by Calculated Risk on 7/30/2025 08:15:00 AM

Wednesday, July 30, 2025

ADP: Private Employment Increased 104,000 in July

“Our hiring and pay data are broadly indicative of a healthy economy,” said Dr. Nela Richardson, chief economist, ADP. “Employers have grown more optimistic that consumers, the backbone of the economy, will remain resilient.”This was above the consensus forecast of 75,000 jobs added. The BLS report will be released Friday, and the consensus is for 118,000 non-farm payroll jobs added in July.

emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 7/30/2025 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 25, 2025.

The Market Composite Index, a measure of mortgage loan application volume, decreased 3.8 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 4 percent compared with the previous week. The Refinance Index decreased 1 percent from the previous week and was 30 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 6 percent from one week earlier. The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 17 percent higher than the same week one year ago.

“Mortgage applications fell to their lowest level since May, with both purchase and refinance activity declining over the week. There is still plenty of uncertainty surrounding the economy and job market, which is weighing on prospective homebuyers’ decisions,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The 30-year fixed rate was little changed at 6.83 percent, but high enough that there was not much interest in refinancing, pushing the refinance index lower for the third straight week. Purchase applications decreased by almost 6 percent, as applications for conventional, FHA, and VA purchase loans fell, despite slowing home-price growth and increasing levels of for-sale inventory in many regions.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) decreased to 6.83 percent from 6.84 percent, with points decreasing to 0.60 from 0.62 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 17% year-over-year unadjusted.

Tuesday, July 29, 2025

Wednesday: Q2 GDP, FOMC Statement, Pending Home Sales, ADP Employment

by Calculated Risk on 7/29/2025 08:09:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 75,000 payroll jobs added in June, up from -33,000 in May.

• At 8:30 AM, Gross Domestic Product, 2nd quarter (advance estimate), and annual update. The consensus is that real GDP increased 2.5% annualized in Q2, up from -0.5% in Q1.

• At 10:00 AM, Pending Home Sales Index for June. The consensus is for a 0.3% increase in the index.

• At 2:00 PM, FOMC Meeting Announcement. No change to the Fed Funds rate is expected.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

The July Employment Report and State and Local Education

by Calculated Risk on 7/29/2025 01:41:00 PM

Last month, I noted:

State and local government education hiring was reported at 63.5 thousand in June (seasonally adjusted). On a Not Seasonally Adjusted (NSA) basis, 542.4 thousand education jobs lost. This happens every June. However, this year fewer jobs were lost than expected resulting in the large SA gain. It is possible this is just a timing issue and more than expected educators will be let go in July.BofA economists noted this morning: July jobs report: beware the unexpected

Government employment (federal, state and local) surged by 73k in June, compared to an average of 13k over the first five months of the year. The spike in June was driven by what appears to be a seasonal distortion in state & local education employment, which should get paid back in July. We assume a 25k decline in total government payrolls with risks to the upside if the payback instead happens when schools reopen.Looking back at previous years, it is possible we will see a seasonally adjusted decline in state and local education of 50 thousand or more for July (payback for June). This will be something to watch out for!

BLS: Job Openings Decreased to 7.4 million in June

by Calculated Risk on 7/29/2025 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

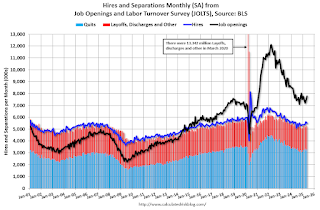

The number of job openings was little changed at 7.4 million in June, the U.S. Bureau of Labor Statistics reported today. Over the month, both hires and total separations were little changed at 5.2 million and 5.1 million, respectively. Within separations, quits (3.1 million) were little changed while layoffs and discharges (1.6 million) were unchanged.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for June; the employment report this Friday will be for July.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings decreased in June to 7.44 million from 7.71 million in May.

The number of job openings (black) were mostly unchanged year-over-year.

Quits were down 4% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

Newsletter: Case-Shiller: National House Price Index Up 2.3% year-over-year in May

by Calculated Risk on 7/29/2025 09:46:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 2.3% year-over-year in May

Excerpt:

S&P/Case-Shiller released the monthly Home Price Indices forMay ("May" is a 3-month average of March, April and May closing prices). March closing prices include some contracts signed in January, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM decrease in the seasonally adjusted (SA) Case-Shiller National Index was at -0.29% (a -3.5% annual rate). This was the third consecutive MoM decrease.

On a seasonally adjusted basis, prices increased month-to-month in just 8 of the 20 Case-Shiller cities. San Francisco has fallen 8.2% from the recent peak, Tampa is down 3.3% from the peak, and Denver down 3.3%.

Case-Shiller: National House Price Index Up 2.3% year-over-year in May

by Calculated Risk on 7/29/2025 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3-month average of March, April and May closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Records 2.3% Annual Gain in May 2025

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 2.3% annual return for May, down from a 2.7% annual gain in the previous month. The 10-City Composite saw an annual increase of 3.4%, down from a 4.1% annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 2.8%, down from a 3.4% increase in the previous month. New York again reported the highest annual gain among the 20 cities with a 7.4% increase in May, followed by Chicago and Detroit with annual increases of 6.1% and 4.9%, respectively. Tampa posted the lowest return, falling 2.4%.

...

The pre-seasonally adjusted U.S. National Index saw slight upward trends in May, posting gains of 0.4%. The 10-City Composite and 20-City Composite Indices both reported gains of 0.4%.

After seasonal adjustment, the U.S. National Index posted a decrease of -0.3%. Both the 10-City Composite and the 20-City Composite Indices saw a -0.3% decrease, as well.

“May’s data continued the year’s slow unwind of price momentum, with annual gains narrowing for a fourth consecutive month,” said Nicholas Godec, CFA, CAIA, CIPM, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices. “National home prices were just 2.3% higher than a year ago, the smallest increase since July 2023, and nearly all of that gain occurred in the most recent six months. The spring market lifted prices modestly, but not enough to suggest sustained acceleration."

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index was down 0.3% in May (SA). The Composite 20 index was down 0.3% (SA) in May.

The National index was down 0.3% (SA) in May.

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 NSA was up 3.4% year-over-year. The Composite 20 NSA was up 2.8% year-over-year.

The National index NSA was up 2.3% year-over-year.

Annual price changes were close to expectations. I'll have more later.

Monday, July 28, 2025

Tuesday: Case-Shiller House Prices, Job Openings

by Calculated Risk on 7/28/2025 09:09:00 PM

If any given week of movement in the mortgage rate world came with disclaimer, this one would be: "Warning. An absence of volatility on Monday has no bearing on odds for volatility in the rest of the week." More simply put, you're essentially guaranteed to see more rate movement over the next 4 days simply because today saw none.Tuesday:

Of all of the days this week, Monday was the best candidate for a ho-hum level of movement because it was the only day without any major economic data on tap. Rates are based on bonds, and econ data is a key source of inspiration for bonds. [30 year fixed 6.81%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for May. The consensus is for a 2.5% year-over-year increase in the Comp 20 index for May.

• At 9:00 AM, FHFA House Price Index for May. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for June from the BLS.

Fannie and Freddie: Single Family Serious Delinquency Rates Decreased in June

by Calculated Risk on 7/28/2025 05:09:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie: Single Family Serious Delinquency Rates Decreased in June

Excerpt:

Freddie Mac reported that the Single-Family serious delinquency rate in June was 0.55%, unchanged from 0.55% May. Freddie's rate is up year-over-year from 0.50% in June 2024, however, this is below the pre-pandemic level of 0.60%.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

Fannie Mae reported that the Single-Family serious delinquency rate in May was 0.53%, down from 0.55% in April. The serious delinquency rate is up year-over-year from 0.48% in May 2024, however, this is below the pre-pandemic lows of 0.65%.

Fannie Mae reported that the Single-Family serious delinquency rate in June was 0.53%, unchanged from 0.53% in May. The serious delinquency rate is up year-over-year from 0.48% in June 2024, however, this is below the pre-pandemic lows of 0.65%.

HVS: Q2 2025 Homeownership and Vacancy Rates

by Calculated Risk on 7/28/2025 01:09:00 PM

The Census Bureau released the Residential Vacancies and Homeownership report for Q2 2025 today.

The results of this survey were significantly distorted by the pandemic in 2020.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. Analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

National vacancy rates in the second quarter 2025 were 7.0 percent for rental housing and 1.1 percent for homeowner housing. The rental vacancy rate was higher than the rate in the second quarter 2024 (6.6 percent) and not statistically different from the rate in the first quarter 2025 (7.1 percent).

The homeowner vacancy rate of 1.1 percent was higher than the rate in the second quarter 2024 (0.9 percent) and virtually the same as the rate in the first quarter 2025 (1.1 percent).

The homeownership rate of 65.0 percent was not statistically different from the rate in the second quarter 2024 (65.6 percent) and not statistically different than the rate in the first quarter 2025 (65.1 percent).

emphasis added

Click on graph for larger image.

Click on graph for larger image.The HVS homeownership rate was decreased to 65.0% in Q2, from 65.1% in Q1.

The results in Q2 and Q3 2020 were distorted by the pandemic and should be ignored.

The HVS homeowner vacancy was unchanged at 1.1% in Q2 from 1.1% in Q1.

The HVS homeowner vacancy was unchanged at 1.1% in Q2 from 1.1% in Q1. The homeowner vacancy rate declined sharply during the pandemic and includes homes that are vacant and for sale (so this mirrors the low but increasing levels of existing home inventory).

TSA: Airline Travel Mostly Unchanged YoY

by Calculated Risk on 7/28/2025 11:01:00 AM

This data is as of July 27, 2025.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for the last 6 years.

The red line is the seven-day average for 2025.

Housing July 28th Weekly Update: Inventory up 0.4% Week-over-week; Down 10% from 2019 Levels

by Calculated Risk on 7/28/2025 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, July 27, 2025

Sunday Night Futures

by Calculated Risk on 7/27/2025 07:46:00 PM

Weekend:

• Schedule for Week of July 27, 2025

Monday:

• At 10:00 AM ET, the Q2 2025 Housing Vacancies and Homeownership from the Census Bureau.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for July.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 28 and DOW futures are up 168 (fair value).

Oil prices were down over the last week with WTI futures at $65.16 per barrel and Brent at $68.44 per barrel. A year ago, WTI was at $79, and Brent was at $81 - so WTI oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.12 per gallon. A year ago, prices were at $3.49 per gallon, so gasoline prices are down $0.37 year-over-year.

FOMC Preview: No Change to Fed Funds Rate

by Calculated Risk on 7/27/2025 09:01:00 AM

Most analysts expect no change to FOMC policy at the meeting this week, keeping the target range at 4 1/4 to 4 1/2 percent. Market participants currently expect the FOMC to cut the Fed Funds rate 25bp in September, with a second rate cut in December.

We do not expect any policy changes at the July Fed meeting. Most FOMC participants likely view this meeting as a placeholder. The balance of risks remains the same as in June: to the upside on inflation and to the downside on the labor market. The Fed will have a lot more information on how these risks have evolved by the September meeting. ...

August’s Jackson Hole Symposium further reduces the urgency to guide markets next week. The Fed will have an additional month’s worth of data by then. With the benefit of hindsight, it is clear that Powell used his Jackson Hole speech last year to signal the 50bp cut in September. This year, Powell will most likely be speaking on the morning of August 22. Although the focus will be on the framework review, we see a strong chance that Powell will also provide a signal on the near-term policy trajectory.

emphasis added

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2025 | 2026 | 2027 | |

| Jun 2025 | 1.2 to 1.5 | 1.5 to 1.8 | 1.7 to 2.0 | |

| Mar 2025 | 1.5 to 1.9 | 1.6 to 1.9 | 1.6 to 2.0 | |

The unemployment rate was at 4.1% in June. The unemployment rate will likely increase later this year.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2025 | 2026 | 2027 | |

| Jun 2025 | 4.4 to 4.5 | 4.3 to 4.6 | 4.2 to 4.6 | |

| Mar 2025 | 4.3 to 4.4 | 4.2 to 4.5 | 4.1 to 4.4 | |

As of May 2025, PCE inflation increased 2.3% year-over-year (YoY), up from 2.2% YoY in April. Early estimate is PCE inflation will increase to 2.6% YoY in June. There will likely be some further increases in the 2nd half of 2025, but the forecast range is probably reasonable.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2025 | 2026 | 2027 | |

| Jun 2025 | 2.8 to 3.2 | 2.3-2.6 | 2.0 to 2.2 | |

| Mar 2025 | 2.6 to 2.9 | 2.1 to 2.3 | 2.0 to 2.1 | |

PCE core inflation increased 2.7% YoY in May, up from 2.6% YoY in April. There will likely be further increase in core PCE inflation.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2025 | 2026 | 2027 | |

| Jun 2025 | 2.9 to 3.4 | 2.3-2.6 | 2.0 to 2.2 | |

| Mar 2025 | 2.7 to 3.0 | 2.1 to 2.4 | 2.0 to 2.1 | |

Saturday, July 26, 2025

Real Estate Newsletter Articles this Week: Existing-Home Sales Decreased to 3.93 million SAAR in June

by Calculated Risk on 7/26/2025 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Decreased to 3.93 million SAAR in June; Unchanged YoY

• New Home Sales Increase to 627,000 Annual Rate in June

• Final Look at Local Housing Markets in June and a Look Ahead to July Sales

• NMHC on Apartments: Market conditions Tightened in Q2

• Goldman's Mid-Year Housing Outlook

• California Home Sales Down Slightly YoY in June

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of July 27, 2025

by Calculated Risk on 7/26/2025 08:11:00 AM

The key reports this week are the advance estimate of Q2 GDP and the July employment report.

Other key reports include May Case-Shiller house prices, July ISM manufacturing index and July vehicle sales.

The FOMC meets this week and no change to the Fed Funds rate is expected.

10:00 AM: the Q2 2025 Housing Vacancies and Homeownership from the Census Bureau.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for July.

9:00 AM: S&P/Case-Shiller House Price Index for May.

9:00 AM: S&P/Case-Shiller House Price Index for May.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 2.5% year-over-year increase in the Comp 20 index for May.

9:00 AM: FHFA House Price Index for May. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM ET: Job Openings and Labor Turnover Survey for June from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for June from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in May to 7.77 million from 7.40 million in April.

The number of job openings (yellow) were down 2% year-over-year and Quits were down 2% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 75,000 payroll jobs added in June, up from -33,000 in May.

8:30 AM: Gross Domestic Product, 2nd quarter (advance estimate), and annual update. The consensus is that real GDP increased 2.5% annualized in Q2, up from -0.5% in Q1.

10:00 AM: Pending Home Sales Index for June. The consensus is for a 0.3% increase in the index.

2:00 PM: FOMC Meeting Announcement. No change to the Fed Funds rate is expected.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for initial claims to increase to 220 thousand from 217 thousand last week.

8:30 AM ET: Personal Income and Outlays, June 2025. The consensus is for a 0.3% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 2.5% YoY, and core PCE prices up 2.7% YoY.

9:45 AM: Chicago Purchasing Managers Index for July.

8:30 AM: Employment Report for July. The consensus is for 118,000 jobs added, and for the unemployment rate to increase to 4.2%.

8:30 AM: Employment Report for July. The consensus is for 118,000 jobs added, and for the unemployment rate to increase to 4.2%.There were 147,000 jobs added in June, and the unemployment rate was at 4.1%.

This graph shows the jobs added per month since January 2021.

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 49.8, up from 49.0 in June.

10:00 AM: Construction Spending for June. The consensus is for a 0.1% increase in construction spending.

10:00 AM: University of Michigan's Consumer sentiment index (Final for July).

Late: Light vehicle sales for July from the BEA. The consensus is for light vehicle sales to be 16.2 million SAAR in July, up from 15.3 million in June (Seasonally Adjusted Annual Rate).

Late: Light vehicle sales for July from the BEA. The consensus is for light vehicle sales to be 16.2 million SAAR in July, up from 15.3 million in June (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for last month.

Friday, July 25, 2025

Realtor.com Reports Most Active "For Sale" Inventory since November 2019

by Calculated Risk on 7/25/2025 05:01:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For June, Realtor.com reported inventory was up 28.9% YoY, but still down 12.9% compared to the 2017 to 2019 same month levels.

Here is their weekly report: Weekly Housing Trends: Latest Data as of July 19

• Active inventory climbed 24.4% year over year

The number of homes active on the market climbed 24.4% year over year, slightly lower than last week. This represents the 89th consecutive week of annual gains in inventory. There were more than 1 million homes for sale again last week, marking the 11th week in a row over the threshold and the highest inventory level since November 2019.

• New listings—a measure of sellers putting homes up for sale—rose 7.2% year over year

New listings rose again last week on an annual basis by 7.2% compared with the same period last year. The June Housing Report showed that new listings declined month over month for the second consecutive month after peaking in April. This figure suggests that the trend could turn around soon.

• The median list price was up 0.8% year over year

The median list price climbed again this week, but is still down 0.2% year to date. The median list price per square foot—which adjusts for changes in home size—rose 0.5% year over year. With inventory on the rise and more than 1 in 5 sellers cutting prices, the market continues to soften and shift toward more buyer favorability.

Q2 GDP Tracking: Mid-2s

by Calculated Risk on 7/25/2025 02:01:00 PM

The advance estimate of Q2 GDP will be released next Wednesday. The consensus is real GDP increased at a 2.5% annual rate in Q2. BofA economists noted this morning:

"The increase in the headline print would be on the back of a reversal of the surge in imports due to pre-tariff front loading in 1Q. Consumer spending should increase by 1.5% after the weather-driven 1Q decline. Equipment investment is likely to decline after the outsized increase in 1Q. Hence final sales will likely come in at a weak 0.3%."From BofA:

Since our last weekly publication, our 2Q GDP tracking is unchanged at 2.2% q/q saar. [July 25th estimate]From Goldman:

emphasis added

We left our Q2 GDP tracking estimate unchanged at +2.7% (quarter-over-quarter annualized) and our Q2 domestic final sales estimate unchanged at +0.9%. [July 25th estimate]And from the Atlanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2025 is 2.4 percent on July 25, unchanged from July 18 after rounding. The forecasts of the major GDP subcomponents were all unchanged or little changed from their July 18 values after this week’s releases from the US Census Bureau and the National Association of Realtors. [July 25th estimate]

Final Look at Local Housing Markets in June and a Look Ahead to July Sales

by Calculated Risk on 7/25/2025 10:56:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in June and a Look Ahead to July Sales

A brief excerpt:

After the National Association of Realtors® (NAR) releases the monthly existing home sales report, I pick up additional local market data that is reported after the NAR. This is the final look at local markets in June.There is much more in the article.

There were several key stories for June:

• Sales NSA are down 1.5% year-over-year (YoY) through June compared to the same period in 2024, and sales last year were the lowest since 1995! The YoY comparisons will be fairly easy for the next three months, so sales in 2025 might be close to the level in 2024.

• Sales SA were down or unchanged YoY for the 5th consecutive month and have been down YoY for 41 of the last 46 months.

• Months-of-supply is at the highest level since 2016.

• The median price is barely up YoY, and with the increases in inventory, some regional areas will see more price declines - and we might see national price declines later this year (or in 2026).

Sales at 3.93 million on a Seasonally Adjusted Annual Rate (SAAR) basis were below the consensus estimate; however, housing economist Tom Lawler’s estimate was right on (usually very close).

Sales averaged close to 5.40 million SAAR for the month of June in the 2017-2019 period. So, sales are about 27% below pre-pandemic levels.

...

In June, sales in these markets were up 4.7% YoY NSA. Last month, in May, these same markets were also down 3.8% YoY Not Seasonally Adjusted (NSA). The NAR reported sales in June were up 4.0% YoY NSA, so this sample is close.

Important: There were more working days in June 2025 (20) than in June 2024 (19). So, the year-over-year change in the headline SA data was lower than for the NSA data. According to the NAR, seasonally adjusted sales were unchanged YoY in June.

...

More local data coming in August for activity in July!

Hotels: Occupancy Rate Decreased 2.6% Year-over-year; Weak Summer

by Calculated Risk on 7/25/2025 08:11:00 AM

The U.S. hotel industry reported negative year-over-year comparisons, according to CoStar’s latest data through 19 July. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

13-19 July 2025 (percentage change from comparable week in 2024):

• Occupancy: 71.6% (-2.6%)

• Average daily rate (ADR): US$165.49 (-0.7%)

• Revenue per available room (RevPAR): US$118.54 (-3.3%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2025, blue is the median, and dashed light blue is for 2024. Dashed purple is for 2018, the record year for hotel occupancy.