by Calculated Risk on 1/13/2009 01:25:00 PM

Tuesday, January 13, 2009

Credit Crisis Indicators: TED Spread Below 1.0

Here are a few indicators of credit stress:

| The TED spread was stuck above 2.0 for some time. The peak was 4.63 on Oct 10th. The TED spread has finally moved below 1.0, although a normal spread is around 0.5. |

This is the spread between high and low quality 30 day nonfinancial commercial paper. Right now quality 30 day nonfinancial paper is yielding close to zero. If the credit crisis eases, I'd expect a significant further decline in this spread - although this is good progress.

|

By these indicators, the Fed is making progress.

Federal Home Loan Bank of Seattle Suspends Dividend

by Calculated Risk on 1/13/2009 11:10:00 AM

The FHLBs are probably about to become a huge story.

From Bloomberg: Seattle FHLB Likely Short of Capital on Mortgage Debt (hat tip Brian)

The Federal Home Loan Bank of Seattle joined its San Francisco counterpart in suspending dividends and “excess” stock repurchases, after the declining value of mortgage bonds likely led to a regulatory capital shortfall.From Roubini's testimony to Congress on February 26th, 2008:

The shortfall is being caused by “unrealized market value losses” on home-loan securities without government backing, the Seattle bank cooperative said in a filing with the U.S. Securities and Exchange Commission today.

...

The FHLB system has $1.25 trillion of debt, making it the largest U.S. borrower after the federal government.

[T]he widespread use of the FHLB system to provide liquidity – but more clearly bail out insolvent mortgage lenders – has been outright reckless. ... A system that usually provides a lending stock of about $150 billion has forked out loans amounting to over $750 billion in the last year with very little oversight of such staggering lending. The risk that this stealth bailout of many insolvent mortgage lenders will end up costing massive amounts of public money is now rising.

Beazer Homes: Sales Off more than 50%

by Calculated Risk on 1/13/2009 10:27:00 AM

From Beazer Homes press release:

Home closings for the quarter ended December 31, 2008 totaled 938, a 53.2% decline from 2,006 homes closed during the same period in the prior fiscal year. Net new home orders totaled 551 for the quarter, a decrease of 56.0% from 1,252 net orders in the first quarter of the prior fiscal year. ... The cancellation rate for the first quarter was 45.6%, compared to 46.6% for the same period in the prior year.It just keeps getting worse ...

Trade Deficit Declines Sharply

by Calculated Risk on 1/13/2009 08:45:00 AM

Both exports and imports are declining, but the decline in the trade deficit was mostly about oil prices. Petroleum import prices fell from $92 per barrel in October to under $67 per barrel in November - and will fall further in December.

The Census Bureau reports:

[T]otal November exports of $142.8 billion and imports of $183.2 billion resulted in a goods and services deficit of $40.4 billion, down from $56.7 billion in October, revised. November exports were $8.7 billion less than October exports of $151.5 billion. November imports were $25.0 billion less than October imports of $208.2 billion.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph from the Census Bureau shows that both imports and exports are declining.

Although the trade deficit is declining - and will probably decline further in December because of the continued decline in oil prices - growth in export related businesses will probably no longer be a positive for the U.S. economy as the global economy slides into recession too.

This graph shows the U.S. trade deficit through November. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. The current recession is marked on the graph.

This graph shows the U.S. trade deficit through November. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. The current recession is marked on the graph.The oil deficit declined sharply in November and will decline further in December. But even ex-petroleum, the trade deficit is still declining.

Obama Drops Jobs-Credit Proposal

by Calculated Risk on 1/13/2009 12:06:00 AM

From the WaPo: Obama Shelves Jobs-Credit Proposal

Bowing to widespread Democratic skepticism, President-elect Barack Obama will drop his bid to include a business tax break he once touted in the economic stimulus bill now taking shape on Capitol Hill, aides said last night.It's hard to analyze a plan without many details, but this seems like progress. The larger deductions for tax losses can be junked too, although the capital investment tax incentive is probably worthwhile since capital investment is falling off a cliff.

Obama suggested the $3,000-per-job credit last week as one of five individual and business tax incentives aimed at winning Republican support. He proposed $300 billion in tax relief in a bill that could reach $775 billion, and he resurrected the jobs-credit proposal from the campaign trail as one of his main provisions.

...

Obama advisers said further adjustments may be made to the president-elect's tax priorities, including to a proposed $500 payroll tax credit for individuals. ...

Obama also has suggested tax incentives for businesses to make capital investments. Such benefits are popular across party lines and have been successful in recent years. But another Obama proposal, to allow companies to deduct larger portions of recent losses, has raised eyebrows on the Hill, where lawmakers see it as a costly reward for behavior that was possibly irresponsible.

Monday, January 12, 2009

Retail Bankruptcy: Shane Jewelry

by Calculated Risk on 1/12/2009 05:18:00 PM

These will become too common to list them all ... the story also notes ShopperTrak is predicting that retail sales will likely drop 4 percent in the first quarter.

From Bloomberg: Shane Co., U.S. Jewelry Retailer, Seeks Bankruptcy

Shane Co., the family-owned jewelry retailer with 23 stores in 14 states, sought bankruptcy court protection blaming “disappointing” holiday sales and a “grim” outlook on the deepening U.S. recession.Note: The Census Bureau will release Q4 retail sales on Wednesday, and those numbers are guaranteed to be UGLY.

The 38-year-old company, based in Centennial, Colorado, listed both assets and debt of $100 million to $500 million in Chapter 11 documents filed today in U.S. Bankruptcy Court in Denver.

Alcoa: $1.2 Billion Loss

by Calculated Risk on 1/12/2009 04:21:00 PM

From MarketWatch: Alcoa swings to loss as demand, sales slump

Alcoa said it lost $1.2 billion ... Sales fell to $5.7 billion from $7 billion. Alcoa is in the midst of cutting 15,000 jobs, curbing more production, and slashing its capital budget to make it through the downtrodden economy.Alcoa announced the job cuts and the 50% reduction in planned capital expenditures (a reduction of $1.8 billion) last week. Still pretty amazing numbers ...

More CRE Woes: Multifamily housing

by Calculated Risk on 1/12/2009 03:55:00 PM

From Dow Jones: Apartment-Complex Developers Falling Behind On Loan Payments (hat tip Robert)

The rapid reversal of fortunes in commercial real estate is taking down yet another sector: multifamily housing.This is a great follow up to my post last Friday: The Residential Rental Market. I noted that despite the increase in demand for rentals, rents are now falling because of the rapid increase in supply due to condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), and other reasons. And falling rents means rising delinquencies for properties purchased with overly optimistic pro forma projections.

...

While sharp declines in retail and office sectors of commercial real estate have commanded attention in recent months, some analysts say deterioration in the multifamily sector is quickly catching up. ... Much of the multifamily sector's problems center around troubles in converting apartments to condominiums, as is the case in Miami, or the challenges in converting rent-controlled units to market-rate apartments, as in Manhattan.

In Florida, California, Arizona and Nevada, the flood of unsold condominiums is entering the apartment market and the excess supply is lowering rents in those areas, Barclays Capital analysts say. That's resulted in lower revenues for owners, which in some cases is making it more difficult to keep up with mortgage payments.

...

In November, the delinquency rate on securitized loans to apartment and condominium properties rose to 1.9%, a dramatic jump from the 0.9% at the start of the year, according to Realpoint LLC ...

Obama Asks Bush to Request Remaining TARP Funds

by Calculated Risk on 1/12/2009 11:26:00 AM

WSJ Headline: Obama has asked Bush to request the remaining $350 billion in TARP funds from Congress.

UPDATE: From CNBC: Bush to Seek Rest of TARP Money At Obama's Request

President-elect Barack Obama asked President Bush to request the remaining $350 billlion of the Wall Street bailout fund, and the White House said Bush would do so.

"President Bush agreed to the president-elect's request," White House spokeswoman Dana Perino said in a statement.

...

The request would permit Obama's administration to have the ability to use the money shortly after taking office.

Hologic: Decline in Hospital Spending

by Calculated Risk on 1/12/2009 10:03:00 AM

This is interesting because medical spending is frequently considered recession proof ...

From Hologic Press Release:

"This year will be challenging for our entire industry, as many drivers of our business remain uncertain," said Jack Cumming, Chairman and Chief Executive Officer. "The severe and rapid economic downturn, result[ed] in a decline in hospital spending ... we witnessed an unprecedented decline in demand for capital equipment at the end of the quarter ... Hospital systems across the country have responded to tightening access to capital by restricting capital expenditures, implementing tight spending controls and reducing personnel."

emphasis added

Zandi: The "Lost Economic Decade"

by Calculated Risk on 1/12/2009 12:28:00 AM

"It's sad to say, but we really went nowhere for almost ten years, after you extract the boost provided by the housing and mortgage boom. It's almost a lost economic decade."From the WaPo: Economy Made Few Gains in Bush Years

Mark Zandi, chief economist of Moody's Economy.com

President Bush has presided over the weakest eight-year span for the U.S. economy in decades, according to an analysis of key data ...We will probably see a slew of articles over the next ten days on the various failures of the Bush administration. I think the two worst economic mistakes were the Bush fiscal policies (creating a huge structural budget deficit) and the administration's ideological opposition to regulation and oversight that allowed the housing and credit bubbles to form.

The WaPo article outlines other failures.

Sunday, January 11, 2009

Retailer Bankruptcy Filings Expected

by Calculated Risk on 1/11/2009 08:24:00 PM

From the WSJ: Wave of Bankruptcy Filings Expected From Retailers in Wake of Holidays

... U.S. retailers are expected to begin a wave of post-holiday bankruptcy filings, altering the landscape at malls and on main streets across the country.Poor sales, too much debt and tighter lending standards ... the BK attorneys will probably be busy!

Retailers are particularly vulnerable in the current downturn after a decade of buoyant consumer spending, which encouraged them to overexpand and overborrow. Now, the banks and private investors who financed the boom are pulling back.

Several of the industry's biggest lenders, including General Electric Co.'s GE Capital, CIT Group Inc. and Wachovia Corp., are tightening lending terms and reducing exposure to retailers.

Their tougher terms are making it harder for retailers to find capital to reorganize under bankruptcy-court protection, as they were able to do in the past, meaning there are likely to be more liquidations.

Demolition as Stimulus

by Calculated Risk on 1/11/2009 02:37:00 PM

Last year I noted that there weren't anywhere near enough shovel ready public projects to even offset the expected decline in non-residential structure investment in 2009 - much less make up for the declines in residential construction employment and other areas of job losses.

In May of 2008, I estimated the decrease in non-residential investment for malls, offices and lodging alone at about $60 billion. This is far greater than the $18.4 billion estimate of shovel ready projects from The American Association of State Highway and Transportation Officials.

As the Obama team has noted, properly chosen infrastructure projects provide the best bang for the buck. These projects provide jobs today, and they are an investment in the future. We need more projects ...

And since Obama asked for suggestions ... How about a demolition program?

First, if any state and local governments have old idle buildings waiting for future plans, why not demolish them today? This would provide jobs for local workers, and prepare the land for future development and remove an eyesore. The Federal Government could pay for this demolition.

Second, how about a tax credit for demolishing residential housing units? In many areas there are old, vacant housing units. These are a public nuisance, but the owners have no motivation to demolish the property. Why not provide a tax credit if the properties are demolished in 2009? This could eliminate housing units from the housing stock, provide local jobs, and possibly remove a public nuisance.

A demolition plan would probably only add a few billion to the stimulus package, but it would be well targeted providing jobs in many communities and prepare the land for renewed growth in the future.

Just my 2 cents ...

Trucking Quote of the Day

by Calculated Risk on 1/11/2009 01:17:00 PM

"We have this trucking survey, and it went down to almost eight this week. [the index is 0 to 100 with 50 being normal] ... This is suicidal on that particular survey which is highly correlated to the economy."ISI Chairman Ed Hyman (no link)

Christina Romer Explains Stimulus Plan

by Calculated Risk on 1/11/2009 10:44:00 AM

Christina Romer, the Chair-designate for the Council of Economic Advisers talks about the stimulus plan ...

Saturday, January 10, 2009

The Obama Stimulus Plan

by Calculated Risk on 1/10/2009 04:43:00 PM

| Here is an outline of the Obama Plan (not much detail): The Job Impact of American Recovery and Reinvestment Plan Click on graph for larger image in new window. |  |

Morgan Stanley May Pay $3 Billion for Smith Barney Interest

by Calculated Risk on 1/10/2009 09:25:00 AM

From Bloomberg: Morgan Stanley May Pay Citigroup $3 Billion in Brokerage Merger

Morgan Stanley may pay Citigroup Inc. as much as $3 billion for control of a venture that would combine their brokerage units ... Morgan Stanley ... may get 51 percent of the new company and an option to acquire the rest over three to five years ... The transaction may be announced as soon as tomorrow, the person said.Just shuffling the TARP money ...

Citigroup ... would get cash for its Smith Barney brokerage, while Morgan Stanley would get recurring fee revenue and more potential banking customers.

Friday, January 09, 2009

Office Investment

by Calculated Risk on 1/09/2009 10:38:00 PM

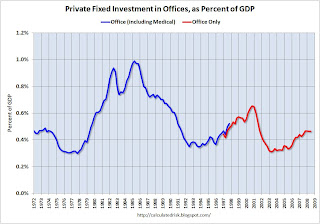

Just to put the coming office space bust in perspective, here are two graphs that show the amount of investment in office space in the U.S. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the amount of office space delivered per year in the U.S. in millions of square feet since 1958. The over investment during the '80s (S&L crisis) is obvious, as is the office boom during the stock bubble.

The red columns are based on projections from Costar for projects already in the pipeline. The second graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q3 2008 in nominal dollars, but decreased slightly as a percent of GDP.

The second graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q3 2008 in nominal dollars, but decreased slightly as a percent of GDP.

NOTE: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

Although I expect a significant decline in office investment over the next few years, the good news is the current boom wasn't anywhere near as large as the previous booms - so hopefully the bust will not be as bad as the early '90s.

Automaker Pensions Underfunded

by Calculated Risk on 1/09/2009 07:11:00 PM

From the WSJ: Agency Raises Concerns About Car Makers' Pensions

The head of the U.S. Pension Benefit Guaranty Corp. acknowledged in an interview that General Motors Corp., Ford Motor Co., and Chrysler LLC have well funded pensions according to the standard accounting rules applied by the Securities and Exchange Commission.The PBGC is another bailout waiting to happen.

But by the PBGC's measures, the pension funds of Detroit's Big Three would be underfunded by as much as $41 billion ...

[PBGC Director Charles E. F. Millard] estimates that the three auto makers only have enough money in their pension funds to cover only 76% of the pension obligations they have made, if they terminate the pension plans. GM's plan is estimated to be $20 billion, or about 20% underfunded, while Chrysler's plan is 34% underfunded, leading to a $9 billion-plus shortfall, the agency said. Ford's funded ratio is not publicly available, but the company's pension plans are likely running at a $12 billion deficit.

About $13 billion of the estimated $41 billion shortfall would be covered by the PBGC ...

The Residential Rental Market

by Calculated Risk on 1/09/2009 02:47:00 PM

Yesterday I linked to an article in the Los Angeles Times about declining residential rents: Housing downturn hits L.A.-area rents

There are several different factors impacting rental supply and demand - and therefore rents - for residential properties.

First, there has been a significant shift away from homeownership: Click on graph for larger image in new window.

Click on graph for larger image in new window.

The homeownership rate decreased slightly to 67.9% in Q3 2008 (most recent data) and is now back to the levels of the summer of 2001. Note: graph starts at 60% to better show the change.

This would suggest a rising demand for rental properties.

Second, a large number of homes are now sitting vacant: This graph shows the homeowner vacancy rate. A normal rate for recent years appears to be about 1.7%.

This graph shows the homeowner vacancy rate. A normal rate for recent years appears to be about 1.7%.

The recent surge in homeowner vacancy rates is probably due to foreclosures and other distressed properties. Many REOs (lender Real Estate Owned) are left vacant until sold, and this has taken a number of housing units off the market.

Note that Fannie and Freddie have proposed a new program to keep tenants in foreclosed properties, but so far the standard lender practice is to evict tenants after foreclosure and let the house sit vacant.

So the first two graphs might suggest rising rents. Demand was rising as households moved from homeownership to renting, and the overall available supply of housing units was declining as many REOs were left vacant. And in fact, rents have been rising in many areas until now, from the LA Times story:

Nationwide, apartment rents eased 0.1% in the fourth quarter, the first drop since 2002, according to the analysis by research firm Reis Inc. ... according to [REIS] apartment rents fell in 54 out of 79 U.S. metropolitan areas in the fourth quarter of 2008.However the supply of rental units has been surging:

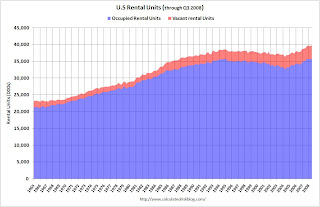

This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).The total number of rental units (red and blue) bottomed in Q2 2004, and started climbing again. Since Q2 2004, there have been almost 3.5 million units added to the rental inventory. This increase in units almost offset the recent strong migration from ownership to renting, so the rental vacancy rate has only declined slightly (from a peak of 10.4% in 2004 to 9.9% in the most recent quarter).

Where did these 3.5 rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 1.05 million units completed as 'built for rent' since Q2 2004. This means that another 2.5 million rental units came from conversions from ownership to rentals.

These could be investors buying REOs for cash flow, older out-of-service units being brought back to the rental market, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling.

Note: it is also common in a recession for apartment vacancies to rise as households double up by moving in with a friends or family members.

Although there are several factors increasing the supply, I believe the surge in REO sales to cash flow investors is having a significant impact on rents. Many of those vacant homeowner units are being converted to rental properties - although this isn't showing up in the Census Bureau data yet (something to watch for).

And falling or flat rents will lead to lower house prices too. Here is a graph of the price-to-rent ratio using the Case-Shiller house price index through Q3 2008 and the Owners' Equivalent Rent (OER) from the BLS.

Looking at the price-to-rent ratio based on the Case-Shiller index, the adjustment in the price-to-rent ratio is probably 60% to 70% complete as of Q3 2008 on a national basis.

Looking at the price-to-rent ratio based on the Case-Shiller index, the adjustment in the price-to-rent ratio is probably 60% to 70% complete as of Q3 2008 on a national basis. However flat or falling rents would suggest even larger future house price declines to return to normal (as opposed to rising rents).