by Calculated Risk on 7/07/2005 06:04:00 PM

Thursday, July 07, 2005

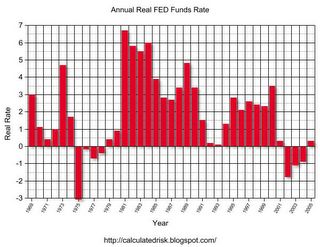

The Real FED Funds Rate

Dr. Hamilton of Econbrowser asks: "How high will the Fed push interest rates?"

First, how high is the Fed Funds Rate now? In nominal terms, the FED Funds Rate is 3.25%. But in real terms it is barely positive.

Click on graph for larger image.

For this graph, I subtracted the averaged trailing 12 months median CPI (SOURCE: Cleveland Fed) from the average of the monthly Fed Funds rate (SOURCE: Federal Reserve).

After the '73-75 recession, the FED Funds Rate chased the inflation rate. This led to ever higher inflation until the Volcker FED put the brakes on in the early '80s. The Real FED Funds Rate has declined since the early '80s, with a low in the early '90s as the FED provided stimulus in reaction to the '90/'91 recession.

A neutral Real FED Funds Rate is probably 2% or higher. If the economy is as healthy as the FED claims "... the expansion remains firm and labor market conditions continue to improve gradually.", then the FED will raise the FED Funds Rate to over 4% unless inflation diminishes.

Like many others, I believe the economy has serious and intractable imbalances: the current account deficit, the structural budget deficits and the housing bubble. These are the result of global shifts and poor public and fiscal policies.

Wednesday, July 06, 2005

Bank of England to Lower Rates?

by Calculated Risk on 7/06/2005 07:39:00 PM

UPDATE: We are all British today ...

The Bank of England's Monetary Policy Committee will conclude a two day meeting tomorrow and will announce monetary policy at 12 noon immediately following the Thursday meeting. The London Times has called for a rate cut.

THE Bank of England should move to bolster the economy today with a cut in interest rates, four out of nine members of The Times Monetary Policy Committee (MPC) said yesterday amid anxiety over faltering growth.The calls for a rate cut come as more evidence of economic weakness has emerged:

As worries were fuelled by figures showing manufacturing stagnating and homeowners further scaling back borrowing against their properties, pressure on the Bank to act was emphasised by the close vote among the independent experts.

Fears that the consumer downturn will be prolonged were heightened by the Bank’s latest figures for mortgage equity withdrawal, when homeowners borrow against increased property values for reasons other than moving home. The amount of cash raised in this way fell to £6.4 billion in the first quarter from a revised £8.3 billion in the previous three months and a peak of £17.7 billion in late 2003.The Confederation of British Industry has also called for a rate cut:

In The Times MPC vote, Martin Weale, NIESR’s director, and Sir Steve Robson, former Treasury Second Permanent Secretary, added their voices to call for an immediate rate cut. They were joined by The Times’s Anatole Kaletsky and Sushil Wadhwani, a former member of the Bank’s MPC, who also voted for a cut in June.

Sir Steve said that last week’s overhauled GDP data “suggested that the economy has been losing momentum for a good deal longer than previously thought”. “There are no new factors in prospect which would give it new momentum,” he said. Inflation remained subdued, he added. Mr Weale echoed this, arguing that growth was likely to have been below its long-term trend for a year.

``As there still seems little risk of inflation, the time for action is now,'' said CBI Director-General Digby Jones in the text of speech to be given in northern England this evening. There are ``troubling signs of decline in the housing market where confidence is everything. Such a loss of confidence is something the U.K. economy cannot afford.''

U.K. growth lagged behind the euro region for the first time in more than four years during the first quarter as the increase in consumer spending slowed and manufacturing contracted, government statistics showed last week. Inflation in May stayed at a seven-year high of 1.9 percent for the third month running.

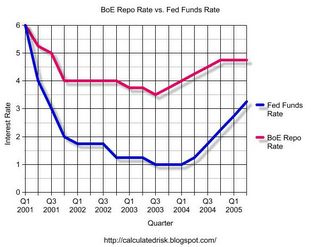

Click on graph for larger image.

Click on graph for larger image.It is possible that the UK housing slowdown is a leading indicator for the US housing market. The BoE didn't lower rates as far as the FED and they started raising rates sooner. Now, with the UK housing market faltering and high street sales slumping, it looks like the peak of the BoE interest rate cycle will be the lowest in fifty years.

What does this mean for the FED? Probably nothing. As Dr. Altig points out, the futures market is indicating at least two more 25 bps point rate increases from the FED at the next two meetings.

UPDATE: Financial Times: Grim outlook for UK manufacturing sector

David Page at Investec said: “Although manufacturing appeared firmer than markets were expecting in May, wholesale revisions in line with last week’s National Accounts revealed a weaker recent past for manufacturing and firmly pointed to a manufacturing recession.”Scotsman: Manufacturing recession rears its ugly head

"UK manufacturers are finding it difficult to pass on cost increases, particularly given the scale of the increase in oil,'' said George Buckley, an economist at Deutsche Bank. "In addition, weakening consumption makes it difficult to sell their products."

Tuesday, July 05, 2005

$1 Million Trailer: Land not included

by Calculated Risk on 7/05/2005 11:22:00 PM

The USA Today reports Mobile home madness: Prices top $1 million

A two-bedroom, two-bathroom mobile home perched on a lot in Malibu is selling for $1.4 million. This isn't a greedy seller asking a ridiculous amount no one will pay. (Photo gallery: Mobile home boasts of spectacular views)Uh, OK.

Two others sold in the area recently for $1.3 million and $1.1 million. Another, at $1.8 million, is in escrow. Nearby, another lists for $2.7 million.

"Those are the hottest (prices) I've ever heard," says Bruce Savage, spokesman for the Manufactured Housing Institute. He says prices in another hot spot, Key West, Fla., top $500,000. As if the price isn't tough enough to swallow, trailer buyers:

•Don't own the land. As with most mobile homes sold in Malibu, the land is owned by the proprietor of the trailer park, in this case, Point Dume Club.

•Still pay rent. Not owning the land means paying what's called "space rent" that is as high as or higher than many mortgages in other parts of the USA. On the $1.4 million trailer, space rent is $2,700 a month.

•Can't get mortgages. Since the buyers don't own the land, most of the mobile homes are paid for in cash or with a personal property loan that usually amounts to $100,000 or less, says Clay Dickens, mortgage loan agent at Community West Bank.

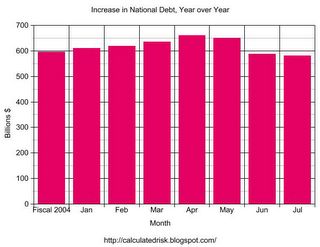

Budget Deficit: $581 Billion Year over Year

by Calculated Risk on 7/05/2005 03:58:00 PM

As of July 1, 2005 our National Debt is:

$7,827,306,264,287.53 (Over $7.8 Trillion)

As of July 1, 2004, our National Debt was:

$7,246,142,474,951.77

SOURCE: US Treasury.

Click on graph for larger image.

For comparison:

For Fiscal 2004 (End Sept 30, 2004): $596 Billion

For Jan 1, 2004 to Jan 1, 2005: $609.8 Billion

For Feb 1, 2004 to Feb 1, 2005: $618.6 Billion

For Mar 1, 2004 to Mar 1, 2005: $635.9 Billion

For Apr 1, 2004 to Apr 1, 2005: $660.9 Billion

For May 1, 2004 to May 1, 2005: $648.8 Billion

For Jun 1, 2004 to Jun 1, 2005: $588.0 Billion

For Jul 1, 2004 to Jul 1, 2005: $581.2 Billion

I still expect fiscal 2005 to set a new nominal budget deficit record although it might be close. The current record annual increase in the National Debt is $596 Billion for fiscal '04.

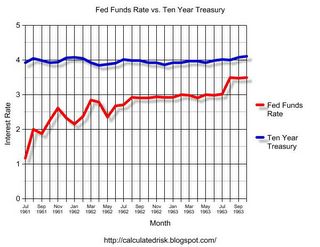

A Unique Conundrum?

by Calculated Risk on 7/05/2005 12:03:00 AM

The Federal Reserve has been steadily raising rates from a low of 1% to over 3%. And the yield on the Ten Year Treasury stubbornly refuses to budge.

Click on graph for larger image.

That is what happened in the early '60s. The Fed Funds rate moved from 1.1% in July 1961 to 3.5% in late 1963 and the Ten Year yield stayed steady at 4%.

All data from the Federal Reserve.

The yield curve narrowed and then what happened to the economy? It continued to grow and the stock market rallied.

There are many differences from forty years ago and today. But, with the constant drum beat in the financial press about the yield curve, I decided to check if the current situation was unique. It isn't. Nothing profound, I was just curious.

Also, my most recent post is up on Angry Bear: Housing Update.