by Calculated Risk on 1/18/2009 05:36:00 PM

Sunday, January 18, 2009

UK: More on New Bailout Scheme

The Times is reporting that Gordon Brown will announce on Monday: Banks bail-out: Taxpayers may take shares in Barclays and HSBC

* The Government's £250 billion Credit Guarantee Scheme to support lending between banks will be extended until the end this year.Still scheming ...

* An expansion of the Bank of England's £200 billion Special Liquidity Scheme. The Bank will now accept consumers' car loans in exchange for high-grade Government bonds ...

* A plan for the Government to guarantee £100 billion of mortgage-backed securities...

* Northern Rock, the state-owned bank will be told to offer more mortgages ...

Talks are also underway for the state to increase its holdings in RBS and the newly-formed Lloyds Banking Group ...

Intrade: Odds of a Depression

by Calculated Risk on 1/18/2009 03:42:00 PM

OK, this is amusing. Although there is no formal definition of an economic depression, the most common definition is a sustained recessionary period with at least a 10% decline in real GDP from peak to trough.

And that brings us to the odds of a depression from Intrade Prediction Markets. (hat tip Asymmetric). This graph shows that traders believe the odds of a depression in 2009 are about 55%.

And how does Intrade define a depression? Here are the rules:

This contract will settle (expire) at 100 ($10.00) if quarterly GDP figures show the US economy has gone into a depression in 2009.Quiz: If the annualized real GDP declines 2.5% in each quarter of 2009, how much does real GDP decline in 2009?

The contract will settle (expire) at 0 ($0.00) if quarterly GDP figures DO NOT show the US economy has gone into a depression in 2009.

For expiry purposes a depression is defined as a cumulative decline in GDP of more than 10.0% over four consecutive quarters. This is calculated by adding together the published (annualized) Real GDP figures (as detailed below). If these annualised figures add up to more than -10.0% over four consecutive quarters then the contract will expire at 100.

Example 1:

In Q1 the Final Real GDP figure is -3.5%

In Q2 the Final Real GDP figure is -2.5%

In Q3 the Final Real GDP figure is -2.0%

In Q4 the Final Real GDP figure is -2.3%

The sum of these figures is -10.3% so the contract will be expired at 100.

...

Negative quarters in the preceding year will count towards the total GDP decline for expiration purposes. For example, if the total decline in GDP from Q3 2008 to Q2 2009 exceeds 10.0% then the contract will expire at 100.

A: -10% (as calculated by Intrade adding the four quarters together)

B: -2.5%

I'm not making this up. The answer is B. If GDP declines at an annualized rate of 2.5% each quarter, then the total decline in real GDP over four quarters is 2.5%.

So which is correct for Intrade? A a cumulative decline in GDP of more than 10.0% or "adding together the published (annualized) Real GDP figures"? ROFLOL. I think they might have a dispute coming!

I suspect this might actually come up if reported GDP declines 5% in Q4 2008 and another 5% in Q1 2009; some observers might claim GDP has declined 10% (adding the two together). Readers of this blog will know that real GDP would have only declined about 2.5%! That is bad enough. (5% annual rate for half a year)

Bad CRE Loans threaten Regional Banks

by Calculated Risk on 1/18/2009 12:57:00 PM

From the Chris Serres at the StarTribune: Loans threaten Minnesota community banks (hat tip dryfly)

Dozens of Minnesota banks have entered the new year on shaky footing, hobbled with millions of dollars of commercial real estate loans going sour at an alarming pace. ... "Any bank that has a sizable book of commercial real estate loans could have serious problems in 2009," predicted Jamie Peters, a bank analyst at Morningstar in Chicago.As I've noted several times, most regional banks avoided the residential real estate market (because they couldn't compete) and instead focused on CRE and C&D (construction & development) lending. This exposed many regional banks to excessive CRE loan concentrations, and now that CRE will implode in 2009, many of these banks will be in serious jeopardy.

...

As of the third quarter of last year, 5.7 percent of commercial real estate loans in Minnesota were more than 30 days past due, up from 3.1 percent a year ago.

...

Officials with the Minnesota Department of Commerce, which regulates 429 state-chartered banks and credit unions in Minnesota, acknowledged the problem and said they are concerned. The department's watch list of banks it considers in "less than satisfactory" condition has nearly doubled over the past 18 months to 50, from 26 in June 2007.

Along these lines, here are some comments from Fed Vice Chairman Donald L. Kohn from April, 2008:

Setting aside the 100 largest banks, the share of commercial real estate loans in bank loan portfolios nearly doubled over the past 10 years and is approaching 50 percent. The portfolio share at these banks of residential mortgage and other consumer loans, which are more readily securitized, fell by 20 percentage points over the same period.Here come the regional bank failures ...

...

Concentration risk is another familiar risk that is appearing in a new form. Banks have always had to worry about lending too much to one borrower, one industry, or one geographic region. But as smaller banks hold more of their balance sheet in types of loans that are difficult to securitize, concentration risks can develop. Concentrations of commercial real estate exposures are currently quite high at some smaller banks. This has the potential to make the banking sector much more sensitive to a downturn in the commercial real estate market.

Saturday, January 17, 2009

More on new UK Bank Bailout

by Calculated Risk on 1/17/2009 08:14:00 PM

From The Times: Treasury’s £100bn lifeline

THE Treasury will tomorrow drastically revise the terms of last October’s bank bailout and say it will guarantee at least £100 billion of new lending.It sounds like the details will be released on Monday, and will include more capital for banks and a Government guarantee for new lending ... but no "bad bank".

...

Three key proposals are being finalised. The government will offer guarantees on new consumer loans, outline plans to ringfence “toxic” assets on bank balance sheets and propose to refinance the preference shares that were used to rescue Royal Bank of Scotland and HBOS.

The taxpayer’s stake in Royal Bank of Scotland could jump from 57.9% to about 70% as part of the deal.

...

Tomorrow’s announcements will centre on measures to get the banks through the crisis and to boost lending. The existing Bank of England Special Liquidity Scheme (SLS), which has provided the banks with £200 billion of liquidity over the past nine months, will expire on January 30. But officials say there will be a “son of SLS”, to replace it and ensure liquidity does not dry up.

...

There has been intense speculation that the government plans to set up a “bad bank” to take so-called toxic assets off the banks’ books and put them in a new taxpayer-owned entity, to be sold on when economic conditions improve.

Officials, however, played this down. “There will be no announcement of a bad bank next week,” one well-placed Whitehall official said.

We're All Subprime Now! *

by Calculated Risk on 1/17/2009 04:34:00 PM

Atrios notes:

... suddenly our great newspapers are discovering the "stereotypes" they helped to perpetuate weren't, you know, true. Subprime loans were never the problem, just an early warning signal ...Oh well, better late than never.

* Note: "We're all subprime now!" was Tanta's response to the false subprime meme.

From the WaPo: The Growing Foreclosure Crisis

One oft-repeated assertion no longer holds true. Those in trouble are not, primarily, lower-income borrowers. The foreclosure crisis has become a wave, afflicting neighborhoods of every stripe -- but particularly communities created by the boom itself.And please excuse me, but I found this paragraph amusing:

... interviews and a Washington Post analysis of available data show that the foreclosure crisis knows no class or income boundaries. Many borrowers ensnared in the evolving mortgage mess do not fit neatly into the stereotypes that surfaced by early 2007 when delinquency rates shot up. They don't have subprime loans, the lending industry's jargon for the higher-rate mortgages made to borrowers with shaky credit or without enough cash for a down payment.

The wave of subprime delinquencies appears to have crested. But in October, for the first time, the number of prime mortgages in delinquency exceeded the subprime loans in danger of default, according to The Post's analysis.

In 2005 and 2006, more than half the homes sold in Southern California were in Riverside and neighboring San Bernardino County, pumping thousands of new jobs into the regional economy, said John Husing, an independent economist. "Real estate became what gold was to the gold mining towns," he said. "Everyone's job was tied to the mine, whether they realized it or not."And here is what I wrote in 2006, in response to an optimistic forecast for the Inland Empire from Mr. Husing: Housing: Inverted Reasoning?

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.Hoocoodanode? This cartoon is worth repeating ...

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

The Next Step for the U.S. Bank Bailout

by Calculated Risk on 1/17/2009 01:16:00 PM

From the WSJ: U.S. Plots New Phase in Banking Bailout

Officials at the Treasury, Federal Reserve and Federal Deposit Insurance Corp., in consultation with the incoming Obama administration, are discussing a plan to create a government bank that would buy up the bad investments and loans that are behind the huge losses that U.S. banks continue to report, say government officials. Also under consideration is an additional and giant government guarantee of banks' assets against further losses.The Times is reporting an announcement could come this week:

The discussions, which are intensifying, show how the rapid deterioration of bank assets is outpacing the government's rescue efforts. Banks are now struggling not only with the real-estate investments that sparked the crisis, but also with the car loans, credit-card debt and other consumer debt that have taken a hit with the faltering economy.

An announcement could be made within days of Barack Obama taking office as President on Tuesday.Also the WSJ article has a table of credit losses based on estimates from Goldman Sachs: $1.1 trillion from residential mortgages, $390 billion from corporate loans and bonds, $234 billion from commercial real estate, $226 billion from credit cards, and $133 billion from auto loans.

The $1.1 trillion for residential is in line with my estimates from Dec 2007, and the additional estimate also seem reasonable (close to $2.1 trillion total in U.S. credit losses). These losses will be shared among banks and investors worldwide, so probably less than half of the losses will be for U.S. banks. However U.S. banks will also suffer losses on overseas loans.

UK: New £200bn "Bad Bank" Bailout Plan

by Calculated Risk on 1/17/2009 01:28:00 AM

From the Telegraph: £200bn to save banks from bad debt

In an attempt to restore confidence within the financial sector, the Treasury will tell the banks of its plan on Saturday. It aims to announce details of the rescue package publicly early next week.That is equivalent to a total U.S. bailout of almost $10 trillion (about 2/3 of GDP).

The bad bank plan has climbed the political agenda in the past couple of weeks as the Government has become aware of the extent of the lenders' bad debts.

Sources said that a bad bank would have to take on about £200 billion of toxic assets. That would take the Government's total commitment to solving the banking crisis to almost £1 trillion in taxpayers' money that has either been spent or pledged.

That equates to about £33,000 per taxpayer. The total sum is equivalent to more than two-thirds of Britain's annual GDP of £1.4 trillion.

Friday, January 16, 2009

Bird and Fortune: Silly Money

by Calculated Risk on 1/16/2009 10:33:00 PM

This is a followup to the subprime piece from a year ago ...

(Part 1: 8 min 42 sec)

(Part 2: 8 min 42 sec)

2009 Bank Failure #2: Bank of Clark County, Vancouver, WA

by Calculated Risk on 1/16/2009 09:24:00 PM

From the FDIC: Umpqua Bank Acquires the Insured Deposits of Bank of Clark County, Vancouver, WA

Bank of Clark County, Vancouver, Washington, was closed today by the Washington Department of Financial Institutions, and the Federal Deposit Insurance Corporation (FDIC) was named receiver.A Bank Failure Friday Twofer ...

...

As of January 13, 2009, Bank of Clark County had total assets of $446.5 million and total deposits of $366.5 million. At the time of closing, there were approximately $39.3 million in uninsured deposits held in approximately 138 accounts that potentially exceeded the insurance limits.

...

In addition to assuming the failed bank's insured deposits, Umpqua Bank will purchase $30.4 million of assets comprised of cash, cash equivalents, marketable securities and loans secured by deposits. The FDIC will retain the remaining assets for later disposition.

The transaction is the least costly resolution option, and the FDIC estimates the cost to its Deposit Insurance Fund will be between $120 and $145 million.

2009 Bank Failure #1: National Bank of Commerce, Berkeley, IL

by Calculated Risk on 1/16/2009 07:37:00 PM

From the FDIC: Republic Bank of Chicago Acquires All the Deposits of National Bank of Commerce, Berkeley, IL (hat tip Soylent Green Is People)

National Bank of Commerce, Berkeley, Illinois, was closed today by the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Republic Bank of Chicago, Oak Brook, Illinois, to assume all of the deposits of National Bank of Commerce.Now it feels like a Friday.

...

As of January 7, 2009, National Commerce Bank had total assets of $430.9 million and total deposits of $402.1 million. In addition to assuming all of the failed bank's deposits, Republic Bank agreed to purchase approximately $366.6 million in assets at a discount of $44.9 million. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $97.1 million.

Layoffs: I read the news today, oh boy!

by Calculated Risk on 1/16/2009 05:33:00 PM

WSJ: Circuit City to Liquidate, Meaning 30,000 Job Losses

Bloomberg: GE Capital May Cut as Many as 11,000 Jobs This Year

WSJ: Pfizer to Cut Up to 2,400 Jobs

WSJ: Google Plans 100 Layoffs of Recruiters

AP: AMD to cut 1,100 workers, 9 pct of staff

Reuters: Hertz to cut more than 4,000 jobs

Bloomberg: WellPoint Cuts 1,500 Jobs, Blames ‘State of Economy’

AP: Blue Cross Blue Shield to cut up to 1,000 jobs

Tampa Bay Business Journal: Report: Layoffs looming at Clear Channel

I'm sure I missed a few ...

California: No Tax Refund for you!

by Calculated Risk on 1/16/2009 04:24:00 PM

From the LA Times: California controller to suspend tax refunds, welfare checks (hat tips Thomas and Circle the Drain)

State Controller John Chiang announced today that his office would suspend tax refunds, welfare checks, student grants and other payments owed to Californians starting Feb. 1 ... The payments to be frozen include nearly $2 billion in tax refunds; $300 million in cash grants for needy families and the aged, blind and disabled; and $13 million in grants for college students.

CBO: $64 Billion "Subsidy Cost" for TARP

by Calculated Risk on 1/16/2009 02:35:00 PM

From the CBO: The Troubled Asset Relief Program: Report on Transactions Through December 31, 2008

This is the first of CBO’s statutory reports on the TARP’s transactions. Through December 31, 2008, those transactions totaled $247 billion. Valuing those assets using procedures similar to those specified in the Federal Credit Reform Act (FCRA), but adjusting for market risk as specified in the EESA, CBO estimates that the subsidy cost of those transactions (broadly speaking, the difference between what the Treasury paid for the investments or lent to the firms and the market value of those transactions) amounts to $64 billion.CBO calls its a "subsidy cost", others call it a "loss".

Click on table for larger image in new window.

Click on table for larger image in new window.Here is the CBO table of subsidies.

AIG and the auto companies are the big winners (in percent subsidy).

CNBC: Circuit City Will Be Liquidated

by Calculated Risk on 1/16/2009 10:53:00 AM

From CNBC: Circuit City Will Be Liquidated, Sources Say

Not good news for mall owners ...

Just a reminder, from Bloomberg last week: U.S. Shopping Mall Vacancies Reach 10-Year High as Stores Fail

Vacancies at U.S. malls and shopping centers approached 10-year highs in the fourth quarter, and are set to rise further as declining retail sales put more stores out of business, research firm Reis Inc. said.

Regional mall vacancies rose to 7.1 percent last quarter from 6.6 percent in the third quarter. It was the highest vacancy rate since Reis began tracking regional malls in 2000, as well as the largest quarter-to-quarter jump in vacancies, according to New York-based Reis.

At neighborhood and community shopping centers, the vacancy rate rose to 8.9 percent from 8.4 percent in the third quarter, the highest since Reis began publishing quarterly data in 1999.

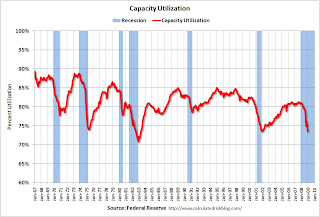

Capacity Utilization and Industrial Production Cliff Diving

by Calculated Risk on 1/16/2009 09:15:00 AM

From Greg Robb at MarketWatch: U.S. Dec. industrial production down 2%, down 11.5% in Q4

Capacity utilization ... fell to 73.6% from 75.2%. This is the lowest level since December 2001. Industrial output fell at an 11.5% rate in the fourth quarter.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This is a very sharp decline in industrial output, and industrial production is a key to the depth of the economic slowdown. Up until recently export growth had been strong, and the decline in industrial production had been mild. Now, with the global economy slowing sharply, industrial production and capacity utilization are falling off a cliff.

Also the significant decline in capacity utilization suggests less investment in non-residential structures for some time.

CPI declines 0.7% in December

by Calculated Risk on 1/16/2009 08:34:00 AM

From Rex Nutting at MarketWatch: Consumer prices show smallest gain in 54 years

The consumer price index fell 0.7% in December, the third decline in a row, led by an 8.3% drop in energy prices and a 0.1% drop in food prices.More later on CPI.

...

Core prices - which exclude food and energy prices - were flat in December for the second straight month ...

Consumer prices were up 0.1% in 2008, the slowest annual inflation since prices fell 0.7% in 1954. The core CPI was up 1.8% in 2008, the lowest increase since 2003.

BofA, Citi Report Losses

by Calculated Risk on 1/16/2009 08:16:00 AM

From the WSJ: Bank of America Swings to a Loss

Bank of America Corp. swung to a fourth-quarter loss as provisions for credit-losses nearly tripled, while the company showed why it needed further help from the government to support its acquisition of Merrill Lynch, whose preliminary loss was $15.31 billion.And from the WSJ: Citigroup Posts Loss, Splits Up Company

Citigroup Inc. reported an $8.29 billion net loss for the fourth quarter, putting the year's red ink at $18.72 billion, as the company announced it will reorganize into two business lines focused on banking and other financial services.

Treasury, Federal Reserve, and the FDIC Provide Assistance to Bank of America

by Calculated Risk on 1/16/2009 12:24:00 AM

Press Release: Treasury, Federal Reserve, and the FDIC Provide Assistance to Bank of America

The U.S. government entered into an agreement today with Bank of America to provide a package of guarantees, liquidity access, and capital as part of its commitment to support financial market stability.Term Sheet

Treasury and the Federal Deposit Insurance Corporation will provide protection against the possibility of unusually large losses on an asset pool of approximately $118 billion of loans, securities backed by residential and commercial real estate loans, and other such assets, all of which have been marked to current market value. The large majority of these assets were assumed by Bank of America as a result of its acquisition of Merrill Lynch. The assets will remain on Bank of America's balance sheet. As a fee for this arrangement, Bank of America will issue preferred shares to the Treasury and FDIC. In addition and if necessary, the Federal Reserve stands ready to backstop residual risk in the asset pool through a non-recourse loan.

In addition, Treasury will invest $20 billion in Bank of America from the Troubled Assets Relief Program in exchange for preferred stock with an 8 percent dividend to the Treasury. Bank of America will comply with enhanced executive compensation restrictions and implement a mortgage loan modification program.

Treasury exercised this funding authority under the Emergency Economic Stabilization Act's Troubled Asset Relief Program (TARP). The investment was made under the Targeted Investment Program. The objective of this program is to foster financial market stability and thereby to strengthen the economy and protect American jobs, savings, and retirement security.

Separately, the FDIC board announced that it will soon propose rule changes to its Temporary Liquidity Guarantee Program to extend the maturity of the guarantee from three to up to 10 years where the debt is supported by collateral and the issuance supports new consumer lending.

With these transactions, the U.S. government is taking the actions necessary to strengthen the financial system and protect U.S. taxpayers and the U.S. economy. As was stated in November when the first transaction under the Targeted Investment Program was announced, the U.S. government will continue to use all of our resources to preserve the strength of our banking institutions and promote the process of repair and recovery and to manage risks.

Thursday, January 15, 2009

Possible BofA Bailout Details

by Calculated Risk on 1/15/2009 11:15:00 PM

From the NY Times: U.S. Said Close to Giving More to Bank of America

The program ... will hold Bank of America responsible for the first $10 billion in losses on a pool of $118 billion in illiquid assets. The government will take on the next $10 billion in losses and then taking on 90 percent of any additional losses with Bank of America absorbing the rest.That puts the taxpayers on the line for close to $100 billion. What do we get for taking on this risk?

Hopefully we will have more details in the morning.

LA Area Port Traffic Collapses in December

by Calculated Risk on 1/15/2009 09:05:00 PM

Both imports and exports declined sharply in November, but just wait until we see the December trade numbers. Based on LA area port traffic numbers released today, trade volumes collapsed in December. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the combined loaded inbound and outbound traffic at the ports of Long Beach and Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic was 19% below last December. This slowdown in exports (inbound traffic to the U.S.) is hitting Asian countries hard.

But even more shocking and important for the U.S. economy is that export traffic has collapsed. For the LA area ports, outbound traffic continued to decline in December, and was 30% below the level of December 2007. Export traffic is now at about the same level as in late 2005. So much for the export boom!

Now it is the export bust.