by Calculated Risk on 6/30/2025 09:51:00 AM

Monday, June 30, 2025

FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores

Today, in the Calculated Risk Real Estate Newsletter: FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores

A brief excerpt:

Here are some graphs on outstanding mortgages by interest rate, the average mortgage interest rate, borrowers’ credit scores and current loan-to-value (LTV) from the FHFA’s National Mortgage Database through Q1 2025 (released last Friday).There is much more in the article.

...

This shows the surge in the percent of loans under 3% starting in early 2020 as mortgage rates declined sharply during the pandemic.

Note that a fairly large percentage of mortgage loans were under 4% prior to the pandemic!

The percent of outstanding loans under 4% peaked in Q1 2022 at 65.1% (now at 53.4%), and the percent under 5% peaked at 85.6% (now at 71.3%). These low existing mortgage rates made it difficult for homeowners to sell their homes and buy a new home since their monthly payments would increase sharply.

This was a key reason existing home inventory levels were so low. However, time is eroding this lock-in effect.

Housing June 30th Weekly Update: Inventory up 0.3% Week-over-week, Up 28.7% Year-over-year

by Calculated Risk on 6/30/2025 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, June 29, 2025

Sunday Night Futures

by Calculated Risk on 6/29/2025 07:08:00 PM

Weekend:

• Schedule for Week of June 29, 2025

Monday:

• At 9:45 AM ET, Chicago Purchasing Managers Index for June.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for June.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 17 and DOW futures are up 212 (fair value).

Oil prices were down over the last week with WTI futures at $65.52 per barrel and Brent at $67.77 per barrel. A year ago, WTI was at $83, and Brent was at $82 - so WTI oil prices are down about 21% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.17 per gallon. A year ago, prices were at $3.49 per gallon, so gasoline prices are down $0.32 year-over-year.

Hotels: Occupancy Rate Increased 1.3% Year-over-year

by Calculated Risk on 6/29/2025 08:11:00 AM

The U.S. hotel industry reported positive year-over-year comparisons, according to CoStar’s latest data through 21 June. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

15-21 June 2025 (percentage change from comparable week in 2024):

• Occupancy: 70.5% (+1.3%)

• Average daily rate (ADR): US$163.77 (+2.0%)

• Revenue per available room (RevPAR): US$115.39 (+3.3%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2025, blue is the median, and dashed light blue is for 2024. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, June 28, 2025

Real Estate Newsletter Articles this Week: New Home Sales Decrease to 623,000 Annual Rate in May

by Calculated Risk on 6/28/2025 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales Decrease to 623,000 Annual Rate in May

• NAR: Existing-Home Sales Increased to 4.03 million SAAR in May; Down 0.7% YoY

• Case-Shiller: National House Price Index Up 2.7% year-over-year in April

• Inflation Adjusted House Prices 1.7% Below 2022 Peak

• Final Look at Local Housing Markets in May and a Look Ahead to June Sales

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of June 29, 2025

by Calculated Risk on 6/28/2025 08:11:00 AM

The key report scheduled for this week is the June employment report to be released on Thursday.

Other key reports include the June ISM Manufacturing survey, June Vehicle Sales and the Trade Deficit for May.

9:45 AM: Chicago Purchasing Managers Index for June.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for June.

9:30 AM: Discussion, Fed Chair Jerome Powell, Policy Panel Discussion, At the European Central Bank Forum on Central Banking 2025, Sintra, Portugal

10:00 AM: ISM Manufacturing Index for June. The consensus is for the ISM to be at 48.8, up from 48.5 in May.

10:00 AM: Construction Spending for May. The consensus is for a 0.1% decrease in construction spending.

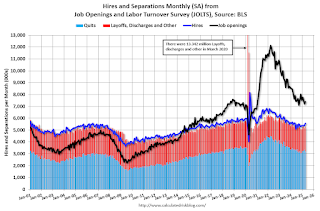

10:00 AM ET: Job Openings and Labor Turnover Survey for May from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for May from the BLS. This graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in April to 7.39 million from 7.20 million in March.

The number of job openings were down 3% year-over-year and quits were down 6% year-over-year.

Late in the day: Light vehicle sales for June.

Late in the day: Light vehicle sales for June.The consensus is for light vehicle sales to be 15.5 million SAAR in June, down from 15.6 million in May (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for last month.

J.D. Power is forecasting sales of 15.0 million SAAR in June.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 110,000 payroll jobs added in June, up from 37,000 in May.

8:30 AM: Employment Report for June. The consensus is for 129,000 jobs added, and for the unemployment rate to be unchanged at 4.2%.

8:30 AM: Employment Report for June. The consensus is for 129,000 jobs added, and for the unemployment rate to be unchanged at 4.2%.There were 139,000 jobs added in May, and the unemployment rate was at 4.2%.

This graph shows the jobs added per month since January 2021.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for initial claims to increase to 239 thousand from 236 thousand last week.

8:30 AM: Trade Balance report for May from the Census Bureau.

8:30 AM: Trade Balance report for May from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $69.8 billion. The U.S. trade deficit was at $61.6 billion the previous month.

10:00 AM: the ISM Services Index for June. The consensus is for a reading of 50.8, up from 49.9.

All US markets will close early at 1:00 PM ET in observance of Independence Day

All US markets will be closed in observance of Independence Day

Friday, June 27, 2025

Las Vegas in May: Visitor Traffic Down 6.5% YoY; Convention Traffic up 10.7% YoY

by Calculated Risk on 6/27/2025 06:15:00 PM

From the Las Vegas Visitor Authority: May 2025 Las Vegas Visitor Statistics

With headwinds of ongoing economic uncertainty, the destination hosted approximately 3.4 million visitors in May, down ‐6.5% YoY.

Convention attendance reached approx. 511k for the month (up 10.7%), supported in part by show rotations including LightFair International (8,500 attendees), the Bitcoin conference (30k attendees) and the National Automatic Merchandising Association/NAMA Show (5k attendees). Also, a few shows were held in May this year vs. other months last year, including Las Vegas Antique Jewelry & Watch Show (7,500 attendees, held in June last year) and PETZONE360 Live (5k attendees, held in April last year.)

Hotel occupancy reached 83.0% for the month, down ‐3.1 pts with Weekend occupancy of 89.9% (down ‐3.5 pts) and Midweek occupancy of 79.3% (down ‐3.2 pts). ADR for the month reached $198 (‐2.2% YoY) with RevPAR of $165 (‐5.7% YoY).

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (Black), 2020 (dark blue), 2021 (light blue), 2022 (light orange), 2023 (orange), 2024 (dark orange) and 2025 (red).

Visitor traffic was down 6.5% compared to last May. Visitor traffic was down 7.4% compared to May 2019.

Q2 GDP Tracking: Moving Down, Still Wide Range

by Calculated Risk on 6/27/2025 02:59:00 PM

There will be additional trade related distortions in Q2 boosting GDP.

From BofA:

Since our last weekly publication, our 2Q GDP tracking is down one-tenth to +2.5% q/q saar. [June 27th estimate]From Goldman:

emphasis added

We lowered our Q2 GDP tracking estimate by 0.1pp to +3.9% (quarter-over-quarter annualized). Our Q2 domestic final sales estimate stands at 0%. [June 27th estimate]And from the Atlanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2025 is 2.9 percent on June 27, down from 3.4 percent on June 18. After recent releases from the US Census Bureau and the US Bureau of Economic Analysis, an increase in the nowcast of the contribution of net exports to second-quarter real GDP growth from 2.07 percentage points to 3.49 percentage points was more than offset by a decrease in the nowcasted GDP growth contribution of inventory investment from -0.42 percentage points to -2.22 percentage points. [June 27th estimate]

Final Look at Local Housing Markets in May and a Look Ahead to June Sales

by Calculated Risk on 6/27/2025 11:12:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in May and a Look Ahead to June Sales

A brief excerpt:

After the National Association of Realtors® (NAR) releases the monthly existing home sales report, I pick up additional local market data that is reported after the NAR. This is the final look at local markets in May.There is much more in the article.

There were several key stories for May:

• Sales NSA are down year-over-year (YoY) through May, and sales last year were the lowest since 1995! The YoY comparisons will be easier the next several months, so sales in 2025 might be close to the level in 2024.

• Sales SA were down YoY for the 4th consecutive month and 41 of the last 45 months.

• Months-of-supply is at the highest level since 2016 (tying one month near the start of the pandemic).

• The median price is barely up YoY, and with the increases in inventory, some regional areas will see more price declines.

Sales at 4.03 million on a Seasonally Adjusted Annual Rate (SAAR) basis were above the consensus estimate; however, housing economist Tom Lawler’s estimate was right on (usually very close).

Sales averaged close to 5.44 million SAAR for the month of May in the 2017-2019 period. So, sales are about 26% below pre-pandemic levels.

...

In May, sales in these markets were down 3.8% YoY. Last month, in April, these same markets were also down 3.8% YoY Not Seasonally Adjusted (NSA). The NAR reported sales in May were down 4.0% YoY NSA, so this sample is close.

Important: There were fewer working days in May 2025 (21) as in May 2024 (22). So, the year-over-year change in the headline SA data was higher than for the NSA data. According to the NAR, seasonally adjusted sales were only down 0.7% YoY in May.

...

More local data coming in July for activity in June!

PCE Measure of Shelter Decreases to 4.1% YoY in May

by Calculated Risk on 6/27/2025 08:55:00 AM

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through May 2025.

Since asking rents are mostly flat year-over-year, these measures will slowly continue to decline over the next year as rents for existing tenants continue to increase.

The second graph shows PCE prices, Core PCE prices and Core ex-housing over the last 3 months (annualized):

The second graph shows PCE prices, Core PCE prices and Core ex-housing over the last 3 months (annualized):Key measures are below the Fed's target on a 3-month basis.

3-month annualized change:

Core PCE Prices: 1.7%

Core minus Housing: 1.1%

There appears to be some residual seasonality, especially in Q1.

Personal Income Decreased 0.4% in May; Spending Decreased 0.1%

by Calculated Risk on 6/27/2025 08:30:00 AM

From the BEA: Personal Income and Outlays, May 2025

Personal income decreased $109.6 billion (0.4 percent at a monthly rate) in May, according to estimates released today by the U.S. Bureau of Economic Analysis. Disposable personal income (DPI)—personal income less personal current taxes—decreased $125.0 billion (0.6 percent) and personal consumption expenditures (PCE) decreased $29.3 billion (0.1 percent).The May PCE price index increased 2.3 percent year-over-year (YoY), up from 2.1 percent YoY in April, and down from the recent peak of 7.2 percent in June 2022.

Personal outlays—the sum of PCE, personal interest payments, and personal current transfer payments—decreased $27.6 billion in May. Personal saving was $1.01 trillion in May and the personal saving rate—personal saving as a percentage of disposable personal income—was 4.5 percent.

From the preceding month, the PCE price index for May increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

From the same month one year ago, the PCE price index for May increased 2.3 percent. Excluding food and energy, the PCE price index increased 2.7 percent from one year ago.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through May 2025 (2017 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income and PCE were below expectations.

Using the two-month method to estimate Q2 real PCE growth, real PCE was increasing at a 2.4% annual rate in Q2 2024. (Using the mid-month method, real PCE was increasing at 2.0%). This suggests moderate PCE growth in Q2.

Thursday, June 26, 2025

Friday: Personal Income and Outlays, PCE Inflation

by Calculated Risk on 6/26/2025 07:59:00 PM

Friday:

• At 8:30 AM ET: Personal Income and Outlays, May 2024. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%. PCE prices are expected to be up 2.2% YoY, and core PCE prices up 2.5% YoY.

• At 10:00 AM: University of Michigan's Consumer sentiment index (Final for June).

• At 4:30 PM: Federal Reserve Board announces results from its annual bank stress test

Realtor.com Reports Most Active "For Sale" Inventory since December 2019

by Calculated Risk on 6/26/2025 03:29:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For May, Realtor.com reported inventory was up 31.5% YoY, but still down 14.4% compared to the 2017 to 2019 same month levels.

Here is their weekly report: Weekly Housing Trends: Latest Data as of June 21

• Active inventory climbed 27.5% year over year

The number of homes actively for sale remains on a strong upward trajectory, now 27.5% higher than this time last year. This represents the 85th consecutive week of annual gains in inventory. There were more than 1 million homes for sale again last week, marking the eighth week in a row over the threshold and the highest inventory level since December 2019.

• New listings—a measure of sellers putting homes up for sale—rose 3.5% year over year

New listings rose again last week on an annual basis, up 3.5% compared with the same period last year. ... This will be an important trend to watch, especially as regional real estate dynamics diverge and the market gradually shifts back in favor of buyers.

• The median list price was up 0.9% year over year

The median list price climbed again this week, but it’s still down 0.3% year to date. The median list price per square foot—which adjusts for changes in home size—rose 0.7% year over year. With inventory growing and 1 in 5 sellers slashing prices, the pendulum is swinging back toward a balanced market, as price growth slows and buyers gain more leverage.

Inflation Adjusted House Prices 1.7% Below 2022 Peak; Price-to-rent index is 8.8% below 2022 peak

by Calculated Risk on 6/26/2025 11:44:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 1.7% Below 2022 Peak

Excerpt:

It has been 19 years since the housing bubble peak, ancient history for many readers!There is much more in the article!

In the April Case-Shiller house price index released Tuesday, the seasonally adjusted National Index (SA), was reported as being 78% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 11% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 2% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $300,000 in January 2010, the price would be $442,000 today adjusted for inflation (47% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.

...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI).

In real terms (using CPI), the National index is 1.7% below the recent peak, and the Composite 20 index is 1.8% below the recent peak in 2022.

Both the real National index and the Comp-20 index decreased in April.

It has now been 35 months since the real peak in house prices. Typically, after a sharp increase in prices, it takes a number of years for real prices to reach new highs (see House Prices: 7 Years in Purgatory)

NAR: Pending Home Sales Increase 1.8% in May; Up 1.1% YoY

by Calculated Risk on 6/26/2025 10:00:00 AM

From the NAR: NAR Pending Home Sales Report Reveals 1.8% Increase in May

Pending home sales increased by 1.8% in May from the prior month and 1.1% year-over-year, according to the National Association of REALTORS® Pending Home Sales report. All four U.S. regions experienced month-over-month increases – most notably the West. Year-over-year, contract signings rose in the Midwest and South, while they fell in the Northeast and West.Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

Northeast

2.1% month-over-month increase.

0.5% year-over-year decrease.

Midwest

0.3% month-over-month increase.

2.6% year-over-year increase.

South

1.0% month-over-month increase.

2.0% year-over-year increase.

West

6.0% month-over-month increase.

1.2% year-over-year decrease.

emphasis added

Q1 GDP Growth Revised down to -0.5% Annual Rate

by Calculated Risk on 6/26/2025 08:38:00 AM

From the BEA: Gross Domestic Product, 1st Quarter 2025 (Third Estimate), GDP by Industry, and Corporate Profits (Revised)

Real gross domestic product (GDP) decreased at an annual rate of 0.5 percent in the first quarter of 2025 (January, February, and March), according to the third estimate released by the U.S. Bureau of Economic Analysis. In the fourth quarter of 2024, real GDP increased 2.4 percent..Here is a Comparison of Third and Second Estimates. PCE growth was revised down from 1.2% to 0.5%. Residential investment was revised down from -0.6% to -1.3%.

The decrease in real GDP in the first quarter primarily reflected an increase in imports, which are a subtraction in the calculation of GDP, and a decrease in government spending. These movements were partly offset by increases in investment and consumer spending.

Real GDP was revised down 0.3 percentage point from the second estimate, primarily reflecting downward revisions to consumer spending and exports that were partly offset by a downward revision to imports.

emphasis added

Weekly Initial Unemployment Claims Decrease to 236,000

by Calculated Risk on 6/26/2025 08:30:00 AM

The DOL reported:

In the week ending June 21, the advance figure for seasonally adjusted initial claims was 236,000, a decrease of 10,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 245,000 to 246,000. The 4-week moving average was 245,000, a decrease of 750 from the previous week's revised average. The previous week's average was revised up by 250 from 245,500 to 245,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 245,000.

The previous week was revised up.

Weekly claims were close to the consensus forecast.

Wednesday, June 25, 2025

Thursday: GDP, Unemployment Claims, Durable Goods, Pending Home Sales

by Calculated Risk on 6/25/2025 07:59:00 PM

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for initial claims to increase to 247 thousand from 245 thousand last week.

• At 8:30 AM: Gross Domestic Product, 1st quarter 2024 (Third estimate). The consensus is that real GDP decreased 0.2% annualized in Q1, unchanged from the second estimate of a 0.2% decrease.

• At 8:30 AM: Durable Goods Orders for May from the Census Bureau. The consensus is for a 4.5% increase in durable goods orders.

• At 8:30 AM ET: Chicago Fed National Activity Index for May. This is a composite index of other data.

• At 10:00 AM: Pending Home Sales Index for May. The consensus is for a 0.1% increase in this index.

• At 11:00 AM: the Kansas City Fed manufacturing survey for June.

• During the Day: Census Bureau releases the Vintage 2024 Population Estimates

June Vehicle Forecast: Sales "Subdued" at 15.0 million SAAR

by Calculated Risk on 6/25/2025 03:56:00 PM

From J.D. Power: June New-Vehicle Sales Subdued After Reverse of Tariff-Driven Rush to Showrooms; Retail Sales Rise 7.5% in First Half of 2025 Brief excerpt:

The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 15.0 million units, up 0.2 million units from June 2024.From Haig Stoddard at Omdia: US Light-Vehicle Sales Slow Again in June (pay content). Brief excerpt:

emphasis added

Much of June’s anticipated 12-month-low in the seasonally adjusted annualized rate is an offset from pre-tariff pull-ahead volume in March and April. But also dampening demand is worsening affordability and leaner inventory. Furthermore, a dent in the year-ago month’s sales caused by a cyberattack impacting dealers’ online systems is making year-over-year comparisons look stronger than they would have otherwise.

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and J.D. Power's forecast for June (Red).

On a seasonally adjusted annual rate basis, the J.D. Power forecast of 15.0 million SAAR would be down 4.1% from last month, and up slightly from a year ago.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 6/25/2025 02:11:00 PM

Another update ... a few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern. This was because distressed sales (at lower price points) happened at a steady rate all year, while regular sales followed the normal seasonal pattern. This made for larger swings in the seasonal factor during the housing bust.

Click on graph for larger image.

Click on graph for larger image.This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through April 2025). The seasonal pattern was smaller back in the '90s and early '00s and increased once the bubble burst.

The seasonal swings declined following the bust, however the pandemic price surge changed the month-over-month pattern.

The second graph shows the seasonal factors for the Case-Shiller National index since 1987. The factors started to change near the peak of the bubble, and really increased during the bust since normal sales followed the regular seasonal pattern - and distressed sales happened all year.

The second graph shows the seasonal factors for the Case-Shiller National index since 1987. The factors started to change near the peak of the bubble, and really increased during the bust since normal sales followed the regular seasonal pattern - and distressed sales happened all year. The swings in the seasonal factors were decreasing following the bust but have increased again recently - this time without a surge in distressed sales.