by Calculated Risk on 12/17/2020 03:16:00 PM

Thursday, December 17, 2020

Comments on November Housing Starts

Earlier: Housing Starts increased to 1.547 Million Annual Rate in November

Total housing starts in November were slightly above expectations, however starts in September and October were revised down, combined. The single family sectors has increased sharply, but the volatile multi-family sector is down year-over-year (apartments are under pressure from COVID).

The housing starts report showed starts were up 1.2% in November compared to October, and starts were up 12.8% year-over-year compared to November 2019.

Single family starts were up 27% year-over-year. Low mortgage rates and limited existing home inventory have given a boost to single family housing starts.

The first graph shows the month to month comparison for total starts between 2019 (blue) and 2020 (red).

Click on graph for larger image.

Click on graph for larger image.Starts were up 12.8% in November compared to November 2019.

Last year, in 2019, starts picked up at the end of the year - and were strong in early 2020 - so the comparison next month will be more difficult. Don't be surprised if starts are down year-over-year sometime over the next few months.

Starts, year-to-date, are up 7.0% compared to the same period in 2019. This is close to my forecast for 2020, although I didn't expect a pandemic!

I expect starts to remain solid, but the growth rate will slow.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions. The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - then mostly moved sideways. Completions (red line) had lagged behind - then completions caught up with starts- then starts picked up a little again late last year, but have fallen off the pandemic.

The last graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The last graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Single family starts are getting back to more normal levels, and I expect some further increases in single family starts and completions on rolling 12 month basis.

CAR on California November Housing: Sales up 26% YoY, Active Listings down 47% YoY

by Calculated Risk on 12/17/2020 01:32:00 PM

The CAR reported: Low rates, flexibility to work from home drive California home-buying interest to levels not seen since the last decade, C.A.R. reports

efying an otherwise struggling economy, California home sales remained red hot in November, breaking the 500,000 sales benchmark for the first time since January 2009 and reaching the highest level in 15 years, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.CR Note: Existing home sales are reported when the transaction closes, so this was mostly for contracts signed in September and October.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 508,820 units in November, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2020 if sales maintained the November pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

November sales rose 5.0 percent from 484,510 in October and were up 26.3 percent from a year ago, when 402,880 homes were sold on an annualized basis. The year-over-year, double-digit sales gain was the fourth consecutive and the largest yearly gain since May 2009.

...

On a year-to-date basis, sales in the Central Coast region has already surpassed 2019’s level by 4.3 percent, while Southern California (-0.7 percent), the San Francisco Bay Area (-1.2 percent), the Central Valley (-1.5 percent) and the Far North (-2.6 percent) continued to trail slightly behind last year’s level.

...

With a resurgence in COVID-19 cases in recent weeks and the market entering the traditional holiday season, active listings declined from the prior month as expected, contributing to a substantial decline in inventory. Active listings fell 46.6 percent from last year and continued to drop more than 40 percent on a year-over-year basis for the sixth straight month. The Unsold Inventory Index (UII) fell sharply from 3.1 months in November 2019 to 1.9 months this November. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales.

emphasis added

Hotels: Occupancy Rate Declined 37.4% Year-over-year

by Calculated Risk on 12/17/2020 11:18:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 12 December

U.S. weekly hotel occupancy remained relatively flat from the previous week, according to the latest data from STR through 12 December.Since there is a seasonal pattern to the occupancy rate - see graph below - we can track the year-over-year change in occupancy to look for any improvement. This table shows the year-over-year change since the week ending Sept 19, 2020:

6-12 December 2020 (percentage change from comparable week in 2019):

• Occupancy: 37.8% (-37.4%)

• Average daily rate (ADR): US$85.88 (-31.7%)

• Revenue per available room (RevPAR): US$32.49 (-57.3%)

emphasis added

| Week Ending | YoY Change, Occupancy Rate |

|---|---|

| 9/19 | -31.9% |

| 9/26 | -31.5% |

| 10/3 | -29.6% |

| 10/10 | -29.2% |

| 10/17 | -30.7% |

| 10/24 | -31.7% |

| 10/31 | -29.0% |

| 11/7 | -35.9% |

| 11/14 | -32.7% |

| 11/21 | -32.6% |

| 11/28 | -28.5% |

| 12/5 | -37.9% |

| 12/12 | -37.4% |

This suggests no improvement over the last 3 months.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Seasonally we'd expect the occupancy rate to decline into the new year.

Note: Y-axis doesn't start at zero to better show the seasonal change.

Philly Fed Manufacturing "growth was less widespread" in December, Kansas City Fed "Activity Expanded Further"

by Calculated Risk on 12/17/2020 11:05:00 AM

From the Philly Fed: December 2020 Manufacturing Business Outlook Survey

Manufacturing activity in the region continued to grow, but growth was less widespread, according to firms responding to the December Manufacturing Business Outlook Survey. The survey’s current indicators for general activity, new orders, and shipments remained positive for the seventh consecutive month but fell notably from their readings in November. Some future indexes also moderated this month but continue to indicate that firms expect growth over the next six months.This was lower than the consensus forecast.

The diffusion index for current activity fell 15 points to 11.1 in December, its lowest positive reading following its fall to long-term lows in April and May... On balance, fewer firms reported increases in manufacturing employment this month. The current employment index has remained positive for six consecutive months but decreased 19 points to 8.5 in December.

emphasis added

And from the Kansas City Fed: Tenth District Manufacturing Activity Expanded Further

The Federal Reserve Bank of Kansas City released the December Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded further in December. Manufacturing activity was still below year ago levels, but expectations for future activity were positive.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

“Regional factories reported another month of solid growth, but activity continues to lag preCOVID levels,” said Wilkerson. “The recent wave of COVID-19 has negatively affected manufacturers, but many firms still indicated significant capital spending plans for the coming year.”

...

The month-over-month composite index was 14 in December, up from 11 in November and 13 in October

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (blue, through December), and five Fed surveys are averaged (yellow, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

These early reports suggest the ISM manufacturing index will show expansion in December, but will likely decrease from the November level.

Weekly Initial Unemployment Claims increased to 885,000

by Calculated Risk on 12/17/2020 08:48:00 AM

The DOL reported:

In the week ending December 12, the advance figure for seasonally adjusted initial claims was 885,000, an increase of 23,000 from the previous week's revised level. The previous week's level was revised up by 9,000 from 853,000 to 862,000. The 4-week moving average was 812,500, an increase of 34,250 from the previous week's revised average. The previous week's average was revised up by 2,250 from 776,000 to 778,250.This does not include the 455,037 initial claims for Pandemic Unemployment Assistance (PUA) that was up from 415,037 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 812,500.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 5,508,000 (SA) from 5,781,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 9,244,556 receiving Pandemic Unemployment Assistance (PUA) that increased from 8,555,763 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

This was much higher than expected, and this was for the BLS reference week for the December employment report.

Housing Starts increased to 1.547 Million Annual Rate in November

by Calculated Risk on 12/17/2020 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in November were at a seasonally adjusted annual rate of 1,547,000. This is 1.2 percent above the revised October estimate of 1,528,000 and is 12.8 percent above the November 2019 rate of 1,371,000. Single-family housing starts in November were at a rate of 1,186,000; this is 0.4 percent above the revised October figure of 1,181,000. The November rate for units in buildings with five units or more was 352,000.

Building Permits:

Privately-owned housing units authorized by building permits in November were at a seasonally adjusted annual rate of 1,639,000. This is 6.2 percent above the revised October rate of 1,544,000 and is 8.5 percent above the November 2019 rate of 1,510,000. Single-family authorizations in November were at a rate of 1,143,000; this is 1.3 percent above the revised October figure of 1,128,000. Authorizations of units in buildings with five units or more were at a rate of 441,000 in November.

emphasis added

Click on graph for larger image.

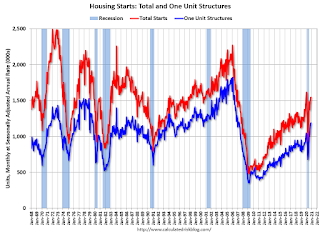

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased slightly in November compared to October. Multi-family starts were down 18% year-over-year in November.

Single-family starts (blue) increased in November, and were up 27% year-over-year. This is the highest level for single family starts since 2007.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in November were slightly above expectations, however starts in September and October were revised down, combined.

I'll have more later …

Wednesday, December 16, 2020

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 12/16/2020 09:16:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 815,000 initial claims, down from 853,000 last week.

• Also at 8:30 AM, Housing Starts for November. The consensus is for 1.530 million SAAR, unchanged from 1.530 million SAAR.

• Also at 8:30 AM, the Philly Fed manufacturing survey for December. The consensus is for a reading of 19.0, down from 26.3.

• At 11:00 AM, the Kansas City Fed manufacturing survey for December.

December 16 COVID-19 Test Results; Record 7-Day Deaths, Hospitalizations

by Calculated Risk on 12/16/2020 07:10:00 PM

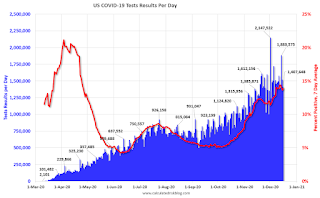

The US is now averaging well over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,407,648 test results reported over the last 24 hours.

There were 230,728 positive tests.

Over 39,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 16.4% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

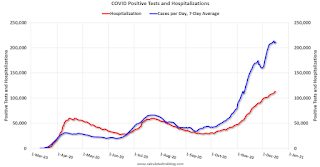

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations (Over 113,000)

• Record 7 Day Average Deaths

FOMC Projections and Press Conference

by Calculated Risk on 12/16/2020 02:08:00 PM

Statement here.

Fed Chair Powell press conference video here starting at 2:30 PM ET.

Here are the projections.

Note that GDP decreased at a 5.0% annual rate in Q1, decreased at a 31.4% annual rate in Q2, and increased at 33.1% annual rate in Q3. This leaves real GDP down 3.5% from Q4 2019.

Wall Street forecasts are for GDP to increase at a 5% to 6% annual rate in Q4. These forecasts would put the economy down around 2.1% to 2.3% Q4-over-Q4. The FOMC revised up their GDP projections for 2020, 2021 and 2022.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Dec 2020 | -2.5 to -2.2 | 3.7 to 5.0 | 3.0 to 3.5 | 2.2 to 2.7 |

| Sept 2020 | -4.0 to -3.0 | 3.6 to 4.7 | 2.5 to 3.3 | 2.4 to 3.0 |

The unemployment rate was at 6.7% in November, down from 6.9% in October, and might decrease more in December. This will put the unemployment rate for Q4 below the lower end of the September projections.

The unemployment rate was revised down for all years.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Dec 2020 | 6.7 to 6.8 | 4.7 to 5.4 | 3.8 to 4.6 | 3.5 to 4.3 |

| Sept 2020 | 7.0 to 8.0 | 5.0 to 6.2 | 4.0 to 5.0 | 3.5 to 4.4 |

As of October 2020, PCE inflation was up 1.2% from October 2019. The projections for inflation were revised up slightly.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Dec 2020 | 1.2 | 1.7 to 1.9 | 1.8 to 2.0 | 1.9 to 2.1 |

| Sept 2020 | 1.1 to 1.3 | 1.6 to 1.9 | 1.7 to 1.9 | 1.9 to 2.0 |

PCE core inflation was up 1.4% in October year-over-year. Projections for core inflation were revised up slightly.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Dec 2020 | 1.4 | 1.7 to 1.8 | 1.8 to 2.0 | 1.9 to 2.1 |

| Sept 2020 | 1.3 to 1.5 | 1.6 to 1.8 | 1.7 to 1.9 | 1.9 to 2.0 |

FOMC Statement: No Change

by Calculated Risk on 12/16/2020 02:02:00 PM

Fed Chair Powell press conference video here starting at 2:30 PM ET.

FOMC Statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world. Economic activity and employment have continued to recover but remain well below their levels at the beginning of the year. Weaker demand and earlier declines in oil prices have been holding down consumer price inflation. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus. The ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee's maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Patrick Harker; Robert S. Kaplan; Neel Kashkari; Loretta J. Mester; and Randal K. Quarles.

emphasis added

AIA: "Architecture billings lose ground in November"

by Calculated Risk on 12/16/2020 10:59:00 AM

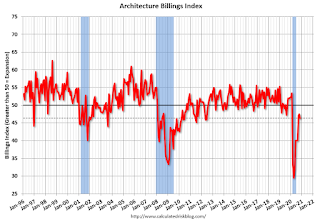

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture billings lose ground in November

Architecture firm billing activity is contracting once again after two months of a slowing decline, according to a new report from the American Institute of Architects (AIA).

The pace of decline during November accelerated from October, posting an Architecture Billings Index (ABI) score of 46.3 from 47.5 (any score below 50 indicates a decline in firm billings). The pace of inquiries into new projects slowed, but remained positive with a score of 52.0, however the value of new design contracts dipped back into negative territory with a score 48.6.

“In previous design cycles, we typically haven’t seen a straight line back to growth after a downturn hits,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “The path to recovery is shaping up to be bumpier than we hoped for. While there are pockets of optimism in design services demand, the overall construction landscape remains depressed.”

...

• Regional averages: Midwest (50.1); West (48.3); South (46.7); Northeast (38.7)

• Sector index breakdown: multi-family residential (52.2); mixed practice (49.5); commercial/industrial (47.5); institutional (41.9)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 46.3 in November, down from 47.5 in October. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has been below 50 for nine consecutive months. This represents a significant decrease in design services, and suggests a decline in CRE investment through most of 2021 (This usually leads CRE investment by 9 to 12 months).

This weakness is not surprising since certain segments of CRE are struggling, especially offices and retail.

NAHB: Builder Confidence Decreased to 86 in December

by Calculated Risk on 12/16/2020 10:04:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 86, down from 90 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Down from Record High, Still Strong

Ending a string of three successive months of record highs, builder confidence in the market for newly built single-family homes fell four points to 86 in December, according to the latest NAHB/Wells Fargo Housing Market Index (HMI) released today. Despite the decline, this is still the second-highest reading in the history of the series after last month’s mark of 90.

“Housing demand is strong entering 2021, however the coming year will see housing affordability challenges as inventory remains low and construction costs are rising,” said NAHB Chairman Chuck Fowke. “Policymakers should take note to avoid increasing regulatory costs associated with land development and residential construction.”

“Builder confidence fell back from historic levels in December, as housing remains a bright spot for a recovering economy,” said NAHB Chief Economist Robert Dietz. “The issues that have limited housing supply in recent years, including land and material availability and a persistent skilled labor shortage, will continue to place upward pressure on construction costs. As the economy improves with the deployment of a COVID-19 vaccine, interest rates will increase in 2021, further challenging housing affordability in the face of strong demand for single-family homes.”

...

The HMI index gauging current sales conditions dropped four points to 92, the component measuring sales expectations in the next six months fell four points to 85 and the gauge charting traffic of prospective buyers also decreased four points to 73.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell one point to 82, the Midwest was up one point to 81, the South rose one point to 87 and the West increased two points to 96.

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was close to the consensus forecast.

Housing and homebuilding have been one of the best performing sectors during the pandemic.

Retail Sales decreased 1.1% in November

by Calculated Risk on 12/16/2020 08:39:00 AM

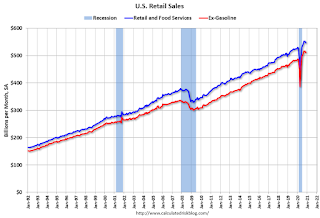

On a monthly basis, retail sales decreased 1.1 percent from October to November (seasonally adjusted), and sales were up 4.1 percent from November 2019.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for November 2020, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $546.5 billion, a decrease of 1.1 percent from the previous month, but 4.1 percent above November 2019. Total sales for the September 2020 through November 2020 period were up 5.2 percent from the same period a year ago. The September 2020 to October 2020 percent change was revised from up 0.3 percent to down 0.1 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 1.0% in November.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 5.9% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 5.9% on a YoY basis.The decrease in November was well below expectations, and sales in October were revised down (September was revised up).

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 12/16/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 11, 2020.

... The Refinance Index increased 1 percent from the previous week and was 105 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 26 percent higher than the same week one year ago.

“U.S. Treasury rates stayed low last week, in part due to uncertainty over the prospects of additional pandemic-related government stimulus, as well as concerns about the continued rise in COVID-19 cases across the country. Mortgage rates as a result fell to another survey low, with the 30-year fixed mortgage rate dropping five basis points to 2.85 percent,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Homeowners once again acted on the decline in rates, with refinance activity rising for the second straight week and up 105 percent from a year ago.”

Added Kan, “The ongoing strength in the housing market has carried into December. Applications to buy a home increased for the fourth time in five weeks, as both conventional and government segments of the market saw gains. Government purchase applications rose for the sixth straight week to the highest level since June – perhaps a sign that more first-time buyers are entering the market.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to a survey low of 2.85 percent from 2.90 percent, with points decreasing to 0.33 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index remains up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 26% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, December 15, 2020

Wednesday: Retail Sales, Homebuilder Confidence, FOMC Statement

by Calculated Risk on 12/15/2020 09:32:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for November will be released. The consensus is for a 0.3% decrease in retail sales.

• At 10:00 AM, The December NAHB homebuilder survey. The consensus is for a reading of 88, down from 90. Any number above 50 indicates that more builders view sales conditions as good than poor.

• During the day, The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Meeting Announcement. No change to rate policy is expected at this meeting.

• At 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

December 15 COVID-19 Test Results; Record 7-Day Deaths, Hospitalizations

by Calculated Risk on 12/15/2020 07:28:00 PM

The US is now averaging well over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,480,147 test results reported over the last 24 hours.

There were 189,783 positive tests.

Almost 36,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.8% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations (Over 112,000)

• Record 7 Day Average Deaths

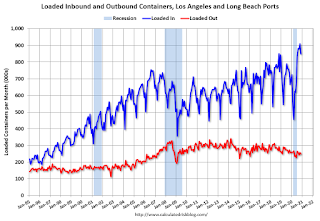

LA Area Port Traffic: Strong Imports, Weak Exports in November

by Calculated Risk on 12/15/2020 01:29:00 PM

Note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 2.2% in November compared to the rolling 12 months ending in September. Outbound traffic was down 0.5% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 28% YoY in November, and exports were down 5% YoY.

Denver Real Estate in November: Sales Up 18% YoY, Active Inventory Down 63%

by Calculated Risk on 12/15/2020 11:37:00 AM

From the DMAR: Monthly Indicators, November 2020

The number of single family homes sold in November increased to 4,647, up 15.2% from 4,033 in November 2019.

Active listings are at 2,965, down 69.2% from 9,626 in November 2019.

Sales to date are up 7.3% compared to 2019.

For condos, 1,753 were sold in November, up 26.0% from 1,391 in November 2019.

Active listings are at 1,927, down 48.4% from 3,737 in November 2019.

Condo sales to date are up 7.1% compared to 2019.

Industrial Production Increased 0.4 Percent in November; 5% Below Pre-Crisis Level

by Calculated Risk on 12/15/2020 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production increased 0.4 percent in November. After having fallen 16.5 percent between February and April, the level of the index has risen to about 5 percent below its pre-pandemic (February) reading. In November, manufacturing output advanced 0.8 percent for its seventh consecutive monthly gain. An increase of 5.3 percent for motor vehicles and parts contributed significantly to the gain in factory production; excluding motor vehicles and parts, manufacturing output moved up 0.4 percent. The output of utilities declined 4.3 percent, as warmer-than-usual temperatures reduced the demand for heating. Mining production increased 2.3 percent after decreasing 0.7 percent in October.

At 104.0 percent of its 2012 average, total industrial production was 5.5 percent lower in November than it was a year earlier. Capacity utilization for the industrial sector increased 0.3 percentage point in November to 73.3 percent, a rate that is 6.5 percentage points below its long-run (1972–2019) average but 9.1 percentage points above its low in April.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April, but still well below the level in February 2020.

Capacity utilization at 73.3% is 6.5% below the average from 1972 to 2017.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in October to 104.0. This is 4.9% below the February 2020 level.

The change in industrial production was close to consensus expectations, and industrial production in September and October were revised up slightly.

NY Fed: Manufacturing: Business activity "edged slightly higher" in New York State in December

by Calculated Risk on 12/15/2020 08:33:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity edged slightly higher in New York State, according to firms responding to the December 2020 Empire State Manufacturing Survey. The headline general business conditions index was little changed at 4.9. New orders increased marginally, and shipments were modestly higher. Inventories continued to move lower, and delivery times edged up. Employment posted its strongest gain in months, and the average workweek lengthened somewhat. Input prices increased at the fastest pace in two years, while selling prices increased at about the same pace as last month. Looking ahead, firms remained optimistic that conditions would improve over the next six months.This was below expectations, and showed activity "edged slightly higher" in December.

...

The index for number of employees rose five points to 14.2, its highest level in over a year, pointing to ongoing significant gains in employment. The average workweek index was unchanged at 4.8, signaling a small increase in hours worked.

emphasis added