by Calculated Risk on 7/12/2005 11:27:00 AM

Tuesday, July 12, 2005

Bernanke on Housing: Market Forces, not Speculation

Ben Bernanke gave his first speech this morning as the new chairman of the White House's Council of Economic Advisers. At the American Enterprise Institute, Bernanke commented on housing:

"While speculative behavior appears to be surfacing in some local markets, strong economic fundamentals are contributing importantly to the housing boom,"I disagree. Speculation, including excessive leverage, appears rampant in many markets.

Those fundamentals, Bernanke said, include low mortgage rates, rising employment and incomes, a growing population and a limited supply of homes or land in some areas.I disagree. Low mortgage rates are not a housing "fundamental", employment in California (one of the hottest real estate markets) is struggling, and population growth / limited supply of land was true 10 years ago too when housing was in a bust.

"For example, states exhibiting higher rates of job growth also tend to have experienced greater appreciation in house prices,"

"The administration will continue to monitor" developments in the housing market, Bernanke said. "However, our best defenses against potential problems in housing markets are vigilant lenders and banking regulators, together with perspective and good sense on the part of borrowers."And on the budget deficit:

"One consequence of the strong income growth we are enjoying is higher-than-expected levels of tax collections so far this year which, if maintained with spending controls, will reduce the government's budget deficit for this year well below its projected level,"This is laughable. There is a small improvement in the deficit this year, due to one time events, but next year will be worse.

As the Chairman of the CEA, it is understandable that Bernanke supports the Bush Administration's positions.

Monday, July 11, 2005

Free Money: Part III

by Calculated Risk on 7/11/2005 07:47:00 PM

About four months ago, I wrote that they were giving away free money in The OC (Orange County, CA). At that time the median home price in OC was $555,000.

According to the OC Register, the median home price in May was $585,000. That is a gain of $30,000 in just two months. See Free Money II.

Today the OC Register reports that the OC median home price is now $601,000.

That is a total of $46,000 in FREE MONEY since local RE Broker Gary Watts' prediction of $70,000 in gains this year. I'm starting to feel a little heat for making fun of Mr. Watts' comments.

Housing: The Tax Myth

by Calculated Risk on 7/11/2005 01:31:00 AM

Also: Please see my most recent post on Angry Bear: Help Wanted: Real Estate Agents

Housing: The Tax Myth

Various people have suggested that the current Real Estate boom is a direct result of the Tax Relief Act of 1997. The Tax Relief Act was sponsored by Rep John Kasich (R-OH) that replaced a similar senate Bill sponsored by Senator Roth (R-DE). Although the Bill was Republican sponsored, it passed the Senate 92 - 8 and the House 389 - 43 and was signed into law by President Clinton. Obviously the Act had widespread bipartisan support.

The '97 Act made a major change in how gains on primary residences are taxed. Under the old law, gains could be rolled over into a new home, as long as the home was of equal or greater value than the old home. Once a homeowner (or their spouse) reached the age of 55, they could take a one time exclusion up to $125,000 of the profit from the sale of their residence to "step down" and buy a smaller home. NOTE: I'm outlining the standard rules and skipping all complications.

Under the new law, homeowners receive a $250K (single) or $500K (married) tax exclusion when they sell their home. They can use this exclusion every two years. The old "rollover" and 55+ year old rules no longer apply. Some people have argued that this exclusion is responsible for the real estate boom.

What would motivate someone to take advantage of the exclusion? Here is the simple case: A married couple buys a home for $400K and some time later the house could be sold for $800K. Should they sell to take advantage of the $500K exclusion?

Assumptions: Property taxes are 1% (added: California Law). Transaction costs are 6%.

Here is the argument some people are making: To take advantage of the exclusion, this couple would sell their home for $800K and buy a similar home for $800K. They would have to take out a loan for $48K more on the new home to cover the transaction costs and their property taxes would increase from $4K per year to $8K per year. For doing this transaction, their basis on the new house would be $800K (as opposed to $400K under the old law). This new basis would save the couple from paying capital gains in the future on $352K ($400K minus $48K) or taxes of $70K (if taxed at 20% capital gains).

What is the better deal: 1) To have a $48K immediate increase in debt plus payments of $4K more per year or 2) to have a future tax liability of $70K? For most situations the answer is #2, so the Tax Relief Act of '97 isn't motivating people to buy and sell similar properties.

Is there an example of where the '97 Act would motivate people to buy and sell? If homeowners are moving down in price (moving to a smaller property or moving to a less expensive state or even renting) then the Act might be contributing to the boom. Is there evidence of homeowners en masse moving to renting? No, the opposite has happened. Is there evidence of homeowners moving to smaller homes or less expensive areas? Not a significant number. Besides this would drive up the prices in less expensive areas and lower the price in expensive areas - is that what is happening? No.

The bottom line is the Tax Relief Act of '97 is not contributing to the bubble as some people suspect.

However, there is one impact that might be happening in more expensive areas. Long time homeowners over 55, with significantly more than $500K in equity, might not move to less expensive housing to avoid paying taxes. This might reduce inventories of expensive homes, but I doubt this is a widespread problem.

Friday, July 08, 2005

Housing: Calpers is Selling

by Calculated Risk on 7/08/2005 02:43:00 AM

Forbes reports that "Public pensions are rushing into real estate the way they rushed into tech in the late 1990s."

When the tech boom went bust A few years ago, New Jersey's public pension fund was among the hardest hit in the country, suffering a loss in its tech-laden portfolio of nearly one-third of its value, or $30 billion. Now the State Investment Council has another great idea: In January it decided to jump into--this can't be a surprise--real estate.The Real Estate rush is on:

All told, the top 50 public funds increased their commitments to real estate last year by $9.8 billion, equal to 11% of their property holdings, according to the newsletter Real Estate Alert. Now they have set a target of loading another $34 billion into land and buildings as quickly as is practical, representing a 37% hike to $128 billion, or 7.2% of their assets.And some old timers are worried:

"We're drowning in liquidity," says Dale Anne Reiss, who heads Ernst & Young's real estate practice. "Banks are lending aggressively, and every flavor of institution thinks real estate is the best alternative out there. Some of us remember an equal degree of enthusiasm in the late 1980s just before the market collapsed."Meanwhile, Calpers is selling:

... California's pension fund Calpers, the nation's largest public fund and often in the investing vanguard [is selling]. As less savvy funds rush in, Calpers has lately sold about $7 billion in expensive real estate and taken profits.Of course, in California the affordability index is near the all time low.

"We think the timing is right" to sell, says Brad W. Pacheco, a Calpers spokesman. "We have a property on the block right now and plan to continue selling."

The percentage of households in California able to afford a median-priced home stood at 16 percent in May, a 3 percentage-point decrease compared with the same period a year ago when the Index was at 19 percent, according to a report released today by the California Association of REALTORS® (C.A.R.). The May Housing Affordability Index (HAI) declined 1 percentage point from April, when it stood at 17 percent.

"The record low was 14 percent set back in May and June of 1989," said Robert Kleinhenz, an economist with the group.

Thursday, July 07, 2005

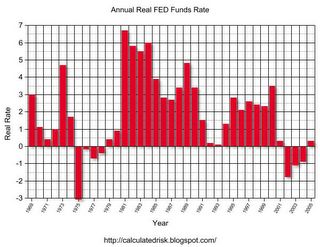

The Real FED Funds Rate

by Calculated Risk on 7/07/2005 06:04:00 PM

Dr. Hamilton of Econbrowser asks: "How high will the Fed push interest rates?"

First, how high is the Fed Funds Rate now? In nominal terms, the FED Funds Rate is 3.25%. But in real terms it is barely positive.

Click on graph for larger image.

For this graph, I subtracted the averaged trailing 12 months median CPI (SOURCE: Cleveland Fed) from the average of the monthly Fed Funds rate (SOURCE: Federal Reserve).

After the '73-75 recession, the FED Funds Rate chased the inflation rate. This led to ever higher inflation until the Volcker FED put the brakes on in the early '80s. The Real FED Funds Rate has declined since the early '80s, with a low in the early '90s as the FED provided stimulus in reaction to the '90/'91 recession.

A neutral Real FED Funds Rate is probably 2% or higher. If the economy is as healthy as the FED claims "... the expansion remains firm and labor market conditions continue to improve gradually.", then the FED will raise the FED Funds Rate to over 4% unless inflation diminishes.

Like many others, I believe the economy has serious and intractable imbalances: the current account deficit, the structural budget deficits and the housing bubble. These are the result of global shifts and poor public and fiscal policies.