by Calculated Risk on 3/02/2005 07:05:00 PM

Wednesday, March 02, 2005

Will an Adjustment in the Current Account Deficit Lead to a Recession?

Here is a new paper that does an historical review of previous CAD adjustments , "Financial Market Developments and Economic Activity during Current Account Adjustments in Industrial Economies" by Croke, Kamin and Leduc.

The consequences of an adjustment in the current account deficit is being widely discussed. Some observers believe that an orderly adjustment is probable. Others, like Roubini and Setser, argue that a disorderly adjustment is very possible and "could result in a sharp economic slowdown in the US." This new paper looks at historical occurrences of Current Account Adjustments and Croke, Kamin and Leduc conclude:

"a significant subset of the adjustment episodes we studied were associated with substantial declines in GDP growth ... Thus, the fear that current account adjustment might be associated with recession is not entirely without basis."

BUT ...

"[O]ur second main finding is that the shortfall in growth experienced in the contraction episodes appears to reflect the playing out of standard cyclical developments rather than a response to current account adjustment."My interpretation of their conclusion is that a CAD adjustment doesn't necessarily cause a recession, but a recession cures a CAD problem. Is that good news or bad?

NOTE: DeLong reviews another recent paper "The U.S. Current Account and the Dollar" by Oliver Blanchard, Francesco Giavazzi, Filipa Sa". I also recommend Macroblog and New Economist.

UPDATE: Both Macroblog and New Economist have posts reviewing this new paper.

The Worsening General Fund Deficit

by Calculated Risk on 3/02/2005 03:06:00 PM

Here is the current Year over Year deficit number (March 1, 2004 to March 1, 2005). As of March 1, 2005 our National Debt is:

$7,701,629,503,518.55 (that is over $7.7 Trillion)

As of March 1, 2004, our National Debt was:

$7,065,724,603,168.71

So the General Fund has run a deficit of $635.9 Billion and change over the last 12 months. SOURCE: US Treasury

Source: U.S. Treasury

For comparison:

For Fiscal 2004 (End Sept 30, 2004): $596 Billion

For Jan 1, 2004 to Jan 1, 2005: $609.8 Billion

For Feb 1, 2004 to Feb 1, 2005: $618.6 Billion

It just keeps getting worse.

NOTE: I use the increase in National Debt as a substitute for the General Fund deficit. For technical reasons this is not exact, but it is close. Besides I think this is a solid measure of our indebtedness; it is how much we owe!

Update: New Home Sales as Leading Indicator

by Calculated Risk on 3/02/2005 02:53:00 AM

In my earlier post, I suggested that the volume of New Home Sales might be a leading indicator for a consumer led economic slowdown. One of the questions I was asked was how many times did housing decline and the economy not slide into recession (a false positive)? Another reasonable question would be how many recessions does the signal miss (a false negative)?

We only have 42 years of data from the Census Bureau that includes 6 recessions. This is a very small sample. A housing slowdown did not immediately precede either the 1969 or 2001 recessions (the 2001 recession was mostly business related). The following graph shows the annual volume of New Home Sales since 1963 (the earliest data from the Census Bureau).

NOTE: The annual data loses resolution and does not show all of the information contained in the previous post's graphs.

The shaded lines on the graph are approximate and represent U.S. economic recessions.

Click on the graph for a larger image.

Source: Census Bureau

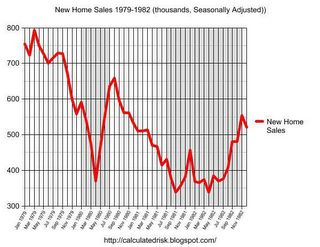

Here is a graph from the earlier post showing housing and the early '80s recession. Compare that to the double dip recession in the previous graph. In this graph we can see the monthly detail and that the declining volume of New Home Sales were a reasonable leading indicator for both economic recessions.

Source: Census Bureau

K Harris pointed out some potential anomalies in the Census Bureau data. It is very possible that the January numbers were impacted by weather or other factors. I was NOT suggesting that the January drop in housing was indicative of a slowdown, only that if housing volumes continue to decrease that that might be a strong leading indicator. For this indicator to suggest an economic slowdown, the volume of New Home Sales would have to continue to decline over the next few months.

Predicting recessions is very difficult. The only reliable indicator is a flattening (or inverted) yield curve - and the running joke is that the yield curve has predicted 11 of the last 7 recessions! Also there is a strong incentive for most economists to always be bullish on the economy. Nobody will blame you if you miss a turning point, but to cry wolf is a disaster for your reputation. Here are a couple of examples from the Fed Chairman Alan Greenspan:

"It is very rare that you can be unqualifiedly bullish as you can be now."

Alan Greenspan, Jan 1973 (about 6 months before the economy went into recession).

"But such imbalances and dislocations as we see in the economy today probably do not suggest anything more than a temporary hesitation in the continuing expansion of the economy."

Alan Greenspan, Jan 1990 (about 6 months before the recession)

I'm not picking on Mr. Greenspan, just using him as an example. Here is another example: The WSJ conducted a survey of 40 economists in July 1990, and only one predicted a recession. The Journal went so far as to ridicule the one economist predicting a recession, suggesting that he "now has predicted four of the past zero recessions." With hindsight we now know that in July 1990 the economy was ALREADY in recession!

For an excellent analysis of recession prediction, I suggest the following paper by the IMF's Prakash Loungani "The Arcane Art of Predicting Recessions".

Tuesday, March 01, 2005

More Evidence of Housing Speculation

by Calculated Risk on 3/01/2005 01:26:00 PM

The National Association of Realtors released a new report today. Here are a few key findings:

"... 23 percent of all homes purchased in 2004 were for investment, while another 13 percent were vacation homes. In addition, there was a record of 2.82 million second home sales in 2004, up 16.3 percent from 2.42 million 2003. The investment-home component rose 14.4 percent to 1.80 million sales in 2004 from 1.57 million in 2003, while vacation-home sales rose 19.8 percent to 1.02 million in 2004 from 850,000 in 2003."

And in the NYTimes today, "Speculators Seeing Gold in a Boom in the Prices for Homes", the story starts with this anecdote:

'Within six months last year, Carlos and Betti Lidsky bought and sold two condominiums. Then they bought and sold two houses. They say they will clear a half-million dollars in profit, and none of the homes have even been built.

Now Mr. Lidsky, a lawyer, and his wife, a charity fund-raiser, have put down a deposit on a fifth property, a $1.3 million condo in a high-rise under construction, and are planning to sell before the deal closes, without even taking out a mortgage.

"It is much better than the stock market," Mr. Lidsky said. "This is an extraordinary, phenomenally good result." '

And this on speculation:

'According to LoanPerformance Inc., a San Francisco mortgage data firm, about 8.5 percent of mortgages nationwide in the first 11 months of last year were taken out by people who did not plan to live in the houses themselves, up from 5.8 percent in 2000. In some markets, that proportion is much higher: in Phoenix, more than 12 percent of mortgages were taken out by investors; in Miami, the figure is 11 percent.

The National Association of Realtors, a trade organization that represents real estate brokers, said in a study being released on Tuesday that the percentage of homes bought for investment might be as high as one-quarter of the 7.7 million sold last year.

"Americans are treating real estate as a viable alternative to stocks and bonds," said David Lereah, chief economist at the Realtors association. And some are buying at least two properties at a time.'

Excessive speculation, poor credit quality, excessive leverage, oversupply of housing units ... all indicators of a bubble.

"Homeownership has become a vehicle for borrowing and leveraging as much as a source of financial security."

Former Fed Chairman Paul Volcker, Feb 11, 2005 (See Volcker's speech)

Monday, February 28, 2005

New Home Sales as Leading Indicator

by Calculated Risk on 2/28/2005 07:52:00 PM

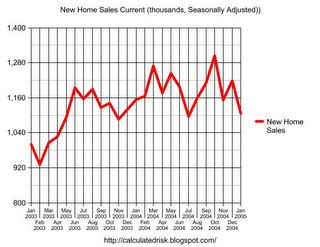

The Census Bureau announced today that New Home Sales "in January 2005 were at a seasonally adjusted annual rate of 1,106,000" and that "is 9.2 percent below the revised December rate of 1,218,000 and is 4.2 percent below the January 2004 estimate of 1,155,000". Although this decrease could just be normal monthly fluctuations, the volume of New Home Sales is very important to watch over a several month period. Below are several graphs showing the value of watching New Home Sales as a leading indicator for the economy.

There are three main numbers released each month: New Home Sales (Census Bureau), Construction Permits (Census Bureau) and Existing Home Sales (National Association of Realtors). The most important one to watch is New Home Sales. These are reported in the month that the buyer signs the contract, whereas existing home sales are reported at the close of escrow, usually 30 to 60 after the purchase agreement is signed. Permits are inexpensive and are therefore not predictive since they are not indicative of a builder's commitment to a project.

Here is a graph of the last two years of seasonally adjusted New Home Sales volume (Source: Census Bureau)

NOTE: Click on Graph for larger image.

Source: Census Bureau

It appears that a peak may have occurred last October, but it could also be another head fake (like last March). A few more months of declining sales would be concerning.

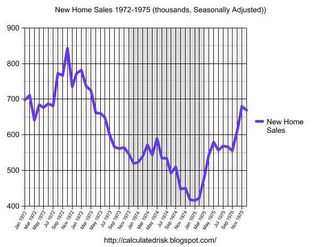

The following are the last three consumer recessions (four counting the '80s double dip). The gray area signifies that the economy was in recession based on the National Bureau of Economic Research's cycle dates. In each of these recessions New Home Sales were falling for 8 to 12 months prior to the onset of the recession. This holds true for the double dip recession of the early '80s; both dips were preceded by significant declines in sales volume.

Source: Census Bureau

Souce: Census Bureau

Source: Census Bureau

As an aside: Some observers might assume that mortgage interest rates were increasing while housing volumes were declining. This was not true for the '91 recession - mortgage rates were declining from a high of 11% in '89 to under 9% in '91. (See FreddieMac's Mortgage Summary)

If the peak for this housing cycle was in October, then we might see a housing related economic slowdown (even possibly a recession) starting in the 2nd half of 2005. However it also depends on the steepness of the decline. To be concerning volumes would need to drop 20% to 25% or more over a 6 to 8 month period.

We need to see several more months of sales declines, and seasonal volume under one million units, before we start to worry.