by Calculated Risk on 2/17/2013 02:26:00 PM

Sunday, February 17, 2013

Update: Recovery Measures

By request, here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

These graphs show that some major indicators are still significantly below the pre-recession peaks.

Click on graph for larger image.

Click on graph for larger image.

This graph is for real GDP through Q4 2012.

Real GDP returned to the pre-recession peak in Q4 2011, and hit new post-recession highs for four consecutive quarters until dipping slightly in Q4 2012 (Q4 GDP will probably be revised up).

At the worst point - in Q2 2009 - real GDP was off 4.7% from the 2007 peak.

Real GDP has performed better than other indicators ...

Real GDP has performed better than other indicators ...

This graph shows real personal income less transfer payments as a percent of the previous peak through the December report.

This measure was off 11.2% at the trough in October 2009.

Real personal income less transfer payments returned to the pre-recession peak in December, but that was due to a one time surge in income as some high income earners accelerated earnings to avoid higher taxes in 2013. Without that distortion, real personal income less transfer payments would probably still be 2.5% or so below the previous peak.

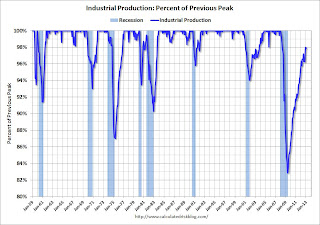

The third graph is for industrial production through January 2013.

The third graph is for industrial production through January 2013.

Industrial production was off over 17% at the trough in June 2009, and has been one of the stronger performing sectors during the recovery.

However industrial production is still 2.1% below the pre-recession peak. This indicator will probably return to the pre-recession peak in 2013.

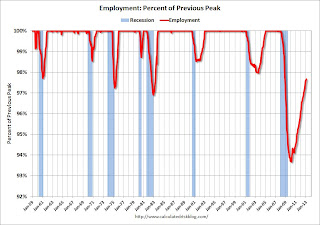

The final graph is for employment and is through January 2013. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment and is through January 2013. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

Payroll employment is still 2.3% below the pre-recession peak.

All of these indicators collapsed in 2008 and early 2009, and only real GDP is back to the pre-recession peak (personal income was due to a one time increase in income and will be back below the pre-recession peak in January). At the current pace of improvement, industrial production will be back to the pre-recession peak later this year, personal income less transfer payments late in 2013, and employment in late 2014.

Inland Empire: Starting to Recover

by Calculated Risk on 2/17/2013 10:28:00 AM

Southern California's "Inland Empire" was one of epicenters of the housing bust. Now the area is recovering ...

From Alejandro Lazo at the LA Times: Inland Empire housing is more affordable but still out of reach

Bill Sepe has gotten used to rejection.

The 28-year-old Rancho Cucamonga native has put in nearly 200 unsuccessful offers since August on Inland Empire homes, varying from typical suburban ranches to classic craftsman homes.

All this anguish comes in pursuit of a modest home in the exurb of San Bernardino County, the epicenter of the Southern California housing crash. Plummeting values here sparked a vicious wave of foreclosures.

...

The repeated rejections come despite Sepe's solid qualifications: a stable job as a cell tower technician and a pre-approved home loan. He watches as houses hit the market, then get scooped up within an hour. ...

The Inland Empire has gone from bust to boom with a vigor few could have predicted, mirroring Western regions such as Phoenix and Las Vegas. Surging demand has tightened inventory ... That's great for the real estate industry and helps the local economy. ...

In the Inland Empire's darkest hour, nearly one of five borrowers was behind on a home loan. Foreclosed properties made up more than two-thirds of sales. Work on half-built subdivisions stopped dead, with as construction jobs drying up and the unemployment rate soaring. Last year the city of San Bernardino declared bankruptcy.

...

But a turnaround is well underway, thanks in part to deep-pocketed investors snapping up bargains with cash. The housing supply is now so tight that it's common for home shoppers to put in 20 or 30 offers before securing a house, real estate agents say.

...

For real estate professionals, the turnaround is like a downpour after years of drought.

"There is optimism here for the first time in eight years," said Paul Herrera, government affairs director for the Inland Valleys Assn. of Realtors. "For the first time since 2005, we are thinking that next year will be better than this year."

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate for the Inland Empire (using MSA: Riverside, San Bernardino, Ontario), and also the number of construction jobs as a percent of total employment.

The unemployment rate is falling, but still very high 10.9% (down from 15.0% in 2010). And construction employment is still near the lows. But the area is recovering.

Saturday, February 16, 2013

Unofficial Problem Bank list declines to 812 Institutions

by Calculated Risk on 2/16/2013 04:30:00 PM

Here is the unofficial problem bank list for Feb 15, 2013.

Changes and comments from surferdude808:

Many changes were made to the Unofficial Problem Bank List this week with a failure and the OCC releasing its enforcement action through mid-January 2013. In all, there were 10 removals and three additions that leave the list at 812 institutions with assets of $303 billion. A year ago, the list held 956 institutions with assets of $389.6 billion.Earlier:

The three additions this week were Acacia Federal Savings Bank, Falls Church, VA ($911 million); The Baraboo National Bank, Baraboo, WI ($739 million); and Commonwealth Bank, FSB, Mount Sterling, KY ($21 million).

The OCC terminated actions against Inter National Bank, McAllen, TX ($2.2 billion); The Kishacoquillas Valley National Bank of Belleville, Belleville, PA ($564 million Ticker: KISB); The First National Bank of Elk River, Elk River, MN ($248 million); Noble Bank & Trust, N.A., Anniston, AL ($169 million); Frontier Bank, Rock Rapids, IA ($151 million); International City Bank, National Association, Long Beach, CA ($144 million); First National Bank of Decatur County, Bainbridge, GA ($111 million); Neighborhood National Bank, Alexandria, MN ($48 million); and The Farmers and Merchants National Bank of Hatton, Hatton, ND ($26 million).

The other removal was the failed Covenant Bank, Chicago, IL ($60 million), which was the third failure this year. Covenant Bank was quite costly to shutter as the FDIC cost estimate is $21.8 million or about 37 percent of the failed bank's assets. The last failure in Chicago, Second Federal Savings and Loan Association of Chicago, in July 2012, was also quite expensive with an estimated cost of 40.3 percent of assets. Excluding Washington Mutual, failure costs have averaged an estimated 24.8 percent of failed assets for the 467 closings since 2008. Prior to the crisis, resolution costs were around 12 percent. Thus, the losses in this crisis are well above historical experience, which suggests the banking regulators did not effectively curb risk taking before the bursting of the bubble and that insolvent institutions have not been closed in a timely manner.

Late in the day on Friday, eyes were focused on New Mexico to see if the state banking department would declare Sunrise Bank of Albuquerque, Albuquerque, NM ($52 million) insolvent as it needed a $1 million capital infusion by 5:30 p.m. According to a media report by SNL Securities, Sunrise's parent, Capitol Bancorp, asked a federal bankruptcy judge to approve a secured loan from unnamed investors that could be used to recapitalize the bank. Capitol Bancorp controls 11 banks on the Unofficial Problem Bank List, of which eight also operating under a Prompt Corrective Action order. In its filing, Capitol Bancorp intimated that a failure of its New Mexico unit would have dire consequences as it could trigger a cross guaranty liability of more than $10 million the FDIC could assess across the other controlled bank units, which could lead to a collapse of the entire company. Capitol Bancorp has agreed to sell its New Mexico bank to Westar Bancorp, but the buyer has not been able to secure the necessary regulatory approvals to consummate the transaction. The FDIC has provided Capitol Bancorp much latitude by issuing at least 16 cross guaranty liability waivers to previously controlled banking units the company has sold as part of its recapitalization efforts. As of 11 p.m. east coast, it has been radio silence as there is no update if the capital made it to the New Mexico unit or if the deadline has been extended. We will continue to monitor and provide updates on Capitol Bancorp. Should a unit fail and if the cross guaranty liability is applied, it could make for a busy night for the FDIC as it is unlikely the units would be purchased by a single buyer given their size and geographic dispersion.

• Summary for Week Ending Feb 15th

• Schedule for Week of Feb 17th

Summary for Week ending February 16th

by Calculated Risk on 2/16/2013 01:11:00 PM

The Industrial Production release was a reporting challenge this week. Expectations were for production to increase 0.1% in January, but the Federal Reserve reported a 0.1% decrease. At first glance, this appears to be disappointing, however production for November and December were revised up significantly, and total production in January was actually above expectations. Here are a few details ...

First, Industrial Production is an index that is set to 100 for a base year, currently 2007. Production in December was originally reported as 98.1 (98.1% of 2007 production). Production in January was reported at 98.6 (98.6% of 2007 levels - yes, production is still below the pre-recession levels). That would have been a 0.5% increase, well above expectations. However production in December was revised up to 98.7, so production in January showed a slight decline.

This is a reminder that we need to look at more than one month of data and that headlines can be a little misleading. Overall - with revisions - the industrial production report was solid.

The key report for the week was January retail sales. This showed an increase of only 0.1% in January indicating sluggish retail sales growth. Retail sales are probably being impacted by the payroll tax increase. Two internal WalMart memo leaked this week suggest the largest US retailer is seeing weak sales, see from Bloomberg: Wal-Mart Executives Sweat Slow February Start in E-Mails. A couple of emails:

"In case you haven’t seen a sales report these days, February MTD sales are a total disaster," Jerry Murray, Wal- Mart’s vice president of finance and logistics, said in a Feb. 12 e-mail to other executives, referring to month-to-date sales. "The worst start to a month I have seen in my ~7 years with the company."This is probably an impact of the payroll tax increase.

...

"Have you ever had one of those weeks where your best- prepared plans weren’t good enough to accomplish everything you set out to do?" [Cameron Geiger, senior vice president of Wal-Mart U.S. Replenishment] asked in a Feb. 1 e-mail to executives. "Well, we just had one of those weeks here at Walmart U.S. Where are all the customers? And where’s their money?"

And here is a summary of last week in graphs:

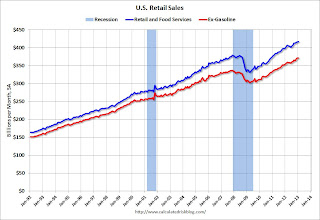

• Retail Sales increased 0.1% in January

Click on graph for larger image.

Click on graph for larger image.On a monthly basis, retail sales increased 0.1% from December to January (seasonally adjusted), and sales were up 4.7% from January 2012. Sales for December were unrevised at a 0.5% gain.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

This was at the consensus forecast of a 0.1% increase, and might indicate some slowdown in retail spending growth related to the payroll tax increase.

• Fed: Industrial Production declined 0.1% in January

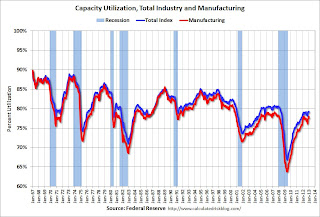

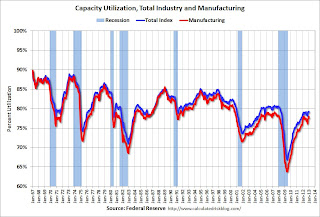

This graph shows Capacity Utilization. The capacity utilization rate for total industry decreased in January to 79.1 percent. This series is up 12.2 percentage points from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. The capacity utilization rate for total industry decreased in January to 79.1 percent. This series is up 12.2 percentage points from the record low set in June 2009 (the series starts in 1967).Capacity utilization at 79.1% is still 1.1 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007. Note: December 2012 was revised up from 78.8%.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in January to 98.6 (December 2012 was revised up from 98.1). This is 18.2% above the recession low, but still 2.1% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were slightly below expectations, however the previous months were revised up significantly.

• Weekly Initial Unemployment Claims decline to 341,000

"In the week ending February 9, the advance figure for seasonally adjusted initial claims was 341,000, a decrease of 27,000 from the previous week's revised figure of 368,000."

"In the week ending February 9, the advance figure for seasonally adjusted initial claims was 341,000, a decrease of 27,000 from the previous week's revised figure of 368,000."The previous week was revised up from 366,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 352,500.

Weekly claims were below the 360,000 consensus forecast, and the 4-week average is close to the lowest level since early 2008.

• BLS: Job Openings "little changed" in December

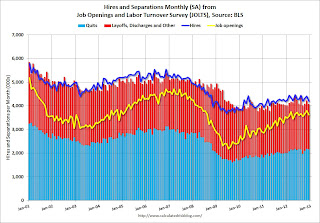

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. Jobs openings decreased in December to 3.617 million, down from 3.790 million in November. The number of job openings (yellow) has generally been trending up, but openings are only up 2% year-over-year compared to December 2011.

Quits decreased slightly in December, and quits are up 7% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report, but the trend suggests a gradually improving labor market.

• Preliminary February Consumer Sentiment increases to 76.3

The preliminary Reuters / University of Michigan consumer sentiment index for February increased to 76.3 from the January reading of 73.8.

The preliminary Reuters / University of Michigan consumer sentiment index for February increased to 76.3 from the January reading of 73.8. This was slightly above the consensus forecast of 75.0, but still very low. There are a number of factors that impact sentiment including unemployment, gasoline prices and, for 2013, the payroll tax increase and the default threat from Congress. People will slowly adjust to the payroll tax increase, and the threat of default is now behind us ... and sentiment has improved a little.

Schedule for Week of Feb 17th

by Calculated Risk on 2/16/2013 08:53:00 AM

Note: I'll post a summary for last week later today.

There are three key housing reports that will be released this week: January housing starts on Wednesday, January Existing home sales on Thursday, and the homebuilder confidence survey on Tuesday.

Other key releases include the Q4 MBA National Mortgage Delinquency Survey on Thursday, and the FOMC minutes of the January meeting on Wednesday.

For manufacturing, the February Philly Fed survey will be released this week.

For prices, CPI and PPI for January will be released.

All US markets are closed in observance of the President's Day holiday.

10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 48, up from 47 in January. Although this index has been increasing sharply, any number below 50 still indicates that more builders view sales conditions as poor than good.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for January.

8:30 AM: Housing Starts for January. Total housing starts were at 954 thousand (SAAR) in December, up 12.1% from the revised November rate of 851 thousand (SAAR). Single-family starts increased to 616 thousand in December.

The consensus is for total housing starts to decrease to 914 thousand (SAAR) in January, down from 954 thousand in December.

8:30 AM: Producer Price Index for January. The consensus is for a 0.3% increase in producer prices (0.2% increase in core).

During the day: The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes for January 29-30, 2013.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 359 thousand from 341 thousand last week.

8:30 AM: Consumer Price Index for January. The consensus is for a 0.1% increase in CPI in January and for core CPI to increase 0.2%.

9:00 AM: The Markit US PMI Manufacturing Index Flash. The consensus is for a decrease to 55.5 from 56.1 in January.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for sales of 4.90 million on seasonally adjusted annual rate (SAAR) basis. Sales in December 2012 were 4.94 million SAAR.

A key will be inventory and months-of-supply.

10:00 AM: the Philly Fed manufacturing survey for February. The consensus is for a reading of 1.1, up from minus 5.8 last month (above zero indicates expansion).

10:00 AM: Conference Board Leading Indicators for January. The consensus is for a 0.3% increase in this index.

During the day: The MBA's National Mortgage Delinquency Survey for Q4.

No releases scheduled.

Friday, February 15, 2013

Bank Failure #3 in 2013: Covenant Bank, Chicago, Illinois

by Calculated Risk on 2/15/2013 09:07:00 PM

The rate of bank failures has slowed significantly, and most of the recent failures have been pretty small banks. But here is a Friday tradition ...

From the FDIC: Liberty Bank and Trust Company, New Orleans, Louisiana, Assumes All of the Deposits of Covenant Bank, Chicago, Illinois

As of December 31, 2012, Covenant Bank had approximately $58.4 million in total assets and $54.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $21.8 million. ... Covenant Bank is the 3rd FDIC-insured institution to fail in the nation this year, and the first in Illinois.

Update: Table of Short Sales and Foreclosures for Selected Cities in January

by Calculated Risk on 2/15/2013 07:13:00 PM

Economist Tom Lawler sent me this updated table (below) of short sales and foreclosures for several selected cities and areas in January.

Look at the right two columns in the table below (Total "Distressed" Share for Jan 2013 compared to Jan 2012). In every area that reports distressed sales, the share of distressed sales is down year-over-year - and down significantly in many areas.

Also there has been a decline in foreclosure sales just about everywhere. Look at the middle two columns comparing foreclosure sales for Jan 2013 to Jan 2012. Foreclosure sales have declined in almost all of these areas (Orlando is an exception), and some of the declines have been stunning (the Nevada sales were impacted by a new foreclosure law).

Also there has been a shift from foreclosures to short sales. In most areas, short sales now out number foreclosures (Minneapolis and Orlando are exceptions).

Overall this is moving in the right direction, although some areas are lagging behind.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 13-Jan | 12-Jan | 13-Jan | 12-Jan | 13-Jan | 12-Jan | |

| Las Vegas | 36.2% | 28.1% | 12.5% | 45.5% | 48.7% | 73.6% |

| Reno | 41.0% | 37.0% | 10.0% | 40.0% | 51.0% | 77.0% |

| Phoenix | 17.6% | 29.8% | 16.2% | 27.9% | 33.8% | 57.7% |

| Sacramento | 30.3% | 32.1% | 14.2% | 34.5% | 44.5% | 66.6% |

| Minneapolis | 10.6% | 16.2% | 32.3% | 39.0% | 42.9% | 55.2% |

| Mid-Atlantic (MRIS) | 13.1% | 16.4% | 12.7% | 16.9% | 25.8% | 33.3% |

| Orlando | 23.7% | 37.6% | 26.7% | 26.2% | 50.4% | 63.7% |

| California (DQ)* | 26.1% | 27.0% | 18.7% | 34.3% | 44.8% | 61.3% |

| Bay Area CA (DQ)* | 23.3% | 28.1% | 14.4% | 27.2% | 37.7% | 55.3% |

| So. California (DQ)* | 25.9% | 27.2% | 15.0% | 32.6% | 40.9% | 59.8% |

| Hampton Roads | 34.9% | 37.2% | ||||

| Chicago | 49.0% | 52.0% | ||||

| Charlotte | 18.1% | 21.0% | ||||

| Metro Detroit | 36.3% | 54.5% | ||||

| Memphis* | 25.9% | 36.6% | ||||

| Birmingham AL | 30.2% | 38.2% | ||||

| *share of existing home sales, based on property records | ||||||

Lawler: Publicly-Traded Home Builder Results and Comparison to Census New Home Sales

by Calculated Risk on 2/15/2013 03:28:00 PM

From economist Tom Lawler:

Below is a summary of some selected stats from nine large publicly-traded home builders.

While not shown below, the combined order backlog of these builders on December 31, 2012 was 28,455, up 55.8% from the end of 2011.

As I’ve noted before, comparing these builder results with the Census Bureau’s estimate of overall US new home sales is tricky; first, Census deals with sales cancellations differently from home builder results, and second, there appear to be differences between when builders “book” a sales order and when Census “counts” a sale.

While I only have data for the above builders back to Q2/2009, the limited data suggest that reported builder sales “lead” the Census home sales data. At the bottom is a chart showing Census new home sales data and a two-quarter average of the above builders’ net orders data (shown in index form).

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | Dec 2012 | Dec 2011 | % Chg | Dec 2012 | Dec 2011 | % Chg | Dec 2012 | Dec 2011 | % Chg |

| D.R. Horton | 5,259 | 3,794 | 38.6% | 5,182 | 4,118 | 25.8% | $236,067 | $214,740 | 9.9% |

| PulteGroup | 3,926 | 3,084 | 27.3% | 5,154 | 4,303 | 19.8% | $287,000 | $271,000 | 5.9% |

| NVR | 2,625 | 2,158 | 21.6% | 2,788 | 2,391 | 16.6% | $331,900 | $304,600 | 9.0% |

| The Ryland Group | 1,502 | 915 | 64.2% | 1,578 | 1,040 | 51.7% | $270,000 | $254,000 | 6.3% |

| Beazer Homes | 932 | 724 | 28.7% | 1,038 | 867 | 19.7% | $235,500 | $215,500 | 9.3% |

| Standard Pacific | 983 | 615 | 59.8% | 973 | 782 | 24.4% | $388,000 | $374,000 | 3.7% |

| Meritage Homes | 1,094 | 749 | 46.1% | 1,240 | 894 | 38.7% | $294,000 | $275,000 | 6.9% |

| MDC Holdings | 869 | 523 | 66.2% | 1,221 | 792 | 54.2% | $318,700 | $291,300 | 9.4% |

| M/I Homes | 673 | 505 | 33.3% | 887 | 667 | 33.0% | $273,000 | $257,000 | 6.2% |

| Total | 17,863 | 13,067 | 36.7% | 20,061 | 15,854 | 26.5% | $282,723 | $263,035 | 7.5% |

Click on graph for larger image.

Click on graph for larger image.The chart suggests that Census’ industry estimates and these nine builders’ net orders moved pretty closely together from 2009 through early 2012. Over the last three quarters, however, these nine builders’ net orders showed considerably more strength that Census’ estimates in the last three quarters of 2012, with the “gap” widening throughout the year. This suggests either that large builders’ share of the new SF home market increased last year, though it also suggests that Census’ new home sales estimate for the last quarter of 2012 may be revised upward.

Mortgage Rates Unchanged in Latest Survey, Up slightly over last few months

by Calculated Risk on 2/15/2013 01:32:00 PM

From Freddie Mac yesterday: 30-Year Fixed-Rate Mortgage Unchanged for Third Consecutive Week

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates unchanged from the previous week and remaining near their record lows ...

30-year fixed-rate mortgage (FRM) averaged 3.53 percent with an average 0.8 point for the week ending February 14, 2013, the same as last week. Last year at this time, the 30-year FRM averaged 3.87 percent.

15-year FRM this week averaged 2.77 percent with an average 0.8 point, the same as last week. A year ago at this time, the 15-year FRM averaged 3.16 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and mortgage rates are currently near the record low for the last 40 years.

The record low in the Freddie Mac survey for a 30 year fixed rate mortgage was 3.31% in November 2012.

The second graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).

The second graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).Note: Mortgage rates were at or below 5% back in the 1950s.

Preliminary February Consumer Sentiment increases to 76.3

by Calculated Risk on 2/15/2013 10:03:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for February increased to 76.3 from the January reading of 73.8.

This was slightly above the consensus forecast of 75.0, but still very low. There are a number of factors that impact sentiment including unemployment, gasoline prices and, for 2013, the payroll tax increase and the default threat from Congress. People will slowly adjust to the payroll tax increase, and the threat of default is now behind us ... and sentiment has improved a little.

Earlier, a solid report from the NY Fed: February Empire State Manufacturing Survey indicates conditions for New York manufacturers improved for first time since summer of last year

The general business conditions index rose into positive territory, advancing eighteen points to 10.0. The new orders index also rose sharply, climbing twenty points to 13.3, and the shipments index increased to 13.1. The prices paid index pointed to a continued acceleration in selling prices, and the prices received index, while positive, inched lower. The index for number of employees rose for a third consecutive month and, at 8.1, registered its first positive reading since September, though the average workweek index remained negative.

Fed: Industrial Production declined 0.1% in January

by Calculated Risk on 2/15/2013 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production edged down 0.1 percent in January after having risen 0.4 percent in December. In January, manufacturing output decreased 0.4 percent following upwardly revised gains of 1.1 percent in December and 1.7 percent in November. For the fourth quarter as a whole, manufacturing production is now estimated to have advanced 1.9 percent at an annual rate; previously, the increase was reported to have been 0.2 percent. In January, the output of utilities rose 3.5 percent, as demand for heating was boosted by temperatures that fell closer to their seasonal norms; the production at mines declined 1.0 percent. At 98.6 percent of its 2007 average, total industrial production in January was 2.1 percent above its level of a year earlier. The capacity utilization rate for total industry decreased in January to 79.1 percent, a rate that is 1.1 percentage points below its long-run (1972--2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.1% is still 1.1 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007. Note: December 2012 was revised up from 78.8%.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in January to 98.6 (December 2012 was revised up from 98.1). This is 18.2% above the recession low, but still 2.1% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were slightly below expectations, however the previous months were revised up significantly.

Thursday, February 14, 2013

Friday: Industrial Production, Consumer sentiment, Empire State Mfg Survey

by Calculated Risk on 2/14/2013 07:29:00 PM

I'd like to mention a few key economic themes that I will write more about soon:

• Residential investment (RI) has bottomed and is now contributing to economic growth. Since RI is usually the best leading indicator for the economy, the economy will probably continue to grow for the next couple of years.

• House prices bottomed in early 2012, and will increase further in 2013 - although not all areas are the same. A key this year will be how much inventory comes on the market (something I will track closely). More inventory would mean smaller house price increases.

• The drag from state and local governments is probably over following four years of austerity.

• Construction employment should pick up in 2013.

• The Federal deficit is declining fairly rapidly, and will decline further over the next few years - before starting to increase again due to health care costs.

Not much has changed, but here were my 10 questions for 2013:

• Question #1 for 2013: US Fiscal Policy

• Question #2 for 2013: Will the U.S. economy grow in 2013?

• Question #3 for 2013: How many payroll jobs will be added in 2013?

• Question #4 for 2013: What will the unemployment rate be in December 2013?

• Question #5 for 2013: Will the inflation rate rise or fall in 2013?

• Question #6 for 2013: What will happen with Monetary Policy and QE3?

• Question #7 for 2013: What will happen with house prices in 2013?

• Question #8 for 2013: Will Housing inventory bottom in 2013?

• Question #9 for 2013: How much will Residential Investment increase?

• Question #10 for 2013: Europe and the Euro

Friday economic releases:

• At 8:30 AM ET, the NY Fed will release the Empire State Manufacturing Survey for February. The consensus is for a reading of minus 2.0, up from minus 7.8 in January (below zero is contraction).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for January. The consensus is for a 0.3% increase in Industrial Production in January, and for Capacity Utilization to increase to 78.9%.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for February) will be released. The consensus is for a reading of 75.0, up from 73.8.

FNC: Residential Property Values increased 4.9% year-over-year in December

by Calculated Risk on 2/14/2013 03:02:00 PM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

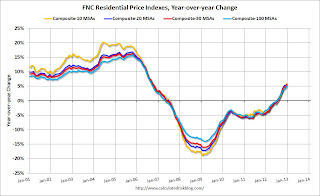

From FNC: FNC Index: U.S. Home Prices Hit Two-Year High

The latest FNC Residential Price Index™ (RPI) shows continuing momentum in the U.S. housing market with home prices rising to a two-year high in December. Despite an unexpected deceleration in economic growth, the ongoing housing recovery has maintained its pace with steady gains in home prices, sending the index up 5.4% year to date. ...The year-over-year change continued to increase in December, with the 100-MSA composite up 4.9% compared to December 2011. The FNC index turned positive on a year-over-year basis in July, 2012, and that was the first year-over-year increase in the FNC index since year-over-year prices started declining in early 2007 (over five years ago).

A stabilizing foreclosure market is contributing to the recovery of the underlying property values. While challenges remain for many hard-hit markets, particularly those undergoing a judicial process for home foreclosures, there are signs that foreclosure prices have bottomed out—the first encouraging development in the long housing recession where a rising underlying market and stabilizing foreclosure prices co-exist. Foreclosures as a percentage of total home sales were 17.8% in December, down from 24.0% a year ago.

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that December home prices remained relatively unchanged from the previous month, but were up 4.9% on a year-over-year basis from the same period in 2011. ... The 30-MSA and 10-MSA composite indices show similar trends of continued price momentum, relatively unchanged from November and up 5.8% from December 2011.

Half of the component markets tracked by the FNC 30-MSA composite index show rising prices in December. ... Although signs of a housing recovery are widening, the degree of market improvement is inconsistent across the country. In Baltimore, Chicago, Houston, and San Antonio, prices were relatively flat over the last 12 months (year-to-year change). In contrast, Phoenix and Denver saw a double-digit growth, led by Phoenix at nearly 23%. The Chicago market continues to underperform other major cities that make up the FNC 30-MSA composite index. The city’s home prices were up only 1.0% on a year-over-year basis, compared to an average of 5.0% among the nation’s largest cities.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

The key is the indexes are now showing a year-over-year increase indicating prices probably bottomed early in 2012.

Report: Housing Inventory declines 16% year-over-year in January

by Calculated Risk on 2/14/2013 12:00:00 PM

From Realtor.com: January 2012 Real Estate Trend Data

January, the total U.S. for-sale inventory of single-family homes, condos, townhomes and co-ops (SFH/CTHCOPS) dropped to its lowest point since Realtor.com started collecting these data, with 1,477,266 units for sale, down 16.47 percent compared with a year ago and less than half its peak of 3.1 million units in September 2007.Realtor.com only started tracking inventory in September 2007, and this is probably the lowest inventory level in over a decade. On a month-over-month basis, inventory declined 5.6%.

...

On a year-over-year basis, for-sale inventory declined in all but three of the 146 markets tracked by Realtor.com while list prices increased in 71 markets, held steady in 24 markets and declined in 51 markets. The number of markets experiencing year-over-year list price declines has increased in the past six months, underscoring the growing fragility of many housing markets.

Note: Realtor.com reports the average number of listings in a month, whereas the NAR uses an end-of-month estimate. Since inventory usually starts to come back on the market following the holidays in mid-to-late January, the NAR will probably report a month-to-month increase in inventory for January (or a smaller decline than Realtor.com).

Click on graph for larger image.

Click on graph for larger image.This graph from Realtor.com shows the reported average monthly inventory over the last few years.

Inventory will be important to track in 2013. There is a good chance that inventory has bottomed, or, at the least, the year-over-year declines in inventory should get much smaller.

My guess is inventory has bottomed, and I expect more inventory will come on the market in areas that have seen recent price appreciation.

The NAR is scheduled to report January existing home sales and inventory on Thursday, Feb 21st.

Report: U.S. Foreclosure Starts Decline in January due to new California Law

by Calculated Risk on 2/14/2013 10:18:00 AM

From RealtyTrac: U.S. Foreclosure Starts Fall to Six-Year Low in January

RealtyTrac® ... today released its U.S. Foreclosure Market Report™ for January 2013, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 150,864 U.S. properties in January, a decrease of 7 percent from the previous month and down 28 percent from January 2012.This is a tale of different states, and different laws. Mostly the non-judicial states are resolving delinquent mortgages quicker since foreclosures don't have to go through the court system. However new laws - like the "Homeowners Bill of Rights" in California - are dramatically slowing foreclosures in some non-judicial states.

“The U.S. foreclosure landscape in January was profoundly altered by the effects of new legislation that took effect in California on the first of the year,” said Daren Blomquist, vice president at RealtyTrac. “Dubbed the Homeowners Bill of Rights, this legislation extends many of the principles in the national mortgage settlement — including a prohibition on so-called dual tracking and requiring a single point of contact for borrowers facing foreclosure — to all mortgage servicers operating in California. In addition the new law imposes fines of up to $7,500 per loan for filing of multiple unverified foreclosure documents. As a result, the downward foreclosure trend in California accelerated into hyper speed in January, decisively shifting the balance of power when it comes to the nation’s foreclosure activity.

“For the first time since January 2007 California did not have the most properties with foreclosure filings of any state. Instead that dubious distinction went to Florida, where January foreclosure activity increased on an annual basis for the 11th time in the last 13 months.”

The national decrease in foreclosure starts was caused in large part by a sharp drop in California notices of default (NOD) in January, down 62 percent from December and down 75 percent from January 2012 to the lowest level since October 2005.

Scheduled foreclosure auctions increased from the previous month in 26 states and the District of Columbia, hitting 12-month or more highs in several key judicial foreclosure states, including Florida, Illinois, Pennsylvania, and New Jersey, although foreclosure starts were down on a year-over-year basis in Florida, Illinois and Pennsylvania.

Weekly Initial Unemployment Claims decline to 341,000

by Calculated Risk on 2/14/2013 08:30:00 AM

The DOL reports:

In the week ending February 9, the advance figure for seasonally adjusted initial claims was 341,000, a decrease of 27,000 from the previous week's revised figure of 368,000. The 4-week moving average was 352,500, an increase of 1,500 from the previous week's revised average of 351,000.The previous week was revised up from 366,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 352,500.

Weekly claims were below the 360,000 consensus forecast, and the 4-week average is close to the lowest level since early 2008.

Wednesday, February 13, 2013

Thursday: Weekly Unemployment Claims

by Calculated Risk on 2/13/2013 09:13:00 PM

Jim Hamilton at Econbrowser discusses Brent, WTI, and the price of gasoline: Prices of gasoline and crude oil

West Texas Intermediate is a particular grade of crude oil whose price is usually quoted in terms of delivery in Cushing, Oklahoma. Brent is a very similar crude from Europe's North Sea. As similar products, you'd expect them to sell for close to the same price, and up until 2010 they usually did. But an increase in production in Canada and the central U.S. combined with a decrease in U.S. consumption has led to a surplus of oil in the central U.S. This overwhelmed existing infrastructure for cheap transportation of crude from Cushing to the coast, causing a big spread to develop between the prices of WTI and Brent.See Hamilton's discussion for more ...

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 360 thousand from 366 thousand last week.

CoStar: Commercial Real Estate prices up 4.3% Year-over-year

by Calculated Risk on 2/13/2013 04:52:00 PM

Here is a price index for commercial real estate that I follow. CoStar notes a few key trends: 1) Sales volume has increased significantly (highest since 2004), 2) the percent of distressed sales has declined, and 3) it appears price increases have moved beyond core properties (the first to recover). There is much more in the release.

From CoStar: U.S. commercial real estate posts record gain in sales volume and broadening pricing recovery to close 2012

COMMERCIAL REAL ESTATE SALES VOLUME SURGED IN 2012: While rising steadily over the last four years, sales volume reached nearly $64 billion in 2012, a 22% increase from 2011 and the highest annual total since 2004. Activity spiked significantly in December as investors rushed to close deals prior to year-end. In fact, at 1,593, the number of repeat sales in December reached an all-time high since CoStar started tracking the property sales used in the CCRSI.

...

Pricing gains in the value-weighted U.S. Composite Index began earlier in the recovery and have been consistently stronger than pricing gains in its equal-weighted counterpart throughout much of the recovery. This reflects the more rapid recovery at the high end of the market for larger, more expensive properties. It also mirrors the trend in the recent recovery of market fundamentals for commercial property, in which demand for Four-Star and Five-Star office buildings, luxury apartments and modern big-box warehouses has outpaced the broader market. However, pricing trends suggest this may be shifting.

Despite the recent dominance of larger, more-expensive properties in pricing gains, momentum appears to be shifting to the broader market dominated by smaller, less-expensive properties. This shift is apparent in the value-weighted U.S. Composite Index, which posted a 4.3% year-over-year gain in December 2012, slowing from its double-digit growth rate throughout 2011. At the same time, year-over-year growth in the equal-weighted U.S. Composite Index accelerated in the second half of 2012 and registered 8.1% for the year. Taken together, the two trends signify that investors are moving beyond core properties and driving up pricing at the lower end of the market.

Distressed sales made up only 11.5% of observed trades in December 2012, the lowest level witnessed since the end of 2008. This reduction in distressed deal volume has been driving higher, more consistent pricing.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. As CoStar noted, the Value-Weighted index is up 37.1% from the bottom (showing the demand for higher end properties) and up 4.3% year-over-year. However the Equal-Weighted index is only up 12.8% from the bottom, and up 8.1% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

DataQuick: January Home Sales in SoCal highest in Six Years

by Calculated Risk on 2/13/2013 12:59:00 PM

One of the housing markets I follow closely is southern California. I highlighted a couple of key points in this article: 1) Activity is picking up, especially in the move-up markets, 2) there should be a "supply response" to more activity and rising prices (I expect more supply to come on the market), and 3) foreclosure resales are at the lowest level since 2007.

From DataQuick: Southland Begins 2013 With Sales and Price Gains Vs. Year Earlier

Southern California's housing market started 2013 with the highest January home sales in six years as sales to investors and cash buyers hovered near record levels and move-up activity remained relatively brisk. ...

A total of 16,058 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. ... Last month’s sales were the highest for the month of January since 18,128 homes sold in January 2007, though they were 8.8 percent below the January average of 17,609 sales. The low for January sales was 9,983 in 2008, while the high was 26,083 in 2004.

“This fledgling housing recovery has momentum. Already, price hikes have caused some to question whether it's sustainable, whether it's a 'bubble.' Let's not forget, though, that we're still climbing out of a deep hole from the housing downturn. Regional home sales remain sub-par and prices in many areas are at least 30 to 40 percent below their peaks. That's not to say we don't see risks. Sharp price gains can attract speculation, which could lead to unsustainable, short-term gains in certain submarkets. A lot of today's housing demand is fueled not by spectacular job growth and soaring consumer confidence, but by super-low mortgage rates and unusually high levels of investor and cash purchases. Take away any one of those elements and it will matter,” said John Walsh, DataQuick president.

“For the overall market, price pressures should gradually ease as more homeowners react to rising values. This is the 'supply response' many analysts expect. The idea is that many who've held out for higher prices will be tempted to stick a for-sale sign in the front yard. Fewer will owe more than their homes are worth, enabling them to sell. Construction is already rising, and we could see lenders clear backlogs of distressed properties faster, adding to the supply.”

The move-up market continued to post sizeable sales gains last month. January sales between $300,000 and $800,000 – a range that would include many first-time move-up buyers – shot up 49.6 percent year-over-year. Sales over $500,000 jumped 74.0 percent from one year earlier, while sales over $800,000 rose 84.2 percent compared with January 2012.

Last month foreclosure resales – properties foreclosed on in the prior 12 months – accounted for 15.0 percent of the Southland resale market. That was up slightly from 14.2 percent the month before and down from 32.6 percent a year earlier. In recent months foreclosure resales have been at the lowest level since September 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 25.9 percent of Southland resales last month. That was down from an estimated 26.5 percent the month before and 27.2 percent a year earlier.

Emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 2/13/2013 10:04:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 6 percent from the previous week. The seasonally adjusted Purchase Index decreased 10 percent from one week earlier.

...

The refinance share of mortgage activity of total applications was unchanged at 78 percent from the previous week. The HARP share of refinance applications was unchanged from last week at 28 percent. The adjustable-rate mortgage (ARM) share of activity increased to 4 percent of total applications.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.75 percent, the highest rate since September 2012, from 3.73 percent, with points unchanged at 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance activity is down over the last three weeks, but activity is still very high - and has remained high for over a year.

There has been a sustained refinance boom, and 78 percent of all mortgage applications are for refinancing.

The second graph shows the MBA mortgage purchase index. The purchase index was off last week - and is still very low, but the index has generally been trending up over the last six months.

The second graph shows the MBA mortgage purchase index. The purchase index was off last week - and is still very low, but the index has generally been trending up over the last six months.This index will probably continue to increase as conventional home purchase activity increases.