by Calculated Risk on 7/07/2009 06:32:00 PM

Tuesday, July 07, 2009

CNBC Interview with Bryan Marsal, CEO of Lehman Brothers Holdings

This is an interesting interview from early this morning with Bryan Marsal, CEO of Lehman Brothers Holdings, who is unwinding Lehman Brothers ... especially at the 18 minute mark:

One of my partners said yesterday that we are going to call this phase the "extend and pretend" phase in our economy. Which is you extend someone's maturity - because they are going to default - and you pretend that business will come back or that leverage factor is going to come back.This applies to all kinds of debt - extend and pretend - that sounds like most of the residential loan modifications! But eventually many of those same loans will reach the "send" phase.

Then we'll enter phase two, which he said is the request to extend or "amend".

Then "send". In other words send the keys.

That is the phases we are in right now. Everyone is trying to buy time, as opposed to dealing with the leverage, they are trying to buy time. Whether you are a banker or a company, they are all trying to buy time. I don't see the leverage coming back, and I don't see the consumption of good and services coming back.

Bryan Marsal, CEO of Lehman Brothers Holdings.

CRE: Another Half Off Sale and Market

by Calculated Risk on 7/07/2009 03:54:00 PM

First, the market was off about 2% today ... Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

And from Bloomberg: Deutsche Bank to Sell New York Tower for $605 Million (ht Brad, Brian)

Deutsche Bank AG, Germany’s largest bank, plans to sell Manhattan’s Worldwide Plaza to ... RCG Longview and George Comfort & Sons ... for about $605 million ...More like 65% off, but all that vacant space was probably a huge factor.

Deutsche Bank is selling the last of seven buildings it seized from developer Harry Macklowe. He paid $1.74 billion for the 1.75 million square-foot property in February 2007, according to Real Capital Analytics Inc. data. Manhattan office building prices have dropped 30 percent to 50 percent since the peak in 2007, according to Woody Heller, head of the capital transactions group at Studley, a New York-based brokerage. Heller wasn’t involved in the transaction.

...The 47-story building will have more than 700,000 square- feet of vacant space with the expected departure of advertising and public relations firm Ogilvy & Mather.

Office Vacancy Rate and Unemployment

by Calculated Risk on 7/07/2009 02:33:00 PM

Last night Reis reported that the U.S. office vacancy rate hits 15.9 percent in Q2. (See Reis: U.S. Office Vacancy Rate Hits 15.9% in Q2 for a graph). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the office vacancy rate vs. the quarterly unemployment rate and recessions.

The unemployment rate and the office vacancy rate tend to move in the same direction - and the peaks and troughs mostly line up.

As the unemployment rate continues to rise over the next year or more, the office vacancy rate will probably rise too. Reis' forecast is for the office vacancy rate to peak at 18.2 percent in 2010, and for rents to continue to decline through 2011.

One of the questions is why - given 9.5% unemployment - the office vacancy rate isn't even higher? This is probably a combination of less overbuilding as compared to the S&L related overbuilding in the '80s, and the tech bubble overbuilding a few years ago. And possibly because a higher percentage of construction, manufacturing and retail workers (non-office workers) have lost their jobs in the recession (I'll have to check that).

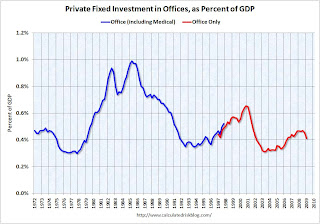

Note: Hotel and retail structure investment were off the charts during the recent boom, but office investment was somewhat muted in comparison ... The second graph shows office investment as a percent of GDP since 1972 through Q1 2009. Office investment peaked in Q3 2008, and with the office vacancy rate rising sharply, office investment will probably decline at least through 2010.

The second graph shows office investment as a percent of GDP since 1972 through Q1 2009. Office investment peaked in Q3 2008, and with the office vacancy rate rising sharply, office investment will probably decline at least through 2010.

Note: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

There is still too much space coming online. From Reuters:

During the second quarter, office space coming on the market topped rented space by about 20 million square feet, slightly less than the 25.2 million square feet in the first quarter.

Year-to-date, 45.2 million more square feet came onto the market than was rented, in line with Reis' projection of about 67.6 million square feet for all of 2009.

If the projection holds true, 2009 will be the worst year for net absorption of office space since Reis began tracking it in 1980.

Hotel Recession Reaches 20 Months

by Calculated Risk on 7/07/2009 12:21:00 PM

From HotelNewsNow: Industry enters 20th month of recession

Economic research firm e-forecasting.com, in conjunction with Smith Travel Research, announced HIP edged down 0.7 percent in June, following a decline of 1.2 percent in May. HIP, the Hotel Industry’s Pulse index, is a composite indicator that gauges business activity in the U.S. hotel industry in real-time. The latest decrease brought the index to a reading of 82.5. The index was set to equal 100 in 2000.

...

“This recession continues to drag out, just one month shy of matching the longest one the industry felt back in May ’81 to January ’83, which lasted 21 months,” said Maria Simos, CEO of e-forecasting.com

| Click on graph for larger image in new window. |

And a quote from The Arizona Republic: Resorts suffer financial strains (ht Jonathan)

Richard Warnick of Warnick & Co. said he'd be surprised if nearly all hotels and resorts, here and across the country, weren't in technical default on their loans, falling below required minimums on debt service coverage, for example, given the sad state of travel. That is often a precursor to more serious financial problems that prompt lenders to foreclose.Actually the hotel industry has "committed economic suicide" by overbuilding and taking on too much debt.

...

He and others say hotels have committed economic suicide by slashing rates to levels not seen even in the aftermath of 9/11, and many are concerned it will take years to get back to "normal," or at least the new normal.

Smith Travel Research is now forecasting RevPAR (revenue per available room) off 17.1% this year and declining another 3.7% next year.

Banks Will Stop Accepting California IOUs Friday

by Calculated Risk on 7/07/2009 11:04:00 AM

From the WSJ: Big Banks Don't Want California's IOUs

A group of the biggest U.S. banks said they would stop accepting California's IOUs on Friday ... if California continues to issue the IOUs, creditors will be forced to hold on to them until they mature on Oct. 2, or find other banks to honor them.I guess the banks don't think the 3.75% annual interest rate is worth the risk for a "BBB" rated debtor on the Rating Watch Negative list.

...

The group of banks included Bank of America Corp., Citigroup Inc., Wells Fargo & Co. and J.P. Morgan Chase & Co., among others.

ABA: Record Home-Equity Loan Delinquencies

by Calculated Risk on 7/07/2009 09:25:00 AM

From Bloomberg: U.S. Home-Equity Loan Delinquencies Set Record in First Quarter (ht Bob_in_MA)

Late payments on home-equity loans rose to a record in the first quarter ...Update: headline corrected, ABA, not MBA.

Delinquencies on home-equity loans climbed to 3.52 percent of all accounts in the quarter from 3.03 percent in the fourth and late payments on home-equity lines of credit climbed to a record 1.89 percent, the group said. ...

“The number one driver of delinquencies is job loss,” James Chessen, the group’s chief economist, said in an e-mailed statement. “Delinquencies won’t improve until companies start hiring again and we see a significant economic turnaround.”

Bank Failures and Trust-preferred securities

by Calculated Risk on 7/07/2009 08:46:00 AM

From the WSJ: Hybrid Securities Doomed Six Banks (ht Brian)

The six family-controlled Illinois banks that collapsed on Thursday were doomed by massive holdings of trust preferred securities, Wall Street instruments that came into vogue during the industry's boom but are now battering a growing number of small banks.These trust-preferred securities (TPS) were attractive investments for small banks because they have characteristics of both debt and equity. If the securities were issued by a bank holding company (BHC) - with certain characteristics - they were treated as a tier 1 capital by regulators.

... Wall Street brokerage firms bought the securities from individual banks and packaged them into collateralized-debt obligations. The firms then sold slices of the CDOs to investors, marketing them as lucrative but low risk. Many of the buyers were small and regional banks.

One of the big disadvantages for investors (usually small banks) was that the securities were subordinated to all of the issuing BHC's other debt, and the issuer could opt to stop paying dividends on the securities for several years. As the WSJ notes:

When the credit crisis hit, the values of the securities and pools into which they were packaged rapidly lost value, partly because some banks stopped paying dividends on the securities. Under accounting rules, the banks were required to write down the securities to market value. That forced the banks to absorb big losses, winnowing their capital cushions.From the Philly Fed: Emerging Issues Regarding Trust Preferred Securities

As of December 31, 2008, almost 1,400 bank holding companies had approximately $148.8 billion in outstanding TPS, compared to 110 BHCs with $31.0 billion outstanding in 1999.

...

TPS have proven to be an effective way to bolster a BHC's capital position when financial performance is strong. If a BHC or its subsidiary bank's financial condition (particularly, its capital levels) deteriorates, however, the limitations on including TPS for regulatory capital purposes and the restrictive covenants in the debentures could further exacerbate the institution's financial problems and raise supervisory concerns.

...

Adverse economic and market conditions have resulted in rating downgrades of TPS and significant valuation declines for these securities. For instance, on February 10, 2009, Standard and Poor's Ratings Services lowered its ratings on 35 tranches from 14 U.S. trust preferred CDOs. These downgrades reflect fears that institutions issuing TPS may be more likely to defer interest payments as the current economic crisis continues.

...

Given the interrelated ownership of a financial institution's TPS by another banking organization, the underlying stability and strength of the issuing bank must be considered when assessing the risk associated with holding a security which is currently in the deferral phase of dividend payment. Given the extensive issuance of TPS over the past 10 years and the present danger for bank failures, the potential exists for many of these securities to default permanently.

emphasis added

Reis: U.S. Office Vacancy Rate Hits 15.9% in Q2

by Calculated Risk on 7/07/2009 12:14:00 AM

"It's bad. It's decaying and getting worse. Given the depth and magnitude of the recession, you can argue that we are facing a storm of epic proportions and we're only at the beginning."

Victor Calanog, Reis director of research.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the office vacancy rate starting 1991.

Reis is reporting the vacancy rose to 15.9% in Q2; the peak following the previous recession was 17%.

From Reuters: US office market continues to spiral down--report

The U.S. office market vacancy rate reached 15.9 percent in the second quarter, its highest in four years and rent fell by the largest amount in more than seven as demand from companies and other office renters remained weak, real estate research firm Reis said Inc.I'll take the over.

... Factoring in rent-free months and improvement costs to landlords, effective rent -- the net amount of cash landlords take in -- fell 2.7 percent in the quarter to $23.42 per square foot. The second-quarter drop was more severe than the first quarter's 2.3 percent ...

... Reis ... forecast [is] for the U.S. office vacancy rate to top out at 18.2 percent in 2010 and for rent to continue to fall through 2011.

Monday, July 06, 2009

D.C. Office Market: Vacancies Increase, Rents Fall

by Calculated Risk on 7/06/2009 09:27:00 PM

Stop me if you've heard this story before ...

From V. Dion Haynes at the WaPo: Local Office Vacancies Soar, Driving Down Rent

The office vacancy rates in the District, Northern Virginia and suburban Maryland rose substantially in the second quarter, forcing building owners to push down rents to fill empty space ...And in Chicago, from Crain's Rising vacancies, distress in suburban office market

The result is that the vacancy rate rose to 10.2 percent in the second quarter from 8.5 percent in the first quarter in the District, to 13.9 percent from 12.9 percent in Northern Virginia; and to 13.9 percent from 13.1 percent in suburban Maryland.

Almost one-fourth of the 96 million square feet of office space in the suburbs is now vacant ... The rising vacancy rate, which has soared to 24.3% from 19.8% two years ago ... While rents overall haven’t dropped dramatically, down just 2% for the year, landlords are upping tenant improvement allowances and offering lots of free rent.

CRE: Half Off Sale in San Francisco and More

by Calculated Risk on 7/06/2009 06:24:00 PM

A few interesting stories. The first story (more than half off from the peak price) the buyer bought the loan, and then the current owner transferred the deed in lieu of foreclosure. The second story is a photo essay of the real estate bust, and third story is about the City Center project in Las Vegas.

From the San Francisco Business Times: Sale shows San Francisco property values in free fall (ht Steve)

A downtown San Francisco office building that sold for $400 a square foot in 2006 has traded for just $172 a square foot, a 57 percent decline ...From the NY Times Magazine, a photo essay: Ruins of the Second Gilded Age (ht Shawn)

The sale, at a price that represents about 25 percent of replacement cost, represents the first San Francisco office building sale in a year. ... Colliers International Executive Vice President Tony Crossley said the price “gives the market a data point it has been lacking.”

And from the WSJ (condos): Buyer's Remorse Hits Vegas Project (ht ShortCourage)

One of the costliest and highest-profile condominium developments in the country -- the $8.4 billion City Center project in Las Vegas -- is facing a revolt from some early buyers. ... So far, buyers have put down $313 million in deposits on 1,500 units in the 2,440-unit complex. Those who agreed to buy early on now fear they will take possession of condos whose market values are far below what they agreed to pay. Many of the contracts were signed in 2006 and 2007 ...

S&P Increases Loss Estimates for Alt-A and Subprime RMBS

by Calculated Risk on 7/06/2009 04:49:00 PM

From Reuters: S&P raises loss expectations for risky US mortgages

Standard & Poor's on Monday boosted its expectations for losses on risky loans backing U.S. mortgage securities ... [this] "significantly impact" bonds originally carrying AAA ratings, S&P said in a report.According to the article, S&P noted a surge in the inventory of bank-owned properties. Here is the S&P report.

...

S&P boosted loss projections for subprime loans made at the peak of the market in 2006 and 2007 to 32 percent and 40 percent from 25 percent and 31 percent, respectively. For 2005 loans, loss projections rose to 14 percent from 10.5 percent.

For Alt-A loans ... loss projections for 2006 and 2007 mortgages rose to 22.5 percent and 27 percent from 17.3 percent and 21 percent, respectively. S&P expects Alt-A loans from 2005 to post losses of 10 percent, up from its previous estimate of 7.75 percent.

Loss severities ... are expected to rise to 70 percent for 2006 and 2007 subprime bonds and 60 percent for Alt-A bonds issued in those years, S&P added.

Update: From the S&P report: Standard & Poor's Chief Economist David Wyss expects "home prices will decline by an additional 5%-7% from the 2006 peak before residential real estate prices start to stabilize in the first half of 2010, marking an overall decline of approximately 37% from the July 2006 peak."

Fitch Downgrades Calif. long-term bond rating to 'BBB'

by Calculated Risk on 7/06/2009 03:57:00 PM

Fitch's analysis suggests that issuing IOUs will only work until October, at which point the cash shortfall will start impacting priority spending.

Note: "GO" General Obligation.

Press Release: Fitch Downgrades State of California GOs to 'BBB'; Maintains Rating Watch Negative

The downgrade to 'BBB' is based on the state's continued inability to achieve timely agreement on budgetary and cash flow solutions to its severe fiscal crisis. Since no agreement was reached by the June 30, 2009 fiscal year (FY) end, the state's controller has now begun issuing registered warrants (IOUs) for certain non-priority payments to preserve cash, and the budget gap to be addressed has increased to $26.3 billion from $24.3 billion. The use of IOUs for non-priority payments would offset cash shortfalls into September 2009 as now currently projected.Fitch downgraded California from A to A-minus just 10 days ago.

The Rating Watch Negative reflects the short-term risk, in Fitch's view, that institutional gridlock could persist, further aggravating the state's already severe economic, revenue and liquidity challenges and weighing on the state's credit. Resolution of the Negative Watch will depend on actions taken to address the cash flow imbalance. The 'BBB' rating indicates that expectations of default risk remain low, although the rating is well below that of most other tax supported issuers. GO debt in California has a constitutional prior claim on revenues, although after education; appropriation debt has a lesser legal claim, but the controller prioritizes payment directly after GO debt service, ahead of other mandatory payments.

With issuance of IOUs for non-priority payments, margins for meeting constitutional and court-required contractual commitments are narrowing. After September 2009, absent any proposed budget and payment adjustments, cash deficits will expand dramatically. Cash flow solutions, including the ability to access short-term borrowing, are inextricably tied to reaching timely agreement on effective and credible budget solutions.

...

The inability of the state to reach agreement has prompted the controller to begin issuing IOUs for non-priority payments, primarily disbursements to vendors, for certain social services, and for tax refunds, in order to ensure payment of priority payments, including GO and lease debt service. The controller's office estimates that $3 billion in IOUs will be issued during July 2009; priority payments of $10.8 billion will be made for education, debt service, Medicaid, payroll, pensions and other mandatory contractual obligations. Projections will be revised to reflect June revenue performance and other changes but as currently estimated, cumulative cash deficits of $3.7 billion are projected through August, offset by $4.5 billion in non-priority payments that could be covered with IOUS, excluding tax refunds. However, by the end of October, the projected cash deficit expands to $16.1 billion, well beyond non-priority spending of only $10.6 billion, excluding tax refunds.

emphasis added

The Booming Repo Business

by Calculated Risk on 7/06/2009 02:02:00 PM

From Jim Wasserman at the SacBee: Repo business soars as Sacramento area home sales slump

... As the U.S. foreclosure crisis grinds on, the detailed work of processing, repairing and selling thousands of homes repossessed by banks is real estate's new gold. In the past year, repo-related business has rapidly grown to national scale, fueling job growth in Colorado, Texas, Ohio and elsewhere to service the meltdown in markets like Sacramento and the Central Valley along with Phoenix, Las Vegas and Florida.I've spoken with a number of real estate agents that are really busy, and conversely some agents (mostly high end) that having nothing to do but count their listings. The low-to-mid end business is tough though - many homes receive multiple offers (Jeff Collins at the O.C. Register reports on one home with 135 offers). And even if a transaction is completed, the deals are frequently 'one and done' as opposed to the chain reaction of a more normal market.

... [Austin-based Field Asset Services], which repairs, cleans and maintains repos right down to mowing the lawns weekly, has almost tripled its hiring in the past 18 months. Austin business publications gush over the firm's "hiring spree," its 550 employees and third expansion into larger offices in a year.

Clearly, the housing distress that has overwhelmed states like California has become big business.

BTW, Wasserman also writes a blog (with Dale Kasler) at the SacBee, the Home Front.

TALF CMBS Update

by Calculated Risk on 7/06/2009 11:54:00 AM

Just a quick update on the Term Asset-Backed Securities Loan Facility (TALF) for Commercial Mortgage Backed Securities (CMBS).

At the end of last week, the NY Fed announced a TALF CMBS auction on July 16th. The details are here.

Many market participants expected the Fed to include CMBS "originally rated AAA" because S&P has recently placed a large number of CMBS on watch for downgrade. This did not happen and is apparently a shock to many participants.

The Fed updated the terms and conditions. The Fed is really restricting legacy eligibility:

TALF loans for legacy CMBS will beOne participant told me that all potential trades are being heavily scrutinized too:usedrequired to fund recent secondary market transactions between unaffiliated parties that are executed on an arm’s length basis.

"[Y]ou cannot leverage a bond you already own, and you can't sell and buyback a bond you already own to create a trade. That's an interesting twist."Clarification: July 16 is the first operation for Legacy TALF, which provides loans against Legacy CMBS securities. Legacy securities were issued before January 1 2009.

The new issue CMBS program, for securities issued after January 1 2009, started in June.

The first TALF CMBS auction on June 16th attracted no interest.

ISM Non-Manufacturing Index Shows Contraction in June

by Calculated Risk on 7/06/2009 10:03:00 AM

From the Institute for Supply Management: June 2009 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector contracted in June, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.The service sector is still contracting but at a slightly slower pace than in May. Not exactly a green shoot.

"The NMI (Non-Manufacturing Index) registered 47 percent in June, 3 percentage points higher than the 44 percent registered in May, indicating contraction in the non-manufacturing sector for the ninth consecutive month, but at a slower rate. The Non-Manufacturing Business Activity Index increased 7.4 percentage points to 49.8 percent. The New Orders Index increased 4.2 percentage points to 48.6 percent, and the Employment Index increased 4.4 percentage points to 43.4 percent. The Prices Index increased 6.8 percentage points to 53.7 percent in June, indicating an increase in prices paid from May. This is the first time the index has registered above 50 percent since October 2008. According to the NMI, six non-manufacturing industries reported growth in June. Respondents' comments continue to be mixed and tend to be industry- and company-specific about business conditions."

GM Bankruptcy Plan Approved

by Calculated Risk on 7/06/2009 09:03:00 AM

From the NY Times: Court Ruling Clears Path for G.M. to Restructure

A federal judge approved a plan by General Motors late on Sunday to sell its best assets to a new, government-backed company ...The ruling is being appealed.

In his 95-page opinion, Judge Gerber wrote that he agreed with G.M.’s main contention: that the asset sale was needed to preserve its business in the face of steep losses and government financing that is scheduled to run out by the end of the week.

“Bankruptcy courts have the power to authorize sales of assets at a time when there still is value to preserve — to prevent the death of the patient on the operating table,” Judge Gerber wrote.

...

Other groups, including those representing product liability claims and asbestos litigants, ... fought against G.M.’s plan. Under the terms of the sale, most of those claims would remain with the remnants of G.M. in bankruptcy, meaning they were likely to recover little, if anything.

This was quick - GM filed for bankruptcy on June 1st.

Loan Mod Frauds

by Calculated Risk on 7/06/2009 12:27:00 AM

The scamsters are thriving ...

From Jessica Garrison at the LA Times: In California, mortgage scammers find easy pickings

Maricela Castellanos sat at her desk, the telephone pressed to her ear, a chill running through her body.These scamsters pretended to be from Castellanos bank. They offered her an attractive loan modification that lowered her monthly payments, and instructed her to send the payments to a "Payment Processing Department" at a P.O. Box. They even had a 1-800 number. Amazing.

A representative from her mortgage company was on the line with troubling information about the loan on Castellanos' Hesperia home.

No one at the company had previously been in contact with her, Castellanos recalled the man saying. The bank had no record of a new loan agreement with her, he said, nor had it received cashier's checks for $2,260 and $1,408.23 she said she had sent.

Castellanos had been a victim of an alleged loan modification swindle -- a financial crime in which scammers pretend to help distressed borrowers renegotiate their mortgages with their banks but instead pocket the money and leave the homeowners in worse straits than before.

Law enforcement officials say the scams are becoming increasingly prevalent, especially in California, where the Department of Real Estate has reported an explosion from 10 open cases a year ago to more than 750 this spring. Nationally, U.S. Atty. Gen. Eric Holder has said that the FBI's "rescue scam" caseload is up 400% from five years ago.

Sunday, July 05, 2009

Gordon Brown Sounds "Second-wake up call for the world economy"

by Calculated Risk on 7/05/2009 10:13:00 PM

"There are many voices saying that the worst of the downturn is over, but there is no room for complacency."Gordon Brown, July 6, 2009

...

If we do not take the necessary action now to strengthen the world economy and put in place the conditions for sustainable world growth, we will be confronted with avoidable unemployment for years to come."

From The Times: Recession may get worse, Gordon Brown warns world leaders

The worst of the recession may be yet to come and world leaders are in danger of hampering the recovery, Gordon Brown will say today.Maybe Brown was reading Roubini!

As he begins a week of meetings with world leaders, the Prime Minister will strike an unexpectedly gloomy note about the prospects of an upturn and will demand that fellow heads of government “sound a second-wake up call for the world economy”.

...

Mr Brown will also say that although public finances need to be sustainable in the long term, “now is not the time for fiscal contraction”.

A Second Stimulus Plan?

by Calculated Risk on 7/05/2009 07:03:00 PM

From ABC's This Week, George Stephanopoulos interviews Vice President Joe Biden:

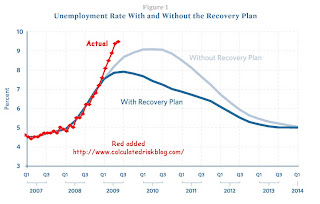

STEPHANOPOULOS: While we've been here, some pretty grim job numbers back at home -- 9.5 percent unemployment in June, the worst numbers in 26 years.Here is the January forecast with the BLS reported data ...

How do you explain that? Because when the president and you all were selling the stimulus package, you predicted at the beginning that, to get this package in place, unemployment will peak at about 8 percent. So, either you misread the economy, or the stimulus package is too slow and to small.

BIDEN: The truth is, we and everyone else misread the economy. The figures we worked off of in January were the consensus figures and most of the blue chip indexes out there.

...

BIDEN: ... So the second question becomes, did the economic package we put in place, including the Recovery Act, is it the right package given the circumstances we're in? And we believe it is the right package given the circumstances we're in.

We misread how bad the economy was, but we are now only about 120 days into the recovery package. The truth of the matter was, no one anticipated, no one expected that that recovery package would in fact be in a position at this point of having to distribute the bulk of money.

STEPHANOPOULOS: No, but a lot of people were saying that you needed to do something bigger and bolder then, including the economist Paul Krugman. He's saying -- right now he's saying the same thing again -- don't wait. You need a second stimulus, you need it now.

BIDEN: Look, what we have to do now is we have to properly, adequately, transparently and effectively spend out the $787 billion.

...

The question is, how do you now -- do we -- what we have to do, George, is we have to, as this rolls out, put more pace on the ball. The second hundred days you're going to see a lot more jobs created.

And the reason you are is now all of these contracts for the over several thousand highway projects that have approved.

...

STEPHANOPOULOS: ? today are going to run out of unemployment in September. That means for a lot of those people, if there is not a second stimulus, they're going to be out in the cold.

BIDEN: Well, look, we have increased the amount of money unemployed -- those on unemployment rolls have gotten, 12 million are getting more money because of the stimulus package.

We've increased the number of people eligible by 2 million people. We've given a tax cut to 95 percent of the people who get a pay stub. They have somewhere -- $60 bucks a month out there that's going into the economy.

There is a lot going on, George. And I think it's premature to make the judgment?

STEPHANOPOULOS: So no second stimulus?

BIDEN: No, I didn't say that. I think it's premature to make that judgment. This was set up to spend out over 18 months. ... And so this is just starting, the pace of the ball is now going to increase.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph compares the BLS reported monthly unemployment rate (in red) with the Obama economic forecast from January 10th: The Job Impact of the American Recovery and Reinvestment Plan

The Obama administration underestimated the rise in unemployment (so did I last year), so the question is: does this mean a 2nd stimulus plan?

Krugman says don't wait:

But never mind the hoocoodanodes and ayatollahyaseaux. What’s important now is that we don’t compound the understimulus mistake by adopting what Biden seems to be proposing — namely, a wait and see approach. Fiscal stimulus takes time. If we wait to see whether round one did the trick, round two won’t have much chance of doing a lot of good before late 2010 or beyond.Update: as of June, almost 4.4 million people were unemployed and had exhausted their regular unemployment benefits. Most are now receiving extended benefits, but - at the least - it might be prudent to have additional extended benefits ready to go later this year.

Unemployment Rate and Part Time Employees

by Calculated Risk on 7/05/2009 05:08:00 PM

The following article suggests that the large number of part time workers will slow any labor recovery:

‘I don’t need to hire anybody new. I need to work my existing workers more.’That seems to make sense, but I wondered if it has been true in previous recessions (that a large number of part time workers - for economic reasons - became fully employed before the unemployment rate started to decline).

Here is the article from The Boston Globe: Grappling with part-time work

According to the Bureau of Labor Statistics, there are 9.1 million Americans working part time for economic reasons, more than double the 4.5 million in 2007. That compares with a 50 percent rise in the recession of 1981-82 and a 25 percent increase in the recession of 1990.The following graph shows the unemployment rate and the percent of the civilian labor force that is working part time for economic reasons.

...

For the economy as a whole, the glut of part-time workers could slow any recovery.

“At no time have we ever seen an increase of that magnitude, which is why labor markets are far weaker than the unemployment rate is telling us,’’ says Andrew Sum, director of Northeastern University’s Center for Labor Market Studies.

“When the economy turns around if you have so many people that are in slack work, you’ll say, ‘I don’t need to hire anybody new. I need to work my existing workers more.’ It’s going to be a lot harder to bring the unemployment rate down.’’

Click on graph for larger image in new window.

Click on graph for larger image in new window.Looking back at previous recessions, it doesn't appear that there was a decline in part time workers (for economic reasons) prior to a decline in the unemployment rate.

That doesn't mean part time workers aren't hurting - many are (as noted in the article), but it appears the the number of part time workers, and the unemployment rate, usually peak at about the same time. This time might be different, but I wouldn't count on it.