by Calculated Risk on 5/05/2005 02:11:00 AM

Thursday, May 05, 2005

Buffett and FDR

Warren Buffett was on CNN's Lou Dobbs Tonight on Wednesday. Here is an excerpt:

DOBBS: Are you surprised when you focus on the two deficits we just talked about, the trade deficit, and the budget deficit? The budget deficit is 3.6 percent of our GDP. The trade deficit is reaching just almost 6 percent of GDP. And the president is talking about reforming Social Security. Does that surprise you?There is no question that the Bush Administration is ignoring the most serious economic problems facing America and that they are more interested in ideological driven issues. The most serious fiscal issues are: the General Fund deficit, the current account / trade deficit, and health care. Why are we talking about Social Security?

BUFFETT: Well, it's an interesting idea that a deficit of $100 billion a year, something, 20 years out, seems to terrify the administration. But the $400 plus billion dollars deficit currently does nothing but draw yawns. I mean the idea that this terrible specter looms over us 20 years out which is a small fraction of the deficit we happily run now seems kind of interesting to me.

I'm reminded of this letter that FDR wrote in 1924 to Delaware attorney Willard Saulsbury.

I'm reminded of this letter that FDR wrote in 1924 to Delaware attorney Willard Saulsbury."I remarked to a number of friends that I did not think the nation would elect a Democrat again until the Republicans had led us into a serious period of depression and unemployment", FDR, Dec 9, 1924

Buffett might find the denial of our serious problems "interesting", but I'm worried that FDR's prediction might ring true again.

I hope not. I remain an optimist; I believe if we acknowledge our problems and address them in a rational manner, we can fix them.

But all I see from the Bush Administration is denial and wishful thinking.

Wednesday, May 04, 2005

Slight Deficit Improvement

by Calculated Risk on 5/04/2005 11:48:00 PM

Here is the current Year over Year deficit number (May 1, 2004 to May 1, 2005 - closest non-weekend dates used). As of May 2, 2005 our National Debt is:

$7,754,579,738,148.68 (Almost $7.8 Trillion)

As of May 3, 2004, our National Debt was:

$7,105,796,969,042.55

So the General Fund has run a deficit of $648.8 Billion over the last 12 months. SOURCE: US Treasury

Of course the Washington Post exaggerates the improvement "Tax Receipts Exceed Treasury Predictions." First, they report the Enron style budget ... , uh, Unified budget. Second, they are wrong about the size of the improvement in the deficit. They are correct when they report that "... the positive turn is likely to be short-lived".

Click on graph for larger image.

For comparison:

For Fiscal 2004 (End Sept 30, 2004): $596 Billion

For Jan 1, 2004 to Jan 1, 2005: $609.8 Billion

For Feb 1, 2004 to Feb 1, 2005: $618.6 Billion

For Mar 1, 2004 to Mar 1, 2005: $635.9 Billion

For Apr 1, 2004 to Apr 1, 2005: $660.9 Billion

For May 1, 2004 to May 1, 2005: $648.8 Billion

A slight improvement.

NOTE: I use the increase in National Debt as a substitute for the General Fund deficit. For technical reasons this is not exact, but it is close. Besides I think this is a solid measure of our indebtedness; it is how much we owe!

BBC: Britain braced for credit crunch

by Calculated Risk on 5/04/2005 09:51:00 PM

Is this the future for the US? A housing slowdown with declining consumer spending. And now the BBC reports that Britain is bracing for rising foreclosures and bankruptcies:

"Not since the mid-1990s, as the last economic recession claimed its final victims, has so much debt pain been felt by so many people.

Debt charities and credit industry bodies have told BBC News that they have seen a surge in the numbers of people unable to pay their bills.

At the same time, according to official figures nearly 26,000 property repossession orders were granted in the first three months of 2005, the highest number since 1995.

And on Friday, it is widely expected that the Department for Trade and Industry (DTI) will reveal a sharp rise in the number of people going bankrupt.

In short, the UK's trillion pound debt hangover finally seems to be kicking in."

Senatorial Sciolism

by Calculated Risk on 5/04/2005 12:39:00 AM

Ignorance is curable. It just takes experience and education. But what can we do when the Chairman of the Senate Budget Committee ignorantly proclaims that "we are tackling the problem of federal spending"? Laugh? Cry?

Today Senator Judd Gregg (R-NH) made that outrageous and specious claim. In a commentary in the New Hampshire Union Leader, Gregg claimed "For the first time in nearly a decade, the budget forces meaningful savings in mandatory government programs, which are driving out-of-control, long-term deficits."

Nonsense. What is driving out-of-control structural deficits is the significant drop-off in tax revenue from the Bush tax shifts.

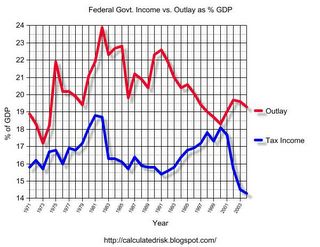

UPDATE: Correct Y axis on Graph.

Click on graph for larger image.

The chart depicts Federal Government income and outlays as a % of GDP. "Income" does not include the surpluses for the various trust funds. A steady combination of spending restraint and tax increases brought the budget into balance at the end of the ‘90s. The primary cause of the current budget deficits is the significant decrease in tax revenues, as a % of GDP, due to the Bush tax shifts.

Gregg seems to believe that the fiscal 2006 budget will reduce the deficit. That is also not true. The $106 billion in additional tax cuts for high income earners exceeded the cuts in programs for the poor, meaning the fiscal 2006 budget deficit will set another dubious record.

Mr. Gregg continues: "First, we must tackle the short-term deficit, ..." Although Gregg predictably misunderstands the causes of the deficits, I agree the short term deficit is the top fiscal issue facing America. Not Social Security. But this budget does nothing about the deficit ...

And finally Gregg wrote:

[The budget] maintains job-creating tax policy that has resulted in the fastest-growing economy since 1999 ...

Absolute nonsense. The tax policy was not targeted at job creation. In fact, despite Gregg's implication, this recovery has seen the weakest job creation of any recovery since the Great Depression.

If Gregg was a writer for NRO, I would just chuckle. But he is the Chairman of the Senate Budget Committee. Ignorance and power are a poor combination.

Tuesday, May 03, 2005

More from the UK

by Calculated Risk on 5/03/2005 10:29:00 PM

Independent: ... but in Britain, retailers see worst slide in sales for nearly 13 years

Scotsman: Double hit hints at rates cut

Scotsman: What slowdown means: now's the time to get real

And a harsh review of Greespan's tenure - Jeremy Warner's Outlook: As the world economy falters, Greenspan, the grand illusionist, faces his Waterloo

"Fast forward 20 years and how will historians come to judge Alan Greenspan, chairman of the Federal Reserve? As things stand, Mr Greenspan's report card reads "outstanding performance so far, but jury still out on the final verdict".

...

Just to put this in perspective, even with the Fed funds rate now at 3 per cent it is still "only" 2 per centage points higher than a year ago. By historic standards, rates remain incredibly low. Yet even at this level of interest rates, with inflationary pressures apparently building, US growth continues to look fragile. It's going to be hard to raise rates much further without sending the economy into a tailspin.

Back in Britain, we are seeing something of the same phenomenon. Interest rates remain low by historic standards, but the economy seems extraordinarily sensitive to anything higher. Just six months ago, everyone was talking about the return of inflation. Now the City wonders whether we have not already reached the peak of the interest rate cycle. Retail is suffering some of its worst trading conditions in years and manufacturing seems to be slipping back into recession.

With Mr Greenspan, the question is whether he can ever now hope to wean the US off its addiction to low interest rates ... continued growth has been achieved only at the cost of mountainous current account and budget deficits and an ever growing housing market bubble.

As he tightens once more, Mr Greenspan again finds the economy beginning to suffer. The magic is beginning to wear thin, and, like an illusionist whose sleight of hand is uncovered, scepticism is now palpable: Mr Greenspan may have succeeded only in delaying the pain, not in removing it.

...

Can Mr Greenspan succeed in engineering a soft landing for the US economy, where there is gradual correction of the present imbalances, or has he lost control of the aircraft as it careers towards the runway? The judgement of history awaits."