by Calculated Risk on 5/03/2005 05:18:00 PM

Tuesday, May 03, 2005

UK: Economy Shaken

More bad news from Europe ... Times: "Economy shaken by worst fall in high street sales for 13 years".

A DOUBLE dose of bleak economic news fuelled fears for Britain’s prospects yesterday, casting a shadow over Labour’s final burst of pre-election campaigning.

High street sales suffered their steepest monthly drop for 13 years while manufacturing activity succumbed to its first decline in two years, according to two surveys. The much worse than expected figures dealt a twin blow to the Government’s hopes of trumpeting a strong economic outlook in the last phase of the election battle.

But there is some good news. Portugal's economy has rebounded from the 2004 recession and posted 1.1% annualized growth for Q1 2005.

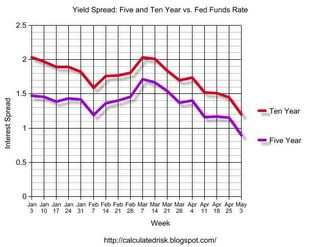

Yield Curve Narrows

by Calculated Risk on 5/03/2005 03:47:00 PM

For the first time since 2001, the spread between the Five Year Note and the Fed Funds Rate is less than 100 bps.

Click on graph for larger image.

This might indicate a slowing economy with a whiff of inflation.

Kash's "The Fed's Statement" provides a comparison between this statement and the previous statement from March.

Monday, May 02, 2005

FDIC Update: U.S. Home Prices: Does Bust Always Follow Boom?

by Calculated Risk on 5/02/2005 10:19:00 PM

The FDIC today released an update to their February report that shows the boom is even more widespread.

"... the number of boom markets according to our definitions increased by 72 percent last year, and now includes some 55 metropolitan areas."

They also express concern about excessive leverage and speculation:

"... there have been a number of changes in mortgage markets that could have an influence on home prices, including the emergence of high loan-to-value lending and subprime lending ...

In addition to increased leverage and subprime lending activity, use of adjustable-rate mortgages, or ARMs, remains high. According to the Mortgage Bankers Association, ARMs accounted for almost 46 percent of the value of new mortgages in 2004 and 32 percent of all applications. Both figures were up sharply from their 2003 levels of 29 percent and 19 percent, respectively. It is noteworthy that this development occurred despite the fact that the average annual fixed rate for a 30-year mortgage remained virtually unchanged from 2003.

Furthermore, data from the Federal Housing Finance Board indicate that the ARM share is high and rising in several of our boom markets. Taken together, these trends suggest that highly-leveraged borrowers are increasingly taking on interest-rate risk as they stretch to afford high-cost housing. ...

Another evolving trend that has not been tested in a housing market downturn is the increasing market penetration of innovative mortgage products, such as interest-only (I/O) and option ARMs. These mortgages are specifically designed to minimize initial mortgage payments by eliminating principal repayment; but these also can increase leverage and expose owners to large jumps in monthly payments as interest rates rise. According to Inside MBS and ABS, interest-only mortgages accounted for 23 percent of the value of non-agency mortgage securitizations in 2004. ...

Finally, although this factor is not directly related to credit conditions, heightened investor purchases of homes could also be signaling a higher degree of speculative activity in housing markets during 2004. Data from Loan Performance indicate that 9 percent of U.S. mortgages in 2004 were taken out by investors, up from just under 6 percent in 2000. Furthermore, this share is significantly higher in local markets that are experiencing the strongest home price appreciation. In some of these markets, it is estimated that the investor share of new mortgage originations is as high as 19 percent. Academic studies show that residential property investors are less loss-averse than owner-occupants and thus more likely to sell precipitously in a declining market, thereby aggravating any existing downtrend in home prices."

More Evidence of Global Slowdown

by Calculated Risk on 5/02/2005 03:18:00 PM

Financial Times Reports: Eurozone manufacturing data point to slowing growth.

Manufacturing in the eurozone contracted in April for the first time in 20 months, highlighting the scale of the economic slowdown across the region and adding to fears that some member states might even be facing recession, according to a survey on Monday.And its not just Germany. "France and Italy experienced a particularly sharp deterioration."

Nevertheless, the sharp fall in the French manufacturing outlook was particularly worrying, economists said, because France's economy had been among the best-performing in the eurozone, buoyed by a strong housing market and government incentives for consumer spending. “France was supporting the eurozone. Now it is significantly less supportive,” he said.

UPDATE: See "David K. Smith Is Bearish On Britain" at Macroblog.

"An unseasonable chill has descended on the economy. Britain’s once-rampant consumers are minding the pennies, proof to me at least that there is a link between the housing market and people’s willingness to spend. The flatter the former, the more subdued the latter."More at Macroblog ...

Looking Ahead: March Trade Deficit

by Calculated Risk on 5/02/2005 02:45:00 AM

I'm getting a little ahead of the news this week with my post recent on Angry Bear: March Trade Balance Preview. But this story in today's NY Times kept me focused on trade: China Trade Surplus With West Still Rising.

China's global exports soared in the first quarter of this year, allowing the country to rack up huge trade surpluses with the United States and western Europe, according to detailed trade data released late last week by Chinese customs officials.And more on China's trade with Germany:

Even Germany, which has long run trade surpluses with China because it sells heavy manufacturing equipment to Chinese factories, is now in the red: its $2 billion trade surplus in the first three months of last year evaporated, turning into a $159 million trade deficit in the first months of this year.

For those of us worried by the impact of global imbalances, this trend is disconcerting.