by Calculated Risk on 4/20/2005 01:22:00 AM

Wednesday, April 20, 2005

Bruce Bartlett Whispers the "R" Word

Bartlett believes that talk of a recession is "premature", but he expresses his general concerns that "the financial sector of the economy is under growing strain that could burst and spill over into the real economy suddenly and without warning."

He concludes:

... there are the dreaded “twin deficits” looming over financial markets. Huge budget and current account deficits mean that vast amounts of capital flows are necessary to keep them funded. So far, this has gone well, but that is largely because the Chinese have been so accommodating about financing them—effectively financing their own exports by buying large quantities of U.S. Treasury securities with their export earnings.My question: Great skill? By whom? Is there anyone in the Administration even thinking about these issues?

But now the U.S. is strongly pressuring China to stop doing this in order to allow its currency to rise against the dollar. It is hoped that this will reduce China’s production advantage in dollar terms and bring down the bilateral trade deficit. However, the cost to the U.S. economy if this happens could be greater than the potential gain. At least in the short run, any scale-back in China’s buying of Treasury securities might cause interest rates to spike very quickly. This could prick the housing bubble and bring down home prices, eroding personal wealth and putting a squeeze on those with floating rate mortgages.

Hopefully, this can all be managed smoothly and without either a recession or a market break. But it will take great skill and a lot of luck to avoid both.

UPDATE: pgl and William Polley add some comments. Make sure to read the comments in response to pgl's post.

Tuesday, April 19, 2005

Housing Starts

by Calculated Risk on 4/19/2005 06:29:00 PM

Angry Bear and Macroblog have commented on housing starts being lower than expected. Usually sales are a better indicator than starts, so look for the New Home Sales announcement next week.

This was an interesting comment buried in the story:

One concern among builders, [Dave Seiders, chief economist with the National Association of Home Builders] said, is that speculators are buying in new housing developments, which drives demand in the short term but could show up as excess supply down the road. "If the investor community should get worried, we could have a wholesale tumbling."I believe speculation is the key to any bubble. This post on Angry Bear discussed the storage aspect of speculation - the "excess supply down the road" that Mr. Seiders is discussing. From the Angry Bear post:

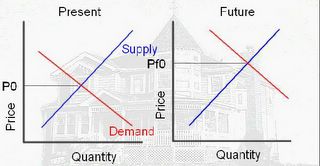

Click on diagram for larger image.

This diagram shows the motive for the speculator. If he buys today, at price P0, he believes he can sell in the future at price Pf0 (price future zero), because of higher future demand. The speculation would return: Profit = Pf0-P0-storage costs (the storage costs are mortgage, property tax, maintenance, and other expenses minus any rents).

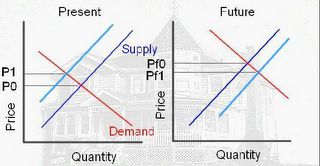

In this model, speculation is viewed as storage; it removes the asset from the supply. The following diagram shows the impact on price due to the speculation:

Since speculation removes the asset from the supply, the Present supply curve shifts to the left (light blue) and the price increases from P0 to P1. In the second diagram, when the speculator sells, the supply increases (shifts to the right). The future price will fall from PF0 to PF1. As long as (PF1 – storage costs) is greater than P1 the speculator makes a profit.

However, if the price does not rise, the speculator must either hold onto the asset or sell for a loss. If the speculator chooses to sell, this will add to the supply and put additional downward pressure on the price.

There is more in the Angry Bear post including a discussion of leverage as speculation.

I know I repeat myself sometimes - an old habit - sometimes I think certain ideas are worth revisiting. Best Regards to All.

Monday, April 18, 2005

Inflation Preview

by Calculated Risk on 4/18/2005 04:15:00 PM

UPDATE: Macroblog has a nice review of today's numbers. Look to Angry Bear tomorrow after the CPI is released.

The BLS reports PPI tomorrow and CPI on Wednesday. Over the last year, both the CORE PPI and CPI, less Food and Energy, have been steadily increasing on a year over year basis.

Click on graph for larger image.

Also plotted is the intended FED Funds Rate. A neutral Fed Funds rate would probably be about 150 to 200 basis points above CPI less food and energy. The Fed funds rate is currently at 2.75% with core inflation running about 2.5% to 3%.

The Fed Funds rate is still very accommodative unless the FED expects future inflation rates to fall. Dr. Krugman suggested that we may be seeing "A Whiff of Stagflation"; a slowing economy with rising inflation.

UPDATE: I probably should have include the FED's favorite measure of inflation, the PCE deflator (around 1.6%). The PCE is also steadily increasing and still puts the neutral rate around 3.25% to 3.5%.

The PPI and CPI numbers deserve close scrutiny this week.

Bubble Employment

by Calculated Risk on 4/18/2005 11:12:00 AM

Here are a couple of charts on real estate related employment.

Click on graph for larger image.

This graph is from The Big Picture.

For RE agents, California alone has added 113,307 licensed RE agents since July 2000. The total RE agents in California (427,389) represents 1.9% of the total working population of California. Many of these agents only work part-time, but that is still a substantial loss of income if RE volumes drop 30 to 40% - like a typical RE slowdown.

Thanks to ild and Elroy for the second chart.

Just like RE agents, there has been a significant increase in mortgage brokers. There has been a similar increase in residential building trades, appraisers, home inspectors and other housing related occupations. The impact of a housing slowdown on employment will be significant.

Sunday, April 17, 2005

More on Housing

by Calculated Risk on 4/17/2005 11:22:00 PM

My most recent post, Housing: After the Boom, is up on Angry Bear.

I know some people don't think there is a bubble. For those people I recommend: "In Real Estate Fever, More Signs of Sickness". Also my post on Speculation might be useful - if you don't mind a few Supply-Demand charts.

For me the more interesting topic is what happens AFTER the boom. This not only has implications for housing, but for the general US economy and the World economy.

A couple of references:

Please see Patrick's blog for a nice list of recent articles on housing.

And Ben's site, appropriately named "The Housing Bubble" has daily analysis of, what else, the housing bubble!

UPDATE: Here is another nice housing bubble blog.