by Calculated Risk on 6/07/2024 12:36:00 PM

Friday, June 07, 2024

Fed's Flow of Funds: Household Net Worth Increased $5.1 Trillion in Q1

The Federal Reserve released the Q1 2024 Flow of Funds report today: Financial Accounts of the United States.

The net worth of households and nonprofits rose to $160.8 trillion during the first quarter of 2024. The value of directly and indirectly held corporate equities increased $3.8 trillion and the value of real estate increased $0.9 trillion.

...

Household debt increased 2.9 percent at an annual rate in the first quarter of 2024. Consumer credit grew at an annual rate of 1.8 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 2.1 percent.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP.

The second graph shows homeowner percent equity since 1952.

The second graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q1 2024, household percent equity (of household real estate) was at 73.8% - up from 73.4% in Q4, 2023. This is close to the highest percent equity since the 1960s.

Note: This includes households with no mortgage debt.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $38 billion in Q1.

Mortgage debt is up $2.38 trillion from the peak during the housing bubble, but, as a percent of GDP is at 46.3% - down from Q4 - and down from a peak of 73.3% of GDP during the housing bust.

The value of real estate, as a percent of GDP, increased in Q1 - but is below the peak in Q2 2022, and is well above the average of the last 30 years.

Q2 GDP Tracking: 1.6% to 3.1%

by Calculated Risk on 6/07/2024 12:15:00 PM

From BofA:

Since last week,1Q GDP tracking is up from 1.3% q/q saar to 1.6% q/q saar and 2Q GDP tracking is down two-tenths to 1.6%. [June 7th estimate]From Goldman:

emphasis added

Wholesale inventories increased somewhat below consensus expectations and the preliminary report. We lowered our Q2 GDP tracking estimate to +2.1% (qoq ar), reflecting weaker details in yesterday’s trade report. Our domestic final sales estimate remains at +2.0% (qoq ar). [June 7th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2024 is 3.1 percent on June 7, up from 2.6 percent on June 6. After this morning’s employment situation release from the US Bureau of Labor Statistics and this morning's wholesale trade report from the US Census Bureau, the nowcasts of second-quarter real personal consumption expenditures growth and second-quarter real gross private domestic investment growth increased from 2.4 percent and 5.8 percent, respectively, to 2.8 percent and 7.7 percent. [June 7th estimate]

Comments on May Employment Report

by Calculated Risk on 6/07/2024 09:08:00 AM

The headline jobs number in the May employment report was well above expectations, however March and April payrolls were revised down by 15,000 combined. The participation rate and employment population ratio decreased, and the unemployment rate increased to 4.0%.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 years old participation rate increased in May to 83.6% from 83.5% in April, and the 25 to 54 employment population ratio was unchanged at 80.8% from 80.8% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.1% YoY in May.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in May. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in May to 4.42 million from 4.47 million in April. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 7.4% from 7.4% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.350 million workers who have been unemployed for more than 26 weeks and still want a job, up from 1.250 million the previous month.

This is slightly above pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 41 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline jobs number in the April employment report was well above expectations, however, March and April payrolls were revised down by 15,000 combined. The participation rate and the employment population ratio decreased, and the unemployment rate increased to 4.0%. Another strong report.

May Employment Report: 272 thousand Jobs, 4.0% Unemployment Rate

by Calculated Risk on 6/07/2024 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 272,000 in May, and the unemployment rate changed little at 4.0 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in several industries, led by health care; government; leisure and hospitality; and professional, scientific, and technical services.

...

The change in total nonfarm payroll employment for March was revised down by 5,000, from +315,000 to +310,000, and the change for April was revised down by 10,000, from +175,000 to +165,000. With these revisions, employment in March and April combined is 15,000 lower than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the jobs added per month since January 2021.

Payrolls for March and April were revised down 15 thousand, combined.

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In May, the year-over-year change was 2.76 million jobs. Employment was up solidly year-over-year.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 62.5% in May, from 62.7% in April. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate decreased to 62.5% in May, from 62.7% in April. This is the percentage of the working age population in the labor force. The Employment-Population ratio decreased to 60.1% from 60.2% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased to 4.0% in May from 3.9% in April.

This was well above consensus expectations; however, March and April payrolls were revised down by 15,000 combined.

Thursday, June 06, 2024

Friday: Employment Report, Q1 Flow of Funds

by Calculated Risk on 6/06/2024 07:47:00 PM

Friday:

• At 8:30 8:30 AM ET, Employment Report for May. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.

12:00 PM: Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

May Employment Preview

by Calculated Risk on 6/06/2024 04:01:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for May. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.

There were 175,000 jobs added in April, and the unemployment rate was at 3.9%.

From Goldman Sachs economist Spencer Hill

We estimate nonfarm payrolls rose by 160k in May, somewhat below consensus ... We estimate that the unemployment rate was unchanged on a rounded basis at 3.9%.From BofA:

emphasis added

The May employment report is likely to show a healthy but better-balanced labor market. Nonfarm payrolls likely rose by 200k ...Strong hiring is likely to result in the unemployment rate edging down a tenth to 3.8%, and wage growth will likely remain at 3.9% y/y.• ADP Report: The ADP employment report showed 152,000 private sector jobs were added in May. This was below consensus forecasts and suggests job gains slightly below consensus expectations, however, in general, ADP hasn't been very useful in forecasting the BLS report.

• ISM Surveys: Note that the ISM indexes are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased to 51.1%, up from 48.6% the previous month. This would suggest about 15,000 jobs lost in manufacturing. The ADP report indicated 20,000 manufacturing jobs lost in May.

The ISM® services employment index increased to 47.1%, from 45.9%. This would suggest few jobs added in the service sector. Combined this suggests few jobs added in May, far below consensus expectations.

• Unemployment Claims: The weekly claims report showed about the same number of initial unemployment claims during the reference week at 216,000 in May compared to 212,000 in April. This suggests a similar number of layoffs in May compared to April.

1st Look at Local Housing Markets in May

by Calculated Risk on 6/06/2024 01:34:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in May

A brief excerpt:

NOTE: The tables for active listings, new listings and closed sales all include a comparison to May 2019 for each local market (some 2019 data is not available).There is much more in the article.

This is the first look at several early reporting local markets in May. I’m tracking over 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in May were mostly for contracts signed in March and April when 30-year mortgage rates averaged 6.82% and 6.99%, respectively (Freddie Mac PMMS). This is down from the 7%+ mortgage rates in the August through November period (although rates are now back above 7% again).

...

In May, sales in these markets were up 3.3% YoY. Last month, in April, these same markets were up 8.2% year-over-year Not Seasonally Adjusted (NSA).

Sales in all of these markets are down compared to May 2019.

...

This is a year-over-year increase NSA for these early reporting markets. There were the same number of working days in May 2024 compared to May 2023, so the year-over-year change in the seasonally adjusted sales will be about the same as the NSA data suggests.

...

This was just a few early reporting markets. Many more local markets to come!

Realtor.com Reports Active Inventory Up 35.5% YoY

by Calculated Risk on 6/06/2024 11:41:00 AM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For April, Realtor.com reported inventory was up 35.2% YoY, but still down almost 34% compared to April 2017 to 2019 levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending June 1, 2024

• Active inventory increased, with for-sale homes 35.5% above year-ago levels

For the 30th straight week, there were more homes listed for sale versus the prior year, giving homebuyers more options. This past week, the inventory of homes for sale grew by 35.5% compared with last year. This growth in inventory is primarily driven by housing markets in the South, which saw a 47.2% year-over-year increase in inventory in May.

• New listings—a measure of sellers putting homes up for sale—were up this week, by 2.1% from one year ago

Seller activity continued to climb annually last week but decelerated relative to the previous week’s growth. Newly listed homes grew by 2.1% compared with a year ago, a slowdown from the 3.6% growth rate in the previous week.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 30th consecutive week.

Trade Deficit Increased to $74.6 Billion in April

by Calculated Risk on 6/06/2024 08:46:00 AM

The Census Bureau and the Bureau of Economic Analysis reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $74.6 billion in April, up $6.0 billion from $68.6 billion in March, revised.

April exports were $263.7 billion, $2.1 billion more than March exports. April imports were $338.2 billion, $8.0 billion more than March imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports imports increased in April.

Exports are up 5.1% year-over-year; imports are up 4.5% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and then bounced back - imports and exports have generally increased recently.

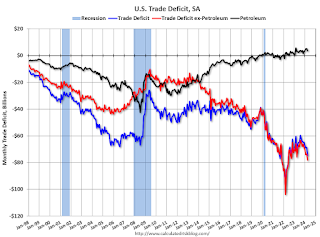

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive and have been increasing.

The trade deficit with China increased to $20.1 billion from $20.0 billion a year ago.

Weekly Initial Unemployment Claims Increase to 229,000

by Calculated Risk on 6/06/2024 08:30:00 AM

The DOL reported:

In the week ending June 1, the advance figure for seasonally adjusted initial claims was 229,000, an increase of 8,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 219,000 to 221,000. The 4-week moving average was 222,250, a decrease of 750 from the previous week's revised average. The previous week's average was revised up by 500 from 222,500 to 223,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 222,250.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.

Wednesday, June 05, 2024

Thursday: Trade Deficit, Unemployment Claims

by Calculated Risk on 6/05/2024 07:01:00 PM

Thursday:

• At 8:30 AM ET, Trade Balance report for April from the Census Bureau. The consensus is the trade deficit to be $69.7 billion. The U.S. trade deficit was at $69.4 Billion in March.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, down from 219 thousand last week.

Update: Lumber Prices Down Slightly YoY

by Calculated Risk on 6/05/2024 01:01:00 PM

SPECIAL NOTE: The CME group discontinued the Random Length Lumber Futures contract on May 16, 2023. I've now switched to a new physically-delivered Lumber Futures contract that was started in August 2022.

This graph shows CME random length framing futures through last August (blue), and the new physically-delivered Lumber Futures (LBR) contract starting in August 2022 (Red).

ISM® Services Index Increases to 53.8% in May

by Calculated Risk on 6/05/2024 10:00:00 AM

(Posted with permission). The ISM® Services index was at 53.8%, up from 49.4% last month. The employment index increased to 47.1%, from 45.9%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 53.8% May 2024 Services ISM® Report On Business®

Economic activity in the services sector grew in May after contracting in April for the first time since December 2022, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®. The Services PMI® registered 53.8 percent, indicating sector expansion for the 46th time in 48 months.The PMI was above expectations.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In May, the Services PMI® registered 53.8 percent, 4.4 percentage points higher than April’s reading of 49.4 percent. The contraction in April ended a string of 15 months of services sector growth following a composite index reading of 49 percent in December 2022; the last contraction before that was in May 2020 (45.4 percent). The Business Activity Index registered 61.2 percent in May, which is 10.3 percentage points higher than the 50.9 percent recorded in April. The New Orders Index expanded in May for the 17th consecutive month after contracting in December 2022 for the first time since May 2020; the figure of 54.1 percent is 1.9 percentage points higher than the April reading of 52.2 percent. The Employment Index contracted for the fifth time in six months, though at a slower rate in May with a reading of 47.1 percent, a 1.2-percentage point increase compared to the 45.9 percent recorded in April.

emphasis added

ADP: Private Employment Increased 152,000 in May

by Calculated Risk on 6/05/2024 08:15:00 AM

Private sector employment increased by 152,000 jobs in May and annual pay was up 5.0 percent year-over-year, according to the May, according to the April ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”). ...This was below the consensus forecast of 174,000. The BLS report will be released Friday, and the consensus is for 180,000 non-farm payroll jobs added in May.

“Job gains and pay growth are slowing going into the second half of the year,” said Nela Richardson, chief economist, ADP. “The labor market is solid, but we're monitoring notable pockets of weakness tied to both producers and consumers.”

emphasis added

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 6/05/2024 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending May 31, 2024. This week’s results include an adjustment for the Memorial Day holiday.

The Market Composite Index, a measure of mortgage loan application volume, decreased 5.2 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 16 percent compared with the previous week. The Refinance Index decreased 7 percent from the previous week and was 5 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 16 percent compared with the previous week and was 13 percent lower than the same week one year ago.

“Mortgage rates moved slightly higher last week, with the 30-year conforming rate reaching 7.07 percent – its highest level since early May – despite incoming data indicating somewhat slower economic growth,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “After adjusting for the Memorial Day holiday, both purchase and refinance application volumes were down, with purchase activity specifically 13 percent below last year’s level.”

Added Fratantoni, “Government purchase volume was down less, helped by growth in VA applications. The market is relying on first-time homebuyer demand, and many first-time buyers do use government lending programs.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) increased to 7.07 percent from 7.05 percent, with points increasing to 0.65 from 0.63 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 13% year-over-year unadjusted.

Tuesday, June 04, 2024

Wednesday: ADP Employment, ISM Services

by Calculated Risk on 6/04/2024 08:18:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 174,000 payroll jobs added in May, down from 192,000 in April.

• At 10:00 AM, the ISM Services Index for May. The consensus is for a reading of 50.5, up from 59.4.

Heavy Truck Sales Unchanged in May

by Calculated Risk on 6/04/2024 02:13:00 PM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the May 2024 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

Asking Rents Mostly Unchanged Year-over-year

by Calculated Risk on 6/04/2024 10:39:00 AM

Today, in the Real Estate Newsletter: Asking Rents Mostly Unchanged Year-over-year

Brief excerpt:

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand). Now that household formation has slowed, and multi-family completions have increased, rents are under pressure.There is much more in the article.

From ApartmentList.com: Apartment List National Rent Report

The national median rent increased by 0.5% in May and now stands at $1,404, but the pace of growth slowed slightly this month. This is typically the time of year when rent growth is accelerating amid the busy moving season, so sluggish growth this month indicates that the market is headed for another slow summer.CoreLogic: “Attached Single-Family Rental Prices Post First Annual Decrease in 14 Years”

Since the second half of 2022, seasonal declines have been steeper than usual and seasonal increases have been more mild. As a result, apartments are on average slightly cheaper today than they were one year ago. Year-over-year rent growth nationally currently stands at -0.8 percent and has now been in negative territory since last summer.U.S. single-family rent growth continued to slowly increase year over year in March to 3.4%.

After registering a 2.9% annual gain in February, attached rental appreciation lost ground in March, posting a -0.6% loss.

BLS: Job Openings Decreased to 8.1 million in April

by Calculated Risk on 6/04/2024 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings changed little at 8.1 million on the last business day of April, the U.S. Bureau of Labor Statistics reported today. Over the month, both the number of hires and total separations were little changed at 5.6 million and 5.4 million, respectively. Within separations, quits (3.5 million) and layoffs and discharges (1.5 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for April; the employment report this Friday will be for May.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings decreased in April to 8.06 million from 8.36 million in March.

The number of job openings (black) were down 19% year-over-year.

Quits were down 3% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

CoreLogic: US Home Prices Increased 5.3% Year-over-year in April

by Calculated Risk on 6/04/2024 08:00:00 AM

Notes: This CoreLogic House Price Index report is for April. The recent Case-Shiller index release was for March. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic: Monthly US Home Price Gains Dip Below Seasonal Average in April

• U.S. year-over-year single-family home price appreciation was 5.3% in April, the same as in March.This was the same YoY increase as reported for March, and down from the 5.8% YoY increase reported at the beginning of 2024.

• All states posted annual appreciation in March, led by New Hampshire (12%), New Jersey (11%) and South Dakota (10.8%).

• Of the 10 tracked major U.S. metro areas, San Diego (9.9%) overtook Miami (9.7%) for the top spot.

...

Annual U.S. home price appreciation remained above 5% in April, with three states posting double-digit gains. By next spring, national price gains are projected to slow to 3.4%, with only a few states putting up increases of higher than 6%. This slow cooling reflects not only the increasing number of homes on the market in some parts of the country, but also elevated, 30-year, fixed-rate mortgages, which remain around 7%, a major factor influencing America’s continuing housing affordability challenges.

“Home price growth continues to slow, as a comparison with a strong 2023 spring is still impacting year-over-year differences,” said Dr. Selma Hepp, chief economist for CoreLogic. “Nevertheless, the April uptick in mortgage rates to this year’s high has cooled some of the typical spring homebuyer demand, which pulled monthly gains of 1.1% below the March-to-April average.”

“The home price slowing also highlights buyers’ increased sensitivity to rising interest rates, as well as the anticipation that presumed lower rates down the road will help ease the affordability crunch,” Hepp continued. “Also, the price cooling is more pronounced in markets where there has been an influx of inventory and/or new construction, as well as those where additional homeownership costs (such as insurance, taxes and HOA fees) have risen relatively faster.”

emphasis added