by Calculated Risk on 1/07/2025 08:30:00 AM

Tuesday, January 07, 2025

Trade Deficit increased to $78.2 Billion in November

The Census Bureau and the Bureau of Economic Analysis reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $78.2 billion in November, up $4.6 billion from $73.6 billion in October, revised.

November exports were $273.4 billion, $7.1 billion more than October exports. November imports were $351.6 billion, $11.6 billion more than October imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports and imports increased in November.

Exports are up 6.6% year-over-year; imports are up 9.4% year-over-year.

Both imports and exports have generally increased recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive and have been increasing.

The trade deficit with China increased to $25.0 billion from $21.6 billion a year ago. It is likely some importers are trying to beat potential tariffs.

Monday, January 06, 2025

Tuesday: Trade Deficit, Job Openings, ISM Services

by Calculated Risk on 1/06/2025 08:11:00 PM

The bond market and interest rates have arrived at the first full week of the new year almost exactly where they left off before the X-mas/New Year holiday weeks. ... Although the past 2 weeks have been uneventful for rates, the next 2 weeks will be heavily influenced by incoming economic data. There are several honorable mentions over the next few days before getting to this week's headliner on Friday: the jobs report. [30 year fixed 7.10%]Tuesday:

emphasis added

• At 8:30 AM ET, Trade Balance report for November from the Census Bureau. The consensus is the trade deficit to be $77.5 billion. The U.S. trade deficit was at $73.8 billion in October.

• At 10:00 AM, Job Openings and Labor Turnover Survey for November from the BLS.

• Also at 10:00 AM, the ISM Services Index for December.

Moody's: Retail Vacancy Rate Unchanged in Q4

by Calculated Risk on 1/06/2025 04:55:00 PM

Note: I covered apartments and offices in the newsletter: Moody's: Apartment Vacancy Rate Increased in Q4; Office Vacancy Rate at Record High

From Moody’s Analytics economists: Multifamily Continued to Defy the Supply Shock, Office’s Vacancy Rate Broke Another Record, Retail Rents Drift Higher with Tight Supply, And Industrial Maintains Status Quo

The retail vacancy rate remained stable at 10.3% in Q4, putting a pause to a one-time decline in the previous quarter. Both asking and effective rent enjoyed a slight increase of 0.3%, reaching $21.90 and $19.19/sqft respectively. This steady performance fit in with the backdrop of retail sales exceeding expectations again in the fourth quarter, with October and November witnessing 0.5% and 0.7% growth respectively. Although these gains were primarily driven by purchases of motor vehicles and online merchandise, this surge in consumer spending reflected the resilience of the labor market, robust household finances, accompanied by Federal Reserve interest rate cuts and a slowdown in inflation, which together bolstered consumer confidence.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual).

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Heavy Truck Sales Decreased 10% YoY in December

by Calculated Risk on 1/06/2025 01:55:00 PM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the December 2024 seasonally adjusted annual sales rate (SAAR) of 422 thousand.

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 288 thousand SAAR in May 2020.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Moody's: Apartment Vacancy Rate Increased in Q4; Office Vacancy Rate at Record High

by Calculated Risk on 1/06/2025 11:07:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Moody's: Apartment Vacancy Rate Increased in Q4; Office Vacancy Rate at Record High

A brief excerpt:

From Moody’s Analytics Economists: Multifamily Continued to Defy the Supply Shock, Office’s Vacancy Rate Broke Another Record, Retail Rents Drift Higher with Tight Supply, And Industrial Maintains Status QuoThere is much more in the article.Amid record-level inventory growth, average vacancy rate edged up 10 bps in each of the last two quarters and finished 2024 at 6.1%, 40 bps higher than the same time last year and the highest level on record since 2011.Moody’s Analytics (formerly Reis) reported that the apartment vacancy rate was at 6.1% in Q4 2024, up from an upwardly revised 6.0% in Q3, and up from the pandemic peak of 5.6% in Q1 2021. This is the highest vacancy rate since 2011. Note that asking rents are flat year-over-year.

This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Moody’s Analytics is just for large cities.

Housing Jan 6th Weekly Update: Inventory down 2.4% Week-over-week, Up 27.3% Year-over-year

by Calculated Risk on 1/06/2025 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, January 05, 2025

Sunday Night Futures

by Calculated Risk on 1/05/2025 08:04:00 PM

Weekend:

• Schedule for Week of January 5, 2025

• Question #2 for 2025: How much will job growth slow in 2025? Or will the economy lose jobs?

• Question #1 for 2025: How much will the economy grow in 2025? Will there be a recession in 2025?

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $73.99 per barrel and Brent at $76.46 per barrel. A year ago, WTI was at $74, and Brent was at $78 - so WTI oil prices are unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.03 per gallon. A year ago, prices were at $3.06 per gallon, so gasoline prices are down $0.03 year-over-year.

Question #1 for 2025: How much will the economy grow in 2025? Will there be a recession in 2025?

by Calculated Risk on 1/05/2025 12:39:00 PM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2025. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I posted thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts and predictions for each question.

Here is a review of the Ten Economic Questions for 2024.

1) Economic growth: Economic growth was probably close to 2.8% in 2024 (around 2.6% Q4-over-Q4). The FOMC is expecting growth of 1.8% to 2.2% Q4-over-Q4 in 2025. How much will the economy grow in 2025? Will there be a recession in 2025?

Note: This table includes both annual change and Q4 over the previous Q4 (two slightly different measures). For 2024, I used a 2.6% growth rate Q4 over Q4. (this gives 2.8% real annual growth).

| Real GDP Growth | ||

|---|---|---|

| Year | Annual GDP | Q4 / Q4 |

| 2005 | 3.5% | 3.0% |

| 2006 | 2.8% | 2.6% |

| 2007 | 2.0% | 2.1% |

| 2008 | 0.1% | -2.5% |

| 2009 | -2.6% | 0.1% |

| 2010 | 2.7% | 2.8% |

| 2011 | 1.6% | 1.5% |

| 2012 | 2.3% | 1.6% |

| 2013 | 2.1% | 3.0% |

| 2014 | 2.5% | 2.7% |

| 2015 | 2.9% | 2.1% |

| 2016 | 1.8% | 2.2% |

| 2017 | 2.5% | 3.0% |

| 2018 | 3.0% | 2.1% |

| 2019 | 2.6% | 3.4% |

| 2020 | -2.2% | -1.0% |

| 2021 | 6.1% | 5.7% |

| 2022 | 2.5% | 1.3% |

| 2023 | 2.9% | 3.2% |

| 20241 | 2.8% | 2.6% |

| 1 2024 estimate based on 2.8% Q4 SAAR annualized real growth rate. | ||

• Question #1 for 2025: How much will the economy grow in 2025? Will there be a recession in 2025?

• Question #2 for 2025: How much will job growth slow in 2025? Or will the economy lose jobs?

• Question #3 for 2025: What will the unemployment rate be in December 2025?

• Question #4 for 2025: What will the participation rate be in December 2025?

• Question #5 for 2025: What will the YoY core inflation rate be in December 2025?

• Question #6 for 2025: What will the Fed Funds rate be in December 2025?

• Question #7 for 2025: How much will wages increase in 2025?

• Question #8 for 2025: How much will Residential investment change in 2025? How about housing starts and new home sales in 2025?

• Question #9 for 2025: What will happen with house prices in 2025?

• Question #10 for 2025: Will inventory increase further in 2025?

Question #2 for 2025: How much will job growth slow in 2025? Or will the economy lose jobs?

by Calculated Risk on 1/05/2025 10:27:00 AM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2025. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I posted thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts and predictions for each question.

Here is a review of the Ten Economic Questions for 2024.

2) Employment: Through November 2024, the economy added 2.0 million jobs in 2024. This is down from 3.0 million jobs added in 2023, 4.8 million in 2022, and 7.3 million in 2021 (2021 and 2022 were the two best years ever), but still a solid year for employment gains. How much will job growth slow in 2025? Or will the economy lose jobs?

| Change in Payroll Jobs per Year (000s) | |||

|---|---|---|---|

| Total, Nonfarm | Private | Public | |

| 1997 | 3,406 | 3,211 | 195 |

| 1998 | 3,047 | 2,734 | 313 |

| 1999 | 3,183 | 2,722 | 461 |

| 2000 | 1,937 | 1,673 | 264 |

| 2001 | -1,734 | -2,285 | 551 |

| 2002 | -515 | -748 | 233 |

| 2003 | 125 | 167 | -42 |

| 2004 | 2,039 | 1,892 | 147 |

| 2005 | 2,527 | 2,341 | 186 |

| 2006 | 2,091 | 1,882 | 209 |

| 2007 | 1,145 | 857 | 288 |

| 2008 | -3,548 | -3,728 | 180 |

| 2009 | -5,041 | -4,967 | -74 |

| 2010 | 1,029 | 1,245 | -216 |

| 2011 | 2,066 | 2,378 | -312 |

| 2012 | 2,172 | 2,239 | -67 |

| 2013 | 2,293 | 2,360 | -67 |

| 2014 | 2,999 | 2,872 | 127 |

| 2015 | 2,717 | 2,567 | 150 |

| 2016 | 2,327 | 2,120 | 207 |

| 2017 | 2,111 | 2,031 | 80 |

| 2018 | 2,283 | 2,156 | 127 |

| 2019 | 1,988 | 1,773 | 215 |

| 2020 | -9,274 | -8,224 | -1,050 |

| 2021 | 7,245 | 6,853 | 392 |

| 2022 | 4,528 | 4,229 | 299 |

| 2023 | 3,013 | 2,304 | 709 |

| 2024 | 2,2741 | 1,7841 | 4901 |

| 112 Month Change Ending in November. | |||

The good news is job market still has momentum heading into 2025.

Click on graph for larger image.

Click on graph for larger image.The bad news - for job growth - is that the labor force will grow slowly in 2025!

So, my forecast is for gains of around 1.0 million jobs in 2025. This will probably be the slowest job growth since 2010 (excluding the 2020 pandemic job losses).

• Question #1 for 2025: How much will the economy grow in 2025? Will there be a recession in 2025?

• Question #2 for 2025: How much will job growth slow in 2025? Or will the economy lose jobs?

• Question #3 for 2025: What will the unemployment rate be in December 2025?

• Question #4 for 2025: What will the participation rate be in December 2025?

• Question #5 for 2025: What will the YoY core inflation rate be in December 2025?

• Question #6 for 2025: What will the Fed Funds rate be in December 2025?

• Question #7 for 2025: How much will wages increase in 2025?

• Question #8 for 2025: How much will Residential investment change in 2025? How about housing starts and new home sales in 2025?

• Question #9 for 2025: What will happen with house prices in 2025?

• Question #10 for 2025: Will inventory increase further in 2025?

Saturday, January 04, 2025

Real Estate Newsletter Articles this Week: Case-Shiller Index Up 3.6% year-over-year in October

by Calculated Risk on 1/04/2025 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index Up 3.6% year-over-year in October

• Final Look at Local Housing Markets in November and a Look Ahead to December Sales

• Fannie and Freddie: Single Family and Multi-Family Serious Delinquency Rates Increased in November

• Freddie Mac House Price Index Increased in November; Up 4.0% Year-over-year

• Inflation Adjusted House Prices 1.3% Below 2022 Peak

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of January 5, 2025

by Calculated Risk on 1/04/2025 08:11:00 AM

The key report this week is the December employment report on Friday.

Other key indicators include the November Trade Deficit and November Job Openings.

No major economic releases scheduled.

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $77.5 billion. The U.S. trade deficit was at $73.8 billion in October.

10:00 AM ET: Job Openings and Labor Turnover Survey for November from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for November from the BLS. This graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in October to 7.74 million from 7.37 million in September.

10:00 AM: the ISM Services Index for December.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release two weeks of results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 143,000, down from 146,000 jobs added in November.

The US NYSE and the NASDAQ will be closed in observance of a National Day of Mourning for former President Jimmy Carter.

6:00 AM: NFIB Small Business Optimism Index for December.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 210 thousand from 211 thousand last week.

8:30 AM: Employment Report for December. The consensus is for 160,000 jobs added, and for the unemployment rate to be unchanged at 4.2%.

8:30 AM: Employment Report for December. The consensus is for 160,000 jobs added, and for the unemployment rate to be unchanged at 4.2%.There were 227,000 jobs added in November, and the unemployment rate was at 4.2%.

This graph shows the jobs added per month since January 2021.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for January)

Friday, January 03, 2025

January 3rd COVID Update: COVID in Wastewater Increasing

by Calculated Risk on 1/03/2025 09:11:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 432 | 464 | ≤3501 | |

| 1my goals to stop weekly posts. 🚩 Increasing number weekly for Deaths. ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported for the last 2 years.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Vehicles Sales Increase to 16.80 million SAAR in December

by Calculated Risk on 1/03/2025 06:18:00 PM

Wards Auto released their estimate of light vehicle sales for December: U.S. Light-Vehicle Sales End 2024 With Long-Time High December, Q4 SAARs (pay site).

December’s 6% year-over-year rise in the daily selling rate capped off a fourth quarter rebound after demand dropped in Q2 and Q3. The return to growth was aided by rising inventory, increased retail incentives and lower interest rates, while pull-ahead volume of electric vehicles from expectations of cuts in government incentives could have played a part. Also, improved consumer confidence in October and November likely helped, while a sudden downturn in confidence in December – as well as an above-normal drain to inventory during the month - might explain some reported softening in demand at the end of the period compared with pre-holiday trajectories.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards' estimate for December (red).

Sales in December were above the consensus forecast.

This was the best December since 2019.

Q4 GDP Tracking: around 2.4%

by Calculated Risk on 1/03/2025 02:01:00 PM

From Goldman:

We left our Q4 GDP tracking estimate unchanged at +2.3% (quarter-over-quarter annualized) and our Q4 domestic final sales forecast unchanged at +2.3%. [Jan 2nd estimate]And from the Atlanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2024 is 2.4 percent on January 3, down from 2.6 percent on January 2. After this morning’s Manufacturing ISM Report on Business from the Institute for Supply Management, the nowcasts of fourth-quarter real personal consumption expenditures growth and fourth-quarter real gross private domestic investment growth decreased from 3.2 percent and -0.7 percent, respectively, to 3.0 percent and -0.9 percent. [Jan 3rd estimate]

Inflation Adjusted House Prices 1.3% Below 2022 Peak; Price-to-rent index is 8.1% below 2022 peak

by Calculated Risk on 1/03/2025 10:37:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 1.3% Below 2022 Peak

Excerpt:

It has been over 18 years since the housing bubble peak. In the October Case-Shiller house price index released earlier this week, the seasonally adjusted National Index (SA), was reported as being 76% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 11% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 3% above the bubble peak.There is much more in the article!

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $300,000 in January 2010, the price would be $435,000 today adjusted for inflation (45% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.

...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI).

In real terms (using CPI), the National index is 1.3% below the recent peak, and the Composite 20 index is 1.5% below the recent peak in 2022. The real National index and the Composite 20 index increased slightly in real terms in October.

It has now been 29 months since the real peak in house prices. Typically, after a sharp increase in prices, it takes a number of years for real prices to reach new highs (see House Prices: 7 Years in Purgatory)

ISM® Manufacturing index Increased to 49.3% in December

by Calculated Risk on 1/03/2025 10:00:00 AM

(Posted with permission). The ISM manufacturing index indicated contraction. The PMI® was at 49.3% in December, up from 48.4% in November. The employment index was at 45.3%, down from 48.1% the previous month, and the new orders index was at 52.5%, up from 50.4%.

From ISM: Manufacturing PMI® at 49.3% December 2024 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in December for the ninth consecutive month and the 25th time in the last 26 months, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing contracted in December. This was above the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The Manufacturing PMI® registered 49.3 percent in December, 0.9 percentage point higher compared to the 48.4 percent recorded in November. The overall economy continued in expansion for the 56th month after one month of contraction in April 2020. (A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index continued in expansion territory for the second month after seven months of contraction, strengthening to 52.5 percent, 2.1 percentage points higher than the 50.4 percent recorded in November. The December reading of the Production Index (50.3 percent) is 3.5 percentage points higher than November’s figure of 46.8 percent. The index returned to expansion after six months in contraction. The Prices Index continued in expansion (or ‘increasing’) territory, registering 52.5 percent, up 2.2 percentage points compared to the reading of 50.3 percent in November. The Backlog of Orders Index registered 45.9 percent, up 4.1 percentage points compared to the 41.8 percent recorded in November. The Employment Index registered 45.3 percent, down 2.8 percentage points from November’s figure of 48.1 percent.

emphasis added

Thursday, January 02, 2025

Friday: ISM Mfg, Vehicle Sales

by Calculated Risk on 1/02/2025 07:21:00 PM

Friday:

• At 10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 48.3, down from 48.4 in November.

All day: Light vehicle sales for December. The Wards forecast is for 16.7 million SAAR in December, up from the BEA estimate of 16.50 million SAAR in November (Seasonally Adjusted Annual Rate).

Freddie Mac House Price Index Increased in November; Up 4.0% Year-over-year

by Calculated Risk on 1/02/2025 12:43:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased in November; Up 4.0% Year-over-year

A brief excerpt:

Freddie Mac reported that its “National” Home Price Index (FMHPI) increased 0.56% month-over-month on a seasonally adjusted (SA) basis in November. On a year-over-year basis, the National FMHPI was up 4.0% in November, up from up 3.9% YoY in October. The YoY increase peaked at 19.1% in July 2021, and for this cycle, bottomed at up 0.9% YoY in May 2023. ...There is much more in the article!

For cities (Core-based Statistical Areas, CBSA), here are the 35 cities with the largest declines from the peak, seasonally adjusted. Austin continues to be the worst performing city. However, 15 of the 30 cities with the largest price declines are in Florida!

Construction Spending Mostly Unchanged in November

by Calculated Risk on 1/02/2025 10:00:00 AM

From the Census Bureau reported that overall construction spending increased:

Construction spending during November 2024 was estimated at a seasonally adjusted annual rate of $2,152.6 billion, virtually unchanged from the revised October estimate of $2,152.3 billion. The November figure is 3.0 percent above the November 2023 estimate of $2,090.7 billion.Private spending increased and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,650.7 billion, 0.1 percent above the revised October estimate of $1,649.8 billion. ...

In November, the estimated seasonally adjusted annual rate of public construction spending was $501.9 billion, 0.1 percent below the revised October estimate of $502.5 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 7.6% below the peak in 2022.

Non-residential (blue) spending is 0.4% below the peak in June 2024.

Public construction spending is 0.2% below the peak in September 2024.

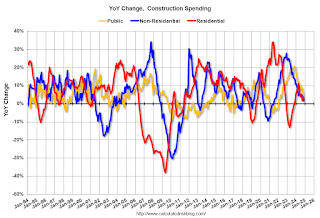

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 3.1%. Non-residential spending is up 1.7% year-over-year. Public spending is up 4.6% year-over-year.

Weekly Initial Unemployment Claims Decrease to 211,000

by Calculated Risk on 1/02/2025 08:30:00 AM

The DOL reported:

In the week ending December 28, the advance figure for seasonally adjusted initial claims was 211,000, a decrease of 9,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 219,000 to 220,000. The 4-week moving average was 223,250, a decrease of 3,500 from the previous week's revised average. The previous week's average was revised up by 250 from 226,500 to 226,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 223,250.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |