by Calculated Risk on 2/09/2009 05:10:00 PM

Monday, February 09, 2009

CNBC: 'Bad Bank' Plan Is Dropped

From CNBC: 'Bad Bank' Is Dropped From Financial-Rescue Package

The Obama administration’s wide-ranging plan to stabilize the financial system no longer includes creating a "bad bank" but will still contain measures to encourage private firms to buy up toxic assets from financial institutions ...The leaked details might keep changing, but I guess the time is set for the announcement.

The latest version of the plan no longer addresses any immediate aid to insurance companies with thrift units that have applied for capital injections under the existing TARP.

...

In a statement Monday, the Treasury said that senior officials from Treasury, the Federal Reserve Board and the Federal Deposit Insurance Corporation would hold a media briefing on the plan at 11:45 a.m. ET

Job Losses During Recessions

by Calculated Risk on 2/09/2009 02:44:00 PM

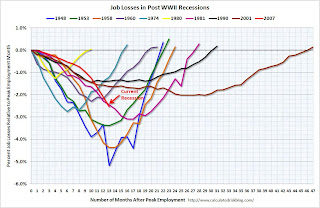

Barry Ritholtz provides us with the following chart: Job Losses in Post WWII Recessions Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows job losses during recessions from the peak month of employment until jobs recover.

The current recession has had the most job losses and the 2001 recession had the weakest job recovery.

However this graph is not normalized for increases in the work force. The second graph (that Barry asked me for) shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph (that Barry asked me for) shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession is about as bad as the 1981 recession in percentage terms at this point.

In the earlier post-war recessions, there were huge swings in manufacturing employment. Now manufacturing is a much smaller percentage of the economy, and the swings aren't as significant because of technological advances. This is the main reason that job losses were larger in those earlier recessions.

Here is Barry's updated post (with another graph). Barry asks: Are recessions taking longer to recover from? The answer appears to be yes. And I expect unemployment to be elevated for some time (even after the economy starts to recover).

CNBC: Dr. Doom & the Black Swan

by Calculated Risk on 2/09/2009 02:37:00 PM

Video from CNBC: Predicting Crisis: Dr. Doom & the Black Swan (hat tip Dwight)

Nouriel Roubini and Nassim Taleb discuss the recession.

30 Year Mortgage Rates vs. Ten Year Treasury Yield

by Calculated Risk on 2/09/2009 12:36:00 PM

On CNBC this morning, PIMCO's Bill Gross said:

"I think at some point we're going to see a 4.5 percent mortgage rate and the 10-year Treasury rate capped at some level."How far would the Ten Year yield have to fall for mortgage rates to decline to 4.5%? The ten year yield is currently at 3.045%.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the relationship between the Ten Year yield (x-axis) and the 30 year mortgage rate (y-axis, monthly from Freddie Mac) since 1971. The relationship isn't perfect, but the correlation is very high.

Based on this historical data, the Fed would have to push the Ten Year yield down to around 2.3% for the 30 year conforming mortgage rate to fall to 4.5%.

The Fed could also buy more agency MBS to push down mortgage rates, but if they buy Ten Year treasuries with the goal of 4.5% mortgage rates, they might have to push Ten Year yields down significantly.

Bill Gross: Fed to Cap Ten Year Yield

by Calculated Risk on 2/09/2009 11:20:00 AM

From CNBC: Mortgage Rates Likely Headed to 4.5%: Pimco's Gross

"I think at some point we're going to see a 4.5 percent mortgage rate and the 10-year Treasury rate capped at some level," he said. "When the Fed comes in to buy Treasurys that will be a big day."CNBC has a video of the interview with Gross.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The 10-year yield is at 3.04% today, well above the record low of 2.07% set on Dec 18th.

This graph shows the 10 year yield since 1962. The smaller graph shows the ten year yield since the start of 2008. In the bigger scheme, this has been a fairly small rebound in yield.

To move the 30 year mortgage rate to 4.5%, the Fed would probably have to cap the Ten Year yield near 3.0%.

When Pier Loans go Bad

by Calculated Risk on 2/09/2009 10:00:00 AM

From Bloomberg: Lyondell Banks Caught in Bankruptcy Lose $3.7 Billion in Loans

The five banks that helped finance the takeover of Lyondell Chemical Co. have lost at least $3.7 billion, and that figure may climb to more than $8 billion, which would make the leveraged buyout the costliest in history for lenders.Back in 2007, when the liquidity crisis first started, many banks were stuck with LBO related pier loans (bridge loans that they couldn't sell). Now the banks are being forced to take write downs on these loans. Or in this case, since these are second and third lien loans, complete write-offs.

...

The financing includes $8 billion of low-ranking loans still held by the banks that may be worthless ...

Each of the five banks [Goldman Sachs Group Inc., Citigroup Inc., UBS AG, Merrill Lynch & Co. and ABN Amro Holding NV] holds $1.6 billion of so-called second- and third-lien loans, the people familiar with the situation said.

Lyondell’s losses dwarf those from the busted LBOs of the 1980s, such as Ohio Mattress Co., the $965 million takeover dubbed “the burning bed” by bond traders.

UK: Demand for Office Space Falls Sharply

by Calculated Risk on 2/09/2009 08:31:00 AM

From the Financial Times: Demand for office space falls at record pace

Demand for offices and shops has fallen at the fastest pace on record, spelling further trouble for commercial property landlords struggling to find tenants in worsening economic conditions."Demand falling at a record pace" ... Just another "record" being set, this time in CRE.

...

Most of the headline indicators of commercial property performance tracked by Rics fell to their lowest levels in the survey’s 11-year history in the fourth quarter, with particular pessimism in the retail sector where almost four-fifths of surveyors reported a fall in demand.

Mansori: Tax Credit Will Not Boost House Prices

by Calculated Risk on 2/09/2009 01:32:00 AM

Kash Mansori writes at Econbrowser: Will a Home Purchase Tax Credit Help Boost House Prices?

Check it out. Kash provides a couple of simple diagrams that suggest that the tax credit will probably not meet the stated goal of stabilizing house prices.

If my hunch is correct, then all the house purchase tax credit will do is to modestly increase the number of houses sold each month... with no noticeable impact on house prices.That is $35 billion for nothing.

That doesn't mean that the tax credit would have no impact. In particular, it may be a boon to some cash-constrained households that want to buy a house right now but can't borrow enough. And it should help to reduce inventories of unsold houses by a bit. But if you're hoping that it will make house prices rise, with all of the beneficial economic effects on home equity that such a rise might have... think again.

Sunday, February 08, 2009

NY Times on Bank Bailout Plan

by Calculated Risk on 2/08/2009 10:50:00 PM

From Floyd Norris at the NY Times: U.S. Bank Bailout to Rely in Part on Private Money

Administration officials said the plan, to be announced Tuesday, was likely to depend in part on the willingness of private investors other than banks — like hedge funds, private equity funds and perhaps even insurance companies — to buy the contaminating assets that wiped out the capital of many banks.Liz Rappaport and Jon Hilsenrath at the WSJ had a story earlier: U.S. Weighs Fed Program to Loosen Lending

... The government would guarantee a floor value, officials say, as a way to overcome investors’ reluctance to buy them. ... Details of the new plan, which were still being worked out during the weekend, are sketchy.

...

By trying to bring in private sector buyers to set prices for the distressed assets, and to take some but not all of the risk that the asset value will continue to decline, Obama officials evidently hope to restore confidence in the banking system. They will also try to avoid the politically perilous course of having the government directly buy the assets at prices that could turn out to be far higher, or lower, than their eventual value.

...

A possible model for the way the new Treasury plan could work arose in a deal last July that had no government involvement. In that case, Merrill Lynch sold $31 billion in securities for 22 cents on the dollar. The buyer, the Lone Star group of private equity funds, put down only one-quarter of the purchase price and had the right to walk away, forfeiting only the down payment, if it later turned out the securities were worth even less than it had agreed to pay.

Thus Lone Star stands to receive the upside profit if the securities prove to be more valuable, but has only a limited downside risk if they do not.

Some hedge funds, which often use borrowed money to boost returns, are lining up to get in on the Fed program, seeing a chance to make high double-digit-percentage returns with little downside using low-cost loans made on easy terms.This really depends on the details. If the model is similar to the Lone Star deal, with hedge funds (or others) putting 25% down, the the Fed loaning the other 75% at attractive rates (with no recourse), and the transaction completely transparent (as they should be), I don't think the returns for investors would be in the "high double digits" as the WSJ article suggests.

This structure would definitely increase the price investors would be willing to pay for toxic assets, as compared to current market values (while putting the taxpayers at risk). For any bank that has aggressively marked down assets to current market values, this could mean a potential markup. But I think most banks will have to take further write downs and will need additional capital.

Affordability "Products" Lead to Higher Defaults in the O.C.

by Calculated Risk on 2/08/2009 08:10:00 PM

From Mathew Padilla at the O.C. Register: Good O.C. borrowers brought down by bank's bad loans

Even as the housing market began to crack, investment bank Bear Stearns increased its bets on mortgages to Orange County homeowners.These were "good borrowers" in the sense that they had high FICO scores. But they used affordibility products - Option ARMs and stated income loans - to buy overpriced homes in Orange County, California. The lenders forgot the three C's!

The loans were often to people with good jobs and solid credit. But many borrowers stretched their incomes to buy some of the county’s pricier homes. Now an alarming number of those borrowers are facing foreclosure.

...

In Orange County, Bear’s borrowers generally had credit scores, known as FICO, above 700 – considered strong during the housing boom.

But by the middle of last year, 12.9 percent of Bear’s loans were in foreclosure. By comparison, subprime loans, which have lower credit scores, had an industry-wide foreclosure rate of 11.8 percent at the time. ... Many of the loans allowed borrowers to provide little or no proof of income, while at the same time delaying payment of interest and sometimes principal too.

This is a good time to reread Tanta's post: Reflections on Alt-A. Here is a brief excerpt:

Residential mortgage lending never, of course, limited itself to considering creditworthiness; we always had "Three C's": creditworthiness, capacity, and collateral. "Capacity" meant establishing that the borrower had sufficient current income or other assets to carry the debt payments. "Collateral" meant establishing that the house was worth at least the loan amount--that it fully secured the debt. It was universally considered that these three things, the C's, were analytically and practically separable.

That, I think, is very hard for people today to understand. The major accomplishment of last five to eight years, mortgage-lendingwise, has been to entirely erase the C distinctions and in fact to mostly conflate them.

...

A lot of folks see the failure of Alt-A as a failure of FICO scores. I don't see it that way. FICO scoring is just an automated and much more consistent way of measuring past credit history than sitting around with a ten-page credit report counting up late payments and calculating balance-to-limit ratios and subtracting for collection accounts and all that tedious stuff underwriters used to do with a pencil and legal pad. I have seen no compelling evidence that FICO scoring is any less reliable than the old-fashioned way of "scoring" credit history.

To me, the failure of Alt-A is the failure to represent reality of the view that people who have a track record of successfully managing modest amounts of debt will therefore do fine with very high amounts of debt. Obviously the whole thing was ultimately built on the assumption that house prices would rise forever and there would always be another refi.

House Looking Tip: The Old Running-Pool Trick

by Calculated Risk on 2/08/2009 03:32:00 PM

This house is a flipper - the buyer bought in December at the Trustee sale for $502 thousand, and is now asking $750 thousand.

Here is the price history from Redfin:

| Date | Event | Amount |

| Jan 16, 2009 | Listed | $749,000 |

| Dec 17, 2008 | Sold | $502,000 |

| Jun 26, 2007 | Sold | $752,287 |

| Jan 21, 2004 | Sold | $752,000 |

The house was built in 2003, and it appears the house was first sold in Jan 2004. The buyer in 2007 bought at the 2004 price, and then lost the home in foreclosure.

The house looks pretty nice, but Realtor Jim unmasks the "running-pool trick"! Enjoy.

Summers: Bank Bailout Announcement Delayed until Tuesday

by Calculated Risk on 2/08/2009 11:02:00 AM

From ABC News: 'This Week' Transcript

STEPHANOPOULOS: Let me ask about that financial overhaul. Originally, Secretary Geithner was supposed to give that speech tomorrow. Administration officials are telling me it's now more likely on Tuesday?And on the Stimulus Package:

SUMMERS: Yes, I think there's a desire to keep the focus right now on the economic recovery program, which is so very, very important.

STEPHANOPOULOS: So Tuesday it is.

STEPHANOPOULOS: Let me start out by putting up a little chart that shows the House and Senate versions of this stimulus package. Let me show our viewers that right now. The overall cost is about the same, the House $820 billion, Senate $827 billion, but the composition different. The Senate has about $100 billion more in tax cuts, but $40 billion less in state aid, $20 billion less in education, $15 billion less in payments to individuals, some other differences.And on the economy:

I know that, when the president was meeting with these moderate Republican senators this week, including Senator Susan Collins of Maine, he told them he endorsed their efforts to scrub the bill of what they called excessive spending. Does that mean the president prefers the Senate version to the House version?

SUMMERS: No, the president feels that, above all, we need a major program enacted very quickly that will create 3 million to 4 million jobs. He believes we need to perfect it in every way we can.

If there are programs that aren't going to serve important purposes, they should be -- they should be eliminated. He certainly believes that. He's open to good ideas from both -- from both sides.

But we're going to have to look at both these bills, assuming the Senate bill passes, as most people expect at this juncture, and craft the best possible approach going forward.

...

STEPHANOPOULOS: Some of the critics of the Senate bill say that the most important elements have been -- have been brought down. Paul Krugman, writing on his blog this morning, said, "Some of the most effective and most needed parts of the plan have been cut." He's citing especially that $40 billion in state aid.

And he goes on to say that, "My first cut says that the changes to the Senate bill will ensure that we have at least 600,000 fewer Americans employed over the next two years."

SUMMERS: There's no question we need -- we need a large, forthright approach here. There are crucial areas, support for higher education, that are things that are in the House bill that are very, very important to the president.

STEPHANOPOULOS: But will the Senate bill produce fewer jobs?

SUMMERS: There's no question -- no question what we've got to do is go after support for education. And there are huge problems facing state and local governments, and that could lead to a vicious cycle of layoffs, falling home values, lower property taxes, more layoffs. And we've got to prevent that.

So we're going to have to try to come together in the conference. And the president is certainly going to be active in sharing his views as that process -- as that process...

STEPHANOPOULOS: Let me -- let me get to the state of the economy, because some economists have been even more alarming than you are right now.I hope Summers understands that house prices are still too high by most measures and need to fall further. On the question of depression, the answer is no, although the Senate appears to be trying for one!

STEPHANOPOULOS: This week, two economists, the president of the Federal Reserve Bank of San Francisco, Janet Yellen, said, "I think we do have the same type of dynamics taking place that do happen in a depression." The managing director of the IMF, Dominique Strauss- Kahn, was quoted in Bloomberg News as saying, "Advanced economies are already in a depression, and the financial crisis may deepen unless the banking system is fixed. The worst cannot be ruled out."

Already in a depression?

SUMMERS: We're in a very serious situation, George. This is worse than any time since the Second World War. It's worse than I think most economists like me ever thought we would see.

But let's remember. In the Depression, the unemployment rate was 25 percent. GDP had fallen in half. We were really in a very different situation than that.

But all of this concern -- the risks of deflation, for example -- points up the importance of acting as aggressively as we can. That's why the president's economic recovery program is so important. That's why it needs to be twinned, as it will be this week, with the financial recovery program directed at shoring up the flow of credit so that people can get the loan to buy a car...

STEPHANOPOULOS: Let me -- let me ask you about that.

SUMMERS: ... so that we can address the problem which has, frankly, gone unattended for much too long of declining house prices.

Saturday, February 07, 2009

The Competing Stimulus Bills

by Calculated Risk on 2/07/2009 11:25:00 PM

From the NY Times: Congress Is Divided Over Competing Stimulus Bills

The price tag for the Senate plan is now only slightly more than the $820 billion cost of the measure adopted by the House.This might be a serious problem since the differences are significant.

...

But the competing bills now reflect substantially different approaches. The House puts greater emphasis on helping states and localities avoid wide-scale cuts in services and layoffs of public employees. The Senate cut $40 billion of that aid from its bill, which is expected to be approved Tuesday.

The Senate plan, reached in an agreement late Friday between Democrats and three moderate Republicans, focuses somewhat more heavily on tax cuts, provides far less generous health care subsidies for the unemployed and lowers a proposed increase in food stamps.

Bank Failure Haiku

by Calculated Risk on 2/07/2009 04:36:00 PM

For each bank failure, reader Soylent Green is People has been writing a Haiku.

Here are the ones yesterday ...

From the FDIC: FirstBank Financial Services, McDonough, GA

First Bank, number seven gone

Still no end in sight.

From the FDIC: Alliance Bank, Culver City, CA

F.D.I.C., plus U.S.

Eight In Oh Nine Now.

From the FDIC: County Bank, Merced, California

Trifecta is now complete

A Quinella next?

Very clever. Thanks!

The Homebuyer Tax Credit

by Calculated Risk on 2/07/2009 01:49:00 PM

The Senate has apparently kept the $15,000 homebuyer tax credit in the stimulus package. The tax credit sponsors, Senators Johnny Isakson and Joe Lieberman, estimated the cost would be $18.5 billion. Several analysts (like Dean Baker) made fun of this estimate, and the new is estimate is a cost of $35.5 billion. But this post isn't about the poor math skills of Senators ...

First the details (as far as I can tell):

Clearly this favors higher income tax payers as compared to the current $7,500 tax credit. Ryan Donmoyer at Bloomberg has more: Senate’s Tax Credit Favors Higher-Income Homebuyers

The Cost

The first cost estimate of $18.5 billion from Isakson and Lieberman was absurd.

There were 4.9 existing homes bought in 2008, and another 482 thousand new homes. Even with a decline in sales in 2009, probably close to 5 million homes will be sold.

Of course many low end REOs are being bought by cash flow investors (to rent), and these buyers would not qualify (only primary residences qualify), and 2nd home purchases are excluded too, but 3 to 4 million homebuyers will probably qualify over the next 12 months. Not all homebuyers will receive the entire credit, but even at $12,000 per buyer (the credit can be spread over two years), the cost will be $36 billion to $48 billion. So the new estimate is probably close.

The Purpose

This tax credit is being compared to the 1975 tax credit for homebuyers. However in 1975 the tax credit was for new homes only, and was intended to reduce the inventory of new homes, and help put residential construction workers back to work. A boom in new home sales followed the enactment of the 1975 tax credit, but the cause and effect is debatable because the economy was emerging from a recession anyway. The tax credit probably helped.

Although new home inventory was a little high in 1975, there were few other excess housing units. The homeowner vacancy rate was 1.2% (compared to 2.9% today) and the rental vacancy rate in 1975 was 6% (compared to 10.1% today). So the supply dynamics were very different.

In this case the tax credit is for both existing and new homes. This is more of an incentive to get people to move as opposed to putting people back to work. Whereas there were few excess units in 1975 (except excess new home inventory), there are far too many excess units today.

The sponsors and supporters of this tax credit believe this will support house prices - a mistake because this will mostly just shuffle homeowners between homes, and not reduce the excess supply.

If the incentive was for new homes only, the credit would probably help create some construction jobs. However, the job creation would be limited because of the competing oversupply of existing homes.

The tax credit for existing homes does almost nothing to help the economy. Some might argue that this is more work for agents and home inspectors, and might help with furniture sales, but the impact will be minor. Remember existing home sales are already at a normal level compared to the stock of owner occupied units, so agents are doing fine already (just not compared to the bubble years).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows sales and inventory of existing homes as a percent of Owner Occupied Units (a measure of turnover).

By this measure sales are still above the normal range of about 6% per year. Inventory is above the usual range too. With 76 million owner occupied households, a normal range for existing homes sales is about 4.5 million per year.

The key problem for housing is prices are too high. How does this tax credit help reduce prices? Why are we trying to artificially increase the turnover rate? And why are we targeting a tax credit at higher income individuals?

This tax credit seems ill-conceived, and probably should be removed from the stimulus package. No one has adequately explained how this helps "fix housing first".

CRE Underwater

by Calculated Risk on 2/07/2009 11:50:00 AM

From the NY Times: Sam Zell’s Empire, Underwater in a Big Way (hat tip Gary)

It was, for a brief shining moment, the real estate deal of the century.Nice timing.

In 2007, Sam Zell, the billionaire Chicago investor, sold a portfolio of 573 properties he had assembled over three decades, Equity Office Properties Trust, to the Blackstone Group for $39 billion. It was the largest private equity deal in history, but Blackstone did not stop there: it immediately flipped hundreds of the buildings for $27 billion.

Today, the wreckage of those purchases is strewn across the country, from Southern California to Austin, Tex., to Chicago to New York. Many of the 16 companies that bought Equity Office buildings are now stuck with punishing debt, properties whose values are plummeting and millions of feet of office space they cannot fill.

...

Buyers purchased buildings at what, in retrospect, were vastly inflated prices. Lenders provided lavish, even excessive, financing based on unrealistic expectations of rising rents. And now that values are tumbling, vacancy rates are rising and credit has become impossibly tight, many on both sides are struggling against default, foreclosure or bankruptcy.

...

The buyers found lenders only too willing to finance as much as 90 percent or more of the purchase price, even as profit margins shrank, on a bet that rents and values would continue to rise. The investment banks, including Morgan Stanley, Wachovia, Goldman Sachs, Bear Stearns and Lehman Brothers, in turn collected their fees as they packaged the loans as securities and sold them to investors.

In April 2008 at the Milken conference, Zell said CRE would be fine. Here is what I wrote from the conference:

Sam Zell started by saying we need to separate commercial from residential. Commercial will be fine in his view (not my view). Also Zell thinks losses are overstated for investment banks and CDOs. ... He feels there is too much global demand ("liquidity") for prices to fall too far - especially for Class-A buildings.I think his actions spoke louder than his words!

Bank Failure #9 in 2009: County Bank, Merced, California

by Calculated Risk on 2/07/2009 01:37:00 AM

From the FDIC: Westamerica Bank, San Rafael, California, Acquires All the Deposits of County Bank, Merced, California

County Bank, Merced, California, was closed today by the California Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Westamerica Bank, San Rafael, California, to assume all of the deposits of County Bank.Missed this one. Three this week again ...

...

As of February 2, 2009, County Bank had total assets of approximately $1.7 billion and total deposits of $1.3 billion. In addition to assuming all of the failed bank's deposits, including those from brokers, Westamerica Bank agreed to purchase all of County Bank's assets.

The FDIC and Westamerica Bank entered into a loss-share transaction. Westamerica Bank will share in the losses on the asset pools covered under the loss-share agreement. The loss-sharing arrangement is projected to maximize returns on the assets covered by keeping them in the private sector. The agreement also is expected to minimize disruptions for loan customers as they will maintain a banking relationship.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $135 million. Westamerica Bank's acquisition of all deposits was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. County Bank is the ninth bank to fail in the nation this year, and the third in California.

Update: Haiku from Soylent Green is People:

Trifecta is now complete

A Quinella next?

Friday, February 06, 2009

Fed's Yellen: Economic Outlook and Community Banks

by Calculated Risk on 2/06/2009 10:31:00 PM

From San Francisco Fed President Janet Yellen: The Economic Outlook for 2009 and Community Banks. A few excerpt on a common topic: CRE and non-residential investment:

Nonresidential construction declined modestly at the end of last year but, surprisingly enough, has not yet shown the steep declines that have been expected for some time. However, such declines are almost surely imminent. With business activity slowing and new buildings coming on line, vacancy rates on office, industrial, and retail space are all on the rise. For developers, financing is indeed extremely hard to get. The market for commercial mortgage-backed securities has all but dried up. Banks and other traditional lenders have also become less willing to extend funding. It’s no wonder that my contacts are talking about substantial cutbacks on new projects and planned capital improvements on existing buildings.

...

Many community banks have significant commercial real estate concentrations, and these loans are a particular concern in the current environment. At present, the performance of such loans has deteriorated only mildly. But, as I suggested earlier, we can’t count on that situation to continue, since the downturn in commercial real estate construction is just getting started and is likely to be quite challenging.

Senate Reaches Deal on Stimulus Package

by Calculated Risk on 2/06/2009 08:11:00 PM

From the WSJ: Senate Leaders Reach Compromise on Stimulus Plan

Senate Democrats have struck a deal on a $767 billion economic stimulus package, several senators said Friday.It sounds like the ill-conceived homebuyer tax credit made the cut, as CNBC reports:

The deal is expected to bring on enough Republicans to ensure support of passage in the Senate, which will likely require 60 votes. Sen. Sherrod Brown (D., Ohio) told reporters late Friday, "We have a deal."

...

The size of the package has been reduced to around $767 billion from the original $885 billion plan the Senate brought to the floor on Monday, Sen. Kent Conrad (D., N.D.), the chairman of the Senate Banking Committee said.

The spending side has been reduced from $349 billion to $263 billion, while the tax credits have been reduced from $342 billion to $324 billion, Conrad said.

Senator Kent Conrad, a Democrat from North Dakota, said measures including a homebuyer tax credit and auto tax credit would remain in the final package.We need to see the details, but it sounds like they made the package smaller and the composition worse.

Bank Failure #8 in 2009: Alliance Bank, Culver City, CA

by Calculated Risk on 2/06/2009 07:51:00 PM

From the FDIC: California Bank and Trust, San Diego, CA, Acquires All of the Deposits of Alliance Bank, Culver City, CA

Alliance Bank, Culver City, California, was closed today by the California Department of Financial Institutions, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with California Bank & Trust, San Diego, California, to assume all of the deposits of Alliance Bank.The FDIC goes for two this week ...

...

As of December 31, 2008, Alliance Bank had total assets of approximately $1.14 billion and total deposits of $951 million. In addition to assuming all of the deposits of the failed bank, including those from brokers, California Bank & Trust agreed to purchase approximately $1.12 billion in assets at a discount of $9.9 million. The FDIC will retain the remaining assets for later disposition.

The FDIC and California Bank & Trust entered into a loss-share transaction. California Bank & Trust will share in the losses on the asset pools covered under the loss-share agreement. The loss-sharing arrangement is projected to maximize returns on the assets covered by keeping them in the private sector. The agreement also is expected to minimize disruptions for loan customers as they will maintain a banking relationship.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $206.0 million. California Bank & Trust's acquisition of all deposits was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. Alliance Bank is the eighth to fail in the nation this year, and the second in California. The last bank to fail in the state was 1st Centennial Bank, Redlands, on January 23.

Update: Haiku from Soylent Green is People:

F.D.I.C., plus U.S.

Eight In Oh Nine Now.