, 'Yeah, we better start saving,' the economy would go into a recession."

And while it's not going to be the warnings of economists that start people saving, the slowing of housing price growth or actual declines will put brakes on the spending as people will run out of equity they can tap.

The savings rate will also have more downward pressure as Baby Boomers start retiring and drawing down on retirement savings. While Social Security benefits count as income, withdrawals from 401(k) and other retirement accounts do not.

So if there is no change in the spending habits, the aging of the U.S. workforce could soon make zero or negative savings rates the norm.

"I find it just odd for all these economists and policy makers to be cheering for all this consumer spending when we're just digging ourselves into a hole," said Brusca. "With all the obligations we have ahead, to retirees and to ourselves, we have all the reasons in the world for people to be saving more and be controlling their spending."

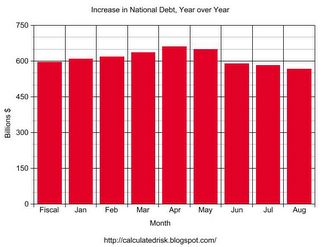

National Debt Increase: $566 Billion YoY

by Calculated Risk on 8/02/2005 05:53:00 PM

As of Aug 1, 2005 our National Debt is:

$7,869,521,621,947.05 (Over $7.8 Trillion)

As of Aug 1, 2004, our National Debt was:

$7,303,319,122,668.55

SOURCE: US Treasury.

Click on graph for larger image.

For comparison:

For Fiscal 2004 (End Sept 30, 2004): $596 Billion

For Jan 1, 2004 to Jan 1, 2005: $609.8 Billion

For Feb 1, 2004 to Feb 1, 2005: $618.6 Billion

For Mar 1, 2004 to Mar 1, 2005: $635.9 Billion

For Apr 1, 2004 to Apr 1, 2005: $660.9 Billion

For May 1, 2004 to May 1, 2005: $648.8 Billion

For Jun 1, 2004 to Jun 1, 2005: $588.0 Billion

For Jul 1, 2004 to Jul 1, 2005: $581.2 Billion

For Aug 1, 2004 to Aug 1, 2005: $566.2 Billion

It now appears that the debt increase for fiscal '05 will be slightly less than the record set in fiscal '04. The current record annual increase in the National Debt is $596 Billion for fiscal '04.