by Calculated Risk on 7/27/2005 06:02:00 PM

Wednesday, July 27, 2005

Bernanke's Bunkum

Dr. Thoma excerpts from Bernanke's commentary in the WSJ. Clearly Bernanke has been drinking the Bush Administration Kool-Aid.

How can anyone claim the Bush Administration has been pursuing "good economic policies" with respect to the budget deficit? That is outlandish.

And on jobs, I've cut the Bush Administration slack. But there is a difference between "cutting them slack" and giving them credit - The Bush Administration deserves no credit on jobs! Since Bush has taken office there have been a total of 161 thousand non-farm private sector jobs created. That is the worst net job creation performance in over 70 years.

The entire commentary is bunkum. But instead of correcting each of Bernanke's false assertions, I've found the template for his talking points:

No Congress of the United States ever assembled, on surveying the state of the Union, has met with a more pleasing prospect than that which appears at the present time. In the domestic field there is tranquillity and contentment, harmonious relations between management and wage earner, freedom from industrial strife, and the highest record of years of prosperity.Calvin Coolidge, State of the Union Address, December 4, 1928

Bernanke is now channeling Coolidge's monument to economic shortsightedness.

Housing: More stories on Inventories

by Calculated Risk on 7/27/2005 01:12:00 PM

Here are three more stories that back up my prediction for July.

New Hampshire: Real Estate Listings In Area Skyrocketing

Along a 2-mile stretch of Route 302 - from Bethlehem Junction to the Memory Lane Apartments - the landscape is dotted with "for sale" signs.Florida: More Strand homes for sale

...

As a result, the number of real estate listings in the greater Littleton area - including Bethlehem - have doubled since this time last year.

...

"Right near me every place is for sale,"

Home listings in the second quarter jumped 9 percent, from 2,916 to 3,165. Condo listings increased 36 percent from 2,636 to 3,584, according to the Multiple Listing Service for Horry and Georgetown counties.California: Higher inventory takes some zing out of sellers' edge that dominated '04

Meanwhile, the latest level of unsold inventory [in Palm Springs], at about 3,296 homes - more than 80 percent higher than a year ago and more than twice the level of April 2004 - suggests that the market is reaching an equilibrium between the needs of buyers and sellers.

"This is not a buyer's market yet," said Greg Berkemer, executive vice president of the California Desert Association of Realtors. "It's just less of a seller's market than it was a year ago."

June: Record New Home Sales

by Calculated Risk on 7/27/2005 11:00:00 AM

According to a Census Bureau report, New Home Sales in June were at a seasonally adjusted annual rate of 1.374 million vs. market expectations of 1.3 million. May sales were revised up to 1.321 million from 1.271 million.

Click on Graph for larger image.

NOTE: The graph starts at 700 thousand units per month to better show monthly variation.

Sales of new one-family houses in June 2005 were at a seasonally adjusted annual rate of 1,374,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.

The Not Seasonally Adjusted monthly rate was 122,000 New Homes sold, down from a revised 123,000 in May.

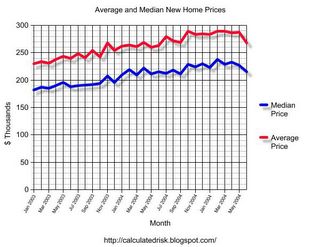

The median sales price of new houses sold in June 2005 was $214,800; the average sales price was $267,400.

The average sales price is down and the median price is the lowest since September of 2004.

The seasonally adjusted estimate of new houses for sale at the end of June was 454,000. This represents a supply of 4.0 months at the current sales rate.

The seasonally adjusted supply of New Homes was 4.0 months, about normal for the last few years.

Tuesday, July 26, 2005

Housing Inventories

by Calculated Risk on 7/26/2005 02:22:00 AM

Existing home inventories rose to 2.653 million in June. Because sales were so strong (7.33 million annual rate), this represented a supply of 4.3 months.

I expect a further increase in inventories based on recent articles like this one: D.C. Area Housing Market Cools Off.

Home sales tend to slow in the summer, but the number of houses for sale in the Washington area has climbed by 50 percent in recent months. The available inventory has risen to about 35,300 homes, up from an average of about 23,000 in the past three years....Therefore I expect a further increase in July inventories to 2.9+ million (from 2.653 million in June). I also expect to see a small drop in July sales to maybe around 6.8 million (still very strong) annual rate.

If both of these predictions hold, this computes to a 5.1 month supply - the highest level in a number of years.

Monday, July 25, 2005

DiMartino: Bubble's Fallout?

by Calculated Risk on 7/25/2005 10:52:00 PM

DiMartino disagrees with Greenspan on the housing bubble:

There's a good chance the housing bubble carries severe macroeconomic implications, a point Alan Greenspan disputed in his congressional testimony last week.I tried to quantify the impact of the housing bust on the economy on Angry Bear. DiMartino does a better job:

If prices fall, he said, "they likely would be accompanied by some economic stress, though the macroeconomic implications need not be substantial."

Let's start with some factoids from Merrill Lynch:

•Real estate accounts for 70 percent of the rise in household net worth since 2001.

•Forty percent of private-sector jobs created since then are housing-related.

•Consumer spending and residential construction have accounted for 90 percent of U.S. economic growth.

The inevitable pullback in construction speaks directly to housing's risks. A similar 40 percent decline in construction to that of the 1981-82 recession implies a decline of 2 percentage points in GDP.

And then there's the wealth effect. The housing bubble has added $5 trillion to household net worth, equating to about $70,000 for a family of four.

"The large wealth effect associated with the housing bubble, which has spurred a consumption boom in the last few years, will go into reverse as housing prices plummet," Mr. Baker predicted.

This dent in consumption would whack an additional 1.6 to 2.5 percentage points off GDP growth. Totaled out, that GDP retreat about equals current GDP growth.

Maybe I'm being obtuse, but a recession is about as macro as you can get, economically speaking.

Maybe the best thing to do is respectfully agree to disagree with Mr. Greenspan and let time render its own decision.