by Calculated Risk on 4/10/2009 10:08:00 AM

Friday, April 10, 2009

More Bandos

Bando: Someone who lives in an abandoned home.

From the NY Times: More Squatters Are Calling Foreclosures Home

When the woman who calls herself Queen Omega moved into a three-bedroom house here last December, she introduced herself to the neighbors, signed contracts for electricity and water and ordered an Internet connection.So now we have organized bandos! And it sounds like the competition is fierce:

What she did not tell anyone was that she had no legal right to be in the home.

...

Michael Stoops, executive director of the National Coalition for the Homeless, said about a dozen advocacy groups around the country were actively moving homeless people into vacant homes ...

“At 10 o’clock in the morning, I went over to the house just to make sure everything was O.K., and squatters took over our squat. Then we went to another place nearby, and squatters were in that place also.”

Fed Orders Banks Not to Release Stress Test Results

by Calculated Risk on 4/10/2009 02:02:00 AM

From Bloomberg: Fed Said to Order Banks to Stay Mum on ‘Stress Test’ Results (ht Justin)

The U.S. Federal Reserve has told Goldman Sachs Group Inc., Citigroup Inc. and other banks to keep mum on the results of “stress tests” that will gauge their ability to weather the recession ...What ever happened to transparency? This suggests the results are very ugly for some banks.

The Fed wants to ensure that the report cards don’t leak during earnings conference calls scheduled for this month. ...

“If you allow banks to talk about it, people are just going to assume that the ones that don’t comment about it failed,” said Paul Miller, an analyst at FBR Capital Markets in Arlington, Virginia.

It's amusing that the article mentions Citi - I doubt Citi wants the results released!

Thursday, April 09, 2009

NY Hotels: Less Demand, More Supply

by Calculated Risk on 4/09/2009 10:55:00 PM

The markets are closed on Friday.

CR will be open.

The following article is mostly about workers' pay, but there are some interesting stats on the New York hotel market.

From the NY Times: With More Rooms Empty, Hotels Seek to Cut Worker Pay

With the city’s hotels in the midst of a sudden slowdown in business, operators are seeking wage cuts and other concessions from the unions representing 27,500 bellhops, housekeepers and waiters.

...

The average occupancy rate at New York City hotels in the first two months of this year was 61.8 percent, down from 73.5 during the same period last year, according to Smith Travel Research, a national hotel research firm. At the same time, the average daily room rate dropped to $196.30, from $232.25.

...

The industry’s problems are compounded by the prospect of 10,000 new hotel rooms in 2009 and 2010.

“We’re in this classic economic model where we’ve got declining demand because of the economy and added supply,” said John Fox, a hotel consultant with PKF Consulting.

Using Corporate Bonds as an Economic Predictor

by Calculated Risk on 4/09/2009 07:55:00 PM

UPDATE: Here is the paper: Credit Market Shocks and Economic Fluctuations: Evidence from Corporate Bond and Stock Markets (ht MrM who writes: "Please note that the authors construct their own bond indices, so one should not draw conclusions about their paper by looking at Moody's charts")

Justin Lahart reports in the WSJ on a new research paper: Giving Corporate Credit Its Due (ht James)

In a forthcoming paper in the Journal of Monetary Economics [economists Simon Gilchrist and Vladimir Yankov at Boston University, and Egon Zakrajsek at the Federal Reserve] show that spreads on low- to medium-risk corporate bonds, particularly those with 15 or more years until maturity, predicted changes in the economy phenomenally well, forecasting the ups and downs in both hiring and production a year before they occurred. Since writing the paper, they extended their analysis back to 1973 and found bonds' predictive ability still held.I haven't seen the paper yet, but here are the spreads I've been following based on 30 year corporate bonds.

With the massive widening in corporate-bond spreads last fall, the economists' model predicts industrial production will fall another 17% by the end of the year, and the economy will lose another 7.8 million jobs on top of the 5.1 million it has shed since the recession began. Ouch.emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

It looks like this spread has predicted a few extra recessions! I'm looking forward to the paper.

China: Record Auto Sales, Now Number 1 Auto Market

by Calculated Risk on 4/09/2009 05:51:00 PM

From The Times: China bucks trend with new record in car sales

... Chinese people ... bought 1.10 million vehicles in March, up some five per cent from the previous record of 1.06 million in March last year, data from the China Association of Automobile Manufacturers showed.Interesting.

The number cemented China in its position as the world’s largest car market, outstripping even the US.

...

Growth in sales had slowed in 2008 to its lowest annual rate in more than a decade as the global financial crisis took its toll towards the end of the year, prompting many Chinese to keep their wallets shut tight in case of more problems ahead. However, the government support measures introduced in February have spurred the market.

For more on China, from Roubini: China’s Economy in 2009 and Beyond

[T]here are greater signs of economic recovery in March from the depths of Q4 2008 and most forward looking indicators suggest that Q2 2009 through Q4 2009 growth will accelerate relative to the dismal Q4 of 2008 and weak Q1 of 2009. In particular, economic data for China (including loan growth, the PMI, recovery in residential sales volume – if not prices, and public investment) do point to a stabilization or even slight improvement but we at RGE Monitor still see risks that Chinese growth will be well below the government target of 8% and even below the 6.5% level that the IMF and World Bank are predicting – a figure of 5-6% seems more likely.Bob_in_MA also recommends: China Financial Markets by Michael Pettis, a professor at Peking University’s Guanghua School of Management.

Market: More Volatility

by Calculated Risk on 4/09/2009 03:45:00 PM

Another day, another big swing ...

Dow up 3.1% (back above 8,000)

S&P 500 up 3.8%

NASDAQ up 3.9% Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The second graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

This puts the recent rally into perspective - the S&P is still off about 45% from the 2007 high.

Hotel Occupancy: RevPAR off 18%

by Calculated Risk on 4/09/2009 01:26:00 PM

Yesterday I summarized the recent data: mall vacancies up, office vacancies up, apartment vacancies up - and rents falling. For lodging, the measure is occupancy and RevPAR (Revenue per available room), and both are off sharply year-over-year.

From HotelNewsNow.com: STR reports U.S. data for week ending 4 April 2009

In year-over-year measurements, the industry’s occupancy fell 9.9 percent to end the week at 56.2 percent (62.3 percent in the comparable week in 2008). Average daily rate dropped 9.0 percent to finish the week at US$98.79 (US$108.59 in the comparable week in 2008). Revenue per available room for the week decreased 18.0 percent to finish at US$55.49 (US$67.68 in the comparable week in 2008).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 9.3% from the same period in 2008.

The average daily rate is down 9.0%, so RevPAR is off 18.0% from the same week last year.

Larry Summers at the Economic Club

by Calculated Risk on 4/09/2009 12:13:00 PM

Larry Summers, Director of the National Economic Council, will speak at to the Economic Club of Washington.

UPDATE: Starting at 12:43 PM ET

Here is the CNBC feed.

Discussion in the comments ...

UPDATE: CSpan Link.

CNBC Interview with Wells Fargo CFO

by Calculated Risk on 4/09/2009 11:09:00 AM

From CNBC: Wells Fargo CFO: Wachovia Merger Behind Record Profits

In December we closed the Wachovia acquisition," said [Howard Atkins, CFO, Wells Fargo]. "This is the first quarter the two companies have been combined and because of the move, we thought it was important to get this news out early."NIMs (Net Interest Margins) are Edit: Higher than expected - and Atkins doesn't say it, but their borrowing costs have to be close to zero.

Atkins said that the losses in the acquistion are behind Wells Fargo. "We did write off most of them [losses]and we are enjoying the benefits of the merged companies," said Atkins.

Atkins said details on Wachovia savings are "going to begin to emerge in the second quarter.

...

Atkins went on to say there was "very little impact" on results from a new rule by the Financial Accounting Standards Board that gives banks more freedom to value assets as they would in normal markets rather than at distressed prices.

U.S. Trade Deficit: Lowest Since 1999

by Calculated Risk on 4/09/2009 08:44:00 AM

The collapse in trade continues to be an important story.

The Census Bureau reports:

[T]otal February exports of $126.8 billion and imports of $152.7 billion resulted in a goods and services deficit of $26.0 billion, down from $36.2 billion in January, revised. February exports were $2.0 billion more than January exports of $124.7 billion. February imports were $8.2 billion less than January imports of $160.9 billion.

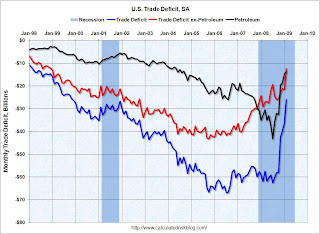

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through February 2009. The recent rapid decline in foreign trade continued in February. Note that a large portion of the recent decline in imports was related to the fall in oil prices, however the decline in February was mostly non-oil related.

The second graph shows the U.S. trade deficit, with and without petroleum, through February.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Import oil prices fell slightly to $39.22 in February, from $39.81 in January, and import quantities decreased too - so the petroleum deficit declined by $1 billion.

However most of the decline in the trade deficit was non-oil related.

I suppose a collapse in U.S. imports is one way to rebalance the world economy ...

Unemployment Insurance: Continued Claims at Record 5.84 Million

by Calculated Risk on 4/09/2009 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending April 4, the advance figure for seasonally adjusted initial claims was 654,000, a decrease of 20,000 from the previous week's revised figure of 674,000. The 4-week moving average was 657,250, a decrease of 750 from the previous week's revised average of 658,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending March 28 was 5,840,000, an increase of 95,000 from the preceding week's revised level of 5,745,000.

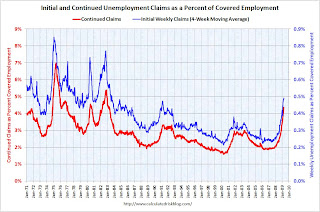

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 657,250.

Continued claims are now at 5.84 million - the all time record.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment, and shows the initial unemployment and continued claims are both at the highest level since the early '80s.

This is another very weak report and shows continued weakness for employment.

Housing Bust in Manhattan

by Calculated Risk on 4/09/2009 12:31:00 AM

From Wall Street (1987):

Real Estate Agent Sylvie when Bud Fox goes to buy a condo:From the NY Times: Housing Slump Hits Manhattan...everybody tells ya they hate the Upper East Side and they wanna live on the West Side but honey when it comes to resale time, believe me the East Side's the one that always moves.Agent Sylvie when Bud tries to sell:... well, the market's dead, hon, even the rich are bitching, nothing's moving except termites and cockroaches ...

Apartment prices have once more become the talk of the town in Manhattan, but this time the talk is of uncertainty and falling numbers. ...And I was told New York was immune ...

In this year’s first quarter, sales of co-ops and condominiums in Manhattan plunged nearly 60 percent from the first quarter of 2008. Average co-op prices fell as much as 24 percent in the same period, according to various market reports released last week.

...

[Jonathan J. Miller, an appraiser] said that during the last big real estate downtown, when studio apartments were so cheap that he considered buying one on a credit card, people thought the luxury market would never come back. “Conspicuous consumption was out of vogue in 1991,” he said. “The market was back by 1997 or 1998.”

Wednesday, April 08, 2009

Bailout Bonds

by Calculated Risk on 4/08/2009 09:31:00 PM

From Graham Bowley and Michael de la Merced at the NY Times: U.S. Imagines the Bailout as an Investment Tool

[T]he Obama administration is encouraging several large investment companies to create the financial-crisis equivalent of war bonds: bailout funds.I assume PIMCO, BlackRock and others will charge minimal or no fees for individual investors.

The idea is that these investments ... would give ordinary Americans a chance to profit from the bailouts that are being financed by their tax dollars. ...

But, as with any investment, there are risks. If, as some analysts suspect, the banks’ assets are worth even less than believed, the funds’ investors could suffer significant losses. Nonetheless, the administration and executives in the financial industry are pushing to establish the investment funds, in part to counter swelling hostility against the financial industry.

...

The new funds are still under discussion, and they are unlikely to be established for several months, if indeed the plans go through at all.

You, too, can help bailout Citigroup and BofA! (in addition to your taxes)

The TARP COP: Elizabeth Warren on April Report

by Calculated Risk on 4/08/2009 06:08:00 PM

Here is the Congressional Oversight Panel page: Assessing Treasury’s Strategy: Six Months of TARP

Here is the April Oversight Report.

Vacancies, vacancies, vacancies ... and falling rents

by Calculated Risk on 4/08/2009 04:08:00 PM

Here is a summary of the vacancy reports released over the last few days.

On vacancies:

Malls: From Bloomberg: Vacancies at U.S. Retail Centers Hit 10-Year High, Reis Says

The vacancy rate at neighborhood and community shopping centers rose to 9.5 percent from 8.9 percent the previous quarter and 7.7 percent a year ago ...Offices: Office Vacancy Rate Rises to 15.2% in Q1 and the WSJ: Companies Sold Office Space at a Fast Pace

The office vacancy rate nationwide rose to 15.2% from 14.5% in the previous quarter, and likely will surpass 19.3% over the next year, according to Reis ...Apartments: From Reuters: US apartment market worsens with economy--Reis

The national apartment vacancy rate rose to 7.2 percent in the first quarter, up 0.60 percentage points from the prior quarter and 1.1 percentage points from a year earlier ...Hotels: From HotelNewsNow.com: STR reports U.S. data for week ending 28 March

In year-over-year measurements, the industry’s occupancy fell 12.3 percent to end the week at 56.6 percent...And on rents:

Offices: From the Telegraph: London's empty office space tops 10m sq ft

The slump is placing immense pressure on rents, which have now fallen 27pc in the past year from an average of £65 per sq ft to £47.50.From Bloomberg: San Francisco Office Rents Fall Most Since 2001

San Francisco office rents dropped 24 percent in the first quarter from a year earlier ... The average rent fell citywide to $38.80 a square foot from $50.92 ...From Bloomberg: Manhattan Office Rents Fall Most in Quarter Century

Manhattan office rents ... dropped 6 percent from the fourth quarter to $65.01 a square foot [Note: 24% annual rate] ... The decline is the most in records dating back to 1984 ...Apartments: From the LA Times: Apartment rents fall in Southern California

... The average rent in Los Angeles County fell almost 4% in 2008 ...From Reuters: US apartment market worsens with economy--Reis

Asking rents fell by 0.6 percent to $1,046 per month, the largest single-quarter decline since Reis began reporting quarterly performance data in 1999.Malls: From Bloomberg:

Landlords’ asking rents for regional malls fell 1.2 percent from the prior quarter, the most in five years, said Reis.Hotels: From HotelNewsNow.com:

[D]aily rate dropped 8.8 percent to finish the week at US$99.77 ... Revenue per available room for the week decreased 20.0 percent to finish at US$56.50

CRE: Rents Fall 24% in San Francisco, Landmark Foreclosure in Atlanta

by Calculated Risk on 4/08/2009 02:48:00 PM

From Bloomberg: San Francisco Office Rents Fall Most Since 2001 (ht Dwight)

San Francisco office rents dropped 24 percent in the first quarter from a year earlier ... The average rent fell citywide to $38.80 a square foot from $50.92 for the highest-quality, best-located space, known as Class A space, according to a preliminary report by commercial brokerage Colliers International. The office vacancy rate rose to 13.2 percent from 12.6 percent in the previous quarter and up from 10.2 percent a year earlier.And from the Atlanta Journal-Constitution: Landmark Equitable building in foreclosure (ht jp, Bradford)

Downtown Atlanta’s Equitable building, an iconic 30-plus story office tower that once dominated the city’s skyline, has fallen into foreclosure.

A foreclosure notice said the 40-year-old skyscraper is scheduled to be auctioned on the Fulton County courthouse steps on May 5.

March FOMC Minutes: Outlook Revised Down

by Calculated Risk on 4/08/2009 02:00:00 PM

Here are the minutes for the March FOMC meeting.

Excerpts:

Staff Economic OutlookAnd the worsening outlook led the FOMC to agree to "substantial additional purchases of longer-term assets":

In the forecast prepared for the meeting, the staff revised down its outlook for economic activity. The deterioration in labor market conditions was rapid in recent months, with steep job losses across nearly all sectors. Industrial production continued to contract rapidly as firms responded to the falloff in demand and the buildup of some inventory overhangs. The incoming data on business spending suggested that business investment in equipment and structures continued to decline. Single-family housing starts had fallen to a post-World War II low in January, and demand for new homes remained weak. Both exports and imports retreated significantly in the fourth quarter of last year and appeared headed for comparable declines this quarter. Consumer outlays showed some signs of stabilizing at a low level, with real outlays for goods outside of motor vehicles recording gains in January and February. .... The staff's projections for real GDP in the second half of 2009 and in 2010 were revised down, with real GDP expected to flatten out gradually over the second half of this year and then to expand slowly next year as the stresses in financial markets ease, the effects of fiscal stimulus take hold, inventory adjustments are worked through, and the correction in housing activity comes to an end. The weaker trajectory of real output resulted in the projected path of the unemployment rate rising more steeply into early next year before flattening out at a high level over the rest of the year. The staff forecast for overall and core personal consumption expenditures (PCE) inflation over the next two years was revised down slightly. Both core and overall PCE price inflation were expected to be damped by low rates of resource utilization, falling import prices, and easing cost pressures as a result of the sharp net declines in oil and other raw materials prices since last summer.

emphasis added

In the discussion of monetary policy for the intermeeting period, Committee members agreed that substantial additional purchases of longer-term assets eligible for open market operations would be appropriate. Such purchases would provide further monetary stimulus to help address the very weak economic outlook and reduce the risk that inflation could persist for a time below rates that best foster longer-term economic growth and price stability.

Pulte and Centex Merge

by Calculated Risk on 4/08/2009 12:26:00 PM

From Bloomberg: Pulte to Buy Centex for $1.3 Billion in Survival Bid

Pulte Homes Inc. agreed to buy Centex Corp. for $1.3 billion in an all-stock deal that creates the largest U.S. homebuilder by revenue ...This is a stock swap (no cash).

“This is really good because not only are there too many homes, there are too many homebuilders,” said Vicki Bryan, a senior high-yield bond analyst for New York-based Gimme Credit LLC.

...

Because of complementary geographic presence and market segments, the new company will save $350 million annually, [Pulte Chief Executive Officer Richard Dugas] said.

Dugas talks about signs of a housing bottom, but the last sentence makes it clear that this merger is about layoffs and cost savings.

Shadow Inventory?

by Calculated Risk on 4/08/2009 11:06:00 AM

From Carolyn Said at the San Francisco Chronicle: Banks aren't reselling many foreclosed homes (ht Starburst)

Lenders nationwide are sitting on hundreds of thousands of foreclosed homes that they have not resold or listed for sale, according to numerous data sources.I'm not convinced. There might just be a built in a lag between when the banks foreclose to when the properties are finally sold. Instead of using aggregate statistics, it would probably be better to do a survey - follow some number of foreclosures and see what happens to them each month.

...

"We believe there are in the neighborhood of 600,000 properties nationwide that banks have repossessed but not put on the market," said Rick Sharga, vice president of RealtyTrac ...

"There is a real danger that there is much more (foreclosure) inventory than we are measuring," said Celia Chen, director of housing economics at Moody's Economy.com in Pennsylvania.

...

In the Bay Area, a Chronicle analysis of data from San Diego's MDA DataQuick shows that more than one-third of foreclosures are in shadow territory - that is, they are not registering in county records as having been resold.

For the 26 months from January 2007 through February 2009, banks repossessed 51,602 homes and condos in the nine-county Bay Area, according to DataQuick. Yet in the same period, only 30,823 foreclosures were resold, leaving about 20,000 bank repos unaccounted for.