by Calculated Risk on 6/24/2005 09:17:00 PM

Friday, June 24, 2005

Buffett Examines living in Squanderville

Kash covered the political reaction to the announcement that China National Offshore Oil Corporation, or CNOOC, is bidding for Unocal. MaxSpeak and Dr. Setser work the numbers.

This event reminds me of the following cautionary tale from Warren Buffett (Oct, 2003).

[T]ake a wildly fanciful trip with me to two isolated, side-by-side islands of equal size, Squanderville and Thriftville. Land is the only capital asset on these islands, and their communities are primitive, needing only food and producing only food. Working eight hours a day, in fact, each inhabitant can produce enough food to sustain himself or herself. And for a long time that's how things go along. On each island everybody works the prescribed eight hours a day, which means that each society is self-sufficient.UPDATE: Buffett was on CNBC Thursday June 23rd. Here are his comments on China:

Eventually, though, the industrious citizens of Thriftville decide to do some serious saving and investing, and they start to work 16 hours a day. In this mode they continue to live off the food they produce in eight hours of work but begin exporting an equal amount to their one and only trading outlet, Squanderville.

The citizens of Squanderville are ecstatic about this turn of events, since they can now live their lives free from toil but eat as well as ever. Oh, yes, there's a quid pro quo-but to the Squanders, it seems harmless: All that the Thrifts want in exchange for their food is Squanderbonds (which are denominated, naturally, in Squanderbucks). Over time Thriftville accumulates an enormous amount of these bonds, which at their core represent claim checks on the future output of Squanderville. A few pundits in Squanderville smell trouble coming. They foresee that for the Squanders both to eat and to pay off-or simply service - the debt they're piling up will eventually require them to work more than eight hours a day. But the residents of squanderville are in no mood to listen to such doom saying.

Meanwhile, the citizens of Thriftville begin to get nervous. Just how good, they ask, are the IOUs of a shiftless island? So the Thrifts change strategy: Though they continue to hold some bonds, they sell most of them to Squanderville residents for Squanderbucks and use the proceeds to buy Squanderville land. And eventually the Thrifts own all of Squanderville. At that point, the Squanders are forced to deal with an ugly equation: They must now not only return to working eight hours a day in order to eat - they have nothing left to trade - but must also work additional hours to service their debt and pay Thriftville rent on the land so imprudently sold. In effect, Squanderville has been colonized by purchase rather than conquest. It can be argued, of course, that the present value of the future production that Squanderville must forever ship to Thriftville only equates to the production Thriftville initially gave up and that therefore both have received a fair deal. But since one generation of Squanders gets the free ride and future generations pay in perpetuity for it, there are - in economist talk - some pretty dramatic "intergenerational inequities."

Buffett said he doesn't subscribe to the view that China is engaging in a trade war with the U.S. He said Chinese corporate takeovers, such as CNOOC Ltd's (CEO) recent bid for Unocal Corp. (UCL) were an "inevitable" consequence of the U.S. trade deficit. He noted that the U.S. imported far more goods from China than it sold to the nation.

"If we're going to consume more than we produce, we have to expect to give away a little bit of the country," said the "Oracle of Omaha."

May New Home Sales: 1.298 Million

by Calculated Risk on 6/24/2005 10:19:00 AM

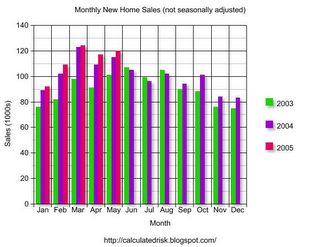

According to a Census Bureau report, New Home Sales in May were at a seasonally adjusted annual rate of 1.298 million vs. market expectations of 1.32 million. April sales were revised down significantly to 1.271 Million.

Click on Graph for larger image.

NOTE: The graph starts at 700 thousand units per month to better show monthly variation.

Sales of new one-family houses in May 2005 were at a seasonally adjusted annual rate of 1,298,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.1 percent above the revised April rate of 1,271,000 and is 4.4 percent above the May 2004 estimate of 1,243,000.

The Not Seasonally Adjusted monthly rate was 120,000 New Homes sold, up from a revised 117,000 in April.

The median sales price of new houses sold in May 2005 was $217,000; the average sales price was $281,400.

UPDATE: Add graph of median and average prices.

The average sales price is down slightly and the median price is the lowest since September of 2004.

The seasonally adjusted estimate of new houses for sale at the end of May was 442,000. This represents a supply of 4.2 months at the current sales rate.

The seasonally adjusted supply of New Homes was 4.2 months, about normal for the last few years. The supply for April was also 4.2 months, revised from 4.1 months.

New Home Sales were below Wall Street forecasts. The story is the downward revisions for March and April. Both months were originally reported as record sales, but they have been revised to be below the record of last October.

Thursday, June 23, 2005

Buffett on Housing: Some people may regret recent purchases

by Calculated Risk on 6/23/2005 10:24:00 PM

Warren Buffet was interviewed on CNBC today. Here are a few of his comments as reported by Dow Jones:

On The Real-Estate Bubble:

Lending practices, low interest rates, and "the psychology that ensues when an asset class moves year after year and people feel 'why didn't I get into it before?'" is creating a precarious situation in some of the real estate markets, Buffett said.On the Dollar and the Trade Deficit:

At the high end of the market, Buffett said people may regret recent purchases.

Buffett said the trade deficit was "a deeply embedded structural problem."On China:

The investor cited Federal Reserve Chairman Alan Greenspan in 2002, saying that countries who experience similar trade-deficit trends in the past, "invariably have run into problems."

"Eventually the current-account deficit will have to be restrained," Buffett said.

"We've gone from being a country that owned more of the rest of the world than they owned of us to a country probably $3 trillion in the hole right now in terms of our net worth position," Buffett said. "So it will have had a effect, it may be a month from now, it may be five years from now."

As a consequence of such imbalances, Buffett warned that the dollar will continue its downdraft "at some point," and indicated that he expects the dollar to be weaker five years from now.

Buffett said he doesn't subscribe to the view that China is engaging in a trade war with the U.S. He said Chinese corporate takeovers, such as CNOOC Ltd's (CEO) recent bid for Unocal Corp. (UCL) were an "inevitable" consequence of the U.S. trade deficit. He noted that the U.S. imported far more goods from China than it sold to the nation.

"If we're going to consume more than we produce, we have to expect to give away a little bit of the country," said the "Oracle of Omaha."

Fed Gov Olson: Housing Concerns

by Calculated Risk on 6/23/2005 11:16:00 AM

Federal Reserve Governor Mark Olson expressed concern today about "homebuying decisions premised on unrealistic rates of home appreciation":

Over the past several years, there has been an explosion of new and novel mortgage products, including mortgages that allow homeowners to skip mortgage payments (which results in increasing the size of their mortgage balance) and mortgages that allow homeowners to pay only the interest on a loan, and not the principal, for a preset period at the beginning of the life of their mortgage loan. Many of these products can be useful financial tools for homebuyers and, indeed, may have helped make homeownership more accessible for some households. But to the extent that these new mortgage products promote homebuying decisions that are premised on unrealistic rates of home appreciation, they raise concerns. Some borrowers may not be able to sustain such a loan over a long time horizon if the pace of home price growth moderates. In particular, when the payments on these novel mortgages adjust upward, the homebuyer may not be able to refinance such mortgages unless the home has increased in value.At the same conference, according to an MSNBC article, Cleveland Fed President Sandra Pianalto cited a study:

... that found 25 percent of Americans claim to have no spare cash after covering regular expenses, warned that tapping wealth stored in the family home carries risks.In a related commentary Double bubble trouble Danielle DiMartino points out that:

“Increasingly, home owners are using home equity as a source of ready cash ... this doesn’t bode well for the ownership society that we’re trying to build,”

Delinquency and foreclosure rates have been falling

The reason, said MBA chief economist Doug Duncan, is strong job creation.

Housing is a chief driver of job creation.

Housing is being driven by "creative loans". (see Olson's comments above)

And she concludes:

The debate reminds us that falling prices not only will coincide with higher foreclosures, they also will be accompanied by millions of pink slips.

Wednesday, June 22, 2005

Option ARMs

by Calculated Risk on 6/22/2005 05:54:00 PM

In the comments to an earlier post, malabar asked if "something like the PIK (payment in kind) bonds used during the 80s LBO days" were being used in the housing market. I suggested that Option ARMs might be similar in that one of the options is a minimum monthly payment that allows for negative amortization.

And reading our minds, The Housing Bubble featured a post today on option ARMs:

S&P Warns On Option ARMs

The alarms about option ARM loans couldn't be any louder. "Recently, option ARMs have become increasingly prevalent in the market. After extensive research, Standard & Poor's has determined that additional credit enhancement is required to account for the increased risk of default resulting from the payment shock inherent in these loans."

"The ratings company said the tightening applies to loans that are bundled into mortgage-backed securities for sale to investors as well as option adjustable-rate mortgage loans, or option ARMs, The Wall Street Journal said."

"Some economists fear that option ARMs and other loans that reduce initial payments are fueling house-price inflation by enabling people to bid more for homes than they could if they were taking out conventional loans, said the Journal."

"Option ARMs and similar loans are among 'the only things left that are keeping home prices rising,' Stuart Feldstein, of (a) financial-services market-research firm."

This link reveals the problem may be bigger than previously reported. "According to UBS AG, option ARMs now account for 40 percent of prime-rated mortgages packaged into securities, compared to just 1 percent in 2003."

The widespread use of Option ARMs is clear evidence of excessive leverage in the housing market.

Thanks to malabar. Hat tip to Ben Jones.