by Calculated Risk on 11/26/2008 01:08:00 PM

Wednesday, November 26, 2008

Credit Crisis Indicators: Mostly Unchanged

The TED spread is stuck above 2.0, and still too high. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is around 0.5.

The 10-Year Treasury Note yield is just below 3.0%. The rush to treasuries of all durations is still stunning!

The effective Fed Funds rate has risen slightly to 0.62% (target rate is 1.0%), so that is a small piece of positive news.

This is the spread between high and low quality 30 day nonfinancial commercial paper. If the credit crisis eases, I'd expect a significant decline in this spread - and the graph makes it clear this indicator is still in crisis.

The LIBOR, the TED spread, and the two-year swap have seen clear progress - but now appear mostly stuck with a long ways to go. For the A2P2 spread (and all treasury yields), the markets are still in crisis.

The exception is the mortgage market with rates falling sharply.

More on New Home Sales

by Calculated Risk on 11/26/2008 11:56:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

First, here is a long term graph of new home sales and inventory from the Census Bureau.

Although home builders have sharply reduced housing starts - and are now starting fewer homes than they are selling (reducing inventory) - new home sales have fallen rapidly too. It has been a race to the bottom!

Also - New home sales in October might be at the lowest level since 1982, however adjusted for owner occupied units, the current year is the worst on record.

The following graph shows both annual new home sales (from the Census Bureau) and sales through October. In 2008, sales through October (before revisions) have totaled 436 thousand. This is slightly ahead of the pace in 1991 (432 thousand sales through October).

In 2008, sales through October (before revisions) have totaled 436 thousand. This is slightly ahead of the pace in 1991 (432 thousand sales through October).

However sales have slowed in the 2nd half of 2008, and it appears that annual sales will be below the 509 thousand in 1991. This would mean sales would be the lowest since 1982 (412 thousand).

Of course the U.S. population and the number of households were much lower in 1982. In 1982 there were 54.2 million owner occupied units in the U.S., in 1991 there were 61.0 million, and there are approximately 76 million today.

If we use a ratio of owner occupied units to compare periods, the low in 1982 was 412 thousand X (76/54.2) = 578 thousand units (based on the number of owner occupied units today).

The calculation for 1991 gives 634 thousand units (to compare to today).

By this measure, 2008 is the worst year for new home sales since the Census Bureau started tracking new home sales (starting in 1963).

October New Home Sales: Lowest Since 1982

by Calculated Risk on 11/26/2008 10:00:00 AM

The Census Bureau reports, New Home Sales in October were at a seasonally adjusted annual rate of 433 thousand. This is the lowest sales rate since 1982.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for October since 1981. (NSA, 34 thousand new homes were sold in October 2008, 29 thousand were sold in October 1981).

As the graph indicates, sales in 2008 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in October 2008 were at a seasonally adjusted annual rate of 433,000, according toAnd one more long term graph - this one for New Home Months of Supply.

estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.

This is 5.3 percent below the revised September of 457,000 and is 40.1 percent below the October 2007 estimate of 723,000.

"Months of supply" is at 11.1 months.

"Months of supply" is at 11.1 months. Sales are falling quickly, but inventory is declining too, so the months of supply is slightly lower than the peak of 11.4 months in August 2008.

The all time high for Months of Supply was 11.6 months in April 1980.

And on inventory:

TheInventory numbers from the Census Bureau do not include cancellations and cancellations are falling, but are still near record levels. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

seasonally adjusted estimate of new houses for sale at the end of October was 381,000. This represents a supply of 11.1 months at the current sales rate.

This is a another very weak report. I'll have more later today ...

2008 Word of the Year: Bailout

by Calculated Risk on 11/26/2008 08:58:00 AM

From Boston Herald: In sign of times, ‘bailout’ is ‘word of year’ (hat tip Spatch)

The word “bailout,” which shot to prominence amid the financial meltdown, was looked up so often at Merriam-Webster’s online dictionary that the publisher says it was an easy choice for its 2008 Word of the Year.

Weekly Initial Unemployment Claims: 4-Week Moving Average at 25 Year High

by Calculated Risk on 11/26/2008 08:42:00 AM

The DOL reports:

In the week ending Nov. 22, the advance figure for seasonally adjusted initial claims was 529,000, a decrease of 14,000 from the previous week's revised figure of 543,000. The 4-week moving average was 518,000, an increase of 11,000 from the previous week's revised average of 507,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending Nov. 15 was 3,962,000, a decrease of 54,000 from the preceding week's revised level of 4,016,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims. The four moving average is at 518,000 - above the highest levels of the '91 and '01 recessions, and the highest level since 1983 (not shown).

Continued claims are now at 3.962 million - a very high level. Just more evidence of a very weak job market.

Tuesday, November 25, 2008

Mortgage Rates Fall: 30 Year Fixed at 5.5%

by Calculated Risk on 11/25/2008 08:38:00 PM

From Bloomberg: U.S. Mortgage Rates Fall on $600 Billion Fed Plan

U.S. mortgage rates fell more than three-quarters of a percentage point today ... The average U.S. rate for a 30-year fixed mortgage ended the day at about 5.5 percent after falling to as low as 5.25 percent, according to Bankrate Inc. It was 6.38 percent this morning ...And refinance activity has picked up immediately, from the WSJ: Fed Aid Sets Off a Rush to Refinance

The Federal Reserve's attempt to stabilize the housing market set off a chain reaction across the U.S. on Tuesday, dropping interest rates and quickly spurring a burst of refinancing activity by borrowers eager to lower their mortgage costs.

Some brokers said it was the most activity they've seen in at least one year, although there was no way to determine to volume of refinancing.

Home Builders Accuse FDIC of Cutting off C&D Loans

by Calculated Risk on 11/25/2008 07:15:00 PM

From the WSJ: Home Builders Hammer FDIC

Home builders from Florida to Texas are railing against the Federal Deposit Insurance Corp., saying the agency is cutting off construction financing from seized banks and demanding early repayment of current loans.It takes some real digging to determine if a Construction & Development (C&D) loan is in trouble. These loans are typically made with interest reserves, and they tend to blow up when the construction project is completed (but not before since the payments are made from the interest reserve).

...

In the third quarter, 15.2% of single-family-home construction loans were delinquent, up from 12.5% in the previous quarter, according to Foresight Analytics, an Oakland, Calif., research firm. About 20.5% of condo construction loans were delinquent, up from 16.5%.

The FDIC put out a guidance on C&D loans and interest reserves in June, see: A Primer on the Use of Interest Reserves

Of particular concern is the possibility that an interest reserve could mask problems with a borrower’s willingness and ability to repay the debt consistent with the terms and conditions of the loan obligation.The FDIC is probably just following their own guidance and freezing the C&D loans until they make sure the projects are viable.

Real House Prices

by Calculated Risk on 11/25/2008 05:33:00 PM

Earlier today I posted the Case-Shiller monthly house prices, the house price-to-rent ratio, and the house price-to-income ratio.

Here is a look at real house prices using both the Case-Shiller national index and the OFHEO purchase only index.

OFHEO released their Q3 house price index today showing:

U.S. home prices fell 1.8 percent in the third quarter of 2008 from the previous quarter, according to FHFA’s seasonally-adjusted purchase-only house price index, which is based on data from repeat home sales. This decline was greater than the 1.4 percent decline in the prior quarter and the largest in the purchaseonly index’s 17-year history. Over the past year, prices fell 6.0 percent between the third quarter of 2007 and the third quarter of 2008.Note: there are a number of difference between OFHEO and Case-Shiller (See House Prices: Comparing OFHEO vs. Case-Shiller), but the main reason for the difference is OFHEO doesn't include many of the really bad loans (subprime and Alt-A) that were sold through Wall Street. OFHEO is GSE only loans.

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the real house prices based on both OFHEO Purchase Only index and the Case-Shiller national index. (Q1 1999 = 100)

Both indices show prices are falling (although I think Case-Shiller more accurately reflects what I'm seeing in the market), and both indices show real prices are still significantly above prices in the '90s.

House Prices vs. PCE

by Calculated Risk on 11/25/2008 03:23:00 PM

Earlier I posted the Case-Shiller monthly house prices, the house price-to-rent ratio, and the house price-to-income ratio.

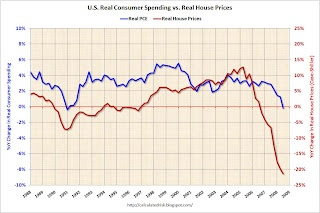

Here is a look at the real year-over-year (YoY) change in house prices vs. personal consumption expenditures (PCE):  Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph compares the YoY change in real house prices with the YoY change in real PCE.

For this limited data set (house price data is only available since 1987) the YoY changes move somewhat together, although house prices started declining before PCE during the current economic downturn. This difference in timing could be because of homeowners withdrawing equity from their homes (the Home ATM) even after prices first started falling. However recent data shows that the Home ATM is now pretty much closed - and as expected consumption has started to decline sharply.

Based on this general relationship, I wouldn't be surprised to see the YoY change in real PCE fall to -4% or so at some point next year.

House Price-to-Income Ratio

by Calculated Risk on 11/25/2008 01:03:00 PM

This morning I posted the price-to-rent ratios for the U.S and a few selected cities. Here is a look at house price to median household income:  Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph shows the price-to-income ratio and is based off the Case-Shiller national index, and the Census Bureau's median income Historical Income Tables - Households (and an estimate of 2% increase in household median income for 2008).

Using national median income and house prices provides a gross overview of price-to-income (it would be better to do this analysis on a local area). However this does shows that the price-to-income is still too high, and that this ratio needs to fall another 15% or so. The further decline in this ratio could be a combination of falling house prices and/or rising nominal incomes (Note: this uses nominal incomes, and even if real incomes are stagnant or declining, nominal incomes usually are rising).

Last quarter this index was over 1.25. Now it is close to 1.2. At this pace the index will hit 1.0 in Q3 2009. However, during a recession, nominal household median incomes are usually stagnate - so it might take even longer.

FDIC: Number of Problem Banks Increased Sharply in Q3

by Calculated Risk on 11/25/2008 11:38:00 AM

A couple key points:

From the FDIC: Insured Banks and Thrifts Earned $1.7 Billion in the Third Quarter

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported net income of $1.7 billion in the third quarter of 2008, a decline of $27.0 billion (94 percent) from the $28.7 billion that the industry earned in the third quarter of 2007. With the exception of the fourth quarter of last year, the latest earnings were the lowest for the industry since the fourth quarter of 1990.And on loan losses and charge-offs:

"We've had profound problems in our financial markets that are taking a rising toll on the real economy. Today's report reflects these challenges," said FDIC Chairman Sheila C. Bair.

...

Nine FDIC-insured institutions failed in the third quarter, the most since the third quarter of 1993. The failures included Washington Mutual Bank, with assets of $307 billion. The FDIC's "problem list" grew during the quarter from 117 to 171 institutions, the largest number since the end of 1995. Total assets of problem institutions increased from $78.3 billion to $115.6 billion.

Provisions for loan losses continue to rise. Higher levels of troubled loans, in both consumer and commercial portfolios, led to increased provisions for loan losses in the quarter. Loss provisions totaled $50.5 billion, compared to $16.8 billion in the third quarter of 2007. ...

Charge-offs and noncurrent loans are still increasing. Insured institutions charged off (removed from their balance sheets because of uncollectibility) $27.9 billion in troubled loans in the third quarter. The annualized net charge-off rate of 1.42 percent was the highest quarterly average since 1991. The amount of noncurrent loans and leases (90 days or more past due or in nonaccrual status) increased by $21.4 billion (13.1 percent) during the third quarter. At the end of the quarter, 2.31 percent of all loans and leases were noncurrent, the highest level for the industry since the third quarter of 1993.

Roubini: Geithner and Summers "Excellent Choices"

by Calculated Risk on 11/25/2008 11:13:00 AM

From a Newsweek interview: Even Dr. Doom Likes Them

NEWSWEEK: What are your thoughts on the team Obama assembled?Roubini adds on his blog:

Nouriel Roubini: The choices are excellent. Tim Geithner is going to be a pragmatic, thoughtful and great leader for the Treasury. He has experience at the Treasury and the IMF [International Monetary Fund], then the New York Fed. I have great respect for both Geithner as well as Larry Summers. I think both of them in top roles in economics in the administration were good moves. I think very highly of them both.

First, I told the Newsweek reporter – as full disclosure – that I had worked for Tim Geithner and Larry Summers when they were both at Treasury: I was head of a Treasury Office and the Senior Advisor to Tim Geithner in 1999-2000 who was at that time the Under Secretary for International Affairs while Larry Summers was Treasury Secretary. So some may [believe] that my positive views of the two may be biased/tinted by my working for them; on the other hand I know first hand about them and I have the greatest respect for their skills, intelligence, expertise, commitment to sound public policy and policy wisdom even if I may not always agree with all of their views.

Second, I have also to add that ... while I have the greatest respect for the new Obama economic team, they will inherit a huge economic and financial mess that will be extremely hard to fix even if they were to implement the most sound and consistent economic and financial policy package. This is going to be the worst US recession in decades as the strapped US consumer is now faltering. ... What policy can do – at best – is to minimize the financial and economic losses and limit the extent and severity and length of the economic and financial crisis, not to prevent it. President Elect Obama and his top notch team will inherit two wars and the worst economic and financial crisis in decades.

Price-to-Rent Ratio

by Calculated Risk on 11/25/2008 10:37:00 AM

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through Q3 2008 using the Case-Shiller National Home Price Index:  Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph shows the price to rent ratio (Q1 1997 = 1.0) for the Case-Shiller ational Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used.

Looking at the price-to-rent ratio based on the Case-Shiller index, the adjustment in the price-to-rent ratio is probably 60% to 70% complete as of Q3 2008 on a national basis. This ratio will probably continue to decline with some combination of falling prices, and perhaps, rising rents. The ratio may overshoot too. The second graph shows the price-to-rent ratio for three cities: Los Angeles, Miami, and New York. On this monthly graph, January 1997 = 1.0. The OER from the BLS for each individual city is used.

The second graph shows the price-to-rent ratio for three cities: Los Angeles, Miami, and New York. On this monthly graph, January 1997 = 1.0. The OER from the BLS for each individual city is used.

Some combination of falling prices, and perhaps rising rents, will probably push the ratio back towards 1.0. By this measure of housing fundamentals, it appears that Miami has corrected about 80% or more of the way to the eventual bottom, Los Angeles about 65%, and New York just over 40%.

Price-to-rent ratios are useful, but somewhat flawed. They give a general idea about house prices, but there are other important factors (like inventory levels, price to income and credit issues). We are getting closer on prices, but it appears we still have a ways to go.

One thing is pretty certain - as long as inventory levels are elevated, prices will continue to decline. And right now inventory levels of existing homes (especially distressed properties) are near all time highs.

Case-Shiller House Prices: Free Falling

by Calculated Risk on 11/25/2008 08:57:00 AM

S&P/Case-Shiller released both the September monthly home price indices for 20 cities (with two composites), and the national house price index. The national index shows prices are off 16.6% from Q3 2007, and off 21% from the peak. I'll have more on the national index shortly.

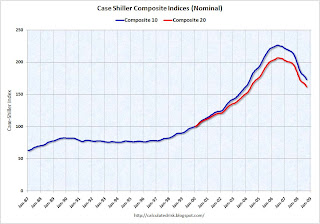

This post focuses on Case-Shiller prices for 20 individual cities, and two composite indices (10 cities and 20 cities).  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 23.4% from the peak.

The Composite 20 index is off 21.8% from the peak.

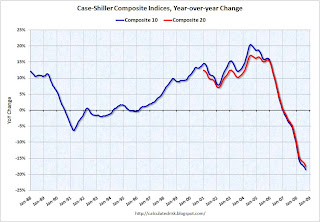

Prices are still falling, and will probably continue to fall for some time.  The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 18.6% over the last year.

The Composite 20 is off 17.4% over the last year.

The following graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. In Phoenix and Las Vegas, home prices have declined about 38% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are only off about 4% from the peak.

In Phoenix and Las Vegas, home prices have declined about 38% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are only off about 4% from the peak.

I'll have more on prices including price-to-rent and price-to-income ratios soon.

Fed Announces New Facility to Buy GSE MBS

by Calculated Risk on 11/25/2008 08:32:00 AM

Note: the Fed also announced a facility to buy asset-backed securities (ABS) collateralized by student loans, auto loans, credit card loans.

From the Fed:

The Federal Reserve announced on Tuesday that it will initiate a program to purchase the direct obligations of housing-related government-sponsored enterprises (GSEs)--Fannie Mae, Freddie Mac, and the Federal Home Loan Banks--and mortgage-backed securities (MBS) backed by Fannie Mae, Freddie Mac, and Ginnie Mae. Spreads of rates on GSE debt and on GSE-guaranteed mortgages have widened appreciably of late. This action is being taken to reduce the cost and increase the availability of credit for the purchase of houses, which in turn should support housing markets and foster improved conditions in financial markets more generally.

Purchases of up to $100 billion in GSE direct obligations under the program will be conducted with the Federal Reserve's primary dealers through a series of competitive auctions and will begin next week. Purchases of up to $500 billion in MBS will be conducted by asset managers selected via a competitive process with a goal of beginning these purchases before year-end. Purchases of both direct obligations and MBS are expected to take place over several quarters. Further information regarding the operational details of this program will be provided after consultation with market participants.

New Lending Facility from Treasury, Fed for Consumer Lending

by Calculated Risk on 11/25/2008 01:45:00 AM

From Bloomberg: Treasury, Fed Said to Unveil Plan to Bolster Consumer Financing

The U.S. Treasury and Federal Reserve will unveil as soon as today a lending program to shore up the consumer-finance market, using money from the [TARP] ...From the WSJ: New Facility Targets Consumer Lending

Treasury Secretary Henry Paulson ... scheduled a press conference for 10 a.m. New York time [Tuesday]

The lending facility, which will be operated by the Federal Reserve, is expected to provide loans to investors who want to buy securities backed by credit cards, auto loans and student loans ... Treasury will contribute between $25 billion to $100 billion to the facility from its $700 billion Troubled Asset Relief Program.Your daily bailout facility ...

Monday, November 24, 2008

Construction Employment and the Obama Stimulus Package

by Calculated Risk on 11/24/2008 11:09:00 PM

One of the key elements of the Obama stimulus package is infrastructure investment.

From the WSJ: Construction Industry Is Poised for a Rebound

The construction industry, beset by one of the biggest drops in employment in the current economic downturn, could be poised for a rebound under President-elect Barack Obama's expected stimulus package.I don't think the plan is to have a rebound in construction employment, but to cushion the blow of the 2nd wave of construction job losses coming in 2009. Most of the construction job losses so far have been in residential construction, but the 2009 construction job losses will be related to the end of the commercial real estate boom.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows construction employment as a percent of the civilian labor force. Even though construction employment has declined as a percent of the workforce, construction employment is still higher than the normal level. This is because the commercial real estate boom has kept many construction workers employed, mostly working on hotels, malls and office buildings.

However non-residential investment is now hitting the wall.

The second graph shows the Architecture Billings Index is at a record low.

The second graph shows the Architecture Billings Index is at a record low.There is "an approximate nine to twelve month lag time between architecture billings and construction spending", so we should expect the first decline in architecture billing to impact non-residential structure investment in Q4 2008, and a further downturn in non-residential construction activity next summer.

The Obama stimulus plan is intended to somewhat offset this coming slowdown in non-residential investment.

From the WSJ article:

From highways to schools, state and local governments have been postponing approved construction projects in recent months. Assured funding would jump-start these projects. The American Association of State Highway and Transportation Officials, a group of state and local government officials, has a list of 3,109 "ready-to-go" highway projects that could break ground in 30 days to 90 days worth $18.4 billion.Back in May I estimated the decrease in non-residential investment for malls, offices and lodging alone at about $60 billion in 2009. So I don't think $18.4 billion is anywhere near enough to offset the probable decline in 2009 non-residential investment.

Two former Clinton administration transit officials, Mortimer Downey and Jane Garvey, are among those spearheading transportation issues for the Obama transition. They have reached out to state and local officials to be ready for a spending package.

Paulson May Ask for Remaining TARP Funds

by Calculated Risk on 11/24/2008 06:48:00 PM

Wow. Does anyone change their mind more than Paulson?

From Bloomberg: Paulson May Ask for Remaining $350 Billion of TARP

Treasury Secretary Henry Paulson, less than a week after indicating he would let the Obama administration decide how to use the second half of the $700 billion financial fund, is considering asking for the money.Amazing.

Existing Home Sales: Turnover Will Slow

by Calculated Risk on 11/24/2008 05:59:00 PM

This was an important disclosure:

"The Realtors are reporting that foreclosure sales - that is distress sales being foreclosures or short sales - have risen from what they thought was 35% to 40% of all existing home sales, now they are saying it is 45% of all existing home sales. They also are saying they are seeing further softening toward the November numbers."This is another reminder that the only reason existing home sales appear to have "stabilized" is because of the high number of REO sales. Sales excluding REOs have plummeted.

CNBC's Diana Olick: Existing Home Sales

I've argued before that REO resales are real sales and should be included in the NAR statistics, but I suspect these REO buyers might hold these properties longer than recent turnover would suggest. If these are owner occupied buyers, they have probably been waiting to buy, and they have saved a down payment and qualified under the tighter lending standards. They probably won't sell until they can make a reasonable profit to buy a move up home - and it will probably be a number of years before prices recover.

If they are investors, they are likely buying REOs for cash flow - not appreciation, unlike the speculators in recent years - and these investors will probably hold the properties for a number of years too.

This suggests to me that turnover will slow further.

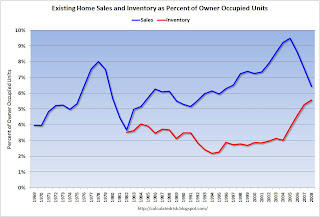

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home turnover as a percent of owner occupied units. Sales for 2008 are estimated at just over 4.9 million units.

I've also included inventory as a percent of owner occupied units (all year-end inventory, except 2008 is for October).

The turnover rate was boosted in recent years by:

Although slowing, the turnover rate is still above the median for the last 40 years and substantially above previous troughs. Both types of speculative buying are over for now. And the Baby Boomers have probably bought move up homes, and the next major move will be downsizing in retirement (still a number of years away).

And finally - and probably a very important point - homeowners with negative equity, who manage to avoid foreclosure, will be stuck in their homes for years.

All of the above suggests the turnover rate - and existing home sales - will fall further, perhaps much further.

Krugman on Stimulus, Citi Bailout, and Geithner

by Calculated Risk on 11/24/2008 04:46:00 PM

Professor Krugman on CBS "The Early Show":