by Calculated Risk on 10/21/2010 10:00:00 AM

Thursday, October 21, 2010

Philly Fed Index "steady" in October

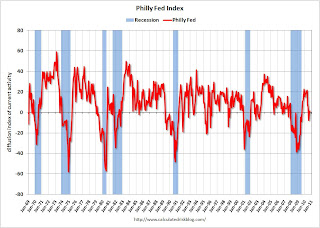

Here is the Philadelphia Fed Index: Business Outlook Survey

Results from the Business Outlook Survey suggest that regional manufacturing activity was steady in October. Although the broad survey measures showed marginal improvement this month, the new orders index continued to suggest weak demand for manufactured goods.

...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of –0.7 in September to 1.0 in October. The index had been negative for two consecutive months (see Chart). Indexes for new orders and shipments continued to indicate weakness this month: The new orders index increased 3 points but remained negative for the fourth consecutive month.

...

Firms reported near steady employment again this month, but lower average work hours for existing employees. The percentage of firms reporting increases in employment (20 percent) narrowly edged out the percentage of firms reporting decreases (17 percent). The index for employment was slightly positive for the second consecutive month but increased just 1 point. Indicative of still weak activity, more firms reported declines in average work hours for existing employees (22 percent) than reported increases (16 percent).emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

This index turned down sharply in June and July and was negative in August and September (indicating contraction). The index was barely positive in October, and the internals (new orders, employment) are still weak.

These surveys are timely, but noisy. However this is further evidence of a slowdown in manufacturing. This was slightly worse than the consensus view of a reading of 1.8 (slight expansion).

Weekly Initial Unemployment Claims: Moving Sideways

by Calculated Risk on 10/21/2010 08:40:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Oct. 16, the advance figure for seasonally adjusted initial claims was 452,000, a decrease of 23,000 from the previous week's revised figure of 475,000 [revised up from 462,000]. The 4-week moving average was 458,000, a decrease of 4,250 from the previous week's revised average of 462,250.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 4,250 to 458,000.

The 4-week moving average has been moving sideways at an elevated level since last December - almost a year - and that suggests a weak job market.

Note: most revisions have been slightly up over the last year or so. The average revision has been up just over 2,000, but the revision last week was up 13,000.

Wednesday, October 20, 2010

WSJ: Here come the GSE Put-Backs

by Calculated Risk on 10/20/2010 10:56:00 PM

From Nick Timiraos at the WSJ: Regulator for Fannie Set to Get Litigious

[The FHFA] hired a law firm specializing in litigation as the agency considers how to move forward with efforts to recoup billions of dollars on soured mortgage-backed securities purchased from banks and Wall Street firms.Back in July, the Federal Housing Finance Agency announced: FHFA Issues Subpoenas for PLS Documents

...

In a statement, the FHFA said it is analyzing requested information and that "no decisions for future action have been made."

FHFA, as Conservator of Fannie Mae and Freddie Mac (the Enterprises), has issued 64 subpoenas to various entities, seeking documents related to private-label mortgage-backed securities (PLS) in which the two Enterprises invested. The documents will enable the FHFA to determine whether PLS issuers and others are liable to the Enterprises for certain losses they have suffered on PLS.The GSEs have a huge advantage over other investors because the FHFA can issue subpoenas. The article mentions estimates that the banks could face put-backs ranging from $24 billion to as high as $179 billion. Quite a range and the actual amount will probably be towards the lower end of the range, and this will play out over a long period (unless there is a settlement).

Note: It is difficult for private investors to obtain the actual loan documents - and that is one of the hurdles the investors asking BofA to repurchase loans need to overcome. Yves Smith at Naked Capitalism points out some of the difficulties: More on Why the PIMCO, BlackRock, Freddie, NY Fed Letter to Countrywide on Putbacks Is Way Overhyped. However the private investors can obtain the required voting rights (usually 25% to 50% depending on the deal), and essentially force the trustee to make the servicer turnover the loan documentation. As I mentioned last night, put-backs could be a big issue for the banks, although I think it will play out over several years and not be a serious issue for the economy.

Comerica and Wells Fargo: Some color on C&I borrowing

by Calculated Risk on 10/20/2010 07:03:00 PM

Just a little color ... this sounds like a sluggish recovery with little new investment. The following comments from Comerica and Wells Fargo on Commercial & Industrial (C&I) lending this morning are mixed. Perhaps a little improvement, but not much. Here are the excerpts from the transcripts (ht Brian).

From Comerica Incorporated conference call:

Analyst: Can you talk about what you saw from your more traditional borrowers during the quarter? Any signs of lines being drawn down or increased optimism?And from Wells Fargo:

Dale Green, EVP, Comerica: Yeah, this is Dale. Number one, as we indicated, the usage was up a bit from about 45% to about 46%, it’s good to see that. We haven’t seen that in a while. If you look at the backlogs and you look at the growth from new customers, and increases to existing customers, it’s kind of spread across most of our businesses. Currently the dealer business is showing growth. The energy business has indicated they are showing growth, those backlogs continue to look good, and what we call the commitments to commit, or the approved deals that we’re waiting to close are up rather substantially this quarter over last quarter, and again, that’s generally across most of the segments. Middle market, technology and life sciences, and so forth. So the quality of the backlog, if you will, is good in the sense that there are more deals that have been approved that are waiting to close, and the level of activity is generally a little better than it’s been. So I would say that we are cautiously optimistic, but you know, this is an uncertain time. So while we’re seeing some improvements, and we’re happy to see it, we’re happy to see better usage, there’s still an economy here that most business people will tell you is concerning, troubling, uncertain.

...

Analyst: I know you talked about utilization rate and everything in terms of demand firming up on commercial lending, but just trying to get an idea of how soon we can see growth commercial offset so CRE roll off in terms of loan growth.

Dale Greene: I hope soon, but the reality is that number one, in terms of new CRE types of opportunities, there are very few new opportunities, so we’ll continue to see the run off of the commercial real estate book as part of a design, if you will. Clearly, as we talked about before, is I had one against growth. While we are seeing some positive trends in the non-CRE, the rest of the C & I book – it’s still very difficult to predict, because there’s just that uncertainty, and so I wouldn’t sit here and tell you exactly when you might see it. It might be a while. I mean, John talked about unemployment rates, and the growth and the economy still being on very muted labels. I don’t know that that’s going to change anytime in the near term, therefore, what we’re doing is the things we’ve done for years. We’re calling on customers, we’re calling on prospects, we’re looking for the core middle market opportunities, particularly in Texas and California. We have loads of good opportunities, we have a better quality backlog, but it will take some time, I think, to see any significant growth, if you will, in the C & I book. It’s just going to be sort of ongoing, quarter to quarter, a block and a tackle kind of an effort.

Ralph Babb, CEO: As Dale was mentioning, we’re staying very close to our customers, and what we’re hearing from our customers, and we have a lot of customers who are doing very well. They are not, because of the uncertainty in the economy, and other things that affect their particular business, investing for the future. They’re really taking care of what’s happening today, and until there is a confidence factor build out there along with the economy showing a steady improvement, I don’t think you’re going to see loans consistently pick up in the industry. You monitor the numbers, I’m sure, just like we do, as to how the industry in total is working. We saw a little bit of that in Q1 and Q2, where things began to pick up, and then all of a sudden the economy slowed back down again, and the estimates that I’ve heard and look at, over the next couple of quarters and into next year, are not significant in pickup. I hope that that’s not correct.

Analyst: So what is the percentage of the C&I loan utilization? I will use that as a measure for how much loan demand there is. What is your feeling about loan demand?

WFC CFO: Roughly in the low 30s on commercial line utilization, and that has been relatively consistent for a couple of quarters now. Again as we say, we are seeing somewhat increased activity, but it is not as robust as we would like to see it be. As I said we think we are picking up market share because we have got so many relationships and all the other cross-sell. So we'll just have to see when demand comes back.

WFC CEO: One of the keys, is our increase in commitments is much greater than what is happening in the portfolio, the outstandings. So we are making investments today, spending money today, to win new clients, service existing clients, that we're not seeing the benefit of yet.

Economix: Tom Lawler answers questions on foreclosures

by Calculated Risk on 10/20/2010 04:06:00 PM

From Economix: Answers to Your Questions on the Foreclosure Crisis. Here is one:

Q: Is it the case that many foreclosures are initiated by processors who receive high fees for foreclosing and have no incentive to pursue workouts of loans? — hmgbird, VirginiaThere are several more questions at Economix.

A. For mortgage servicers who also own (or whose company also owns) the loans, the answer is no, at least in instances where a loan workout is expected to result in lower losses than foreclosing on a home.

For mortgage servicers who service loans for others, the answer is a bit trickier.

In theory, such servicers are supposed to work to minimize losses for the investors for whom they service loans. In practice, however, many so called “third-party” servicers, especially the “mega” servicers, were not adequately staffed to handle effectively the surge in problem loans, which to deal with effectively requires many more resources/staff than is the case just for processing loan payments.

For these servicers, it is not always possible to recoup the costs associated with the massive staff increases and systems changes needed to develop effective loss mitigation/workout strategies from investors, while recouping costs by just doing things the “old” way and foreclosing on properties has been relatively straightforward. So ... the net answer is “in some cases, yes.”

Fed's Beige Book: Economic Activity increased at "modest pace"

by Calculated Risk on 10/20/2010 02:00:00 PM

Note: This is based on information collected on or before October 8, 2010.

From the Federal Reserve: Beige book

Reports from the twelve Federal Reserve Districts suggest that, on balance, national economic activity continued to rise, albeit at a modest pace, during the reporting period from September to early October.And on real estate:

...

Manufacturing activity continued to expand, and several Districts reported gains in production or new orders across a wide range of industries. The only exceptions were the Philadelphia and Richmond Districts, where activity softened compared with the previous reporting period. Exports boosted manufacturing activity according to contacts in the Cleveland, Chicago, and Kansas City Districts.

Housing markets remained weak. Most District Beige Book reports suggested overall home sales were sluggish or declining and were below year-ago levels. ... Single-family construction activity was at very low levels, but had improved somewhat in the Chicago, St. Louis, and Kansas City Districts. ... Respondents' outlooks suggested sales and construction would remain subdued through year-end.Pretty weak, but still growing in September and early October.

...

Conditions in the commercial real estate sector remained subdued. Reports suggested rental rates continued to decline for most commercial property types. The one exception was the apartment sector, where higher leasing activity led to fewer concessions, most notably in Manhattan. Office, industrial and retail rental markets remained weak ... Industry contacts appeared to believe that the commercial real estate and construction sectors would remain weak for some time.

Wells Fargo Conference Call on Foreclosure-Gate

by Calculated Risk on 10/20/2010 11:08:00 AM

From the Wells Fargo conference call (ht Brian):

Let me shift to give you an overview of the foreclosure and mortgage securitization issues. These are issues obviously that are very important to consumers, mortgage investors, and shareholders. But we believe that these issues have been somewhat overstated and, to a certain extent, misrepresented in the marketplace.And on servicing fees:

I would like to be clear here on how they impact Wells Fargo specifically. So starting on slide 26 first [previous post], as John already mentioned , foreclosure at Wells Fargo is a last resort , not a first resort . We work very early with customers who are beginning to experience problems paying their mortgages and continue to do so for the length of time that the problems are being experienced.

80% of customers who are 60 days or more delinquent work with us, and when they do we are successful in helping seven out of every 10 avoid foreclosure. We attempt to contact customers on average over 75 times by phone and nearly 50 times by letter during the roughly 16 months that it takes for foreclosures to be completed once a borrower becomes (technical difficulty ).

Second, our foreclosure and securitization policies, practices, and controls in our view, are sound. To help ensure accuracy over the years, Wells Fargo has built control processes that link customer information with foreclosure procedures and documentation requirements . Our process specifies that affidavit signers and reviewers are the same team member, not different people, and affidavits are properly notarized. Not all banks in our understanding do it this way. If we find errors, we fix them; promptly as we can. We ensure loans in foreclosure are assigned to the appropriate party as necessary to comply with local laws and investor requirements.

Analyst: We are reading all of these headlines that are impacting the mortgage business in one way or another, I guess the thing that jumps out to me is the servicing business really hasn't been priced for what we are seeing right now. Maybe the cost to you in the repurchase is a little bit less; but for some other competitors it seems like it is going to be a pretty high cost. So how do you think about just pricing I guess on the origination side as well as on the servicing side for your current production and going forward?The analyst seems to be asking if Wells Fargo is considering increasing their servicing fee. It is important to remember that servicing is counter-cyclical and that these are the worst of times for servicers. Not only are foreclosures up, but they are also seeing a high level of refinancing because of low mortgage rates (and each loan has an upfront fixed cost, so the servicers sometimes doesn't have time to recoup the upfront costs). But during more normal times, servicing is a real cash cow for the industry - and any increase would suggest insufficient competition and should be opposed by regulators.

WFC CEO: We're always looking at -- as we are looking at this business, first of all there is great scale here. You're right with your comments that when you have problem portfolios it costs more money. ...

Analyst: I guess what I'm getting at is the servicing fees that you get as an industry I think are relatively modest to probably what some of the costs are either to modify some of these loans -- obviously the foreclosure process. So it just feels that that is going to be a much bigger burden for the business going forward, and it might make sense to start repricing some of that business right now.

WFC CFO: The industry might do that, and of course we look at that. But clearly for the 8% that is past due, that is expensive. There is no question about that. But you got to look at a whole, at a portfolio -- from a portfolio perspective. The industry will react to it. If this is a prolonged issue, I am sure new servicing will -- might be considered differently.

Wells Fargo on Foreclosures: "Procedures sound, no moratorium"

by Calculated Risk on 10/20/2010 10:49:00 AM

From Wells Fargo:

“With respect to recent industry-wide foreclosure issues, there are several important facts to know about Wells Fargo. Foreclosure is always a last resort, and we work hard to find other solutions through multiple discussions with customers over many months before proceeding to foreclosure. We are confident that our practices, procedures and documentation for both foreclosures and mortgage securitizations are sound and accurate. For these reasons, we did not, and have no plans to, initiate a moratorium on foreclosures."And a couple of pages from the Quarterly Supplement:

Click on slide for larger image in new window.

Click on slide for larger image in new window.Here is the slide from the Wells Fargo supplement. Not only are they arguing that their foreclosure process and procedures are "sound", but they argue that "Legal documents related to securitization properly transferred ownership".

However last week the Financial Times reported:

In a sworn deposition on March 9 seen by the FT, Xee Moua, identified in court documents as a vice-president of loan documentation for Wells, said she signed as many as 500 foreclosure-related papers a day on behalf of the bank.Note: I'm not analyzing Wells Fargo, just reporting on their comments.

Ms Moua ... said that the only information she verified was whether her name and title appeared correctly ... Asked whether she checked the accuracy of the principal and interest that Wells claimed the borrower owed – a crucial step in banks’ legal actions to repossess homes – Ms Moua said: “I do not.”

excerpt with permission

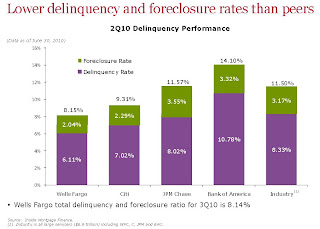

The next slide shows the delinquency and foreclosure rates for the large servicers.

The next slide shows the delinquency and foreclosure rates for the large servicers.BofA (Countrywide) and JPM Chase (WaMu) have the highest combined delinquency and foreclosure rates. BofA is the largest servicer with over 14 million loans ($2.2 trillion) at the end of Q2. Wells Fargo is second with about 12 million loans ($1.8 trillion), and JPM Chase is third with about 9.5 million loans ($1.35 trillion).

MBA: Mortgage Purchase Activity Declines

by Calculated Risk on 10/20/2010 07:39:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 11.2 percent from the previous week. The seasonally adjusted Purchase Index decreased 6.7 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.34 percent from 4.21 percent, with points decreasing to 0.81 from 1.02 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The purchase index declined to near the lows of earlier this year, but this is just one week - the decline might be related to the Columbus Day holiday or to the recent slight change in FHA lending standards.

Note that the 30 year contract rate at 4.34% is just up from the record low of 4.21%.

AIA: Architecture Billings Index shows expansion, first time since Jan 2008

by Calculated Risk on 10/20/2010 12:00:00 AM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

Reuters reports that the American Institute of Architects’ Architecture Billings Index increased to 50.4 in September from 48.2 in August. Any reading above 50 indicates expansion.

"The strong upturn in design activity in the commercial and industrial sector certainly suggests that this upturn can possibly be sustained," said Kermit Baker, AIA's chief economist. "But we will need to see consistent improvement over the next few months in order to feel comfortable about the state of the design and construction industry."The ABI press release is not online yet.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. This is the first time the index has been above 50 since Jan 2008.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So, if the index stays at 50 or above, this suggests there will probably be further declines in CRE investment for the next 9 to 12 months.

Tuesday, October 19, 2010

Foreclosure-Gate: The Investigations and some comments on other issues

by Calculated Risk on 10/19/2010 08:42:00 PM

From Zachary Goldfarb at the WaPo: Task force probing whether banks broke federal laws during home seizures

Goldfarb writes that the Financial Fraud Enforcement Task Force is looking into whether the mortgage servicers misled federal housing agencies, and also "into whether the submission of flawed paperwork during the foreclosure process violated mail or wire fraud laws". There will be a meeting tomorrow (Wednesday), followed by a briefing by "HUD Secretary Shaun Donovan and the task force executive director, Robb Adkins".

White House press secretary Robert Gibbs ... said the administration is strongly supporting a parallel probe by every state's attorney general. Foreclosure law is largely the domain of state courts.And from David Streitfeld at the NY Times: States Continue Foreclosure Inquiries

“There has been an attempt by some of the major servicers to indicate there are no problems,” said Patrick Madigan, Iowa’s assistant attorney general. “We’re not at the end of this process. We’re at the beginning.”My comment: I fully support these investigations, but I've downplayed "foreclosure-gate" because I thought the impact on housing and the economy would be minor - depending of course on the length of the foreclosure delays. Many other people disagree with my view - and please remember I'm not always right.

It is important to separate out two other issues. The first is MERS (the "Mortgage Electronic Registration System"). There are many interesting issues with MERS - and plenty of litigation - but my feeling is that the defects are curable, and these issues will have little impact on the economy. Since I think the impact will be minor, once again I've mostly been ignoring these issues.

The third issue is repurchase requests based on Reps and Warranties for mortgages. This is an important story for the banks. I've been mentioning the increasing push-backs from the GSEs (Fannie and Freddie). That isn't a new story. The important development today was that several major bond investors are pressuring BofA to repurchase defective mortgages. Although I've been following this story, I haven't mentioned it - and some people think I've been "behind the curve". Could be.

The key questions are how many loans will eventually be pushed-back and how long it will take. Usually this process takes a long time and involves analyzing numerous loan files for defects. And these weren't GSE loans for a reason - the loans had significant risk layering (stated income, option ARMs, high LTV, and high debt-to-income ratios etc.) and these risk factors were fully disclosed to the investors. I expect this to be a slow process and be a drag on bank earnings for some time, but not be another major event like the collapse of Lehman. Once again I think the impact on the economy will be minor (my focus is on housing and the economy).

Housing Starts and the Unemployment Rate

by Calculated Risk on 10/19/2010 05:50:00 PM

An update by request ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows single family housing starts and the unemployment rate (inverted) through September. Note: Of course there are many other factors too, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) rebounded a little last year,and then moved sideways for some time, before declining again in May.

This is what I expected when I first posted the above graph over a year ago. I wrote:

[T]here is still far too much existing home inventory, a sharp bounce back in housing starts is unlikely, so I think ... a rapid decline in unemployment is also unlikely.Usually near the end of a recession, residential investment1 (RI) picks up as the Fed lowers interest rates. This leads to job creation and also household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover.

However this time, with the huge overhang of existing housing units, this key sector isn't participating. Earlier today, NY Fed President William Dudley said the NY Fed's estimate was that "there are roughly 3 million vacant housing units more than usual". If that estimate is correct (I think it is too high), then it would take several years of housing starts at the current level, combined with more normal household growth, to eliminate the excess supply.

1 RI is mostly new home sales and home improvement.

Major Bondholders seek BofA Mortgage Repurchases

by Calculated Risk on 10/19/2010 02:46:00 PM

From Bloomberg: Pimco, New York Fed Said to Seek BofA Repurchase of Mortgages

Pacific Investment Management Co., BlackRock Inc. and the Federal Reserve Bank of New York are seeking to force Bank of America Corp. to repurchase soured mortgages packaged into $47 billion of bonds by its Countrywide Financial Corp. unit, people familiar with the matter said.This will take time - and be contested - but the battle over Reps and Warranties will probably continue to grow. Fannie and Freddie have been ramping up their push backs for some time, and here come the push backs from the private investors. I think this will be a drag on bank earnings for some time.

The bondholders wrote a letter to Bank of America and Bank of New York Mellon Corp., the debt’s trustee, citing alleged failures by Countrywide to service the loans properly ...

Moody's: Commercial Real Estate Prices fall to 2002 Levels

by Calculated Risk on 10/19/2010 12:50:00 PM

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index declined 3.3% in August. This is a repeat sales measure of commercial real estate prices.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted. Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

It is important to remember that the number of transactions is very low and there are a large percentage of distressed sales.

HousingWire has more:

"The commercial real estate market in the U.S. has become trifurcated with prices rising for performing trophy assets located in major markets, falling sharply for distressed assets, and remaining essentially flat for smaller healthy properties," said Nick Levidy, managing director at Moody's.

Fed's Dudley: 3 million excess vacant housing units

by Calculated Risk on 10/19/2010 10:09:00 AM

From NY Fed President William Dudley: Regional Economy and Housing Update

[L]et's consider the slow housing recovery. Housing market activity—both new construction and sales—remains depressed. On the construction side, total housing starts are running at just 600,000 units per year (seasonally-adjusted) in recent months. This is up from 530,000 units at the trough in the first quarter of 2009 but it is still extremely low by the standards of the last 50 years. In fact, the rate of new construction is so low that there is barely any net growth in the U.S. housing stock these days.For those in the New York / New Jersey area, much of Dudley speech is on the regional economy and housing market.

One reason why so little housing is being built is that many existing homes stand vacant. We estimate that there are roughly 3 million vacant housing units more than usual. And more vacancies are added daily as the foreclosure process moves homes from families to mortgage lenders. This stock of vacant homes will shrink when fewer are foreclosed upon and more of these homes are sold or rented out.

On the sales side, even though low mortgage interest rates and falling home prices have together boosted housing affordability to its highest level in 40 years, the current pace of sales is quite sluggish. Impediments to home sales include tight lending standards, a weak job market and continued uncertainty regarding the future path of home prices. The large decline in home prices that occurred between 2006 and 2008 is also important. This decline reduced the amount of equity that owners have in their homes, making it difficult for people to come up with the funds needed to "trade-up" and move into better homes.

In addition, the steep decline in home prices put many families at risk of mortgage delinquency and, ultimately, losing their homes to foreclosure. With lower home prices, many families now owe more on their mortgage than their home is worth. This means that they cannot refinance or sell their homes easily if they experience a financial crisis, such as a job loss or a serious illness. Recent developments on foreclosures have been mixed. While RealtyTrac reports that foreclosure completions in the United States exceeded 100,000 for the first time in September, it is important to remember that foreclosure is a lengthy process in most states. Our data indicate that, in recent quarters, borrowers are becoming less likely to fall behind on their mortgages, so fewer households are now entering the foreclosure process. At the same time, though, major lenders have acknowledged serious problems in the processes they have used to repossess homes and announced moratoria on new foreclosures. Taken together, these developments suggest that the situation in housing remains uncertain for the foreseeable future.

The Federal Reserve actively encourages efforts to find viable alternatives to foreclosure, like loan modifications, or deeds in lieu. We also support due process and access to legal counsel for homeowners facing foreclosure, for instance through legal aid programs. At the same time, it is important that foreclosures that properly comply with state and federal law can ultimately take place, as this is a necessary part of the adjustment that will eventually return us to more normal conditions in the housing market.

At present, the extent of the documentation problem and its wider ramifications are still uncertain. In conjunction with the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation, the Federal Reserve is therefore seeking to establish the facts through a review of the foreclosure practices, governance and documentation at the major bank mortgage servicers. We want to ensure that the housing finance business is supported by robust back-office operations—for processing of new mortgages as well as foreclosures— so that buyers of homes and investors in mortgage securities have full confidence in the process. We are monitoring developments closely in order to evaluate any potential impact on the housing market, financial institutions and the overall economy.

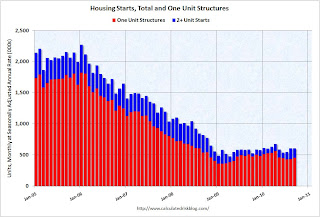

Housing Starts increase in September

by Calculated Risk on 10/19/2010 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 610 thousand (SAAR) in September, up 0.3% from the revised August rate of 608 thousand (revised up from 598 thousand), and up 28% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

There has been an increase in multi-family starts over the last two months, although single family starts are significantly below the levels of earlier this year.

Single-family starts increased 4.4% to 452 thousand in August. This is 25% above the record low in January 2009 (360 thousand).

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for almost two years - with a slight up and down over the last six months due to the home buyer tax credit.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for almost two years - with a slight up and down over the last six months due to the home buyer tax credit.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This was above expectations of 580 thousand starts, mostly because of the volatile multi-family starts. As I've mentioned many times - this low level of starts is good news for the housing market longer term (there are too many housing units already), but bad news for the economy and employment short term.

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 610,000. This is 0.3 percent (±10.3%)* above the revised August estimate of 608,000 and is 4.1 percent (±12.0%)* above theSeptember 2009 rate of 586,000.

Single-family housing starts in September were at a rate of 452,000; this is 4.4 percent (±13.9%)* above the revised August figure of 433,000.

Building Permits:

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 539,000. This is 5.6 percent (±1.4%) below the revised August rate of 571,000 and is 10.9 percent (±2.3%) below the September 2009 estimate of 605,000.

Single-family authorizations in September were at a rate of 405,000; this is 0.5 percent (±1.3%)* above the revised August figure of 403,000.

Monday, October 18, 2010

Foreclosure-Gate: GMAC resumes some foreclosures

by Calculated Risk on 10/18/2010 09:48:00 PM

Statement from GMAC: GMAC Mortgage Statement on Independent Review and Foreclosure Sales

GMAC Mortgage ... has engaged several leading legal and accounting firms to conduct independent reviews of its foreclosure procedures in each of the 50 states.Earlier I posted the BofA and Citi comments (BofA is resuming foreclosures, Citi said their foreclosure process was "sound".) Several large banks report Q3 results over the next two days (BofA, Goldman Sachs, Wells Fargo and Morgan Stanley), and I expect more comments on foreclosure issues (and possibly more questions).

...

In addition to the nationwide measures, the review and remediation activities related to cases involving judicial affidavits in the 23 states continues and has been underway for approximately two months. As each of those files is reviewed, and remediated when needed, the foreclosure process resumes. GMAC Mortgage has found no evidence to date of any inappropriate foreclosures.

On the Citi conference call this morning there were no questions on foreclosure-gate and only one on securitization issues - and that didn't provide any new information.

2010 Census: Final Weekly Payroll Update

by Calculated Risk on 10/18/2010 06:59:00 PM

The Census Bureau has released the final weekly payroll report for the 2010 Census. The report shows only 2,766 temporary workers were on the payroll for the week ending Oct 2nd.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of Census workers paid each week. The red labels are the weeks of the BLS payroll survey.

I'm providing this update because every month there is some confusion over how to report the payroll numbers in the employment report. Starting with the October employment report (to be released on November 5th), we can go back to reporting the headline number (not ex-Census), and we can ignore the impact of the temporary Census hiring on the monthly payroll numbers - well, until the next decennial Census!

Citigroup: Foreclosure Process is 'Sound', BofA expects to submit new affidavits next week

by Calculated Risk on 10/18/2010 03:38:00 PM

From Dow Jones: Citigroup Says Its Foreclosure Processing Is 'Sound' Dow Jones is reporting that the Citigroup CFO John Gerspach said they have found no issues with the foreclosure process, and they see no reason to halt foreclosures.

"While we use external attorneys to prepare [foreclosure] documents, each package is reviewed by a Citi employee, who verifies the information and signs the foreclosure affidavit in the presence of a notary," Gerspach said ...And from the WSJ: BofA Sets Timetable for Foreclosure Review. The WSJ is reporting that BofA will resubmit new affidavits for 102,000 pending foreclosures, and that they expect to resubmit the affidavits, with the proper reviews and new signatures, by October 25th.

Fed's Lockhart: QE2 is an "insurance policy" against further disinflation

by Calculated Risk on 10/18/2010 01:03:00 PM

From Atlanta Fed President Dennis Lockhart: The Challenges of Monetary Policy in Today's Economy

To opt for more quantitative easing at this juncture is a big decision. Today I will walk you through the thicket of considerations that lead me, at this moment, to be sympathetic to more monetary stimulus in the near future.Lockhart is not currently on the FOMC.

...

With current inflation running at about 1 percent or a little higher and with official unemployment measured at 9.6 percent, it's clear that the economy is not where we want it to be. In my mind, the question is whether this situation is a call to immediate action.

...

As a starting point, I expect final measures of third quarter GDP growth to be close to that in the second quarter which came in at 1.6 percent. My current forecast sees a modest increase in the rate of growth in the fourth quarter and further, but still modest, improvement in 2011. In this forecast, inflation remains low but with no further disinflation, and unemployment comes down very gradually.

In my thinking, the range of plausible divergence from this forecast is quite wide, and the risks are more to the downside.

...

In my view, the decision is not clear cut. We policymakers have to weigh these arguments pro and con, potential costs versus benefits, and competing risks. As I said earlier, I am leaning in favor of additional monetary stimulus while acknowledging the longer-term risks the policy may present. At this juncture, and given the circumstances of sluggish growth and measured inflation that is too low, I give greater weight to the risk of further disinflation leading to deflation. In my mind, QE2 is a form of risk management—an insurance policy that is prudent to put in place at this time.

Note: Lockhart see modest improvment in both GDP growth and unemployment, but I think we will see a little more weakness in GDP growth and the unemployment rate will even tick up a little from 9.6%.