by Calculated Risk on 5/28/2025 03:24:00 PM

Wednesday, May 28, 2025

Las Vegas in April: Visitor Traffic Down 5.1% YoY; Convention Traffic up 13.9% YoY

From the Las Vegas Visitor Authority: April 2025 Las Vegas Visitor Statistics

With a strong convention segment and events including Wrestlemania, counterbalanced by consumer uncertainty with evolving federal policies, visitation saw a net YoY decrease of ‐5.1% as the destination hosted approximately 3.3 million visitors in April.

Convention attendance approached 574k attendees for the month, up 13.9% YoY, benefitting from the in‐rotation of shows that were held elsewhere last year including International Sign Expo (21k attendees), American Urological Association (15k attendees) and The Carwash Show (10k attendees).

Occupancy reached 84.5%, down ‐1.0 pt with Weekend occupancy of 93.8% (up +0.4 pts) and Midweek occupancy of 81.2% (down ‐1.4 pts). ADR for the month reached $190 (+4.4% YoY) with RevPAR of $161 (+3.2% YoY).

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (Black), 2020 (dark blue), 2021 (light blue), 2022 (light orange), 2023 (orange), 2024 (dark orange) and 2025 (red).

Visitor traffic was down 5.1% compared to last April. Visitor traffic was down 5.8% compared to April 2019.

FOMC Minutes: "Difficult tradeoffs" if Inflation "more persistent" and "growth and employment weaken"

by Calculated Risk on 5/28/2025 03:07:00 PM

From the Fed: Minutes of the Federal Open Market Committee, May 6–7, 2025. Excerpt:

In considering the outlook for monetary policy, participants agreed that with economic growth and the labor market still solid and current monetary policy moderately restrictive, the Committee was well positioned to wait for more clarity on the outlooks for inflation and economic activity. Participants agreed that uncertainty about the economic outlook had increased further, making it appropriate to take a cautious approach until the net economic effects of the array of changes to government policies become clearer. Participants noted that monetary policy would be informed by a wide range of incoming data, the economic outlook, and the balance of risks.

In discussing risk-management considerations that could bear on the outlook for monetary policy, participants agreed that the risks of higher inflation and higher unemployment had risen. Almost all participants commented on the risk that inflation could prove to be more persistent than expected. Participants emphasized the importance of ensuring that longer-term inflation expectations remained well anchored, with some noting that expectations might be particularly sensitive because inflation had been above the Committee's target for an extended period. Participants noted that the Committee might face difficult tradeoffs if inflation proves to be more persistent while the outlooks for growth and employment weaken. Participants observed, however, that the ultimate extent of changes to government policy and their effects on the economy was highly uncertain. A few participants additionally noted that higher uncertainty could restrain business and consumer demand and that inflationary pressures could be damped if downside risks to economic activity or the labor market materialized.

emphasis added

Inflation Adjusted House Prices 1.0% Below 2022 Peak; Price-to-rent index is 8.1% below 2022 peak

by Calculated Risk on 5/28/2025 12:15:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 1.0% Below 2022 Peak

Excerpt:

It has been almost 19 years since the housing bubble peak, ancient history for some readers!There is much more in the article!

In the March Case-Shiller house price index released yesterday, the seasonally adjusted National Index (SA), was reported as being 78% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 12% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 3% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $300,000 in January 2010, the price would be $441,000 today adjusted for inflation (47% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.

...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI).

In real terms (using CPI), the National index is 1.0% below the recent peak, and the Composite 20 index is 1.2% below the recent peak in 2022.

Both the real National index and the Comp-20 index decreased slightly in March.

It has now been 34 months since the real peak in house prices. Typically, after a sharp increase in prices, it takes a number of years for real prices to reach new highs (see House Prices: 7 Years in Purgatory)

FDIC: Commercial Real Estate "Past-Due and nonaccrual" Highest Since 2014

by Calculated Risk on 5/28/2025 10:00:00 AM

The FDIC released the Quarterly Banking Profile for Q1 2025:

Net Income Increased from the Prior Quarter, Led by Higher Noninterest Income

Quarterly net income for the 4,462 FDIC-insured commercial banks and savings institutions totaled $70.6 billion, up $3.8 billion (5.8 percent) from the prior quarter. The banking industry reported an aggregate return on assets of 1.16 percent in first quarter 2025, up from 1.11 percent in fourth quarter 2024 and up from 1.09 percent in the year-ago quarter. The quarterly increase in net income was led by higher noninterest income (up $5.4 billion, or 7 percent). Gains in noninterest income were due to market movements and volatility as several large firms reported mark-to-market gains on certain financial instruments in the quarter. Industry noninterest income also benefited from other one-time items, such as gains on loan sales. Lower losses on the sale of securities also contributed to the increase in net income.

...

Asset Quality Metrics Remained Generally Favorable, Though Weakness in Certain Portfolios Persisted

Past-due and nonaccrual (PDNA) loans, or loans that are 30 or more days past due or in nonaccrual status, fell 1 basis point from the prior quarter to 1.59 percent of total loans. The industry’s PDNA ratio is still below the pre-pandemic average of 1.94 percent. While banks reported quarterly decreases in PDNA credit card loans (down $2.7 billion, or 9 basis points to 3.22 percent) and auto loans (down $2.6 billion, or 48 basis points to 2.84 percent), weaknesses persisted in certain portfolios. The PDNA rate for commercial real estate (CRE) loan portfolios is the highest it has been since fourth quarter 2014 at 1.49 percent. Multifamily CRE PDNAs have grown the most in the past year, up 88 basis points to 1.47 percent.

The industry’s net charge-off rate decreased 3 basis points to 0.67 percent from the prior quarter and is 1 basis point higher than the year-ago quarter and 19 basis points above the pre-pandemic average. Most portfolios have net charge-off rates above their pre-pandemic averages including credit card loans, which are 123 basis points above the pre-pandemic average at 4.71 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.From the FDIC:

The Number of Problem Banks Decreased in the First QuarterThis graph from the FDIC shows the number of problem banks.

The number of banks on the FDIC’s “Problem Bank List” decreased by a net of three in the first quarter to 63 banks. The number of problem banks represented 1.4 percent of total banks in the first quarter, which is in the middle of the normal range for non-crisis periods of 1 to 2 percent of all banks.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 5/28/2025 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 23, 2025.

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.2 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 2 percent compared with the previous week. The Refinance Index decreased 7 percent from the previous week and was 37 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 18 percent higher than the same week one year ago.

“Mortgage rates reached its highest level since January, following higher Treasury yields. Additional market volatility has added to the increase, keeping the mortgage-Treasury spread wider than it was earlier this year. The 30-year fixed rate increased to 6.98 percent, its third consecutive weekly increase,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “As a result of these higher rates, applications activity decreased, driven by a 7 percent decline in refinance applications. Conventional refinances were down 6 percent, and VA refinances dropped 16 percent. Purchase applications were up over the week and continue to run ahead of last year's pace as increased housing inventory in many markets has been supporting some transaction volume, despite the economic uncertainty.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) increased to 6.98 percent from 6.92 percent, with points decreasing to 0.67 from 0.69 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 18% year-over-year unadjusted.

Tuesday, May 27, 2025

Wednesday: FOMC Minutes

by Calculated Risk on 5/27/2025 07:17:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for May.

2:00 PM, FOMC Minutes, Minutes Meeting of May 6-7, 2025

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 5/27/2025 01:10:00 PM

Another update ... a few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern. This was because distressed sales (at lower price points) happened at a steady rate all year, while regular sales followed the normal seasonal pattern. This made for larger swings in the seasonal factor during the housing bust.

Click on graph for larger image.

Click on graph for larger image.This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through March 2025). The seasonal pattern was smaller back in the '90s and early '00s and increased once the bubble burst.

The seasonal swings declined following the bust, however the pandemic price surge changed the month-over-month pattern.

The second graph shows the seasonal factors for the Case-Shiller National index since 1987. The factors started to change near the peak of the bubble, and really increased during the bust since normal sales followed the regular seasonal pattern - and distressed sales happened all year.

The second graph shows the seasonal factors for the Case-Shiller National index since 1987. The factors started to change near the peak of the bubble, and really increased during the bust since normal sales followed the regular seasonal pattern - and distressed sales happened all year. The swings in the seasonal factors were decreasing following the bust but have increased again recently - this time without a surge in distressed sales.

Newsletter: Case-Shiller: National House Price Index Up 3.4% year-over-year in March

by Calculated Risk on 5/27/2025 09:52:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 3.4% year-over-year in March

Excerpt:

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3-month average of January, February and March closing prices). January closing prices include some contracts signed in November, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM decrease in the seasonally adjusted (SA) Case-Shiller National Index was at -0.30% (a -3.5% annual rate), This was the first MoM decrease since January 2023.

On a seasonally adjusted basis, prices increased month-to-month in just 6 of the 20 Case-Shiller cities. San Francisco has fallen 6.3% from the recent peak, Tampa is down 2.6% from the peak, and Denver down 1.9%.

Case-Shiller: National House Price Index Up 3.4% year-over-year in March

by Calculated Risk on 5/27/2025 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3-month average of January, February and March closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Records 3.4% Annual Gain in March 2025

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.4% annual return for March, down from a 4% annual gain in the previous month. The 10-City Composite saw an annual increase of 4.8%, down from a 5.2% annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 4.1%, down from a 4.5% increase in the previous month. New York again reported the highest annual gain among the 20 cities with an 8% increase in March, followed by Chicago and Cleveland with annual increases of 6.5% and 5.9%, respectively. Tampa posted the lowest return, falling 2.2%.

...

The pre-seasonally adjusted U.S. National, 10-City Composite, and 20-City Composite Indices saw slight upward trends in March, posting gains of 0.8%, 1.2%, and 1.1%, respectively.

After seasonal adjustment, the U.S. National Index posted a decrease of -0.3%. The 10-City Composite Index recorded a 0.01% increase and the 20-City Composite Index presented a -0.1% decrease.

“Home price growth continued to decelerate on an annual basis in March, even as the market experienced its strongest monthly gains so far in 2025,” said Nicholas Godec, CFA, CAIA, CIPM, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices. “This divergence between slowing year-over-year appreciation and renewed spring momentum highlighted how the housing market shifted from mere resilience to a broader seasonal recovery. Limited supply and steady demand drove prices higher across most metropolitan areas, despite affordability challenges remaining firmly in place."

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index was up 0.01% in March (SA). The Composite 20 index was down 0.1% (SA) in March.

The National index was down 0.3% (SA) in March.

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 NSA was up 4.8% year-over-year. The Composite 20 NSA was up 4.1% year-over-year.

The National index NSA was up 3.4% year-over-year.

Annual price changes were lower than expectations. I'll have more later.

Monday, May 26, 2025

Tuesday: Durable Goods, Case-Shiller House Prices

by Calculated Risk on 5/26/2025 06:48:00 PM

Weekend:

• Schedule for Week of May 25, 2025

Tuesday:

• At 8:30 AM ET, Durable Goods Orders for April from the Census Bureau. The consensus is for a 7.8% decrease in durable goods orders.

• At 9:00 AM, S&P/Case-Shiller House Price Index for March. The consensus is for the Case-Shiller 20-City Composite Index to increase 4.5% YoY, unchanged from 4.5% YoY in February.

• Also at 9:00 AM, FHFA House Price Index for March. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Dallas Fed Survey of Manufacturing Activity for May.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 63 and DOW futures are up 402 (fair value).

Oil prices were down over the last week with WTI futures at $61.46 per barrel and Brent at $64.72 per barrel. A year ago, WTI was at $78, and Brent was at $79 - so WTI oil prices are down about 21% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.13 per gallon. A year ago, prices were at $3.56 per gallon, so gasoline prices are down $0.43 year-over-year.

Final Look at Local Housing Markets in April and a Look Ahead to May Sales

by Calculated Risk on 5/26/2025 12:44:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in April and a Look Ahead to May Sales

A brief excerpt:

After the National Association of Realtors® (NAR) releases the monthly existing home sales report, I pick up additional local market data that is reported after the NAR. This is the final look at local markets in April.There is much more in the article.

There were several key stories for April:

• Sales NSA are down YoY through April, and sales last year were the lowest since 1995! Ouch.

• Sales SA were down YoY for the 3rd consecutive month and 40 of the last 44 months.

• Months-of-supply is at the highest level since 2016 (excluding one month near the start of the pandemic).

• The median price is barely up YoY, and with the increases in inventory, some regional areas will see more price declines.

Sales at 4.00 million on a Seasonally Adjusted Annual Rate (SAAR) basis were below the consensus estimate; however, housing economist Tom Lawler’s estimate was very close (as usual).

Sales averaged close to 5.4 million SAAR for the month of April in the 2017-2019 period. So, sales are about 26% below pre-pandemic levels.

Also, months-of-supply for April was above pre-pandemic levels for the period 2017-2019 and the highest for April since 2016.

...

Here is a look at months-of-supply using NSA sales. Since this is NSA data, it is likely months-of-supply will increase over the next few months.

Months in red are areas that are seeing 5+ months of supply now and might see price pressures later this summer.

...

More local data coming in June for activity in May!

Memorial Day: Remembering James Hoey

by Calculated Risk on 5/26/2025 10:29:00 AM

Memorial Day is about remembering those that in the words of Abraham Lincoln, “gave the last full measure of devotion” in defending our nation so “that this government of the people, by the people, for the people, shall not perish from the earth”.

Today I’m thinking of my distant relative, James Hoey (Jan 14, 1842 – Aug 13, 1864) who fought for the Union during the Civil War and gave the ultimate sacrifice at the age of 22. Thank you, James!

My family has fought in every major American war. For example, my 4th Great Grandfather, William Marks (1749 – 1824) fought in the revolutionary war. His son, my 3rd Great Grandfather, William Marks, Jr. was a Brigadier General during the war of 1812 – and went on the serve as a U.S. Senator from the State of Pennsylvania.

We must also remember what they all fought for: America’s core value is the rule of law rooted in the U.S. Constitution. We are a Nation of Laws, not of men.

Housing May 26th Weekly Update: Inventory up 2.6% Week-over-week, Up 32.4% Year-over-year

by Calculated Risk on 5/26/2025 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, May 25, 2025

The Normal Seasonal Pattern for Median House Prices

by Calculated Risk on 5/25/2025 08:12:00 AM

This week, in the CalculatedRisk Real Estate Newsletter on March existing home sales, NAR: Existing-Home Sales Decreased to 4.00 million SAAR in April; Down 2.0% YoY, I noted:

On a month-over-month basis, median prices increased 2.7% from March and are now down 3.0% from the June 2024 peak. This is less than the normal seasonal increase in the median price for April.Seasonally, median prices typically peak in June (closed sales are mostly for contracts signed in April and May).

And seasonally, prices usually bottom the following January (contracts signed in November and December).

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|---|---|

| Jan to Apr | 7.1% | 7.1% | 7.7% | 12.2% | 11.6% | 6.9% | 7.4% | 5.2% |

| Apr to Jun | 6.2% | 6.9% | 2.6% | 7.7% | 4.6% | 6.3% | 5.0% | NA |

| Jan to Jun | 13.7% | 14.4% | 10.6% | 20.8% | 16.8% | 13.7% | 12.8% | NA |

| Jun to Jan | -8.9% | -6.7% | 3.1% | -3.4% | -12.8% | -7.7% | -7.8% | NA |

The 2025 increase in median prices from January to April was less than the normal seasonal increase.

Saturday, May 24, 2025

Real Estate Newsletter Articles this Week: Existing-Home Sales Decreased to 4.00 million SAAR in April

by Calculated Risk on 5/24/2025 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Decreased to 4.00 million SAAR in April; Down 2.0% YoY

• New Home Sales Increase to 743,000 Annual Rate in April

• "How do you grade the Spring housing market?"

• In Q1 2025, 19% of Units Started Built-for-Rent were Single Family

• California Home Sales "Retreat" in April; New Listings "Surge"

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of May 25, 2025

by Calculated Risk on 5/24/2025 08:11:00 AM

The key reports this week are the second estimate of Q1 GDP, March Case-Shiller house prices, and Personal Income and Outlays for April.

For manufacturing, the May Richmond and Dallas Fed manufacturing surveys will be released.

All US markets will be closed in observance of Memorial Day.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 7.8% decrease in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for March. The consensus is for the Case-Shiller 20-City Composite Index to increase 4.5% YoY, unchanged from 4.5% YoY in February.

9:00 AM: S&P/Case-Shiller House Price Index for March. The consensus is for the Case-Shiller 20-City Composite Index to increase 4.5% YoY, unchanged from 4.5% YoY in February.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

9:00 AM: FHFA House Price Index for March. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Dallas Fed Survey of Manufacturing Activity for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

2:00 PM: FOMC Minutes, Minutes Meeting of May 6-7, 2025

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for initial claims of 225 thousand, down from 227 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2025 (Second estimate). The consensus is that real GDP decreased 0.3% annualized in Q1, unchanged from the advance estimate of -0.3%.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.4% decrease in the index.

8:30 AM ET: Personal Income and Outlays, April 2025. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%. PCE prices are expected to be up 2.2% YoY, and core PCE prices up 2.5% YoY.

9:45 AM: Chicago Purchasing Managers Index for May.

10:00 AM: University of Michigan's Consumer sentiment index (Final for May). The consensus is for a reading of 50.8.

Friday, May 23, 2025

May 23rd COVID Update: Weekly COVID Deaths at New Pandemic Low

by Calculated Risk on 5/23/2025 07:05:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 306✅ | 368 | ≤3501 | |

| 1my goals to stop weekly posts. 🚩 Increasing number weekly for Deaths. ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported since Jan 2023.

This appears to be a leading indicator for COVID hospitalizations and deaths. This is moving towards the lows last May.

This appears to be a leading indicator for COVID hospitalizations and deaths. This is moving towards the lows last May.Q2 GDP Tracking: Low 2%

by Calculated Risk on 5/23/2025 02:00:00 PM

From BofA:

Since our last weekly publication, our 2Q and 1Q GDP tracking are down two-tenths each to +2.0% q/q saar and -0.5% q/q saar, respectively. [May 23rd estimate]From Goldman:

emphasis added

We left our Q2 GDP tracking estimate unchanged at +2.1% (quarter-over-quarter annualized) and our Q2 domestic final sales forecast unchanged at 0%. We left our past-quarter tracking estimate unchanged at -0.5%. [May 23rd estimate]And from the Atlanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2025 is 2.4 percent on May 16, down from 2.5 percent on May 15. After this morning’s housing starts report from the US Census Bureau and the release of import and export price indexes from the US Bureau of Labor Statistics, the nowcast of second-quarter real residential fixed investment growth decreased from 0.4 percent to -3.0 percent. [May 16th estimate] (Next update on May 27th)

Newsletter: New Home Sales Increase to 743,000 Annual Rate in April

by Calculated Risk on 5/23/2025 10:59:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales Increase to 743,000 Annual Rate in April

Brief excerpt:

The Census Bureau reported New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 743 thousand. The previous three months were revised down significantly, combined.There is much more in the article.

...

The next graph shows new home sales for 2024 and 2025 by month (Seasonally Adjusted Annual Rate). Sales in April 2025 were up 3.3% from April 2024.

New home sales, seasonally adjusted, have increased year-over-year in 19 of the last 25 months. This is essentially the opposite of what happened with existing home sales that had been down year-over-year for 40 of the last 44 months.

New Home Sales Increase to 743,000 Annual Rate in April

by Calculated Risk on 5/23/2025 10:00:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 743 thousand.

The previous three months were revised down significantly, combined.

Sales of new single-family houses in April 2025 were at a seasonally-adjusted annual rate of 743,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 10.9 percent above the March 2025 rate of 670,000, and is 3.3 percent above the April 2024 rate of 719,000.

emphasis added

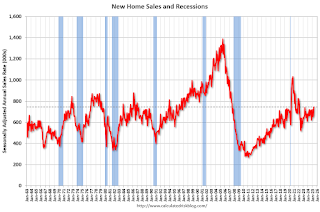

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales were above pre-pandemic levels.

The second graph shows New Home Months of Supply.

The months of supply decreased in April to 8.1 months from 9.1 months in March.

The months of supply decreased in April to 8.1 months from 9.1 months in March. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of April 2025 was 504,000. This is 0.6 percent below the March 2025 estimate of 507,000, and is 8.6 percent above the April 2024 estimate of 464,000.Sales were above expectations of 700 thousand SAAR, however sales for the three previous months were revised down significantly, combined. I'll have more later today.

This represents a supply of 8.1 months at the current sales rate. The months' supply is 11.0 percent below the March 2025 estimate of 9.1 months, and is 5.2 percent above the April 2024 estimate of 7.7 months."