by Calculated Risk on 4/14/2005 12:32:00 PM

Thursday, April 14, 2005

New Inflation Tool at the Cleveland Fed

The Cleveland Fed has introduced "Inflation Central", a Worldwide database of inflation measures.

See World Inflation From The Cleveland Fed at Macroblog for much more.

I was surprised to discover that Bangladesh has had more inflation than Albania. But what do I do with that information?

Wednesday, April 13, 2005

More on Health Care

by Calculated Risk on 4/13/2005 06:39:00 PM

The highest priority fiscal problem in the US is the budget deficit; we will add close to $650 Billion in debt this fiscal year alone! The second highest priority is the US health care system.

In "Ailing Health Care", Paul Krugman tries to change the debate from Social Security to health care. As Krugman wrote, the issue is "health care reform," not "Medicare reform." The problem is far larger than Medicare alone, and yet the Medicare shortfall dwarfs the projected Social Security shortfall.

Earlier this year, the GAO pointed out that health care is the largest and perhaps most difficult part of the long-term fiscal challenges. The GAO calculated the Social Security shortfall at $3.7 Trillion (over 75 years) and the Medicare shortfall at almost $28 Trillion over the same period; more than 7 times larger than the Social Security shortfall. And Medicare is only a portion of the health care crisis!

As a follow up to Krugman, Kash compared some outcomes and expenses in the US to several other developed Nations.

Today, Kash followed up with more comments on the "Performance of the US Health Care System."

Angry Bear followed up with the first in a three part series: "Health Care in The U.S. And The World, Part I: How much do we spend?"

If it was up to me, I would change the debate to the deficit. But real budget solutions are probably unachievable in this ideologically driven period. Doesn't that apply to health care too? So what is the solution? Do nothing for four years?

Tuesday, April 12, 2005

The Mug's Game Challenge: Predict the Start of the Next Recession

by Calculated Risk on 4/12/2005 05:47:00 PM

A recession is probably not imminent, but there are reasons to be concerned. General Glut ventured this today:

The "hard versus soft" landing debate is stale. The real question now is only "how hard?"The next question is: When?

The Mug's Game Challenge

Here is a simple contest to predict the start of the next recession. The rules:

1) Enter a month and a year in the comments at any time right up to the recession being announced (one entry per person). Please feel free to state your reasons. I will feature those comments for the winners.

NOTE: You do not need to enter now. I am still waiting before I make my prediction. But early entries will be rewarded. I will update the contest every month as a reminder.

2) Scoring:

A) The Starting Month: The official starting month will be determined by the NBER. This usually occurs several months after the recession starts.

B) A pick will be considered correct if it is within +/- 2 months of the NBER determination (a 5 month window centered on the month picked). It is VERY difficult to pick the exact month, and being within a couple of months is quite an achievement.

C) All correct picks will be ranked by the number of months prior to the recession that the pick was entered. As an example, say the recession starts in Oct 2005: If someone correctly picks any month August 2005 through December 2005 (+/- 2 months) during April 2005, they will be rated a "6". This rewards picking the recession early.

All correct picks will be featured when the recession is announced and ranked by earliest picks.

Earlier I offered some thoughts on leading indicators for recessions. Several people have suggested other leading indicators to me. No one wants a recession, but we might as well have some fun!

Good luck to all!

UPDATE: Prize? The winners get their names mentioned, their comments featured, the admiration of their peers, and a free subscription to Calculated Risk!

UPDATE 2&3&4: Elaine is already a winner! Here are the picks so far (updates in bold):

Aug 2005 Kirk Spencer, wharf rat

Sep 2005 Vernon Bush

Oct 2005 BE, David Bennett

Nov 2005 David Yaseen, Fernando Margueirat, steve kyle, Nguyen Khuu

Jan 2006 Yusef Asabiyah, dryfly, Frank, redfish

Feb 2006 Mish, E.Robinson

Mar 2006 Colin H, ChasHeath, Alan Greenspend, Movie Guy, F.Hagan

Apr 2006 battlepanda

May 2006 Ken Houghton, navin

Jun 2006 DOR

Aug 2006 Jason Wright

Mar 2008 dilbert dogbert

Jul 2008 jl

Nov 2008 Elaine Supkis

March, 2011 Paul

NEVER Larry Kudlow's doppelganger

Posters can take the same month.

Record US Trade Deficit: $61 Billion for February

by Calculated Risk on 4/12/2005 08:49:00 AM

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis released the monthly trade balance report today for February:

"... total February exports of $100.5 billion and imports of $161.5 billion resulted in a goods and services deficit of $61.0 billion, $2.5 billion more than the $58.5 billion in January, revised.

February exports were $0.1 billion more than January exports of $100.4 billion. February imports were $2.6 billion more than January imports of $158.9 billion."

Click on graph for larger image.

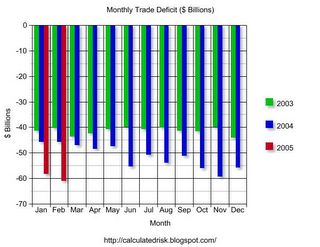

This graph shows the monthly trade balances for 2003, 2004 and 2005 and depicts the worsening year over year trade imbalance. The February trade deficit was an all time record, as exports stalled and imports continued to climb.

The recent increase in oil prices did not impact the February trade deficit. In fact, Oil imports were down slightly in February. The following graph shows the impact of imported oil on the trade deficit.

This graph shows oil imports per month for 2003, 2004 and the first two months of 2005. Oil imports are less than 20% of the trade deficit and just over 1% of GDP (as discussed in this post on Angry Bear). Even without oil, the trade deficit would be 5% of GDP - a serious problem.

The recent run up in oil prices will impact the trade deficit for March.

UPDATE: The average contract price for crude oil in Feb was $36.85 per barrel. According to the DOE, the average price will be almost $10 higher for March. That will add $4.5 Billion to the trade deficit, before seasonal adjustments - or another $3.5+ Billion to imports in March.

I expect the trade deficit for March to even be worse!

Monday, April 11, 2005

More on Oil

by Calculated Risk on 4/11/2005 04:50:00 AM

My most recent post on Angry Bear, Oil: The Impact on the US Economy, is now up.

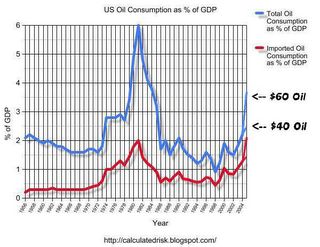

On the following graph, I plotted total oil consumption and imported oil consumption as a % of GDP. The plot for imported oil is slightly different than from my previous post (if you have a microscope!).

Click on graph for larger image.

The reason for the difference is I used different data sources. For this post, I used the DOE's data and for the previous post, I used the Census Bureau's trade data. They were very close, but I was able to plot a longer time series with the DOE's data.

I did not discuss peak oil in this analysis. That is a separate topic. I tried to stick to the question of the immediate impact on the US economy of the current price of oil.

Best Regards to All! And thanks for all the comments.