by Calculated Risk on 12/10/2008 06:49:00 PM

Wednesday, December 10, 2008

Report: GSEs May Waive Appraisals for Refis

From Bloomberg: Fannie, Freddie May Waive Appraisals for Refinancings

Fannie Mae and Freddie Mac, the mortgage-finance companies seized by the U.S. government, are considering forgoing new appraisals on refinanced loans to help struggling homeowners, their regulator said.Update: I misread this proposal. Mort_fin notes:

“If they refinance someone, rather than doing a loan mod, do they need a new appraisal if they already have the credit?” Federal Housing Finance Agency Director James Lockhart told reporters after a speech in Washington today. “That’s an issue that’s being discussed. They’re looking at it.”

I think we're only talking rate and term refi here, and only if the GSE is refi'ing a loan it already has on its books. If today I have a $100,000 loan at 6% on an $80,000 house, and tomorrow I have a $100,000 loan at 5% on the same $80,000 house, am I better off or worse off?

FHA and VA been doing this for 25 years. FHA'S streamline refinance program and VA's interest rate reduction loan program.

Woolies to Hold Closing Down Sale

by Calculated Risk on 12/10/2008 03:10:00 PM

From The Times: Woolworths to hold huge closing down sale tomorrow after search for buyer fails

Woolworths will hold a closing down sale tomorrow after administrators failed to find a buyer for the company's 813-store retail chain.Earlier reports had Woolies possibly closing down after Christmas. I'm not sure "redundancies" - the British term for layoffs - fits when the chain is closing down completely.

...

The administrator made the announcement after informing Woolworths' staff. The closure of the stores makes mass redundancies likely. The group employs 30,000 people, approximately 25,000 of whom work in the retail arm.

Credit Crisis Indicators

by Calculated Risk on 12/10/2008 02:14:00 PM

The progress has been slow, so I've stopped posting this daily. It looks like there has been some small progress over the last week ...

| The TED spread is stuck above 2.0, and still too high. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is around 0.5. |

This is the spread between high and low quality 30 day nonfinancial commercial paper. If the credit crisis eases, I'd expect a significant decline in this spread - and the graph makes it clear this indicator is still in crisis.

Each news story of a major bankruptcy or default (like the Tribune Co.) sends this spread higher again.

|

For the LIBOR, the TED spread, and the two-year swap, there has been some more progress. For the A2P2 spread (and all treasury yields), the markets are still in crisis.

Setser: On Global Trade and China

by Calculated Risk on 12/10/2008 11:40:00 AM

From Brad Setser: Global trade is shrinking, fast

China’s November trade data (a 2.2% year over year fall in exports; a 17.9% year over year fall in imports — see Andrew Batson of the Wall Street Journal) suggests that global trade is contracting quite rapidly. And since trade accounts for a rising share of global activity, it suggests that the global economy has stalled — and perhaps is contracting.But China may still run a strong surplus, because the decline in imports (because of falling commodity prices) will more than offset the decline in exports:

The fall in China’s exports suggests global demand is falling. And the fall in China’s imports on first blush seems larger than can be explained just by the fall in demand for imported components for China’s exports and sliding commodity prices: it suggests that Chinese domestic demand is quite weak ...

The November data from Korea and Taiwan tells a similar story. All experienced far larger falls in year over year falls in their exports than China did.

[R]ight now there isn’t any much reason to think that China’s trade surplus will shrink in 2009. Exports will fall. But so will imports. And the fall in commodity prices implies that the terms of trade have shifted in China’s favor.See Brad's post for more. The recession has gone global.

Some WaMu Office Leases might be Voided

by Calculated Risk on 12/10/2008 10:27:00 AM

Continuing a theme on commercial real estate ...

From the Obersver: It’s a WashMu! Landlords Fear Gaping Spaces as F.D.I.C. Mulls Nuclear Option (hat tip Brian)

[T]he F.D.I.C.’s October agreement with JPMorgan Chase and Washington Mutual allows Chase to pick and choose which of the city’s 148 Washington Mutual branches it will keep. Chase will then turn over the rejects to the F.D.I.C. But here’s the kicker: According to sources, the F.D.I.C. can then simply terminate the leases of those rejected branches, all contractual obligations void.

...

Francis Greenburger, chairman and CEO of Time Equities Inc. and owner of 2554 Broadway, will not be sending the F.D.I.C. a thank-you note. About five years ago, Mr. Greenburger’s firm spent more than half a million dollars wooing WaMu, which ultimately took more than 3,000 square feet at his building’s 96th Street corner. The branch has about five years left on its 10-year lease.

“We’re anticipating that Chase gives [our WaMu branch] back to the F.D.I.C., and then the F.D.I.C. gives it back to us,” Mr. Greenburger said. “Chase has a branch directly across the street.

“We’re in the middle of a recession, the worst recession since the Great Depression,” Mr. Greenburger glumly pointed out. “It’s going to be difficult to find a tenant.”

Office Depot to Close 112 Stores, Reduce New Openings

by Calculated Risk on 12/10/2008 09:16:00 AM

Press Release: Office Depot Announces Update of Strategic Review (hat tip Joshua)

The Company plans to close 112 underperforming retail stores in North America over the next three months, reducing the North American store base to 1,163. ... Additionally, 14 stores will be closed through 2009 as their leases expire or other lease arrangements are finalized.More bad news for retail space, and another company reducing capital spending plans ...

New store openings for 2009 now have been reduced to approximately 20, down from the previous estimate of 40 stores. This will facilitate a reduction in total Company capital spending in 2009 to less than $200 million ...

Office Depot also plans to close six of its 33 distribution facilities in North America.

WSJ: Auto Bailout Deal Reached

by Calculated Risk on 12/10/2008 12:53:00 AM

From the WSJ: Washington Maps Pact for Bailout of Big Three

The White House and top Democrats on Capitol Hill reached agreement in principle on a sweeping rescue package for the nation's auto makers ... The bill would provide short-term funds, expected to total about $15 billion ...

[A]n auto czar ... would bring together labor, management, creditors and parts suppliers to negotiate a long-term restructuring plan ... if a company and its stakeholders can't agree on a plan, the czar would be required to recommend one, including the possibility of a Chapter 11 bankruptcy reorganization.

The plans would have to be in place by March 31.

Tuesday, December 09, 2008

AIG: A Black Hole?

by Calculated Risk on 12/09/2008 09:45:00 PM

From the WSJ: AIG Faces $10 Billion in Losses on Trades

American International Group Inc. owes Wall Street's biggest firms about $10 billion for speculative trades that have soured ... The $10 billion in other IOUs stems from market wagers that weren't contracts to protect physical securities held by banks or other investors against default. Rather, they are from AIG's exposures to speculative investments unrelated to insurance, which were essentially bets on the performance of bundles of derivatives linked to subprime mortgages, commercial real-estate bonds and corporate bonds.Meanwhile, from Bloomberg: AIG Says More Managers Get Retention Payouts Topping $4 Million

American International Group Inc., the insurer whose bonuses and perks are under fire from U.S. lawmakers, offered cash awards to another 38 executives in a retention program with payments of as much as $4 million.Please make it stop ...

The incentives range from $92,500 to $4 million for employees earning salaries between $160,000 and $1 million, Chief Executive Officer Edward Liddy said in a letter dated Dec. 5 to Representative Elijah Cummings.

Lodging Investment and the Hotel Bust

by Calculated Risk on 12/09/2008 07:10:00 PM

Start with a stunning graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows investment in lodging (based on data from the BEA) as a percent of GDP. The recent boom in lodging investment has been stunning.

Note: prior to 1997, the BEA included Lodging in a category with a few other buildings. This earlier data was normalized using 1997 data, and is an approximation.

And a press release today from PKF Hospitality Research: PKF Forecasts 7.8 Percent RevPAR Decline in 2009

U.S. hotels have entered the initial stages of one of the deepest and longest recessions in the history of the domestic lodging industry according to a new report issued today by PKF Hospitality Research (PKF-HR). The 7.8 percent drop in RevPAR that the hospitality research firm is now forecasting for 2009 will be the fifth largest annual decline in this important measure since 1930.Compare this to the recent forecast from PricewaterhouseCoopers: PricewaterhouseCoopers Forecasts a Substantial Reduction in Hotel RevPAR in 2009

According to the PwC forecast, 2008 RevPAR will decrease by 0.8 percent, primarily due to a 3.7 percent decrease in occupancy, the highest annual decrease in occupancy since 2001. In 2009, demand is forecast to decrease by 2.0 percent, which, when coupled with a 1.6 percent increase in supply, is expected to further reduce occupancy to 58.6 percent, the lowest since 1971.Mix in tight lending standards, and I expect a significant decline in lodging investment as current projects are completed.

...

"The deteriorating outlook for the economy is impacting travel habits and spending, and hotels are expected to experience reduced occupancy levels, and to a lesser degree, some room rate erosion through 2009," said Scott Berman, principal and U.S. Leader of PricewaterhouseCoopers' Hospitality and Leisure practice.

Note: notice the scale. Whereas residential peaked at over 6.3% of GDP in 2005, investment in lodging is peaking now at just a fraction of residential investment - around 0.34% of GDP. Size matters when evaluating the economic impact of a bust on the economy.

Report: Consumers Buying more Gasoline

by Calculated Risk on 12/09/2008 06:28:00 PM

From Bloomberg: U.S. Gasoline Demand Up First Time Since April, MasterCard Says (hat tip Travis)

U.S. gasoline demand rose last week for the first time since April as prices at the pump fell further ... Motorists bought an average 9.331 million barrels of gasoline a day in the week ended Dec. 5, up from 9.302 million a year earlier, MasterCard, the second-biggest credit-card company, said in its weekly SpendingPulse report.This weekend I speculated (among other things) that lower gasoline prices would have a larger impact on miles driven than unemployment and the weaker economy. This evidence suggests that that might be correct.

...

“The price relief seems to have had a meaningful steady impact on demand,” said Michael McNamara, vice president of research and analysis for MasterCard Advisors.

The miles driven data from the DOT (for October) will be released in about 10 days.

Update on Mortgage Pig Wear for Charity

by Calculated Risk on 12/09/2008 04:59:00 PM

From Tanta's sister Cathy:

The first MP orders were filled and shipped today. Demand has been very high and we've raised over $2,000 for charity so far. These items are produced as they are ordered and we do apologize about the size and color confusion. The best method is to enter this information in the PayPal message box when completing the order.Here is the ordering information and Cathy's original email:

We will accept check orders outside of Ebay but that will slow things down. Please EMAIL: rwstick AT yahoo DOT com (Dick) with the item, size and color and we will return the cost with shipping. Once the check is received with shipping instructions we will process the order.

Some have asked or complained about Ebay - it is not perfect and they and PayPal do take part of the proceeds that we'd rather see going to a charity. But given our time constraints and the fact we're not actually in this business this was our best method.

To clarify: Image Mark-it is the production end of this project.

Originally this project was supposed to be as much a "Fun-raiser" as it was a "Fund-raiser". We hope that has been the case. We kept prices low so that everyone could participate. We encourage you to donate directly to these or any other worthy causes if you prefer.

Lastly, there will be ball caps and coffee cups coming very soon - we're thinking about adding "Cupidity" and maybe another "Fed Meeting". We have a lot of the "Holidays" transfers left.

We may run some of these outside of Ebay. We'll keep you posted.

Tanta_Vive!

The team at "Mortgage Pig Central"

From Cathy (Tanta' sister):

Back in October, after Tanta came home from the hospital and agreed to come to Ohio with me, we had an idea to create Mortgage Pig Wear and donate the proceeds from the sales to the UMMS Greenebaum Cancer Center.

We have friends in Springboro, OH who own a small, local embroidery company called Image Mark-it that is owned and staffed by the type of caring folks who would want to be involved in a project like this. Jumped at the chance, is more like it.

We enlisted her 16 year-old nephew (my son) to handle the shipping and for that he would receive $1.00 per item in his college fund. Tanta would provide the "quality control" or lovingly ride herd on him. She couldn't wait.

Over the past 4 weeks we have "digitized" the pig for the embroidery on sweatshirts and polos and created high quality photo transfers for T-shirts and sweatshirts. Tanta lived long enough to see the samples but not to see the items go into production and be offered for sale. I still can't believe it.

I worried about what to do with this on Saturday so I simply asked Tanta. She wanted us to proceed. My son and my husband both asked her as well - and both got the same answer "Please go ahead with The Mortgage Pig Wear".

In the last day or so as I read the various tributes to her, I saw references to cure vs care. So we've made a small change - we're offering the embroidered pig items with proceeds donated to the Ovarian Cancer Research Fund (www.ocrf.org) and the photo-transfer items split between UMMS Greenebaum and OSUMC James Cancer Centers.

I hope you enjoy wearing these as much as the folks at Image Mark-it and I have enjoyed creating them. We are planning to work very hard to keep up with demand - and for all of us it's a labor of love.

From CR: I believe these are the larger images:

| Holiday |

|

| Click on the Mortgage Pig™ for a larger image in new window. |

| Slap it |

|

| Convexity |

|

Treasury Bills Trade at Negative Rates

by Calculated Risk on 12/09/2008 03:31:00 PM

Form Bloomberg: Treasury Bills Trade at Negative Rates as Haven Demand Surges (hat tip Justin)

Treasuries rose, pushing rates on the three-month bill negative for the first time ... The Treasury sold $27 billion of three-month bills yesterday at a discount rate of 0.005 percent, the lowest since it starting auctioning the securities in 1929. The U.S. also sold $30 billion of four-week bills today at zero percent for the first time since it began selling the debt in 2001.My guess is the banks are parking the TARP money in short term treasuries - and that has pushed the yield to zero. The flight to treasuries is across all durations: the Ten year is now yielding 2.67% and the thirty year treasury just over 3.0%.

The CRE Bust: Quick Overview

by Calculated Risk on 12/09/2008 01:49:00 PM

This post is a summary of recent commercial real estate (CRE) data suggesting that investment in non-residential real estate will decline sharply over the next several quarters.

Note: There is another problem with CRE too (not discussed here) - many existing properties were recently purchased at prices that were based on overly optimistic pro forma income projections. These loans typically included reserves to pay interest until rents increased (like a negatively amortizing option ARM), and it is likely that many of these deals will blow up when the interest reserve is depleted - probably in the 2009-2010 period.

Historically investment in non-residential structures lags investment in residential by 5 to 8 quarters. The reasons are pretty clear - the commercial builders (for malls, offices, lodging, etc.) usually build after they "see the rooftops", i.e. the residential is in place.

It appears the Commercial Real Estate (CRE) bust has started. Here is a summary of recent data:

Click on graph for larger image in new window.

Click on graph for larger image in new window. On the heels of a six-point drop in September, the Architecture Billings Index (ABI) plummeted to its lowest level since the survey began in 1995. As a leading economic indicator of construction activity, the ABI shows an approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI rating was 36.2, down significantly from the 41.4 mark in September (any score above 50 indicates an increase in billings). The inquiries for new projects score was 39.9, also a historic low point.The key here is that the index fell off a cliff in early 2008, and that there is "an approximate nine to twelve month lag time between architecture billings and construction spending". We should expect weaker non-residential structure investment for the foreseeable future (at least through 2009).

emphasis added

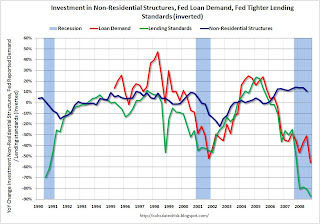

Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.Note that any reading below zero for loan demand means less demand than the previous quarter. This is strong evidence of a significant slump in CRE investment.

The graph shows private residential and nonresidential construction spending since 1993.

The graph shows private residential and nonresidential construction spending since 1993. Nonresidential construction was at a seasonally adjusted annual rate of $417.7 billion in October, 0.7 percent below the revised September estimate of $420.6 billion.It appears spending on private non-residential construction (blue line) peaked in June and is just starting to decline.

This graph based on data from the Federal Reserve shows the delinquency rates at the commercial banks for residential and commercial real estate.

This graph based on data from the Federal Reserve shows the delinquency rates at the commercial banks for residential and commercial real estate.Commercial real estate delinquencies are rising rapidly, and are at the highest rate since Q3 '94 (as delinquency rates declined following the S&L crisis).

From the WSJ: Mall Vacancies Grow as Retailers Pack Up Shop

From the WSJ: Mall Vacancies Grow as Retailers Pack Up Shop For strip centers and other open-air shopping venues, the vacancy rate climbed to 8.4% in the third quarter from 8.1% in the second quarter. That marks the highest rate since 1994, according to Reis.This graph shows the strip mall vacancy rate since Q2 2007. Note that the graph doesn't start at zero to better show the change.

From Reuters: Office vacancy rate reaches 2-year high: report

U.S. office vacancy rose to 13.6 percent, up 0.5 percentage points from the second quarter, its largest one-quarter jump since the second quarter of 2002. The third-quarter vacancy rate was the highest since the second quarter of 2006 and was 110 percentage points higher than its recent low of 12.5 percent set in the third quarter of 2007.

About 23.7 million square feet of office space was available in the third quarter than was leased. About 18.2 million square feet of that was added in just the third quarter, Reis said. That is more than five times the 3.59 million square feet added in the second quarter.

|

This graph shows the annual occupancy rate for the last 50 years. The data is from PricewaterhouseCoopers LLP (1958 to 1986), and Smith Travel Research (1987 to 2007).

The PricewaterhouseCoopers forecast for 2008 and 2009 are in red. Note: The y-axis starts at 50% to better show the change.

SunTrust: Economy has turned "decidedly bleaker" over last month

by Calculated Risk on 12/09/2008 11:06:00 AM

From the Atlanta Business Chronicle: Treasury OKs another $1.4B for SunTrust

"[T]he economic situation is decidedly bleaker than was the case when we announced our initial, partial regulatory capital transaction under the Treasury program," said James M. Wells III, SunTrust chairman and CEO, in a news release. "Given the increasingly uncertain economic outlook, we have concluded that further augmenting our capital at this point is a prudent step, especially if the current recession proves to be longer and more severe than previously expected."SunTrust applied for the previous $3.5 billion on Oct 27th, and received the funds on Nov 17th - less than a month ago!

Here was the CEO comment then:

"Our participation in the Capital Purchase Program enhances SunTrust's already solid capital position and will permit us to further expand our business and take advantage of growth opportunities. In addition, we are pleased to support the Treasury in its ongoing effort to address dislocations in financial markets and spur the market stabilization that is in the public interest."At the end of October, SunTrust was "supporting the Treasury" and "expanding" their business.

Now the situation is "decidedly bleaker".

Pending Home Sales Decline In October

by Calculated Risk on 12/09/2008 10:00:00 AM

From the NAR: Pending Home Sales Holding In Stable Range

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in October, slipped 0.7 percent to 88.9 from an upwardly revised reading of 89.5 in September, and is 1.0 percent below October 2007 when it was 89.8.Existing home sales have been boosted by all the distress sales in low priced areas. Over time, as foreclosure activity shifts to middle and upper income areas, existing home sales will probably decline (the opposite of the NAR view - what a surprise!)

Existing home sales are reported at the close of escrow, pending home sales are reported when contracts are signed. The Pending Home Sales index leads existing home sales by about 45 days, so this suggests existing home sales will decline in December (from November).

For some graphs comparing existing home sales to pending home sales, see: Do Existing Home Sales track Pending Home Sales? The answer is yes - they do track pretty well.

Sony to Cut 16,000 jobs, Reduce Capital Spending

by Calculated Risk on 12/09/2008 08:44:00 AM

From Bloomberg: Sony Will Cut 16,000 Jobs as Recession Curbs Demand

Sony Corp. ... plans to eliminate 16,000 jobs ... The cuts include 8,000 full-time employees, or 5 percent of the company’s electronics workforce, and another 8,000 part-time and seasonal workers, Sony said.Reduced headcount. Reduced capital spending. Two common themes.

...

“The reason for this move is the deterioration of the economy, which was much larger than we expected,” Senior Vice President Naofumi Hara said.

...

Sony said it will invest 30 percent less in its electronics business than planned ... without giving figures.

The company will also cut the number of manufacturing sites by 10 percent by the end of next fiscal year, from 57 currently.

Monday, December 08, 2008

Reports: Bailout Deal Close for Automakers

by Calculated Risk on 12/08/2008 09:13:00 PM

From the NY Times: Washington Close to Deal on Bailout for Automakers

The White House and Democratic Congressional leaders said Monday that they were close to agreeing on the terms of a $15 billion government rescue of the American automobile industry that would be directed by one or more appointees of President Bush and would impose expansive federal oversight of the auto companies.The WSJ suggests we might own some of the automakers: U.S. Could Take Stakes in Big 3

...

The president’s designee would disburse the short-term emergency loans to General Motors and Chrysler ... and would directly supervise the drastic reorganization plans that the auto manufacturers have agreed to carry out in exchange for government aid.

Under the terms of the draft legislation, which continued to evolve Monday evening, the government would receive warrants for stock equivalent to at least 20% of the loans any company receives.According to the NY Times article, Ford will not be receiving a bailout.

Credit Suisse Forecast: 8.1 million foreclosures by 2012

by Calculated Risk on 12/08/2008 06:19:00 PM

In a research note titled "Foreclosure Update: over 8 million foreclosures expected" (no link, hat tip Frank) updated last week, Credit Suisse analysts are now forecasting 8.1 million homes will be in foreclosure by the end of 2012, representing 16% of all households with mortgages.

The analysts projected this could be as low as 6.3 million in a mild recession, with a somewhat successful loan modification program (re-default rates at around 40%), and as high as 10.2 million in a more severe recession. Note: the Comptroller of the Currency John C. Dugan noted this morning that re-defaults rates appear to be well in excess of 50% for recent mods, much higher than the hoped for 40%.

What really stood out in the forecast was the shift from mostly subprime foreclosures to non-subprime (Alt-A and Prime) foreclosures. This fits with some of the housing themes we've been discussing - that foreclosures will now be moving up the price chain. Click on graph for larger image in a new window.

Click on graph for larger image in a new window.

This graph shows the Credit Suisse estimate of loans in Foreclosure and REO as of Sept 2008 (in blue) and their base forecast for new foreclosures by the end of 2012, for both subprime and other mortgages (Alt-A and Prime).

Credit Suisse believes 2008 will be the peak year for subprime foreclosures, although subprime foreclosures will remain elevated over the next few years. However they are forecasting a significant increase in foreclosures over the next couple of year for non-subprime loans.

When I spoke at the Inman Real Estate conference in July 2008, I suggested that real estate agents should expect increasing foreclosures in high end areas. As I've previously mentioned, my comments were greeted with incredulity. I wonder if views have changed? We're all subprime now!

FedEx: "Significantly weaker macroeconomic conditions"

by Calculated Risk on 12/08/2008 04:52:00 PM

[S]ignificantly weaker macroeconomic conditions are expected to offset the benefits from lower fuel prices and the announced departure of DHL from the U.S. domestic package market.There are a couple of key points: 1) the weaker economy is more than offsetting any fuel savings for FedEx, and 2) capital spending plans have been reduced significantly (we are seeing company after company announce lower capital spending plans for 2009).

...

Second quarter results benefited from rapidly declining fuel prices and continued cost management,” said Alan B. Graf, Jr., executive vice president and chief financial officer. “However, demand for our services weakened sequentially throughout the quarter and global economic trends continue to worsen, substantially reducing our second half outlook. We are adjusting our expense plans to more closely align with the weaker business conditions, and are now targeting capital spending of $2.5 billion for fiscal 2009, down from $3.0 billion at the start of the year.”