by Calculated Risk on 7/29/2005 03:11:00 PM

Friday, July 29, 2005

GDP: Three Takes

Dr. Duy considers how the FED will review the GDP data: Fed Watch: A Week of Data That Point to More Tightening ...

And Dr. Hamilton presents: New GDP data and recession probabilities

And pgl is reasonably positive on GDP: Strong Fixed Investment Demand Growth.

Three interesting views.

For those with positive views on the economy, there is nothing in this report that will change their opinion. For those that are negative on the economy (because of the housing bubble, current account and fiscal deficits, etc.), there is nothing in this report that will sway them either.

Dr. Aigner: Trouble in housing market no game

by Calculated Risk on 7/29/2005 11:06:00 AM

Economics Professor and former Dean of the UCI Graduate School of Management Dennis Aigner writes in the OC Register: Trouble in housing market no game, Region's house of cards ready to topple as prices reach unsustainable levels.

Are you familiar with the game Jenga, where players successively remove small wooden blocks from the bottom of a tower and place them on top, creating a progressively more unstable situation until one player causes the whole structure to tumble? (Our family record is 31 courses, by the way, if you want to compare notes.) The remaining players yell, Jenga!, we all clean up the mess, restack the blocks and begin again.See Dr. Aigner's commentary for some comparisons to foreign markets.

That's basically what's about to happen very soon in parts of California and several other "hot" housing markets around the country. Merrill Lynch recently issued a "bubble" warning for six California housing markets - San Diego, the Inland Empire, Los Angeles, San Francisco, San Jose and Sacramento, where "affordability" indexes are at historic lows. In other words, household incomes are way out-of-sync with home prices.

... it won't take a big uptick in mortgage interest rates to trigger a slow-down or retrenchment in prices, and the argument that such high prices are justified by insufficient supply coupled with strong demand just doesn't hold water now that we have gone beyond all rationality with respect to affordability across the board.

We're in the midst of a classic speculative bubble, and even the venerable Alan Greenspan referred to a bit of "froth" in certain housing markets in a recent speech. The UCLA Anderson Forecast, which has been warning of a break in the bubble for the past couple of years, echoed that warning again in its latest quarterly update and predicted a recession to follow even if it's a "soft landing."

A hard landing is more likely (where nominal prices actually fall) because houses are more overvalued than in past booms, inflation is lower and many people have been buying houses as investments.

But the most compelling evidence of a bursting bubble to come is the divergence of home prices and rents. In the United States over the past decade the ratio of home prices to rents has increased by almost 40 percent.

The increase is much higher in hot housing markets like Orange County (99 percent), where the ratio of median home price to average monthly rent now stands at 433:1.

To re-calibrate to more reasonable historical levels will require rents to rise sharply, which is constrained by household income growth, or home prices will have to fall, the only other possibility.

...

Over the past four years, 90 percent of the growth in U.S. GDP was accounted for by consumer spending and residential construction. Declines in the nation's biggest housing markets are likely to trigger a major economic slowdown.

It is not a question of whether this will happen but when, how dire will be the consequences on economic growth, and how long it will take to restack the blocks and begin again.

WSJ: What Housing Bubble?

by Calculated Risk on 7/29/2005 02:32:00 AM

Neil Barsky writes in the WSJ "What Housing Bubble?"

If you want to be scared out of your wits these days, you basically have two choices: go watch Steven Spielberg's latest, or listen to the hysterical warnings of economists and journalists about the imminent popping of our so-called housing bubble.I think I missed out on those "parental contributions"! Barsky lists 3 myths:

...

The reality is this: There is no housing bubble in this country. Our strong housing market is a function of myriad factors with real economic underpinnings: low interest rates, local job growth, the emotional attachment one has for one's home, one's view of one's future earning- power, and parental contributions, all have done their part to contribute to rising home prices.

• Myth #1. There is too much capacity: According to Census data, over the past 10 years, housing permits have averaged about 1.63 million units per year -- including multifamily units. Household formation has averaged 1.49 million families per year. So far, so good. But ... Roughly 6% of the new home sales were for second homes ... approximately 360,000 units every year were torn down either because they were nonfunctional, or because they were "tear-downs." When the latter two numbers are taken into account, the real number of new homes is closer to 1.2 million, or 19% fewer than the average number of new households formed each year.

• Myth #2. Risky mortgage products are fueling house appreciation: Sages from Warren Buffett to Alan Greenspan have warned of the increased risk from the use of new mortgage products, particularly adjustable-rate mortgages and interest-only mortgages. The theory here is that buyers are extending themselves to make payments, and when their mortgages reset they will be in trouble. ... As virtually every mortgagee in the country knows, most ARMs are fixed rate for the first two to seven years. Virtually all have 2% interest-rate caps. The average American owns his home for seven years. Why pay several hundred basis points to lock in rates he is highly unlikely to take advantage of?

• Myth #3. Speculators are Driving Home Prices: The media today is chock-full of stories of day-trading dot-com refugees who have found their calling buying homes and condos "on spec," with the hope of flipping the property for a higher price. Earlier this month, one Wall Street analyst published an article with the catchy headline: "Investors Gone Wild: An Analysis of Real Estate Speculation." Scary ... again, some common-sense thinking is in order. In Manhattan, where I live, friends buy apartments kicking and screaming, convinced they top-ticked the housing market. Is Manhattan special? Are speculators flipping Palm Beach mansions? I don't think so. Yet these markets are experiencing the same price appreciation as Las Vegas, Phoenix and Florida, where real estate investors are supposedly driving prices higher.

Thursday, July 28, 2005

Housing Mortgage Trends

by Calculated Risk on 7/28/2005 06:09:00 PM

UPDATE: Also see Asha Bangalore's (pdf) Signs of Distress in the Effervescent Housing Market?

Fitch Ratings released a newsletter "RMBS Mortgage Principles and Interest" this week. (RMBS: Residential Mortgage Backed Securities)

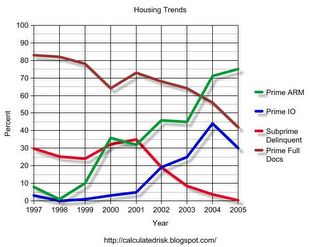

There were several interesting trends. Click on graph for larger image.

Click on graph for larger image.

The percentage of prime loans using ARMs and IOs has been increasing (IOs have dipped slightly so far in '05). The same pattern can be seen for subprime loans (not graphed).

At the same time, the percentage of loans requiring full documentation has dropped significantly.

UPDATE: tanta points out that these are old pools with "junk that can't prepay". Ignore this section on subprime delinquencies ... nothing of value here! Also of interest is the percent of subprime loans (the fastest growing segment) that are in delinquency. Although delinquency rates were around 30% (over 60 days late) for a number of years, recently the rate has fallen to almost zero. Also, I believe the extensive use of ARMs and IOs indicates excessive leverage, even in the prime market.

Lower delinquencies would usually be good, but I am concerned if the housing market slows that delinquency rates will return to the 30% range on subprimes.

Wednesday, July 27, 2005

Dr. Baker: Housing Bubble Fact Sheet

by Calculated Risk on 7/27/2005 10:51:00 PM

Dr. Dean Baker of Center for Economic Policy Research (CEPR) has put out "The Housing Bubble Fact Sheet". (thanks to Ficus for the tip).

1. The unprecedented rise in house prices has dangerous implications for the economy.Read Dr. Baker's fact sheet for the details. I agree with most of his points, but Baker is more pessimistic than me.

2. The housing bubble has created more than $5 trillion in bubble wealth, the equivalent of $70,000 per average family of four.

3. The increase in house prices is not being driven by fundamental factors in the housing market, such as income and population growth.

4. The housing bubble regions are large enough to have a major impact on the national economy.

5. The collapse of the housing bubble will throw the economy into a recession, and quite likely a severe recession.

6. The collapse of the housing bubble is likely to put major strains on the financial system and require a federal bailout of the mortgage market.

7. The sooner house prices drop, the less economic damage there will be.

8. The housing bubble could pop from higher interest rates, but it could also deflate even if interest rates stay low.