by Calculated Risk on 6/19/2010 09:02:00 PM

Saturday, June 19, 2010

Housing Starts and the Unemployment Rate

An update on a theme ...  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows single family housing starts and the unemployment rate through May (inverted).

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Usually housing starts and residential construction employment lead the economy out of a recession, but not this time because of the huge overhang of existing housing units. After rebounding a little in early '09, housing starts (blue) have mostly moved sideways.

This is what I expected when I first posted the above graph last summer. I wrote:

[T]here is still far too much existing home inventory, a sharp bounce back in housing starts is unlikely, so I think ... a rapid decline in unemployment is also unlikely.Usually near the end of a recession, residential investment (RI) picks up as the Fed lowers interest rates. This lead to job creation and also household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recovery.

Note: RI is mostly new home sales and home improvement.

However this time, with the huge overhang of existing housing units, this key sector isn't participating. So in this recovery there is less job creation, less household formation, and less demand for housing units than a normal recovery. This is sort of a circular trap for both GDP growth and employment.

Eventually the excess housing units will be absorbed - (progress is slowly being made, see Housing Stock and Flow) - but until then, this key sector will remain under pressure and I expect the recovery will be sluggish and the unemployment rate will stay elevated.

Summers cautious about recovery

by Calculated Risk on 6/19/2010 05:02:00 PM

From the Boston Globe: Summers cites recovery, risks

The US economy has probably begun a lasting recovery, but the outlook has become more uncertain in recent weeks ... said Lawrence Summers, President Obama’s top economic adviser.No one has a crystal ball, but Summers sure doesn't seem very confident.

...

Summers ... presented a cautious, measured view of economic conditions. For example, after expressing confidence that European policy makers would contain the government debt crisis and avoid another global financial crisis, he added that the assessment was “my best guess, and I could be wrong.’’

Or, when asked if the nation had achieved a self-sustaining recovery, Summers responded, “I think that’s the right presumption and my expectation. I wouldn’t be foolish enough to be certain.’’

Impact of Decennial Census on June Payroll Report

by Calculated Risk on 6/19/2010 01:05:00 PM

In a post last month I reviewed the impact of the decennial Census hiring on the payroll report. Here is an update ...

We can estimate the Census hiring using weekly payroll data from the Census bureau (ht Bob_in_MA). If we subtract the number of temporary 2010 Census workers in the week containing the 12th of the month, from the same week for the previous month - this provides a close estimate for the impact of the Census hiring.

The Census Bureau releases the actual number with the employment report.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of Census workers paid each week. The red labels are the weeks of the BLS payroll survey.

So far the decennial Census payroll has decreased by 156 thousand this month, and will probably subtract 200 to 250 thousand from the payroll report (we will have a good estimate this coming Wednesday when the week ending June 12th is released).

When the employment report is released on July 2nd, a key number will be payroll jobs ex-Census (to understand the underlying trend). The headline number for June - including Census numbers - will probably be negative.

China statement: "To proceed with exchange rate reform"

by Calculated Risk on 6/19/2010 08:48:00 AM

From Bloomberg: China Yuan Pledge Suggests Peg to Dollar May Go

Here are some excerpts from the statement (via WSJ):

In view of the recent economic situation and financial market developments at home and abroad, and the balance of payments (BOP) situation in China, the People´s Bank of China has decided to proceed further with reform of the RMB exchange rate regime and to enhance the RMB exchange rate flexibility.I'll believe it when I see it ...

...

The global economy is gradually recovering. The recovery and upturn of the Chinese economy has become more solid with the enhanced economic stability. It is desirable to proceed further with reform of the RMB exchange rate regime and increase the RMB exchange rate flexibility.

Friday, June 18, 2010

Unofficial Problem Bank List increases to 781 Institutions

by Calculated Risk on 6/18/2010 11:45:00 PM

Sheila may be taking it easy, but surferdude808 is working hard ... Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 18, 2010.

Changes and comments from surferdude808:

After relative calm last week, there were many changes to the Unofficial Problem Bank List this week as the OCC finally released their actions for May. The list stands at 781 institutions with aggregate assets of $404.3 billion, up from 760 institutions with aggregate assets of $385.2 billion last week. Only one removal this week -- the failed Nevada Security Bank ($492 million Ticker: TBHS).

There were 22 additions with aggregate assets of $19.6 billion. Most notable among the additions are Pacific Capital Bank, National Association, Santa Barbara, CA ($7.4 billion Ticker: PCBC); Bank Midwest, National Association, Kansas City, MO ($4.3 billion); Bank of Hampton Roads, Norfolk, VA ($2.7 billion); Seaside National Bank & Trust, Orlando, FL ($808 million); and Waccamaw Bank, Whiteville, NC ($585 million Ticker: WBNK). Bank Midwest is controlled by Dickinson Financial Corporation, a multi-bank holding company, and its other bank subsidiaries were also added this week including Academy Bank, National Association ($507 million), Armed Forces Bank, National Association ($835 million), Armed Forces Bank of California, National Association ($22 million), Southern Commerce Bank, National Association ($257 million), and SunBank, National Association ($88 million).

The OCC issued a Formal Agreement against Saigon National Bank, Westminster, CA ($71 million Ticker: SAGN), which has the dubious distinction of missing six TARP dividend payments. It is a mind scratcher why it has taken the OCC so long to issue an action against Saigon National Bank. One is even more challenged to understand the tardiness in action against Pacific Capital Bank, National Association.

As anticipated, there were two add backs -- Mission Oaks National Bank and Valley National Bank that were removed in the past two weeks when the OCC terminated Formal Agreements. Now these banks are operating under Consent Orders.

Other changes include Prompt Corrective Action Orders against banks already on the list and the conversion of some actions. The Federal Reserve issued PCA Orders against Pierce Commercial Bank ($258 million) and Sterling Bank ($408 million), and the OTS issued a PCA Order against Turnberry Bank ($264 million). The OCC converted Formal Agreements to Consent Orders against Rosemount National Bank ($38 million) and Security Bank, National Association ($160 million).

Bank Failure #83: Nevada Security Bank, Reno, Nevada

by Calculated Risk on 6/18/2010 09:10:00 PM

Silver State institution

Sugar-coat veneer

by Soylent Green is People

From the FDIC: Umpqua Bank, Roseburg, Oregon, Assumes All of the Deposits of Nevada Security Bank, Reno, Nevada

As of March 31, 2010, Nevada Security Bank had approximately $480.3 million in total assets and $479.8 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $80.9 million. ... Nevada Security Bank is the 83rd FDIC-insured institution to fail in the nation this year, and the third in Nevada. The last FDIC-insured institution closed in the state was Sun West Bank, Las Vegas, on May 28, 2010.Friday wasn't cancelled ...

CoreLogic: House Prices increase 0.8% in April

by Calculated Risk on 6/18/2010 07:20:00 PM

From CoreLogic (formerly First American LoanPerformance): CoreLogic® Home Price Index Shows Year-Over-Year and Month-Over-Month Increase

National home prices increased in April, the second consecutive monthly increase. According to the CoreLogic HPI, national home prices, including distressed sales, increased by 2.6 percent in April 2010 compared to April 2009. This was an improvement over March’s yearover-year price increase of 2.3 percent. Excluding distressed sales, year-over-year prices increased in April by 2.2 percent; an improvement over the March non-distressed HPI which increased by 1.0 percent year-over-year.

On a month-over-month basis, the national average home price index increased by 0.8 percent in April 2010 compared to March 2010, which was stronger than the previous one-month increase of 0.1 percent from February to March.

...

“The monthly increase in the HPI shows the lingering effects of the homebuyer tax credit,” said Mark Fleming, chief economist for CoreLogic. “We expect that we will see home prices remain strong through early summer, but in the second half of the year we expect price growth to soften and possibly decline moderately.”

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the national LoanPerformance data since 1976. January 2000 = 100.

The index is up 2.6% over the last year, and off 29.5% from the peak.

House prices are off 3.5% from the recent peak in August 2009 (although some of the decline might be seasonal). The index bottomed in March 2009 ... and the index is up 3.1% since then.

CoreLogic expects prices to "soften and possibly decline moderately". I expect that we will see lower prices on this index later this year.

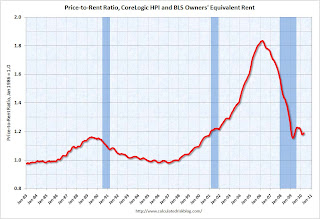

The second graph is an update on the price-to-rent ratio similar to the approach used by Fed economist John Krainer and researcher Chishen Wei in 2004: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

The second graph is an update on the price-to-rent ratio similar to the approach used by Fed economist John Krainer and researcher Chishen Wei in 2004: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.This graph shows the price to rent ratio using the CoreLogic data (January 2000 = 1.0).

This suggests that house prices are much closer to the bottom than the top, but that prices still have a ways to fall on a national basis.

Lumber Prices off 30% since April

by Calculated Risk on 6/18/2010 03:39:00 PM

By request, a graph of lumber prices ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the NAHB, framing lumber prices have collapsed since the end of April.

This graph shows two measures of lumber prices: 1) from Random Lengths (via NAHB), and 2) CME futures.

With so many mills shut down during the bust, the supply of lumber was way down - and prices surged early this year. Now that construction has slowed, prices have collapsed.

Obama urges G-20 Nations to continue stimulus; Cautions about a Double-dip

by Calculated Risk on 6/18/2010 01:25:00 PM

From President Obama: Letter from the President to G-20 Leaders

Our highest priority in Toronto must be to safeguard and strengthen the recovery. We worked exceptionally hard to restore growth; we cannot let it falter or lose strength now.He also cautioned about global imbalances:

This means that we should reaffirm our unity of purpose to provide the policy support necessary to keep economic growth strong. It is essential that we have a self-sustaining recovery that creates the good jobs that our people need. In fact, should confidence in the strength of our recoveries diminish, we should be prepared to respond again as quickly and as forcefully as needed to avoid a slowdown in economic activity.

A strong and sustainable global recovery needs to be built on balanced global demand. Significant weaknesses exist across G-20 economies. I am concerned by weak private sector demand and continued heavy reliance on exports by some countries with already large external surpluses. Our ability to achieve a durable global recovery depends on our ability to achieve a pattern of global demand growth that avoids the imbalances of the past. ... I also want to underscore that market-determined exchange rates are essential to global economic vitality. The signals that flexible exchange rates send are necessary to support a strong and balanced global economy.Obama was clearly writing about China.

Obama argued for stimulus now - while the economy is weak - and fiscal discipline over the medium term:

We need to commit to fiscal adjustments that stabilize debt-to-GDP ratios at appropriate levels over the medium term.

State Unemployment Rates: Slightly lower in May

by Calculated Risk on 6/18/2010 10:00:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were slightly lower in May. Thirty-seven states and the District of Columbia recorded unemployment rate decreases over the month, 6 states had increases, and 7 states had no change, the U.S. Bureau of Labor Statistics reported today. ...

In May, nonfarm payroll employment increased in 41 states and the District of Columbia, decreased in 5 states, and was unchanged in 4 states.

...

Nevada reported the highest unemployment rate among the states, 14.0 percent in May. This is the first month in which Nevada recorded the highest rate among the states and the first time since April of 2006 that a state other than Michigan has posted the highest rate. The rate in Nevada also set a new series high. (All region, division, and state series begin in 1976.) The states with the next highest rates were Michigan, 13.6 percent; California, 12.4 percent; and Rhode Island, 12.3 percent.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Sixteen states and D.C. now have double digit unemployment rates. New Jersey is close.

Nevada set a new series high at 14% and now has the highest state unemployment rate. Michigan held the top spot for over 4 years.

Feds Charge 1,200 with Mortgage Fraud

by Calculated Risk on 6/18/2010 08:30:00 AM

From the LA Times: Feds charge 1,200 people in mortgage fraud crackdown

[F]ederal authorities said Thursday that they had filed criminal charges in recent months against 1,200 mortgage brokers and others accused of cheating banks and borrowers of $2.3 billion.This is a start ...

...

In one of the New York cases, a tax preparer is accused of selling fake pay stubs and tax documents to mortgage and real estate brokers, who allegedly used the documents to apply for loans. Authorities said 17 people were indicted as a result of that investigation.

In another New York case, prosecutors allege that a company offered to help struggling homeowners around the country but did nothing once the borrowers paid the firm's upfront fees.

Thursday, June 17, 2010

Krugman: "That '30s Feeling"

by Calculated Risk on 6/17/2010 11:59:00 PM

From Paul Krugman in the NY Times: That '30s Feeling

Suddenly, creating jobs is out, inflicting pain is in. Condemning deficits and refusing to help a still-struggling economy has become the new fashion everywhere ...And as if on cue, from Alan Greenspan wrties in the WSJ: U.S. Debt and the Greece Analogy

Many economists, myself included, regard this turn to austerity as a huge mistake. It raises memories of 1937, when F.D.R.’s premature attempt to balance the budget helped plunge a recovering economy back into severe recession.

An urgency to rein in budget deficits seems to be gaining some traction among American lawmakers. If so, it is none too soon.I believe Greenspan is flat wrong - just as he was in 2001 when he Greenspan spoke of "an on-budget surplus of almost $500 billion ... in fiscal year 2010". Greenspan offered a projection of "an implicit on-budget surplus under baseline assumptions well past 2030 despite the budgetary pressures from the aging of the baby-boom generation, especially on the major health programs."

I argued Greenspan was wrong then, and I believe he is wrong now.

I believe the focus right now needs to be on jobs, jobs and jobs.

S&P expects up to 70% redefault on Loan Mods

by Calculated Risk on 6/17/2010 06:47:00 PM

From Zach Fox at SNL Financial: Analysts believe loan mod redefaults could hit 70%

Diane Westerback, S&P's managing director of global surveillance analytics, told SNL that the previously reported 30% to 40% redefault rates typically only count borrowers after two or three months of payments. A year after the modification, Westerback expects redefaults to hit between 60% and 70%.More shadow inventory ...

...

Fitch Ratings on June 16 issued similar projections, albeit only for subprime and Alt-A loans in RMBS. The rating agency projects modifications on those product types to redefault at a 65% to 75% range, while prime loans in RMBS are expected to redefault at a rate of 55% to 65%.

European Bond Spreads continue to widen

by Calculated Risk on 6/17/2010 04:02:00 PM

Here are two graphs from the Atlanta Fed weekly Financial Highlights released today (graph as of June 16th): Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Atlanta Fed:

After initially declining in early May, sovereign debt spreads have begun widening for peripheral euro-area countries. As of June 16, the 10-year bond spread (over German bonds) stands at 640 basis points (bps) for Greece, 283 bps for Ireland, 274 bps for Portugal, and 209 bps for Spain.Note: The Atlanta Fed data is one day old. Nemo has links to the current data on the sidebar of his site.

The spread to Spanish bonds has increased 110 bps since May 11, from 1% to 2.09%, while Portuguese bond spreads are 121 bps higher during the same period.

The spreads have widened further today: Greece is up to 668 bps, Ireland 290 bps, Portugal 293 bps, and Spain 211 bps. Oh, and Hungary is up sharply to 495 bps.

Similarly, while CDS spreads declined slightly last week, they are wide relative to earlier this year.Apparently this is what IMF Managing Director Dominique Strauss-Kahn meant by "contained" last week.

Hotel Occupancy Increases

by Calculated Risk on 6/17/2010 03:03:00 PM

From HotelNewsNow.com: STR: Luxury segment leads weekly increases

Overall, the industry’s occupancy increased 8.2 percent to 65.8 percent, ADR was up 1.7 percent to US$98.55, and RevPAR rose 10.0 percent to US$64.83.Note: As I noted last week, Memorial Day was late this year. That made last week look worse than actual, and made this week look better. This is why I use the 4-week moving average.

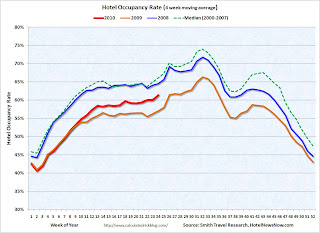

The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change.

On a 4-week basis, occupancy is up 7.6% compared to last year (the worst year since the Great Depression) and still about 7% below normal.

Note: The graph shows the distinct seasonal pattern for the occupancy rate - higher in the summer because of leisure/vacation travel.

Last year leisure travel (summer) held up better than business travel, now it appears business travel is recovering - and we will soon see if leisure travel will also pick up this year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Have Residential Rents bottomed?

by Calculated Risk on 6/17/2010 01:04:00 PM

There is some evidence that apartment rents have bottomed ... at least temporarily.

The BLS reported this morning:

The shelter index increased for the first time since August 2009, rising 0.1 percent. The rise was mostly due to the index for lodging away from home, which increased 2.5 percent. The indexes for both rent and owners' equivalent rent were unchanged in May.The OER measure was up slightly and tends to lag other measures of rents.

Back in May, the NMHC reported that the market tightness index had increased sharply:

The Market Tightness Index, which measures changes in occupancy rates and/or rents, rose sharply from 38 to 81. This was the highest figure in nearly four years.There are some monthly private apartment data providers why say that rents have risen over the first 4 months of the year (on month-to-month basis, rents are still down year-over-year). They are reporting that the occupancy rate has risen slightly too.

...

“We saw a sharp increase in the Market Tightness Index, which fits with the surprisingly strong (for a seasonally weak period) effective rent growth.” [said NMHC Chief Economist Mark Obrinsky]

I spoke with a large apartment owner in Texas who told me they are seeing effective rents rising over the last few months.

I've also heard that the mood really changed at the NMHC meeting in May compared to the January meeting. There is a growing consensus among large apartment owners that rents have bottomed and the industry will rebound in 2011.

And from Dawn Wotapka the WSJ: Apartment Leases, Rents Pick Up

For the first time since the downturn, some of the nation's largest apartment-building landlords are reporting that rent declines have stopped and some are even boasting modest increases. Green Street Advisors, a real-estate research firm, says demand might have struck bottom in the first quarter ... From January through May, rents climbed 2.8% nationwide, according to Axiometrics, which tracks the national apartment market.This seems surprising given that REIS reported a record vacancy rate in Q1: "Nationally, the apartment vacancy rate stayed flat at 8%, the highest level since Reis Inc., a New York research firm, began its tally in 1980" and the Census Bureau reported the rental vacancy rate was at 10.6% in Q1, just below the all time high. Note: Reis is for large cities, the Census Bureau is nationwide.

Just something to be aware of ... rents could start falling again, but it does appear the slide has stopped for now - at least for the large apartment complexes.

Philly Fed Index "decreased notably" in June, Employment turned slightly negative

by Calculated Risk on 6/17/2010 10:00:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased notably from a reading of 21.4 in May to 8.0 in June. The index, which had edged higher for four consecutive months, fell back to its lowest reading in 10 months (see Chart). Although still positive and suggesting growth, indexes for new orders and shipments showed a mixed pattern this month — the new orders index increased 3 points, while the shipments index decreased 2 points. The current inventory index increased 13 points and moved back from a negative reading into positive territory, suggesting an increase in inventories this month.

Until this month, firms’ responses had been suggesting that labor market conditions were improving, but indexes for current employment and work hours were both slightly negative. For the first time in seven months, more firms reported a decrease in employment (18 percent) than reported an increase (17 percent).

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

The index has been positive for ten months now, but turned down "notably" in June.

This might suggest that growth in the manufacturing sector is slowing. Especially concerning is the slightly negative employment index.

Weekly Initial Unemployment Claims increase to 472,000

by Calculated Risk on 6/17/2010 08:34:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending June 12, the advance figure for seasonally adjusted initial claims was 472,000, an increase of 12,000 from the previous week's revised figure of 460,000. The 4-week moving average was 463,500, a decrease of 500 from the previous week's revised average of 464,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending June 5 was 4,571,000, an increase of 88,000 from the preceding week's revised level of 4,483,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The four-week average of weekly unemployment claims decreased this week by 500 to 463,500 (the "decrease" was because last week was revised up).

The dashed line on the graph is the current 4-week average. Initial weekly claims first fell to this level in December 2009, and have been at the same level for about 6 months. The current level of 472,000 (and 4-week average of 463,500) is still high, and suggests ongoing weakness in the labor market.

Wednesday, June 16, 2010

Summary and Misc

by Calculated Risk on 6/16/2010 09:29:00 PM

A quick roundup ...

Remember MERS? From American Banker: Challenges to Foreclosure Docs Reach a Fever Pitch (ht Terry)

From HuffPost: Fannie Mae, Freddie Mac Shares To Be Pulled From NYSE (ht Paulo)

Homebuilder Toll Brothers warns: Demand Choppy, Sales Down

From CNBC: Europe Will Soon Publish Bank Stress Tests: ECB Official

Iceland: Court rules Foreign currency indexed loans illegal

From the NY Times: France and Spain Act to Rein in Budgets

From Bloomberg: Former Taylor Bean Chief Farkas Charged With Fraud

Lee Farkas, the former chairman of Taylor, Bean & Whitaker Mortgage Corp., was accused by the U.S. of helping run a more than $1.9 billion fraud scheme that unsuccessfully attempted to steal money from the government’s Troubled Asset Relief Program.From CNBC: More Than 90 Banks Miss TARP Payments (ht Scott, Ron)

Click on graph for larger image in new window.

Click on graph for larger image in new window.Total housing starts were at 593 thousand (SAAR) in May, down 10% from the revised April rate of 659,000 (revised down from 672 thousand), and up 24% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts collapsed 17.2% to 468,000 in May.

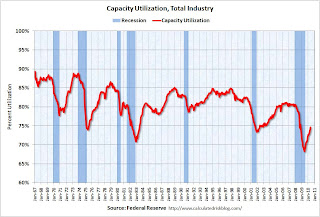

This graph shows Capacity Utilization. This series is up 9.4% from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 9.4% from the record low set in June 2009 (the series starts in 1967). Capacity utilization at 73.7% is still far below normal - and 7.2% below the the pre-recession levels of 80.5% in November 2007.

Best to all.