by Calculated Risk on 6/28/2005 07:57:00 PM

Tuesday, June 28, 2005

Housing: FDIC and California

According to the article in the previous post:

Today, the agency will release new state-by-state economic profiles. Taken together, the profiles conclude that most booming U.S. housing markets are sustained by strong growth in new jobs.Here is the California profile and two graphs.

"In general, that is where home prices are rising most rapidly," said Barbara Ryan, associate director of the FDIC's research division.

Click on graph for larger image.

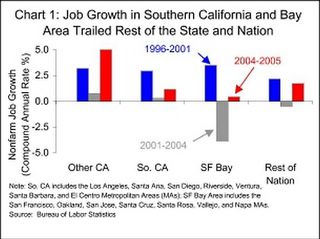

Job growth in the bay area and southern California trailed the rest of the Nation.

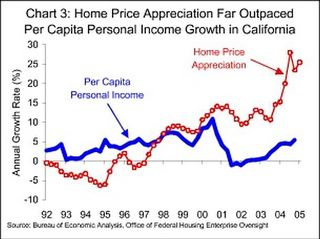

Price appreciation outpaced income growth.

The data for California does not seem to support the FDIC's conclusion.

Sec. Snow and FDIC: No Housing Bubble

by Calculated Risk on 6/28/2005 07:04:00 PM

Treasury Secretary Snow appeared on CNBC today. According to FOX:

"I think in some markets housing prices have risen out of alignment with underlying earnings," Snow said. But also answering the question whether there was a housing bubble in the United States his answer was a flat-out "no."And officials at the FDIC apparently believe that housing prices are the result of strong job growth. From this article:

Top officials at the Federal Deposit Insurance Corp. (FDIC), which regulates national banks, yesterday dismissed fears that rising home prices nationwide reflect a speculative bubble ready to burst.Here are the FDIC State Profiles.

...

Today, the agency will release new state-by-state economic profiles. Taken together, the profiles conclude that most booming U.S. housing markets are sustained by strong growth in new jobs.

"In general, that is where home prices are rising most rapidly," said Barbara Ryan, associate director of the FDIC's research division.

Snow also commented on Oil prices:

"Energy prices are way too high," Snow said on CNBC television. "Clearly, it's hurting."Don't worry, be happy!

"Clearly, energy prices serve as a tax, they reduce the disposable income available to do other things and they take some oxygen out of the economy," Snow said. "Energy is my concern. I think energy is the biggest concern," he added.

But Snow said the U.S. economy is currently managing to withstand the "headwinds" of oil at $60 a barrel. When asked if these energy prices portend a recession, Snow said: "No. I don't see it derailing the strong recovery we're in ... but it does take a few tenths of a (percentage) point off GDP growth, that's for sure."

Monday, June 27, 2005

BIS: US Urged to Act First on Global Imbalances

by Calculated Risk on 6/27/2005 10:44:00 PM

From the Financial Times, the Bank for International Settlements (BIS) warned Monday that "growing domestic and international debt has created the conditions for global economic and financial crises".

UPDATE: Macroblog links to the BIS report with key excerpts.

The Basel-based organisation's annual report said no one could predict if and when such international economic imbalances would unravel but "time might well be running out".The BIS urged the US to act first:

"Given the size of the [US] government deficit, the obvious first step would be to cut expenditures and raise taxes"...The report then turned pessimistic.

Without a smaller budget deficit, lower private sector consumption and higher savings, there was little likelihood of stabilising the ballooning US current account deficit. The ever widening deficit “could eventually lead to a disorderly decline of the dollar, associated turmoil in other financial markets, and even recession."

...the BIS report questioned the Bush administration's willingness to impose the required policies to back up its deficit reduction ambition ..."Time is running out" and no action will be taken "in the near term". How sad.

"If what needs to be done to resolve external imbalances is reasonably clear, it also seems clear that much of it is simply not going to happen in the near term."

Housing Misinformation

by Calculated Risk on 6/27/2005 02:57:00 PM

The LA Times publishes a small community newspaper for my neighborhood called the Daily Pilot. The business section of today's Pilot featured an article on housing. What caught my eye were some quotes from local real estate professionals.

"Much of the appreciation we're seeing is permanent."John Burns, president of Irvine-based John Burns Real Estate Consulting June, 2005

Compare to:

"Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months."Irving Fisher, Ph.D. Economics, Oct. 17, 1929

But far more discouraging are the comments attributed to Bill Cote of the Cote Realty Group. He doesn't believe there is a bubble, but he also apparently wants to withhold information from the home buying public:

[Cote]...is bothered by the potential of academics forecasting real estate deflation to discourage the public. He said it's tough for general audiences to discern between the various forecasts that are out there."People start talking ..." We wouldn't want that to happen.

"It affects the confidence of the market -- people start talking," Cote said. "People can't tell unless they're sophisticated in economics."

Houses and Interest Rates

by Calculated Risk on 6/27/2005 12:22:00 AM

My latest post is up on Angry Bear: The Impact of Interest Rates on House Prices. Several people are arguing that housing prices are appropriate based on current interest rates. I argue that this is incorrect.

And from the NY Times: How Home Prices Can Be Hot but Inflation Cool. This article discusses a potential problem with the CPI calculation. When houses prices fall that might increase the reported CPI:

... when housing prices fall, a trend that most people would deem anti-inflationary, and renting becomes more attractive than owning, the index might process the information as evidence that inflation is on the rise. "We got a great deal of criticism that we were overstating inflation in the early 1990's, because housing prices were declining and rents were going up steadily," Mr. Jackman said.And my friend Mike Shedlock is hearing "Warning bells from homebuilder suppliers".

Best to all.